Gold's Fairly-Odd Behavior

Gold correlates with the four big markets: the dollar, the USD/JPY ratio, Treasury rates, and inflation expectations (TIP).

Gold is behaving oddly relative to three of these four markets.

This fairly-odd behavior may signal a change in the gold market.

In previous SA articles, we demonstrated how gold correlates to the four big markets: the dollar, the USD/JPY ratio, Treasury rates, and inflation expectations (TIP). In this piece, we point out some discordant behavior in gold as it relates to three of these markets.

Inflation Expectations

There is a strong positive correlation between gold and inflation expectations (as measured by TIP).

In December, this correlation turned negative for the first time since mid-2016 (purple rectangles in the chart below). In 2016, the negative correlation signaled the start of a 15% slide in the gold price. It is impossible to know if the same thing is going to happen this time, but the similarity in the patterns is undeniable. Also, rising rates are likely to keep inflation expectations contained and gold under increased pressure, like in the second half of 2016.

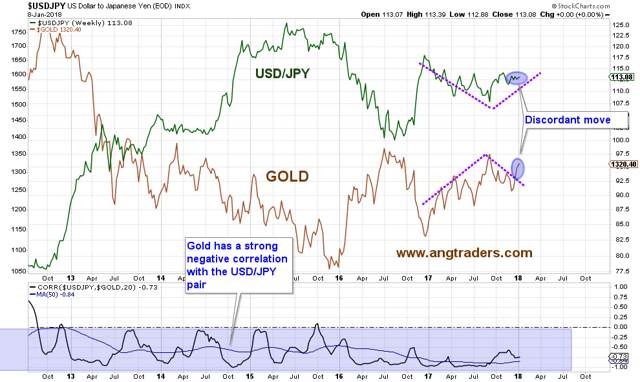

The USD/JPY Ratio

Gold has a strong negative correlation with the USD/JPY ratio. While this correlation continues to be negative, over the last month, gold has made a big move up while the USD/JPY ratio has gone sideways. This fairly-odd behavior may presage a change, but the direction of that change is still to be determined.

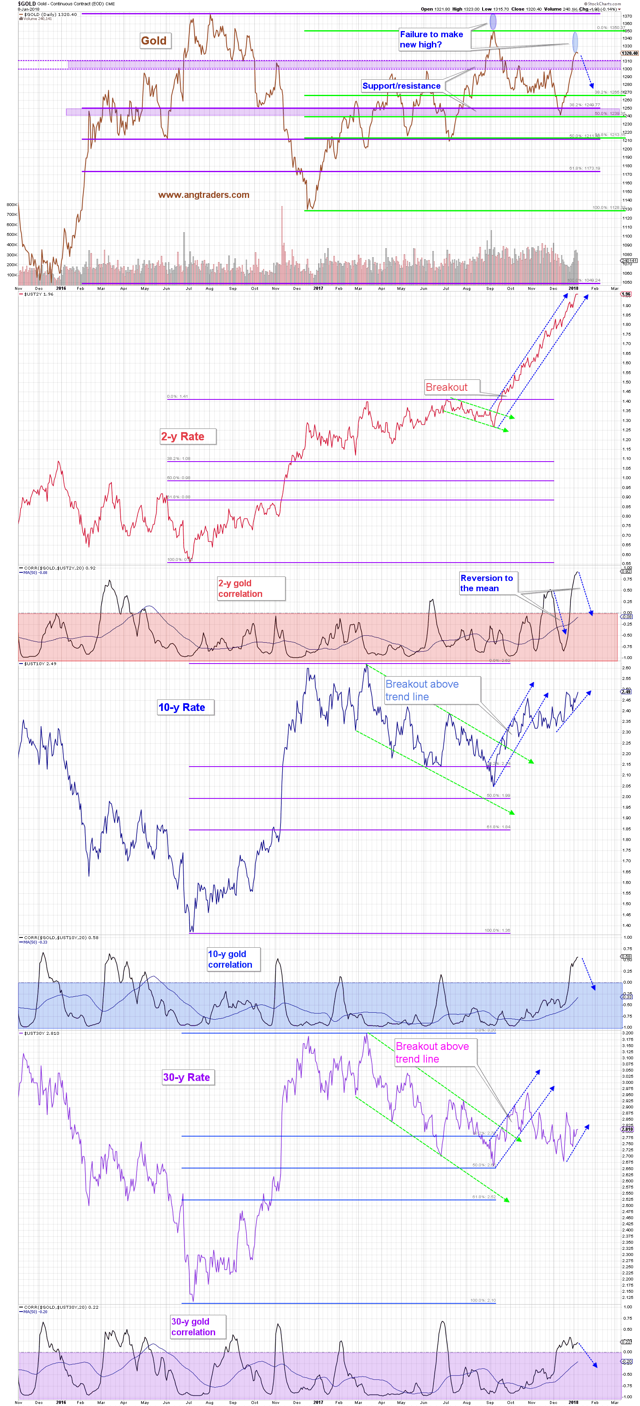

Treasury Rates

Like the USD/JPY ratio, Treasury rates display a negative correlation with the price of gold, however, since the beginning of December this correlation has turned positive in all three parts of the curve. A reversion to the mean (a drop into the negative) is almost guaranteed. This means that either gold drops in price as rates continue to rise, or rates drop, and gold continues to rise. We think this odd behavior is more likely to resolve itself by gold dropping in price since the bias in rates is definitely to the upside.

The Dollar

Gold shows a negative correlation with respect to the dollar, and this is the one situation in which gold is not behaving oddly; gold has rallied as the dollar has fallen.

Between August and October of 2017, the dollar traced-out a classic reverse head-and-shoulders pattern, but subsequently dropped back down and now seems to be testing the lows to form a double bottom. If the latter is indeed the case, then the dollar may be about to rally, and if the negative correlation holds, then gold will give back most, or all of its December price appreciation.

The other possibility is that gold starts behaving oddly with respect to the dollar as well, and we get both gold and the dollar rising together. In that case, gold would be behaving oddly in all four correlated markets (which, of course, is possible).

In conclusion, gold is displaying odd behavior in three of the four correlated markets, and because the bias in rates is to the up-side, inflation expectations will remain contained, making the balance of probabilities point to future weakness in gold.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.