October 05, 2023

Watch This SUPERCHARGED 'Power Play' Opportunity

Contents

- What's Going on With Uranium?

- The Hidden Driver of Uranium Demand

- A Strategic Partner for the World's Largest Producer

- Leveraging a World-Class Location

- Top-Notch Team Focused on Creating Value

- A Well-Established Opportunity in a World-Class Region

- Disclosure

- Sources

- Disclaimer

The world is starved of uranium.

Utilities cannot procure enough to keep their power plants going…

Some utilities will be short of uranium as soon as next year.

Key uranium suppliers are sold out until 2027 … meaning that every single pound of uranium they mine will already be spoken for and not available to market participants… and this situation will last for years.

The war in Ukraine threw a wrench into the supply-demand balance of the uranium market.

And even though Russian nuclear supply is still available, new sanctions could cut it off soon.

We’re talking about roughly 8% of the global supply being potentially unavailable.

That’s not a small deal at all.

The lack of new mining supply and surging demand have lifted the price of uranium.

Since the beginning of the year, it’s up about 36%. Right now, it’s trading at around $66 per pound.

Experts say it could reach $100 soon , according to The Economist.

It’s a full-on rally.

And we do not want you to miss it.

In fact, this uranium rally can potentially last for years, if not decades…

In other words, we are in the early stages of what could ultimately turn into the most significant uranium bull market of this generation, if not the 21st century.

But before you rush to buy a generic uranium ETF, we want to warn you…

We believe that there is a better way to play this trend.

In the pages below, we will explain why and how you could benefit from it.

But for now, remember this stock ticker and add it IMMEDIATELY to your watchlist: Stallion Uranium (TSX-V:STUD, OTC:STLNF).

What's Going on With Uranium?

Let us quickly brief you on the latest developments in this little-known but potentially extremely lucrative corner of the commodity market.

Not a lot of investors know about it… they prefer to chase the latest investment fad or follow the Federal Reserve reality show.

We don’t care about what the Fed is about to do next…

We’re here to inform you about the most exciting and under-followed opportunities.

Because that’s where individual investors like you have a chance at generating life-changing returns…

Not in the S&P 500, not in Nvidia or any other name that everybody talks about.

If you hear about something in mainstream media, it could already be too late.

We prefer to find opportunities early on. And Stallion Uranium is the latest one to have landed on our desks.

Stallion is a junior mining company focused on uranium… which has been on a tear recently.

This niche commodity has become extremely valuable because nuclear power could potentially be the most viable and safe solution to the climate challenges the world is facing.

As countries across the world are waking up to the fact that they need to build out their nuclear power infrastructure, they quickly find out… that securing enough uranium to feed those extra megawatts of power could be tricky.

This is why after years of trading sideways, and especially after the Fukushima incident, uranium is soaring to levels not seen in over ten years .

As a reminder, uranium prices peaked at about $140 back in 2007.

In our view, it could reach that level again, and it could go even higher.

Why?

First, nuclear power plants have started hoarding uranium. With the war in Ukraine raging and the future supply of uranium from Russia not guaranteed to last, they want to protect themselves.

So they buy way more than they currently need. This pushes up total demand and supports the price of uranium.

A mining analyst at SP Angel, a capital markets company, says that uranium prices could continue rising for the next 10-20 years.

That’s not just a short-term rally. It’s a massive multi-decade secular bull market in the making.

And you want to be part of it…

The second reason why uranium prices have been soaring is long-term demand growth. We’re not talking here about utilities trying to secure enough uranium for the next couple of years… No.

According to the World Nuclear Association, demand from nuclear reactors is projected to grow by almost 30% by 2030 , and by 2040, it could double to 130,000 tonnes of elemental uranium (or tU).

But you won’t have to wait until 2040 to see deficits in the uranium market. The situation is already URGENT.

We’re already in a state of deficit this year. UxC, a data provider, forecasts that in 2023, the uranium market is going to see a deficit of 66 million pounds.

This is why uranium as a commodity and uranium miners as a group have been top performers this year.

Share prices of some of them soared by 52%... 76%... and even 110% on a year-to-date basis.

In other words, we have a perfect setup for the price of uranium. Demand is soaring, supply is limited, and the world is set on moving toward cleaner sources of fuel in the decades to come.

The Hidden Driver of Uranium Demand

So far, we have talked about the "traditional" uranium industry. Which is growing fast enough…

But there’s a new development that could supercharge the demand for this commodity even further.

You may have heard about it… the technology is called "small modular reactors" or SMRs.

It’s like an “iPhone moment” for the nuclear energy industry…

Let us explain.

Before smartphones arrived, computers tended to be bulky.

And they didn’t provide the same level of connectivity as smartphones do.

The internet was small back then compared to where it is today.

But in 2007, the iPhone was introduced… and everything changed.

With people taking photos, sharing documents and videos… the size of the internet exploded.

And today, 55% of the global website traffic comes from smartphones.

We believe that small modular reactors could do to the global nuclear energy industry what the iPhone did to internet traffic.

Increase it and dominate it.

They are small, yes. Some of them can even be transported on a truck!

They are small, cheap, and easy to build…

And they will increase the demand for uranium even more.

For example, the World Nuclear Association projects that by 2040, small modular reactors could make up half of France's nuclear capacity.

And France has one of the largest nuclear programs in the world.

In 2021, nuclear energy supplied 68% of the country's electricity. This is the largest share in the world.

According to Allied Market Research, the market for small modular reactors will grow by over five times by 2030.

The United States will be one of the key regions for SMRs.

Back in January, the U.S. Nuclear Regulatory Commission (NRC) approved the first SMR for use in the United States.

This could open the floodgates and generate the “iPhone moment” that we talked about before.

And the conversation about nuclear power has already begun.

The Council on Foreign Relations said that nuclear power could be preferable to other sources of clean energy, such as wind and solar.

Why?

Because wind turbines and large-scale solar installations take up a lot of valuable space, especially farmland.

This puts renewable energy at odds with the country’s agriculture industry.

With food security becoming a significant issue, losing farmland to wind and solar installations isn’t ideal.

In fact, the country is losing farmland at a fast rate. Between 2000 and 2022, U.S. farmland declined by almost 6%.

With less land available for growing fruit and vegetables, land becomes more expensive. This drives up the price of the crops grown on that land. And, eventually, it drives inflation.

In our opinion, the U.S. government will do everything it can to contain inflation. So far, the Federal Reserve has been ruthless in tackling it.

And nuclear power is the perfect solution to this problem.

Both traditional and small modular reactors are much more land-efficient than wind and solar installations.

We will not be surprised to see the demand for wind and solar decline as a result and the demand for nuclear energy soar.

This could drive the price of uranium, needed to power both traditional and the small new-generation reactors, even higher.

And we’re not the only ones who think that.

The Economist says: "Small "modular" reactors—cheap and easy to build—could turbocharge demand for fuel."

And given that uranium supply is limited, the growing demand from SMRs could produce another lasting rally in uranium.

This is the opportunity that Stallion Uranium is banking on.

A Strategic Partner for the World's Largest Producer

The United States is the world’s number one producer of nuclear power.

It’s responsible for about one-third of the global generation of nuclear electricity.

And it has a MASSIVE problem.

It has only five uranium production facilities.

