Finally Some Temporary Relief For Gold

Latest U.S.-China trade talks give gold an excuse to rally.

Massive short interest, fund liquidations, suggest temporary low.

Don't get too bullish, though, as gold's interim trend remains down.

In hitting its low for the year last week, gold's sour performance has generated a flurry of interest in the metal among investors. There has also been a notable increase in gold coverage in recent days by the mainstream financial media as the question, "Has gold finally hit bottom?" seems to be on everyone's lips. We'll examine this question in today's report. I'll also make the case that while there is a good chance for an immediate-term (1-4 week) relief rally, gold's dominant intermediate-term (3-6 month) trend will eventually overpower the latest rally and keep the metal's bear market intact.

For the first time since July, the latest week started off on a positive note for gold. The gold price was higher on Monday after falling to a 1-1/2 year low last week. A pullback in the U.S. dollar index and some strengthening in China's yuan currency made the metal cheaper for overseas buyers. December gold futures rose 0.30 percent on Monday after hitting a 2018 low on Aug. 16. While there is no definite consensus among the pundits, there has definitely been increased interest among value-oriented buyers in gold's near-term rebound prospects as we'll see here.

Gold has lost almost 13 percent in value after peaking in April as the rising dollar index has put relentless downward pressure on the yellow metal. However, last week's announcement that the U.S. and China would resume trade discussions this week put a temporary halt to the dollar's advance and has given the precious metals a much-needed breather from the selling pressure. The announcement coincided with gold's sixth consecutive weekly loss and its worst weekly performance in eight months.

Peter Boockvar of Bleakley Financial Group points out that speculators are net short gold for the first time since December 2001. Reports also indicate that liquidations of gold ETFs have been heavy in recent weeks and that fund managers increased their net short positions in COMEX gold contracts for a sixth straight week. Also making the case for a short-term turnaround attempt for gold is bullion demand in India, the world's second-biggest gold consumer, reportedly rebounded last week. Lower gold prices has also served as an incentive for fresh buying in other major Asian markets, according to Reuters.

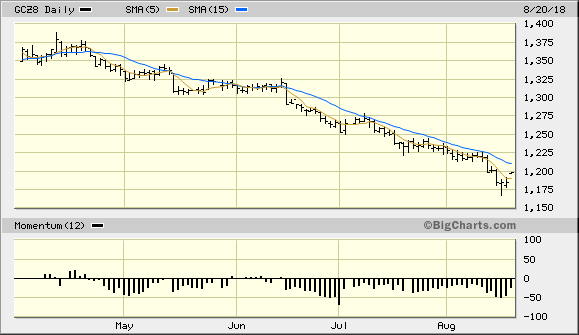

Yet despite the increased buying interest, gold has a lot to contend with before it can begin a new bull market. The amount of supply which was unloaded onto the market in the last four months will likely take several months to be completely absorbed. The downside price momentum generated by the April-August decline is also still a major factor, which can be seen in the following graph of December gold. Gold also hasn't yet managed to close above its 15-day moving average (blue line), which is the minimum requirement for an immediate-term bottom under the rules of my trading discipline.

Source: BigCharts

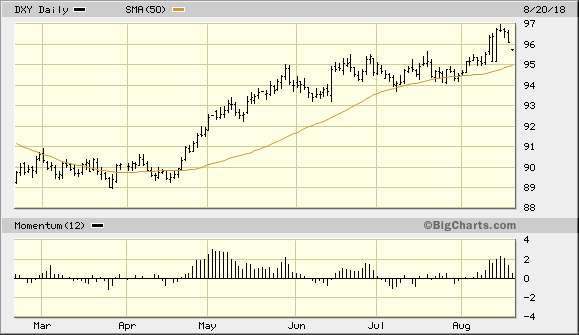

Meanwhile, the U.S. dollar index (DXY) remains above its rising 50-day moving average (below). This tells us that the dollar's upward trend is still intact and will remain a short-term threat to gold as long as DXY is above the 50-day MA on a closing basis. Ever since the dollar's rally commenced back in April, the dollar has stayed above the 50-day MA - a trend line which is widely watched by institutional and retail traders alike - and hasn't been able to close decisively under it. This more than anything else has been responsible for gold's weak performance of the last four months.

Source: BigCharts

Another way of expressing the need for a reversal of the dollar's strength before anything beyond a short-covering gold rally can begin is in the following chart. Shown below is the dollar/gold ratio, which provides a relative strength comparison of the U.S. dollar index versus gold. A decisive reversal of this rising trend is needed to confirm that gold's currency component is no longer weighing against the yellow metal. As long as the dollar/gold ratio is rising, however, investors should continue to favor holding cash over gold.

Source: StockCharts

On an immediate-term (1-4 week) basis, however, the gold/silver ratio has hit a level which has historically meant the gold price is vulnerable for a short-covering rally. Historically, whenever the gold/silver ratio has risen decisively above the 80.00 level as it did last week it has been a bullish for gold, and especially silver, in the immediate-term. The last time the gold/silver ratio hit a similar reading was back in March, and it resulted in a decent upside pop for the silver price.

Source: StockCharts

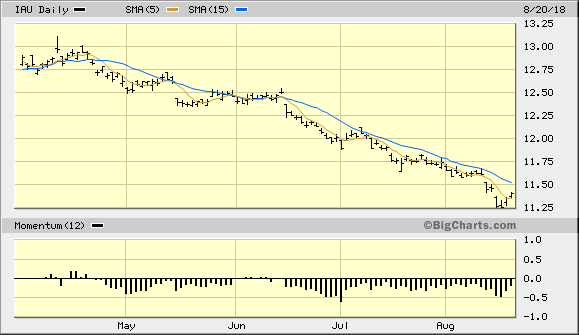

Meanwhile the iShares Gold Trust (IAU), which is my favorite gold proxy and trading vehicle, remains under its 15-day moving average which means its immediate-term trend is still down. However, IAU did manage to close decisively above its 5-day MA on Monday as can be seen in the following graph. One more close above the 5-day MA this week would suffice as a preliminary signal for an immediate-term bottom since a 2-day close above the 5-day moving average typically breaks the immediate downside momentum of a price slide. This would also likely discourage the shorts and force them to temporarily back off enough to allow the bulls to take over for a while. Both the bulls and the bears are well aware that the massive build-up of short interest in recent weeks can serve as fuel for a potentially explosive short-covering rally.

Source: BigCharts

For now though, while the gold price remains under its 15-day moving average, I recommend that investors stand pat and make no new purchases in the iShares Gold Trust (IAU). A confirmed immediate-term bottom could happen very soon, however. Once the technical requirements for a preliminary bottom in IAU are met as discussed in this report, namely a 2-day close above the 5-day moving average, we'll be able to evaluate the prospects for another entry point with greater clarity. For now, I recommend investors remain in cash.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts