Fed's Liquidity Circus and Gold / Commodities / Gold and Silver 2021

Fed pumped so much money into thefinancial system, that the latter started sending it back. How will this andFed’s more hawkish tone impact gold?

With Jerome Powell, Chairman of the U.S.Federal Reserve (FED), testifying before Congress on Jun. 22, his preparedremarks signaled that the FED remains on autopilot. Despite saying that “jobgains should pick up in coming months as vaccinations rise,” he added that “weat the FED will do everything we can to support the economy for as long as it takes to complete therecovery.”

And while Powell supported our thesis by saying that “labor demand is remarkably strong and overtime we will find ourselves with low unemployment and wages going up across thespectrum,” when asked if inflation is transitory, he responded:

“[Perhaps] all of the overshoot ininflation comes from categories such as rising used car and trucks, airplanetickets, hotel prices that have been affected by the reopening of the economy.[And while] these effects have turned out to be larger than we expected , the incoming data are consistent with theview that these factors will waneover time .” For context, of course inflationary pressures will “wane overtime.” That’s not up for debate. However, “when” is the key question.

But in a bid to remove any doubt, headded:

" We will not raise interest rates preemptively because we fear thepossible onset of inflation . We will wait for evidence of actual inflationor other imbalances."

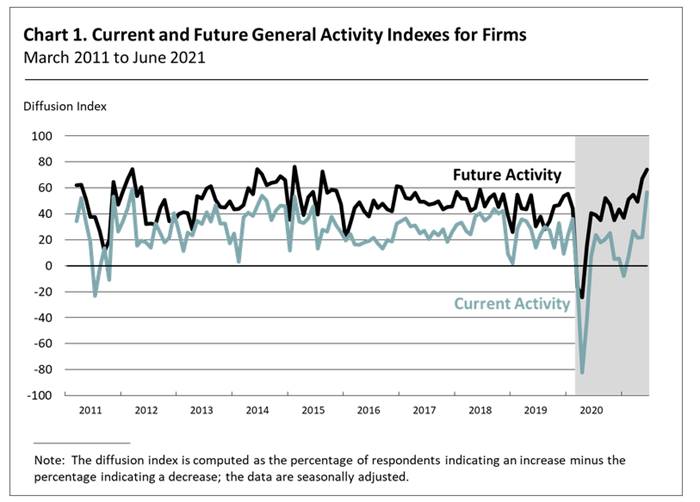

Thus, while investors clearly cheered theFED Chair’s dovish sentiment on Jun. 22, Powell (for better or worse) stillremains out of touch with reality. Case in point: the Philadelphia FED releasedits Nonmanufacturing Business Outlook Survey on Jun. 22. And while “the full-time employment index fell 20 points to4.3 in June after rising 17 points last month,” the report revealed that “bothfuture activity indexes suggest that the respondents expect overall improvementin nonmanufacturing activity over the next six months.”

Please see below:

Source:Philadelphia FED

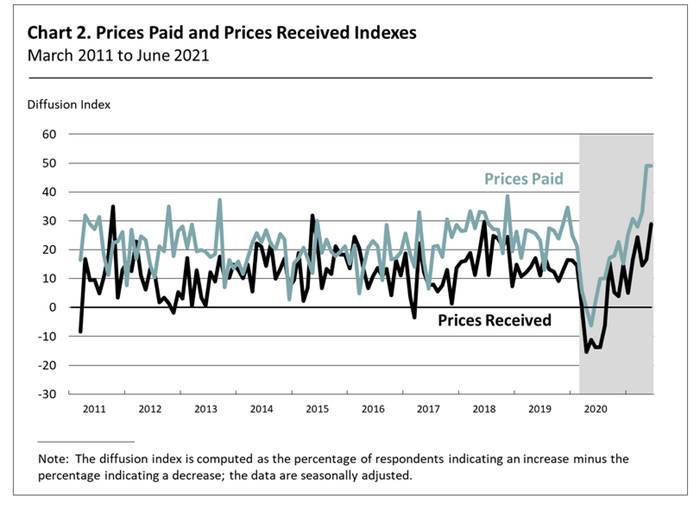

More importantly, though, with theinflation drama still unfolding, the report showed more of the same:

“After reaching its all-time high in May,the prices paid index mostly held steady in June at 49.0 Forty-nine percent ofthe firms reported increases, nonereported decreases , and 33 percent of the firms reported stable inputprices. Regarding prices for the firms’ own goods and services, the pricesreceived index rose 12 points to 28.9 in June, its highest reading since June2018.”

Please see below:

Source:Philadelphia FED

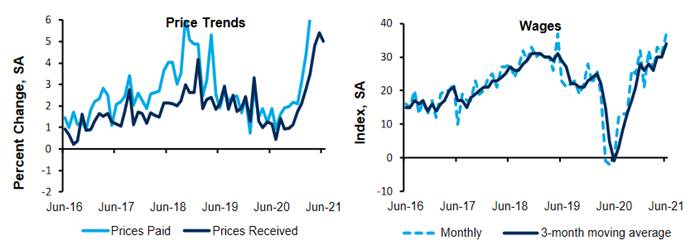

Similarly, the Richmond FED also releasedits Survey of Manufacturing Activity on Jun. 22. And while the report citedthat “average growth rates of both prices paid and prices received by surveyparticipants declined slightly but remained elevated in June,” employment wasmore optimistic, with the report revealing that “many manufacturers increasedemployment and wages in June and [expect] further increases in the next sixmonths.”

Please see below:

Source:Richmond FED

What’s more, while the FED admitted itsinflation error on Jun. 16 – as evidenced by the increase in its forecast forthe headline Personal Consumption Expenditures (PCE) Index – Powell is nowpretending that growth doesn’t exist. For context, the FED increased its 2021real GDP growth estimate from 6.5% to 7.0% on Jun. 16, so Powell’s assertion on Jun. 22that the economy "is still a ways off" is quite the contradiction.

Moreover, absent a severe spread of theDelta variant – which White House chief medical advisor Dr. Anthony Fauci saidwas “the greatest threat in the U.S. to our attempt to eliminate COVID-19” –U.S. economic growth should easily outperform its developed-market peers.

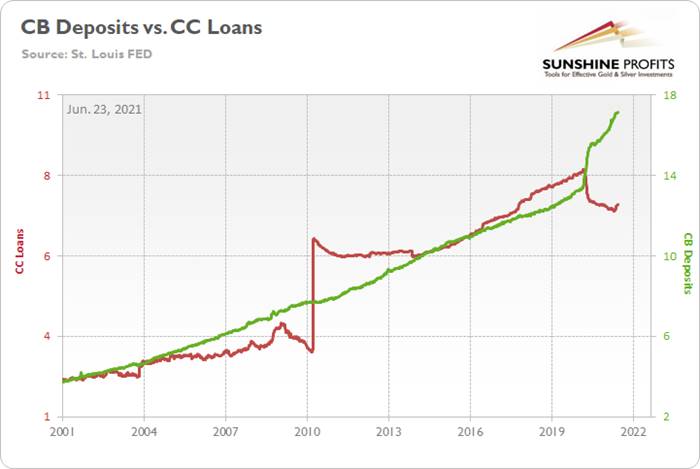

For example, many deflationists cite theslowdown in loan activity as a sign of a weak U.S. economy. However, with U.S.commercial banks releasing their deposit figures on Jun. 22, the argument ismuch more semblance than substance.

Please see below:

To explain, the green line above tracksdeposits held by U.S. commercial banks, while the red line above tracks consumers’revolving and credit card loans. If you analyze the right side of the chart,you can see that a material gap is present. However, with unprecedented fiscalpolicy (stimulus checks and enhanced unemployment benefits) flooding consumers’bank accounts with dollars, why borrow money if you already have the cash tomake the purchase?

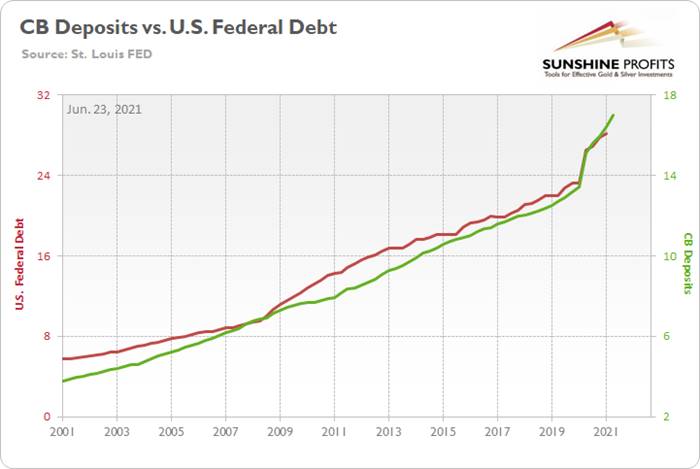

To that point, if we compare U.S.commercial banks’ deposits to the U.S. federal debt, the connection is evenclearer.

