Gold and Stock Bulls Are Getting Ready / Commodities / Gold and Silver 2021

Now that stocks closed at new all time highs, thecorrection is officially over. And what little rest stock bulls could claimlast week, arrived on Friday. Yet, the bull is strong enough to defend the3,900 zone, and charge higher the same day.

Who could be surprised, given the modern monetary theory ruling theeconomic landscape? The Fed amply accomodative, one $1.9T stimulus bill justin, and a $2T infrastructure one in the making. That‘s after the prior Trumpstimulus, and who would have forgotten how it all started in April 2020? Theold congressional saying „a billion here, a billion there, and pretty soonyou‘re talking real money“, needs updating.

Stocks are readying another upswing as the volatilityindex is approaching 20 again, and the put/call ratio shows complacentreadings. The sectoral examination supports higher highs as tech has reversedintraday losses, closing half of the opening bearish gap. Value stocksnaturally powered to new highs, with industrials, energy and financialperforming best. Real estate keeps showing remarkable momentum, and has beenamong the best performers off correction‘s lows.

These all have happened while long-term Treasury yieldshave broken to new highs. Are they stopping to be the boogeyman?

As I‘ll show you, inflation expectations are rising – andthe bond market is reflecting that. The market‘s discounting mechanism is atwork, mirroring the future virtually ascertained CPI rise, if you lookcarefully into the PPI entrails. This inflation won‘t be as temporary as theFed proclaims it would – but it still hasn‘t arrived in full force. We‘remerely at the stage of financial assets rising, because that‘s where the newlyminted money is chiefly going.

As regards gold, let‘s recall my Thursday‘s words:

(…) At the moment, evaluating the strength and internalsof precious metals rebound, is the way to go as we might very well have seen the gold bottom,with the timid $1,670 zone test being all the bears could muster. Time and mydutiful reporting will tell.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

The S&P 500 upswing took a little breath, and at thesame time continued unchallenged. The path of least resistance simply remainshigher.

Credit Markets

High yieldcorporate bonds (HYG ETF) have declined, but don‘t give the impression ofreadying a breakdown. I understand it as a daily weakness, because the wholebond market was under pressure on Friday, with investment grade corporate bonds(LQD ETF) taking it on the chin as well.

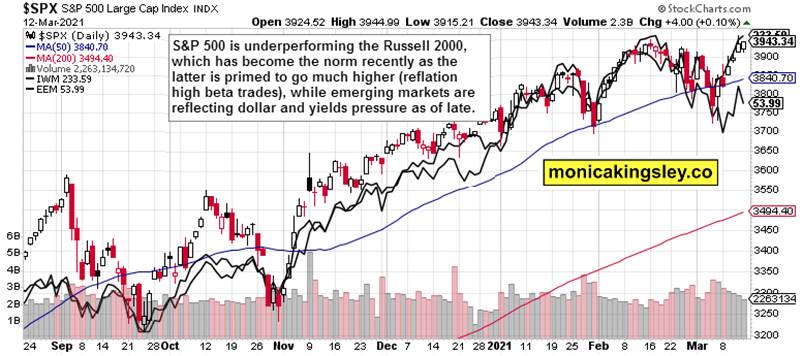

Russell 2000 and Emerging Markets

Russell 2000 keeps doing better than the 500-strongindex, which is natural and expected given the prevailing investment themesdoing well, value stocks rising, and euphoric speculation running rampant.Emerging market weakness needs to be viewed through the strains stronger dollarand rising rates cause abroad. That‘s why I am not viewing EEM underperformanceas a warning sign for U.S. equity markets.

Inflation Expectations and Yields

Quite a relentless rise in my favorite metric of forwardlooking inflation, isn‘t it? Treasury inflation protected securities tolong-dated Treasuries (TIP:TLT) have been relentlessly rising off the coronacrash lows, and their accent in 2021 has accelerated just as steeply as thenominal rates reflect (see below).

Gold Upswing Anatomy

Gold refused the premarket losses, and has rebounded toclose almost unchanged on the day. Is that sign of strength or weakness?

The miners to gold ratio provides a clear answer, andit‘s a bullish one to open the week. Finally, the gold market is showing signsof life on a prolonged basis, which I started talking on Tuesday. Regardless of Friday‘sweakness in the yellow metal, it‘s so far so good as the miners keep leadingthe charge.

Silver weakness in the course of the upswing isn‘t a tooworrying sign – silver miners outperforming as well, is a more importantsignal. Smacks of broadening leadership in the unfolding precious metalsupswing.

Summary

The consolidation of S&P 500 gains was and remainsbound to be a short-term affair as the bulls take on new highs and surge wellpast them in the days and weeks ahead. The top is very far off as this stillnascent recovery gets so much stimulus fuel that overheating becomes a veryreal possibility this year already.

Thank you for having read today‘s free analysis, which isavailable in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, whichfeatures real-time trade calls and intraday updates for both Stock TradingSignals and Gold Trading Signals.

Thank you,

MonicaKingsley

Stock Trading Signals

Gold Trading Signals

www.monicakingsley.co

mk@monicakingsley.co

* * * * *

All essays, research andinformation represent analyses and opinions of Monica Kingsley that are basedon available and latest data. Despite careful research and best efforts, it mayprove wrong and be subject to change with or without notice. Monica Kingsleydoes not guarantee the accuracy or thoroughness of the data or informationreported. Her content serves educational purposes and should not be relied uponas advice or construed as providing recommendations of any kind. Futures,stocks and options are financial instruments not suitable for every investor.Please be advised that you invest at your own risk. Monica Kingsley is not aRegistered Securities Advisor. By reading her writings, you agree that she willnot be held responsible or liable for any decisions you make. Investing,trading and speculating in financial markets may involve high risk of loss.Monica Kingsley may have a short or long position in any securities, includingthose mentioned in her writings, and may make additional purchases and/or salesof those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.