September 18, 2023

US to Lead Global Lithium?

Author - Ben McGregor

Gold near flat as headline inflation rebounds but core declines

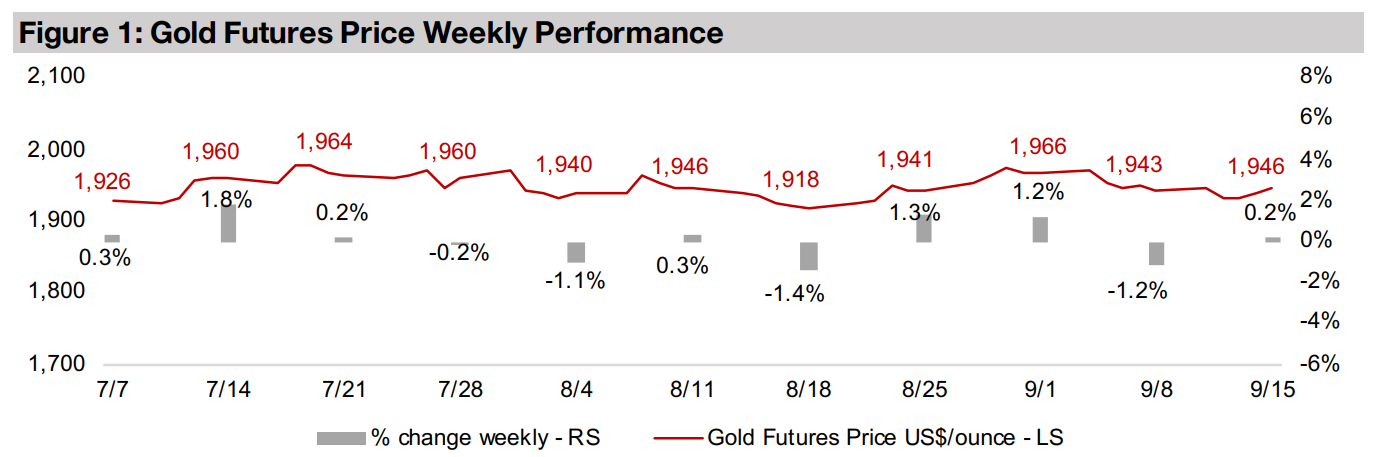

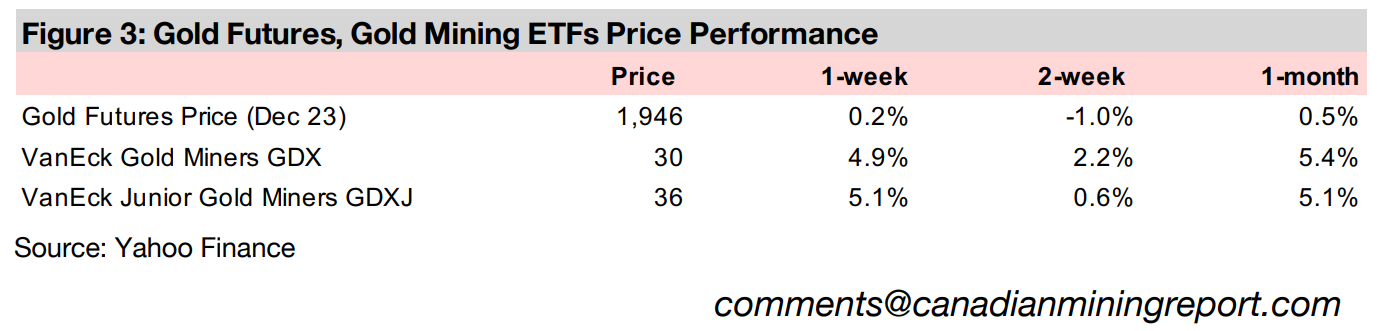

The gold price was near flat, up 0.2% to US$1,946/oz as headline US inflation for August 2023 rebounded but core inflation declined and the European Central Bank raised rates, driving down equity markets overall, although gold stocks gained.

US could have highest lithium reserves after major new find

This week we look at global lithium reserves and production in the context of a major new lithium find in the US on the Oregon-Nevada border that could see the country rise from number four in terms of total resources to by far the global industry leader.

US to Lead Global Lithium?

Gold was near flat, up 0.2% to US$1,946/oz, and has spent the past month averaging

near the US$1,950/oz level. The key economic data release this week was US

inflation, which gave a mixed picture, with the headline number rebounding

substantially month on month, but core inflation continuing to decline. The other

major news was another rate hike by the European Central Bank, and combined with

the rise in US inflation, this was not taken well by the markets, with the S&P 500 down

-0.68% and the Russell 2000 down -0.86%.

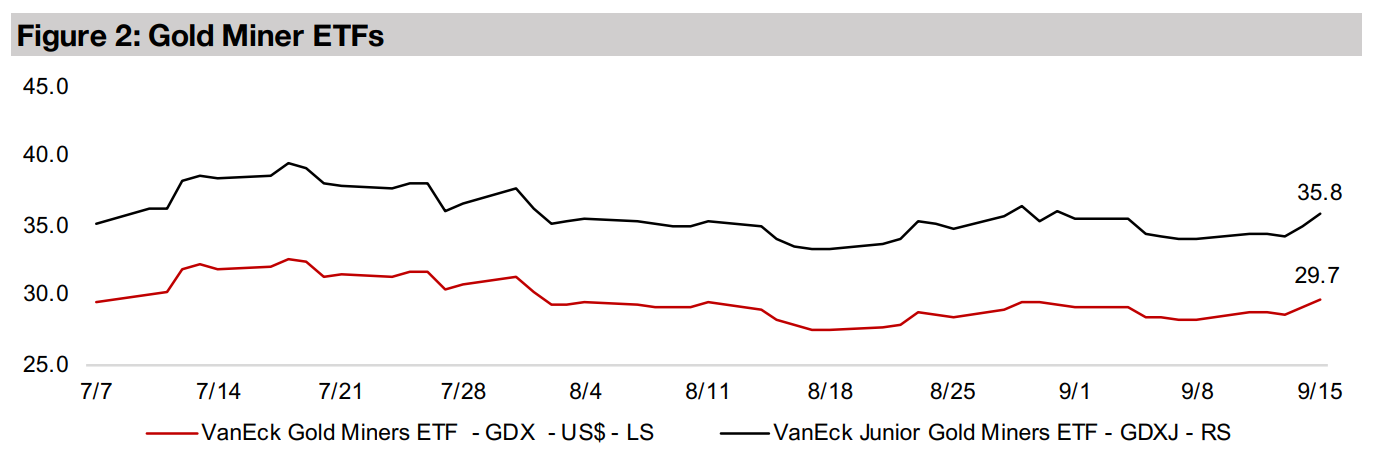

Interestingly, even without much in the way of drivers, with gold moving marginally,

and broader equities declining, gold stocks still saw a strong week, with the GDX ETF

of gold producers up 4.9% and the GDXJ ETF of gold junior rising 5.1%. The sudden

jump in US inflation and the ECB hike seems to have made markets nervous about

the thesis this year that inflation was well under control and that central banks could

soon ease off monetary tightening, and saw them buy gold stocks for relative safety.

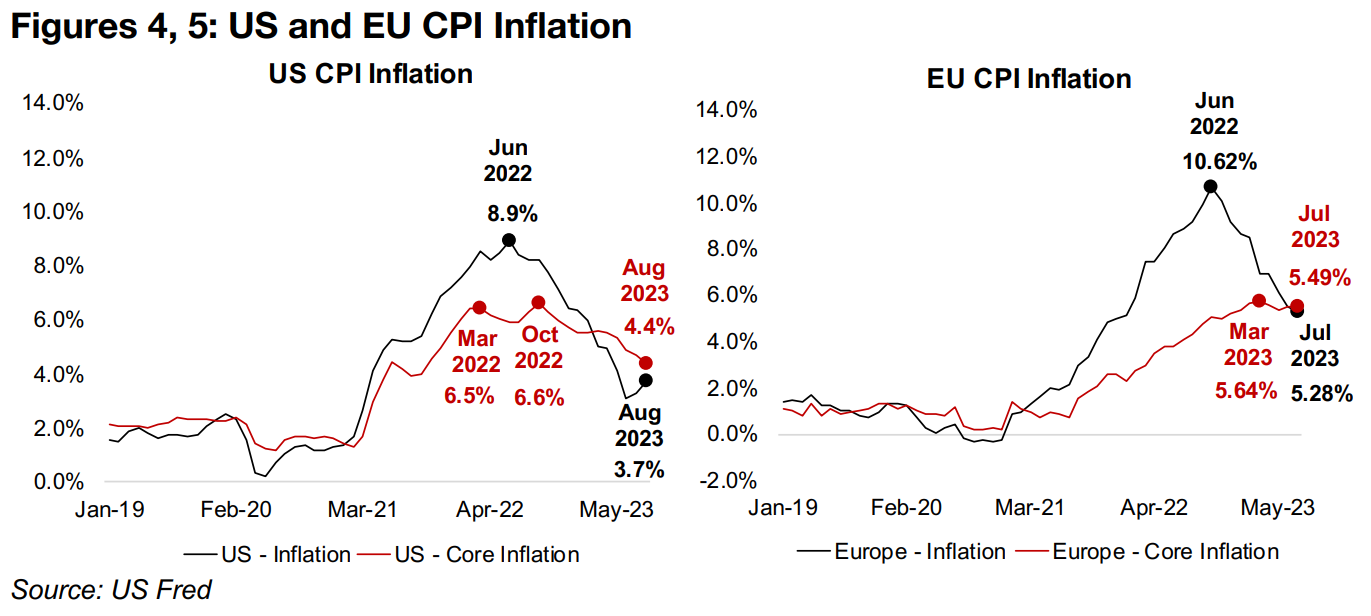

Headline US inflation rebounds, core inflation still well above Fed target

US inflation for August 2023 gave a mixed picture, with the headline number at 3.7%, rising a second month off lows of 3.1% in June 2023, with the 0.4% month on month increase the largest since March 2022 (Figure 4). However, this was driven by rising energy costs, and core US inflation, excluding food and energy, continued to trend down to 4.4% in August 2023 from a peak of 6.6% in October 2022. This remains well above the Fed’s core target of 2.0%, and while inflation is far from the crisis territory reached when it peaked at 8.9% in June 2022, it remains persistently elevated. This suggests that even if the US central bank may be done with hikes for now, rates will likely be maintained at high levels for an extended period, until several months of data show prices have been brought solidly under control.

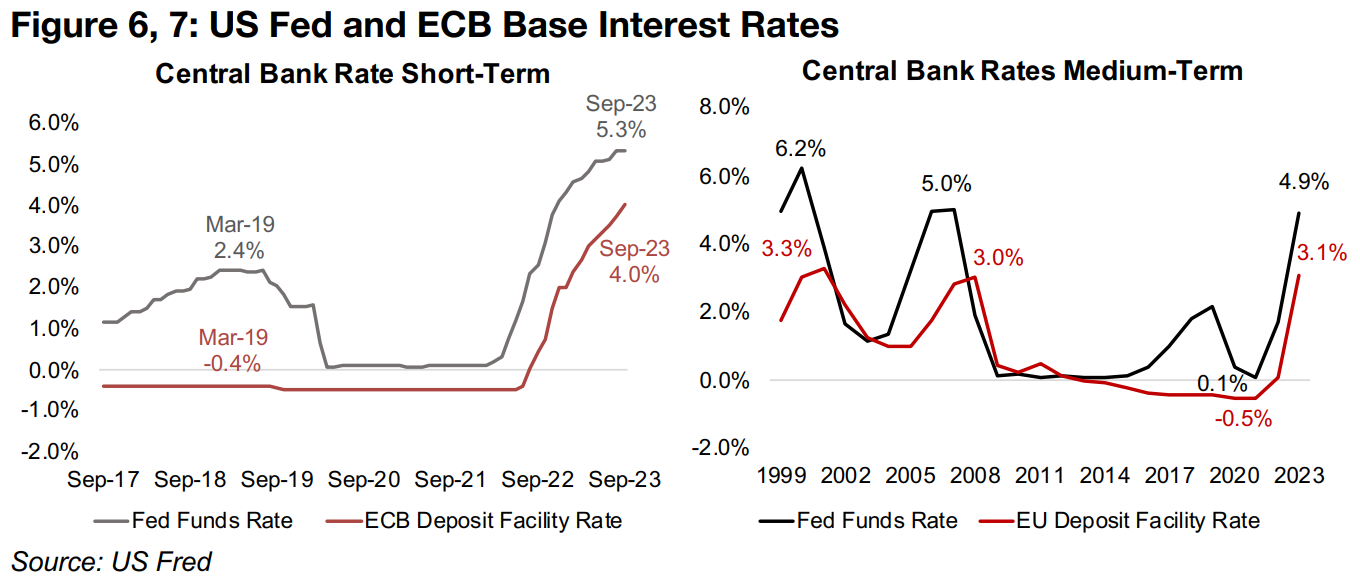

Global rate ramp up continues with ECB hike

In Europe, while headline inflation has also seen a major decline to 5.5% in July 2023

