ECB Accelerates Its Asset Purchases. Gold Needs Fed to Follow Suit / Commodities / Gold and Silver 2021

The ECB accelerated its asset purchases, but unless the Fed follows suit, gold may continue its bearish trend.

The ECB accelerated its asset purchases, but unless the Fed follows suit, gold may continue its bearish trend.

On Thursday (Mar. 11), the European Central Bankdecided to accelerate its asset buying under the Pandemic Emergency Purchase Program :

Based on a joint assessment of financing conditions and the inflation outlook, the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year.

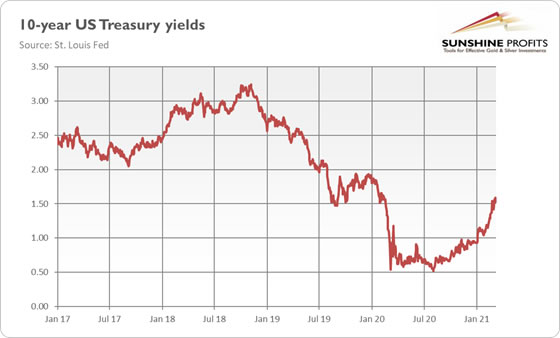

The decision came after a rise in the European bond yields that has mirrored a similar move in the U.S. Treasuries (see the chart below). Christine Lagarde , the ECB President, was afraid that increasing borrowing costs could hamper the economic recovery, so she decided to talk down the bond yields.

Indeed, the growth forecasts for the EU have deteriorated recently amid the persistence of the pandemic and painfully slow rollout of the vaccines. According to the ECB, the real GDP of the bloc is likely to contract again in the first quarter of the year. So, the increase in the market interest rates could additionally drag down the already fragile economic recovery:

Market interest rates have increased since the start of the year, which poses a risk to wider financing conditions. Banks use risk-free interest rates and sovereign bond yields as key references for determining credit conditions. If sizeable and persistent, increases in these market interest rates, when left unchecked, could translate into a premature tightening of financing conditions for all sectors of the economy. This is undesirable at a time when preserving favourable financing conditions still remains necessary to reduce uncertainty and bolster confidence, thereby underpinning economic activity and safeguarding medium-term price stability.

Implications for Gold

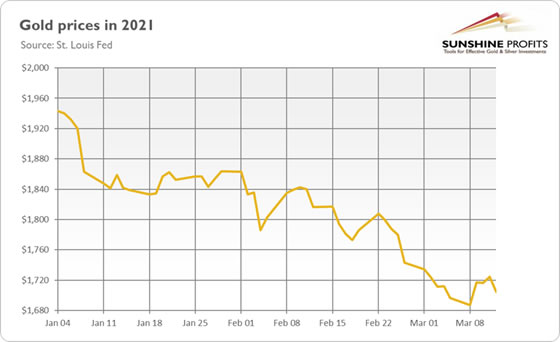

What does this all mean for gold prices? Well, the ECB’s move should prove rather negative for the price of gold , at least initially. This is because the loosening of the European monetary policy could weaken both the euro and gold against the U.S. dollar. Indeed, as the chart below shows, although the price of gold increased on Thursday, it declined one day later.

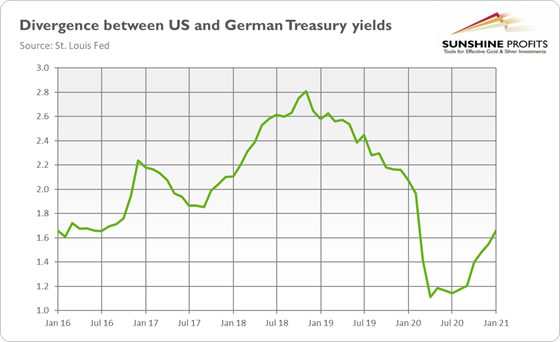

Moreover, the acceleration in the ECB’s quantitative easing could further widen the divergence in the interest rates (that started rising in the third quarter of 2020, as one can see in the chart below) between the U.S. and the EU, which should also support the greenback at the expense of the yellow metal.

On the other hand, the fact that the ECB has intervened in the markets – announcing acceleration in the pace of its asset buying program, after a certain rebound in the bond yields – could turn out to be positive for gold prices, at least in the long-run. This is because it shows how fragile the modern economies are and how dependent they have become on cheap borrowing guaranteed by the central banks.

As I noticed earlier in the past, we are in the debt trap – and the central banks will not allow for the true normalization of the interest rates. The latest ECB’s action is the best confirmation that suppression of the real interest rates will continue, thus supporting gold prices. After all, the ECB has effectively put a cap on bond yields, introducing an informal yield curve control.

So far, only the ECB has intervened in the markets, but other central banks could follow suit. This week, the Fed will announce its decision on the monetary policy. And we cannot exclude that the American central bank will also signal a more dovish stance to calm the turmoil in the bond markets and prevent further increases in the interest rates. One thing is certain: gold needs some fresh dovish hints from the Fed to go up. Unless the Fed further eases its stance, I’m afraid that gold will continue its bearish trend.

If you enjoyed the above analysis, we invite you tocheck out our other services. We provide detailed fundamental analyses of thegold market in our monthly Gold Market Overview reports andwe provide daily Gold & Silver Trading Alerts with clearbuy and sell signals. If you’re not ready to subscribe yet and are not on ourgold mailing list yet, we urge you to sign up. It’s free and if you don’t likeit, you can easily unsubscribe. Sign uptoday!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.