Please see below:

To explain, the green line above tracksdeposits held in U.S. commercial banks, while the red line above tracks theU.S. federal debt. If you analyze the sharp move higher in 2020, it’s anothersign that U.S. citizens don’t need to borrow money when the government isalready writing the checks. For context, there is a slight lag because the U.S.federal debt references Q1 data and U.S. commercial banks’ deposits referenceQ2 data.

Likewise, while rising U.S. nonfarmpayrolls remain the key piece to solving the FED’s puzzle, the idea thatmonetary support is helping the real economy lacks credibility. To explain, theFED sold a record $792 billion worth of reverse repurchase agreements on Jun.22. Moreover, when the FED buys $120billion worth of bonds per month, the cash filters throughout the U.S. bankingsystem and then financial institutions exchange that cash for Treasurysecurities on a daily basis, is QE really helping anyone?

Please see below:

Source:NY FED

For context, I wrote previously:

Areverse repurchase agreement (repo) occurs when an institution offloads cash tothe FED in exchange for a Treasury security (on an overnight or short-termbasis). And with U.S. financial institutions currently flooded with excessliquidity, they’re shipping cash to the FED at an alarming rate.

Moreimportantly, though, after the $400 billion level was breached in December2015, the FED’s rate-hike cycle began. On top of that, the liquidity drain isat extreme odds with the FED’s QE program. For example, the FED aims topurchase a combined $120 billion worth of Treasuries and mortgage-backedsecurities per month. However, with daily reverse repurchase agreementsaveraging $520 billion since May 21, the FED has essentially negated 4.33months’ worth of QE in the last month alone.

To that point, the flood of reverserepurchase agreements signals that financial institutions have no use for theFED’s handouts. Think about it: if commercial banks could generate higherreturns by originating loans for consumers and businesses, wouldn’t they? Andwith 74 counterparties participating on Jun. 22 – up from 46 on Jun. 7 – the FED’s liquidity circus is now on displayevery night.

If that wasn’t enough, I’ve highlightedon several occasions that gold exhibits a strong negative correlation with theU.S. 10-Year real yield (inflation-adjusted). And unsurprisingly, when thelatter peaked in late 2018 and began its descent, it was off to the races forgold.

Please see below:

To explain, the gold line above tracksthe London Bullion Market Association (LBMA) GoldPrice , while the red line above tracks the inverted U.S. 10-Year real yield. For context, inverted means thatthe latter’s scale is flipped upside down and that a rising red line representsa falling U.S. 10-Year real yield, while a falling red line represents a risingU.S. 10-Year real yield.

More importantly, though, if you analyzethe relationship, you can see that before the U.S. 10-Year real yield plunged,gold was trading below $1,250 (follow the arrow). Conversely, once the U.S.10-Year real yield hit an all-time low of – 1.08% in 2020, gold was tradingabove $2,000.

Thus, what emotional goldinvestors fail to appreciate is that the yellow metal benefited fromabnormally low interest rates. And with further strength dependent on anotherall-time low, the FED’s tightening cycle (which is already subtly underway)paints an ominous portrait of gold’s medium-term future.

To that point, with Morgan Stanleytelling its clients that “ We are past“Peak Fed” for the cycle and the market knows it ,” overzealous goldinvestors ignore the difficult realities that lie ahead.

Please see below:

To explain, the blue line above tracksthe U.S. 10-Year real yield and important fundamental developments are markedin red. If you analyze the “Peak Fed” labels near 2012 and 2020 and comparethem with gold’s behavior on the first chart above, you can see how abnormallylow U.S. 10-Year real yields coincided with abnormally high gold prices. As aresult, with the former poised to move higher in the coming months, the yellowmetal will likely head in the opposite direction.

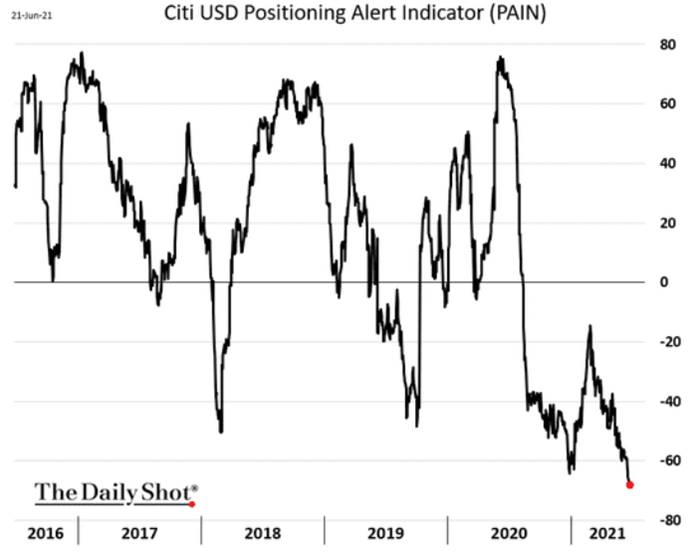

What’s more, not only are the PMs dodgingbullets from the bond market, but the USD Index has barely made its presencefelt. For example, while the FED’s hawkish shift (even if Powell won’t admitit) is extremely bullish for the greenback, market participants – who arewilling to give the FED the benefit of the doubt – still remain skeptical ofthe recent rally.

Please see below:

To explain, the black line above tracksCitigroup’s USD Positioning Alert Indicator (PAIN). For context, the indexgauges whether or not positioning is crowded in the currency market. If youanalyze the right side of the chart, you can see that U.S. dollar sentiment hasfallen off of a cliff. However, with all signs pointing to a September taper, a violent short-covering rally could catchmany investors off guard.

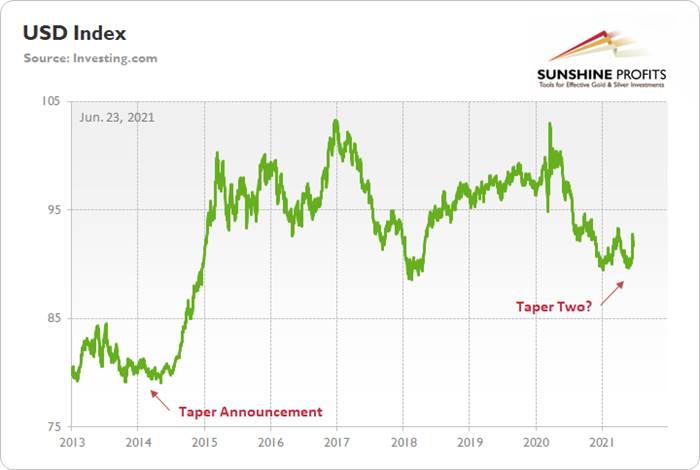

As further evidence, when the FEDdelivered its taper announcement in December 2013, the USD Index recorded (witha delay) one of its sharpest rallies ever.

Please see below:

To explain, the green line above tracksthe USD Index. If you analyze the left side of the chart, you can see thatafter the FED revealed its hand, the USD Index found a bottom and surgedroughly six months later. Thus, with a similar announcement likely in the fall,the PMs could be confronted with even more negativity.

And no, Basel 3 is not likely to be agame-changer for the gold market in the near term – Idiscussed that on June 2 .

In conclusion, while the gold, silver, and mining stocks remain ripe for a short-termrally (no market moves in a straight line and PMs are no exception), theirmedium-term outlook remains extremely treacherous. And though Powell calmedinvestors’ nerves on Jun. 22 and market participants remain loyal followers,it’s important to remember that he is far from omniscient. After a significantabout-face regarding the future trajectory of the headline PCE Index – aforecast that he made only three months ago – his confidence game is all aboutsentiment. Thus, while investors will give him the benefit of the doubt untilthe bitter end, the recent behavior of the bond market, the USD Index and theprecious metals signal that the winds of change have already begun to blow.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.