from a 10.6% peak in June 2022, there has been less progress on reducing core

inflation (Figure 5). This peaked much later than in the US, at 5.6% in March 2023,

and has come down to only 5.3% in as of July 2023. This prompted the European

Central Bank to continue to hike it deposit facility rate over the past week to 4.0%,

and it is now not far below the US Fed Funds rate of 5.3% (Figure 6).

For both the US and EU, the average base rates in 2023, at 4.9% and 3.1%

respectively, are at their highest since just prior to the global financial crisis, and

before that, just before the dot.com bust of the early 2000s (Figure 7). Both these

periods saw extreme downturns in equity markets, and thus the currently elevated

rates do not bode well for stocks into next year. While for the gold price, periods of

crisis can be a strong driver on a flight to safety, the outlook is more mixed for gold

stocks, with it becoming a question of whether the potential increase in the gold price

can offset the downward pressure from an overall plunge in equity markets.

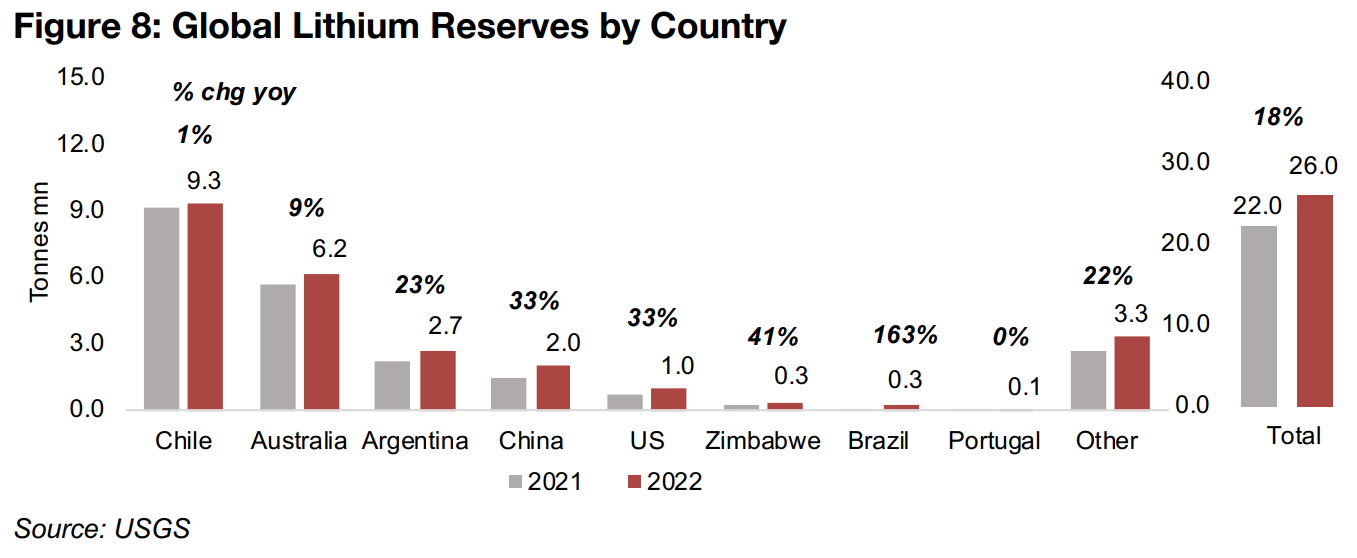

Huge new US lithium find could make country global industry leader

This week a massive new lithium deposit in the US was reported which could make the country by far the largest global player for the metal, which is becoming increasingly critical given the major global shift towards electric vehicles. The company Lithium Americas released a report indicating that the McDermit Caldera deposit on the Nevada-Oregon border could hold up to 20 to 40 mn tonnes of lithium in clay within an inactive volcano. Prior to this find, the US was number five in terms of lithium reserves, at just 1.0 mn tonnes in 2022, well behind global leaders Chile, at 9.3 mn tonnes and Australia, at 6.2 mn tonnes, with Argentina and China also major players, at 2.7 mn and 2.0 mn in reserves, respectively, according to data from the USGS (Figure 8).

