Further Gold Price Pressure as the USDX Is About to Rally / Commodities / Gold & Silver 2020

Gold, mining stocks, and the USD Indexhave not been doing much recently. However, yesterday, this “inactivity” tookquite a decisive shape, and unfortunately, things are not looking good forgold.

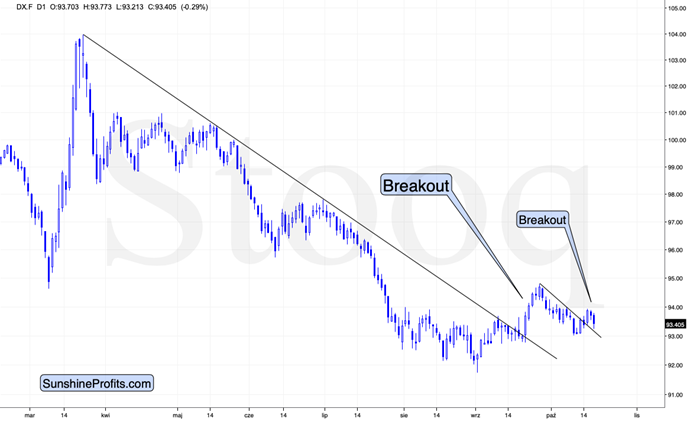

As you are all aware, gold tends to moveconversely to the USD Index. Therefore, it’s useful to focus on the latter forsigns that would influence the former. So, what does the current USDX outlooklook like?

Well, it looks like the USDX is about torally. It broke above its medium-term resistance line and verified thisbreakout. This verification took the form of a decline based on a more recentshort-term breakout, which seems to have ended.

From a medium-term point of view, sincethe market had to correct before moving higher again, it’s no wonder that ithad to do the same from a short-term perspective as well.

Based on the chart above, the outlook forthe USD Index is bullish.

But, before we move to gold, please payattention to the shape of the last candlestick. The USDX moved relativelylower, almost touching the declining support line.

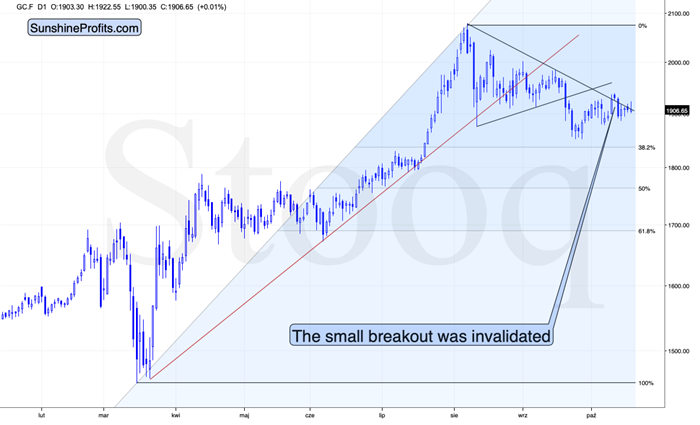

Considering the above, one might haveexpected to see a visible daily gain in gold – maybe with a small correction,but again, with a substantial gain in terms of daily closing prices. So, did wewitness something like that?

Not really.

Gold was marginally up, which is anotable bearish indication. The bearish confirmation comes from the fact thatgold tried and failed to break above the declining resistance line.

Above the resistance line, gold took onlya small comeback from the USD Index that made gold invalidate its intradaybreakout. It is a clear sign of weakness.

And you know what precious metals sectorsign of weakness is even more visible? It’s yesterday’s action in gold and silvermining stocks .

Namely, miners have declined adamantly–much more visibly than gold. This type of underperformance is what precedes thedecline. Or, more precisely, it is often the very initial part of a moresignificant decline.

That is a perfect cherry on the bearishanalytical cake that we’ve “baked” in our previous analyses. Overa week ago , we wrote that the situation was reminiscent of theearlier cases, marked with blue ellipses. Namely, the GDX ETF moved only a tadhigher, which was the final top for at least some time. We argued that thestrong daily rally that started with a bullish price gap was not so bullishafter all. Indeed, over a week later, once again, miners are visibly lower.

Of course, based i.a. in the USDXsituation, most probably, this is not the end of the miners’ decline, butrather, it is just the beginning. The situation relative to the 50-day movingaverage (marked with blue) confirms it. After all, back in March, miners movedslightly above their 50-day moving average only to plunge shortly after that,and the current situation is the only similar case to the above. There were noother cases when the miners broke below this MA and then moved back up slightlyabove it, declining once again afterward.

And due to the above, if the situationwasn’t bearish enough, the Stochastic indicator based on the GDX ETF has justflashed a clear sell signal.

All in all, currently, the outlook forthe precious metals market remains bearish.

Thank you for reading our free analysistoday. Please note that the following is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the interim targetfor gold that could be reached in the next few weeks.

If you’d like to read those premiumdetails, we have good news for you. As soon as you sign up for our free goldnewsletter, you’ll get a free 7-day no-obligation trial access to our premiumGold & Silver Trading Alerts. It’s really free – sign up today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.