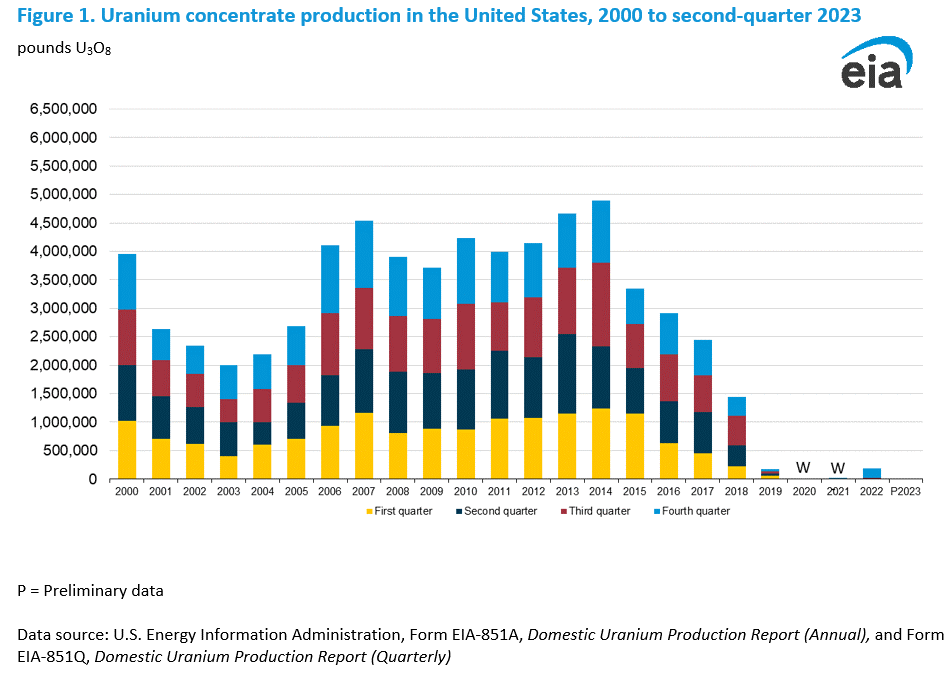

And since 2000, uranium concentrate production has fallen off a cliff.

Take a look.

Because its domestic production is lagging, the United States imports most of its uranium from abroad.

This situation will not likely change soon… because the U.S. just doesn’t have enough uranium reserves to feed its growing nuclear energy industry.

It has only 1% of the global uranium reserves, while Canada has 9%. Kazakhstan and Russia have plentiful resources, but the geopolitical situation these days isn’t great for either of those countries.

In other words, the United States desperately needs reliable supplies of uranium.

This is why Stallion Uranium plans to become a critical player in the North American uranium supply chain.

How?

Leveraging a World-Class Location

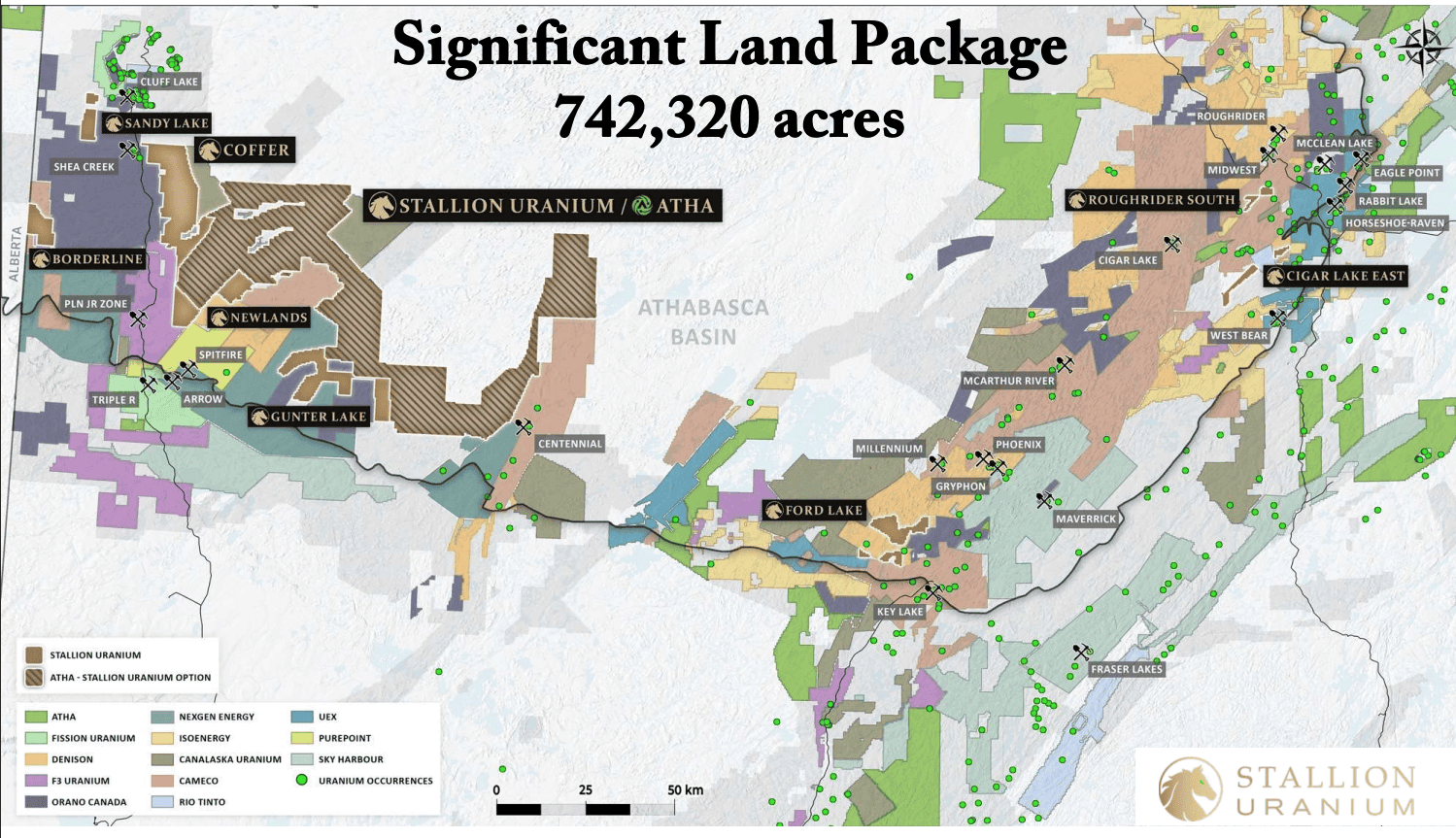

Stallion has a claim on a large land package in the Athabasca Basin.

As a reminder, Athabasca is a region spanning northern Saskatchewan and Alberta, Canada.

It is home to some of the world’s largest AND highest-grade uranium mines.

It’s home to Cameco, the largest private uranium company in the world… and Nexgen Energy, the largest Athabasca company focused exclusively on uranium.

And, as we said above, some of the projects located here feature world-class grades.

In fact, the average grade of an Athabasca-based project is about 20 times higher than those of the projects located in other uranium jurisdictions.

In other words, Athabasca is arguably the best region in the world to look for uranium.

And Stallion has a large claims package consisting of 742,320 acres (or about 300,000 hectares) of land here.

The best part about this package is that it’s strategically diversified across several potentially lucrative areas in the Athabasca region…

Take a look.

These locations aren’t random, of course.

It’s the opposite, in fact. They are located in what the company deems the most promising areas… close to established operations…

The Western Athabasca package (the one on the left in the image above) is the largest continuous project in the Western Basin.

It’s located close to some of the world’s best-known and established uranium companies… such as Cameco, NexGen, Orano, and F3 Uranium.

Stallion estimates that over the past ten years, the projects that border its own land package created over $4.5 billion in value.

This is why Stallion assembled this massive land package…

And the company’s Coffer Project deserves a special mention.

It’s located just three kilometers (or 1.9 miles) away from Shea Creek.

And Shea Creek hosts about 68 million pounds of U3O8 in the Indicated resource category and 28 million pounds of U3O8 in the Inferred category.

In other words, it’s a large resource-rich project.

Stallion’s analysis shows that the Coffer Project has similar characteristics to Shea Creek.

To understand its potential better, the company has been busy doing early-stage exploration work at Coffer.

This year, it conducted a 2,029 line-kilometer geophysical survey. Next year, it plans to drill about 3,000 meters (or 9,800 feet) at the property.

Exploration results from Coffer could become a catalyst to the company’s valuation.

