Gold and Silver Price Ready For Another Rally Attempt / Commodities / Gold & Silver 2020

After nearly three weeks of sideways/downward price action in Gold and Silver, our researchers believe both metals have already set up another breakout/rally attempt after breaching downward resistance (shown as the downward sloping CYAN line). This could be another huge opportunity for precious metals traders as the next move higher should prompt a rally above recent highs. That means a target price level in Gold above $2100 and a target price level in Silver above $30.50.

ARE METALS POISED TO RALLY TO NEW HIGHS SOON?

The deep price retracements recently in both Gold and Silver have come from news events. First, the EU Banking Report that destroyed the market on September 21. Then, just recently, the news that President Trump contracted COVID-19. The resilience in both Gold and Silver near these recent lows suggests demand for metals is still skyrocketing – otherwise, we believe much deeper price lows would have been reached.

If our previous research is correct, this current basing/bottoming pattern could be the beginning of an explosive upside “appreciation” phase in precious metals.

Please take a minute to read the following past research post from our team.

September 27, 2020: GOLD AND SILVER FOLLOW UP & FUTURE PREDICTIONS FOR 2020 & 2021 – PART I

September 28, 2020: GOLD AND SILVER FOLLOW UP & FUTURE PREDICTIONS FOR 2020 & 2021 – PART II

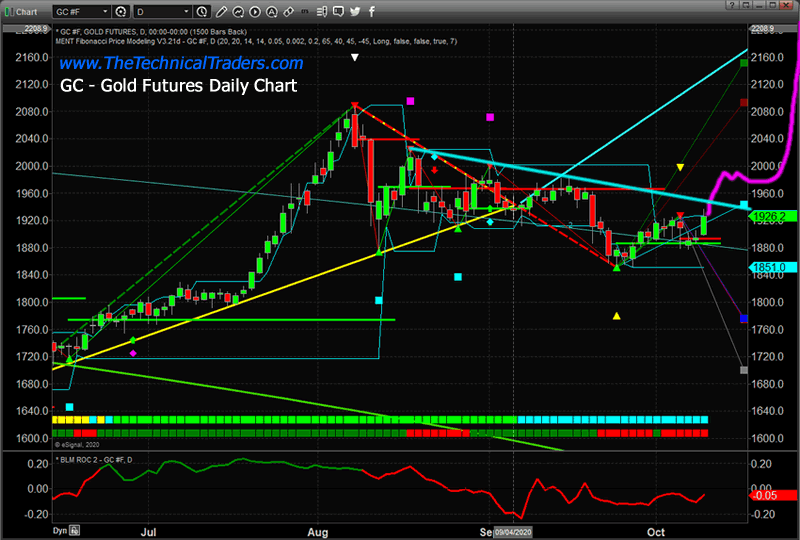

GOLD DAILY CHART

We expect Gold to rally to levels near 1995, then stall a bit before breaking clear of the $2085 level and pushing well above the $2150 as a new rally phase begins. At this point, we believe the upside move to break the CYAN resistance channel is key to starting this upside price recovery.

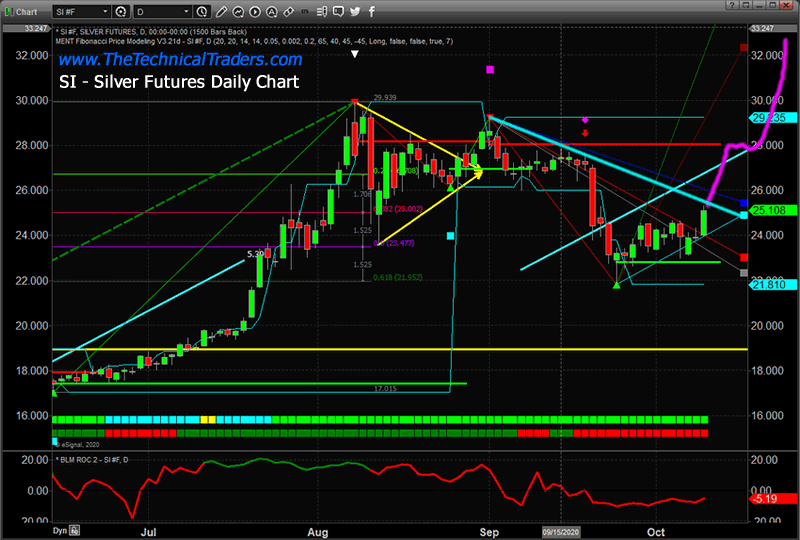

SILVER DAILY CHART

The setup in Silver is very similar and, in many ways, a bit clearer on the chart. The CYAN downward sloping price channel is very clear.

Price is very close to breaking above this channel. We believe the next move in Silver is a rally to levels near $28, then stalling briefly before the next “appreciation” phase begins pushing Silver above $31.50.

Remember, what we are calling the “appreciation phase” is really a much longer-term price appreciation cycle in metals that should begin within the next six months and may last 2+ years.

Before you continue, be sure to opt-in to our free-market trend signals now so you don’t miss our next special report!

When we are reviewing Daily charts, as we are in this article, we are talking about an appreciation phase that may last 7 to 15 days – not two years. Please take a look at the research articles we’ve linked near the top of this article to learn about the broader market phases that are setting up.

Still, the result is that we believe Gold and Silver are ready to start moving much higher at this point – we need to see those CYAN levels broken first.

Metals have been, and continue to be, incredible opportunities for skilled technical traders. Repeating cycles and patterns allows skilled traders to pick from multiple triggers.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is an incredible year for traders and investors. Don’t miss all the incredible trends and trade setups.

If you want to learn how to become a better metals trader, visit www.TheTechnicalTraders.com to learn how we can help you make money with our swing and investing signals.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involvedin the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader,and is the author of the book: 7 Steps to Win With Logic

Through years ofresearch, trading and helping individual traders around the world. He learnedthat many traders have great trading ideas, but they lack one thing, theystruggle to execute trades in a systematic way for consistent results. Chrishelps educate traders with a three-hourvideo course that can change your trading results for the better.

His mission is to help hisclients boost their trading performance while reducing market exposure andportfolio volatility.

He is a regularspeaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chriswas also featured on the cover of AmalgaTrader Magazine, and contributesarticles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.