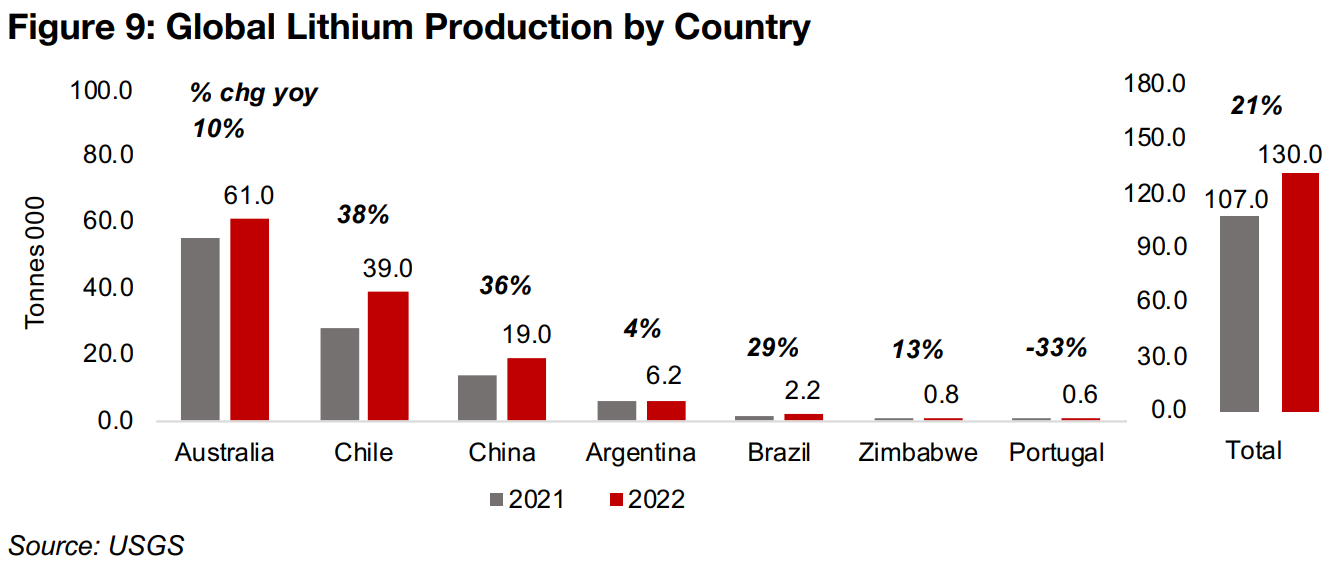

The top four countries in terms of reserves also had the largest production in 2022, although in a different order, with output from Australia, Chile, China and Argentina at 61.0k, 39.0k, 19.0k and 6.2k tonnes in 2022, respectively (Figure 9). While full data for US lithium production is not available from the US, there is only one producing mine in Nevada, estimated to comprise just 1.0% of global output, very small in contrast to the country’s substantial reserves. While this limited production has historically been driven by environmental concerns, policy on this could change as the government increasingly embraces the move to electric vehicles.

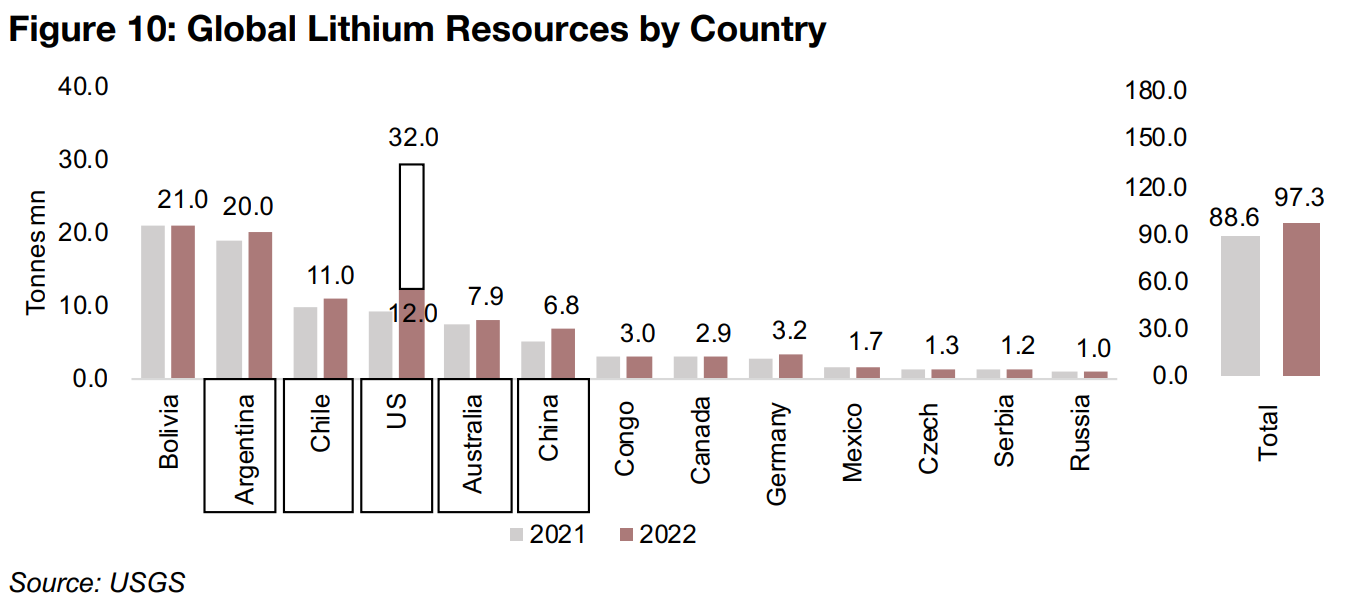

Shifting from the above data for lithium reserves, defined as metal with a very high probability of economic recovery, to lithium resources, which have a lower, but still strong prospect of economic recovery, changes the landscape considerably. While total global reserves were just 26.0 mn tonnes in 2022, total resources are nearly four times as high, at 97.3mn tonnes. Also, a new number one emerges, Bolivia, with 21.0 mn tonnes in estimated resources, while Argentina and Chile remain major players, at number two and three, with 20.0 mn and 11.0 mn tonnes in resources (Figure 10).

The US rises to fourth place using resources instead of reserves, with 12.0 mn tonnes

based on 2022 USGS data, with both Argentina and China, at 7.9 mn tonnes and 6.8

mn tonnes, respectively, also remaining major players. A whole new set of mid-tier

players also emerges when expanding to resources, including Congo, Canada,

Germany, Mexico, Czech Republic, Serbia and Russia, which do not show up at the

top of rankings looking only at reserves.

However, including the new 20.0 m to 40.0 mn tonne lithium find in Oregon-Nevada,

the US jumps to a clear global number one in terms of resources, even using the low

end of the range, at 32.0 mn tonnes, over 50% higher that Bolivia. Using the top of

the range would see US resources surge to 52.0 mn tonnes, the same size as Bolivia,

Argentina and Chile combined, becoming by far the global leader. While it is still early

days for this new deposit and much more study will need to be done to confirm its

economic viability, even cutting the bottom of expected range by half to only 10.0 mn

tonnes still would see the US as number one for lithium resources.

Lithium price drops on new supply and easing demand growth

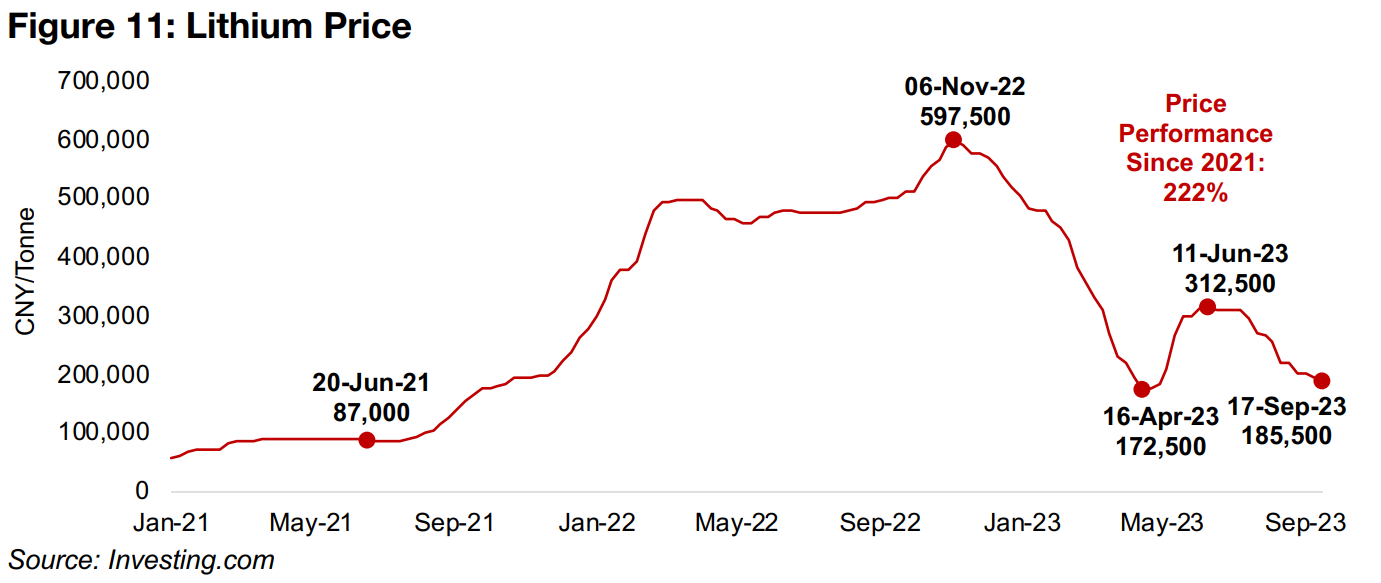

The lithium price has continued to ease as supply and demand have come more into balance this year (Figure 11). While the big price spike in 2021 and 2022 was partially driven by a surge in electric vehicle demand, it was as much because of temporary limitations on supply, especially in China, which is the source of over 80% of global processed lithium, related to the global health crisis shutdown (Note that this huge reliance on China for lithium currently will give further impetus to the US to develop its own potentially massive lithium reserves).

As China exited lockdowns at the end of 2022, the lithium price started to decline,

and continued down to a low of CNY172,500/tonne as the market priced in an

expansion of production capacity coming online in 2023. While the price rebounded

to CNY312,500 tonne as of June 2023, it has slumped since to CNY185,500, back

near the previous lows. However, this is still well over double the level of early 2021,

and suggests that secular demand growth has remained strong, and the 2022 price

spike was a temporary aberration driven main by supply side constraints.

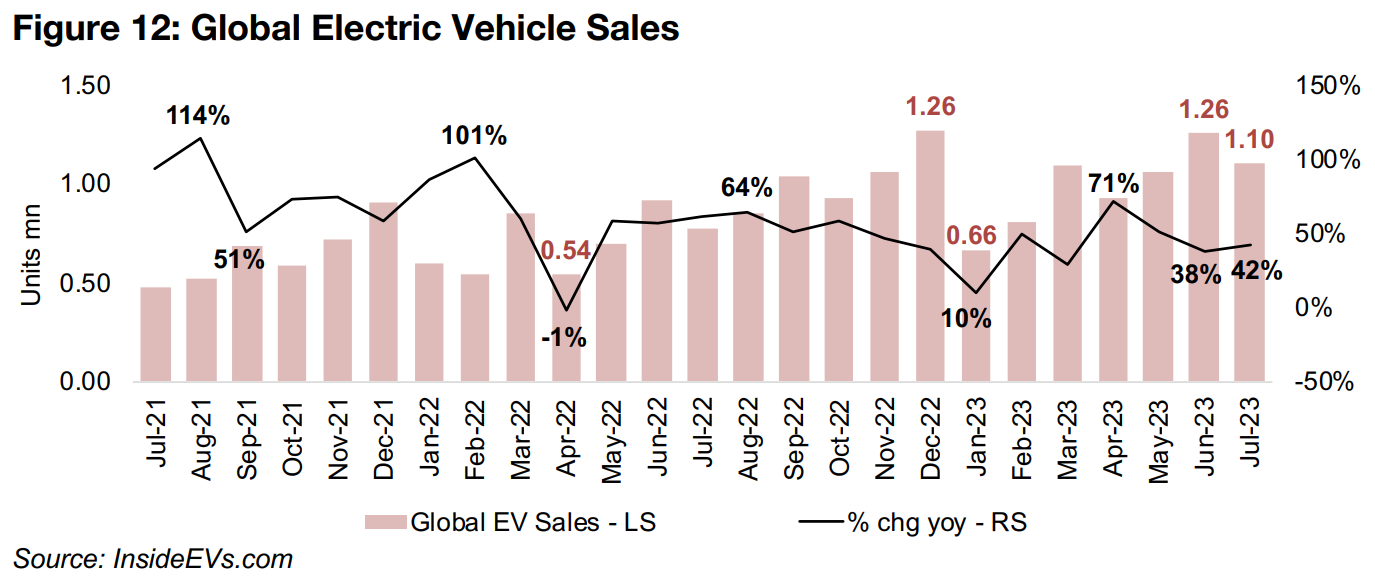

Demand for lithium is driven mainly by global electric vehicle sales, for which growth

still remains strong, with EV sales up 42% yoy in July 2023 to 1.10 mn units. This

follows strong 1.26 mn unit sales in June 2023, up 38%, matching the record high of

1.26 mn in December 2022 (Figure 12). However, compared to the 2021-2022 boom,

even the high recent growth rate looks slow, with peak levels of year on year growth

nearing 500% yoy in early 2021, and rates above 100% being reached until early

2022. This decline in EV sales growth is also likely pressuring the lithium price.

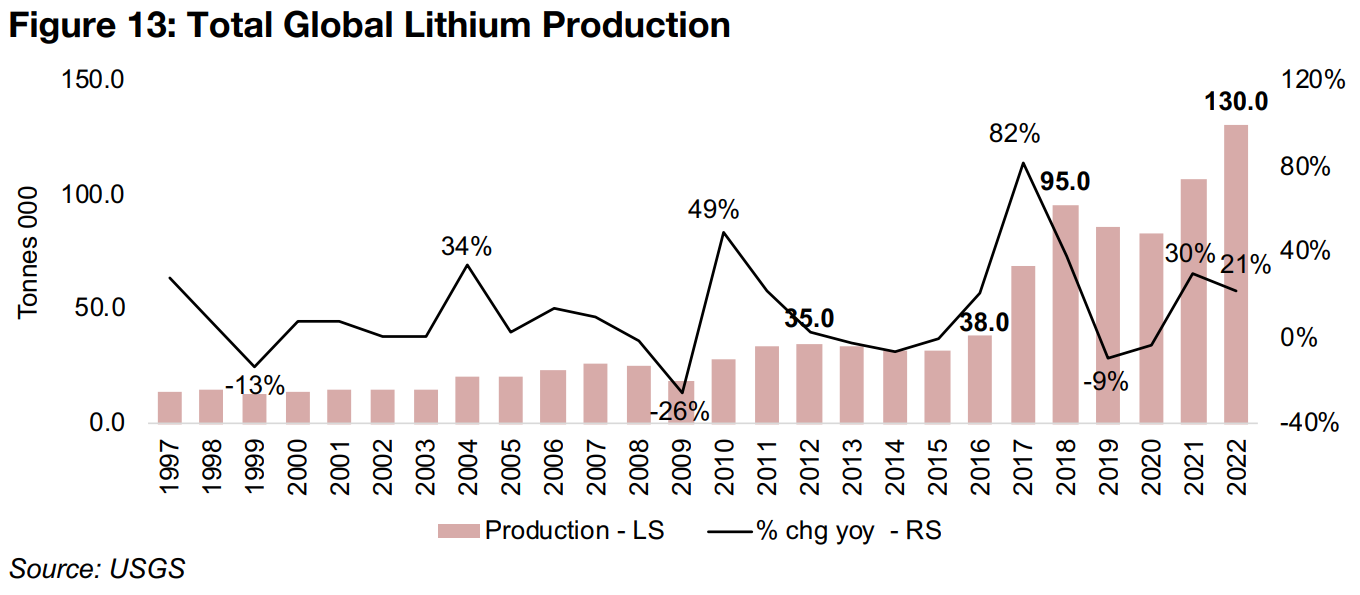

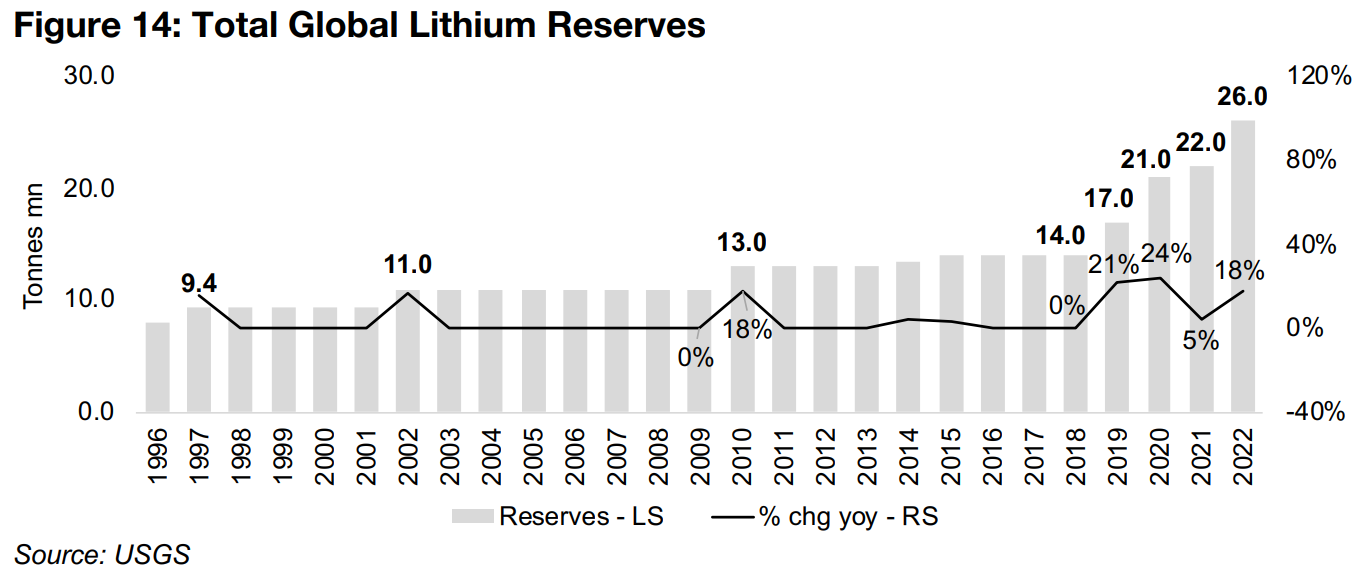

Global lithium production and reserves surge over past six years

While the true magnitude of the surging global demand and supply limitations for lithium became especially obvious over the past two years, the industry had already been in a substantial uptrend since 2017 (Figure 13). Global production was flat in the mid-2010s, with output of 38.0k tonnes in 2016 barely rising from 35.0k tonnes in 2012. It was 2017 that marked the sea change in the industry, and by 2018 production doubled to 95.0k tonnes. The next big jump came in 2021, and production reached 130.0k tonnes by 2022, up nearly four times from 2016. This incentivized lithium producing countries to put much more capital into developing their existing resources into reserves. Global reserves rose only 3.0 mn tonnes from 2002 to 2018, from 11.0 mn to 14.0 mn, but in just four years from 2019 to 2022, 12.0 mn tonnes have been added to global reserves, reaching 26.0 mn (Figure 14).

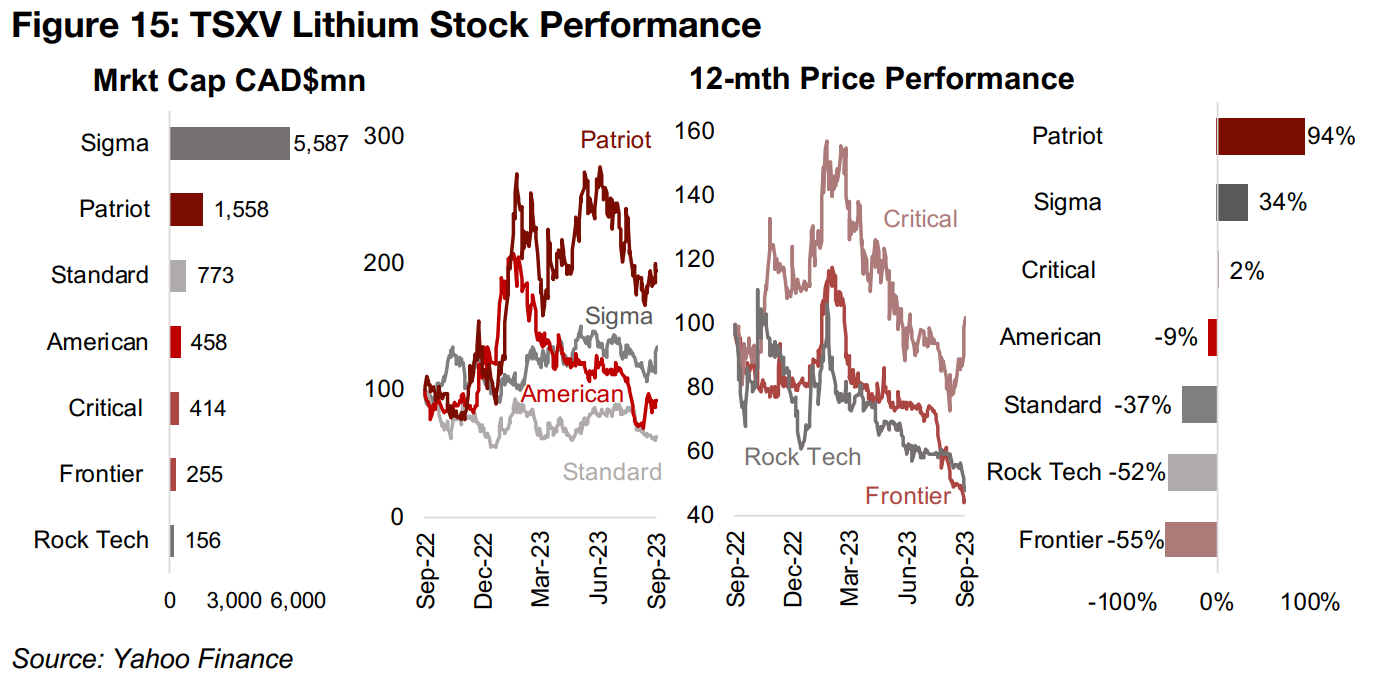

TSXV lithium stocks struggling with decline of metal price

While several of the TSXV larger cap lithium stocks were still seeing gains into Q1/23 and even up to mid-2023, even as the metal price pulled back, over the past three months, most of the group has faced significant declines (Figure 15). It seems that the combination of the metal’s reversal after its April to June 2023 rebound and a shift towards risk off in equities markets, especially for small caps, with the Russell 2000 index up just 1.89% over the past year, has finally started to weigh on the sector.

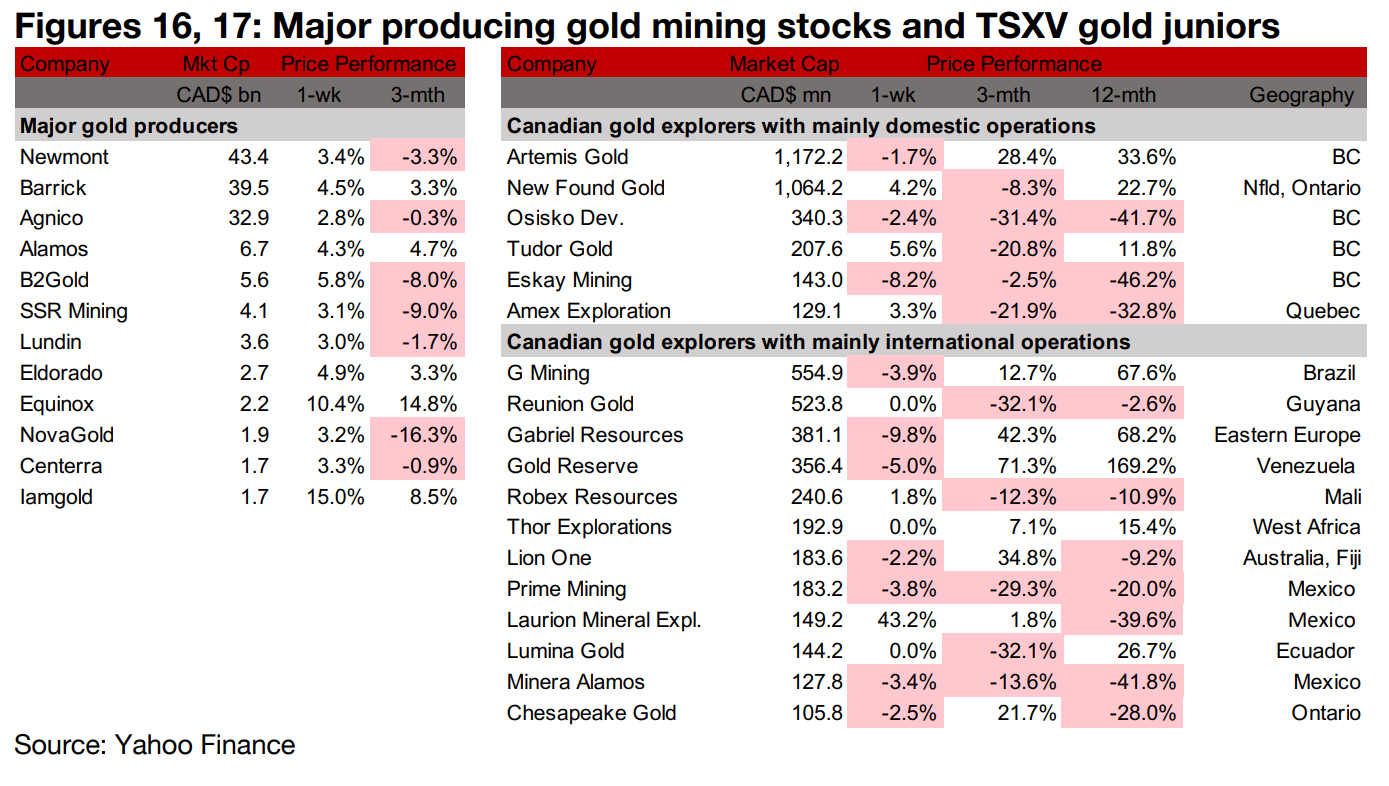

Major gold producers all gain and large TSXV gold mixed

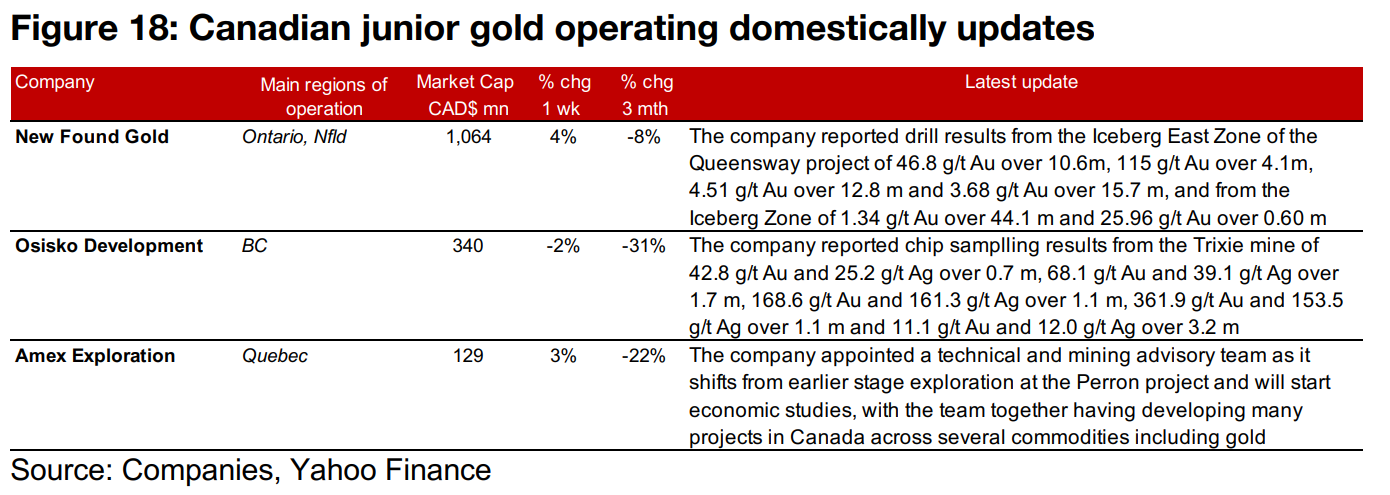

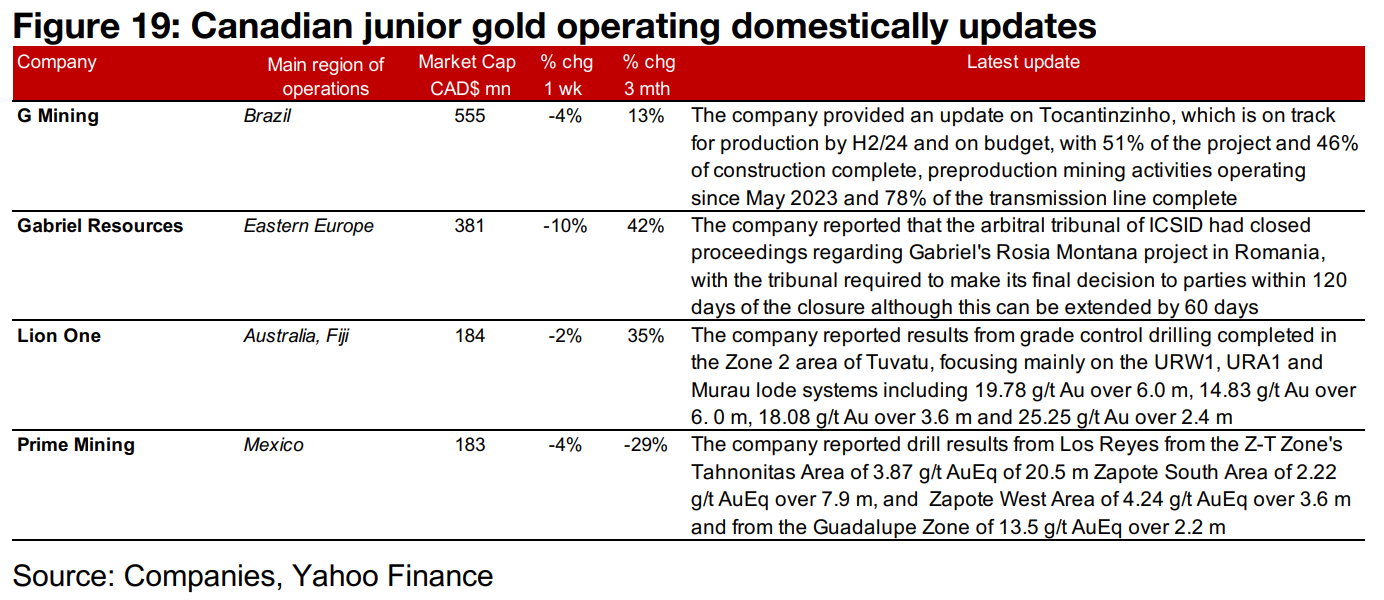

All the major gold producers rose and the TSXV larger cap gold stocks were mixed (Figures 16, 17). For the TSXV gold companies operating domestically, New Found Gold reported drill results from the Iceberg zones of Queensway, Osisko Development reported chip sampling results from the Trixie mine and Amex Exploration appointed a technical advisory team as it shifts into the development stage for Perron with economic studies (Figure 18). For the TSXV companies operating internationally, G Mining provided an update on the construction of Tochantinzinho, Gabriel Resources reported that ICSID’s arbitral tribunal on its Rosia Montana project in Romania had closed proceedings, with a final decision expected with six months, Lion One reported results from grade control drilling at Tuvatu, and Prime Mining reported drill results from several zones at Los Reyes (Figure 19).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.