If you haven’t yet, we urge you to put Stallion Uranium (TSX-V:STUD, OTC:STLNF) on your radar IMMEDIATELY.

The company is about to embark on a massive exploration program soon. The market will be watching closely and react accordingly…

Stallion owns other projects in the region, of course…

Gunter Lake, for example, is another early-stage property the company has. It has conducted a 1,374-line-kilometre geophysical survey there and located a key target zone.

Next year, it plans to drill 1,500 kilometers at Gunter Lake.

We are looking forward to the results of that exploration campaign, too…

In other words, 2024 will be a busy year for Stallion.

And you want to make sure that you are exposed to what we see as the company’s excellent potential.

And look, right now, its shares look cheaper than its peers based on market capitalization per acre of land.

A table compiled by Stallion suggests that a company with a 23% smaller land package is trading at a valuation eight times higher.

This is the value gap that, in our opinion, could close very soon.

The market doesn’t usually keep valuation gaps like that open for too long.

So, we suggest that you start paying close attention to Stallion Uranium.

Top-Notch Team Focused on Creating Value

It takes more than a high-potential project to deliver shareholder value, of course.

And let’s be honest, not every junior mining has a team that is capable of doing that.

But, in our opinion, Stallion’s management has put together a well-rounded team with ample expertise in relevant areas.

The company’s CEO has a financial and capital markets background, which is extremely relevant at this stage of Stallion’s life cycle.

Raising capital to fund exploration campaigns is a key mission for Mr. Drew Zimmerman, Stallion’s CEO.

During his tenure as a derivatives portfolio manager focused on the commodities markets, he acquired a thorough understanding of the uranium space.

He’s a Chartered Financial Analyst with nine years of experience in the public markets.

He’s one of the most dynamic CEOs that we’ve encountered.

And he complements his capital markets experience with the technical knowledge that the company’s Vice-Presidents of Exploration have.

Mr. Darren Slugoski is the company’s VP Exploration Canada. He has over ten years of mineral exploration experience. In particular, Mr. Slugoski has been focused on the Athabasca Region and its multiple uranium projects.

He has plentiful experience in designing and managing exploration programs in the area.

He masterminded the work that the company has done and plans to do at Coffer and Gunter Lake Projects. His track record includes being involved in the discovery of the Spitfire project in the Western Athabasca Basin.

And speaking of track record…

Stephen Stanley, who serves on Stallion’s Board of Advisors, discovered the Roughrider deposit… and sold Hathor Exploration (the company that owned it) to Rio Tinto, the global mining group, for $650 million back in 2012.

Key shareholders of Stallion were responsible for identifying and combining the foundational assets of NexGen Energy, another Athabasca-focused mining company. As a reminder, NexGen’s market capitalization as of writing is $3 billion.

A Well-Established Opportunity in a World-Class Region

As we said in the beginning, the global nuclear energy market can’t get enough uranium…

Global geopolitical pressures and instability have been supporting the price of uranium, and experts agree that it has much more room to run in the years and decades ahead.

The commodity itself seems to have entered a long-term secular bull market.

But it doesn’t mean that all companies exposed to it will create value for their shareholders.

From our perspective, Stallion Uranium (TSX-V:STUD, OTC:STLNF) has everything it takes for a junior mining company to succeed…

A perfect location in what is arguably the best uranium region in the world…

A dynamic team with expertise in the exact area where Stallion’s projects are located…

A track record of past successes in the exploration area and in capital markets demonstrated by its management and advisors…

A perfect market setup that will arguably favor Canada-based mining companies able to supply the growing nuclear energy space of its insatiable southern neighbor…

A series of upcoming catalysts… from discovery potential to macro-level forces pulling the price of uranium upwards.

Watch this company. It may turn out to be the best investment decision you make this year.

SEE DISCLAIMER & DISCLOSURE BELOW

Sign up to receive our future articles and updates.

The Canadian Mining Report has been retained by Stallion Uranium to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by Stallion Uranium and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in Stallion Uranium and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Sources

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient.