Gold Asks Where Is The Inflation / Commodities / Gold & Silver 2020

The inflation remains low and below the Fed’s target. So, should gold bulls worry about it?

The inflation remains low and below the Fed’s target. So, should gold bulls worry about it?

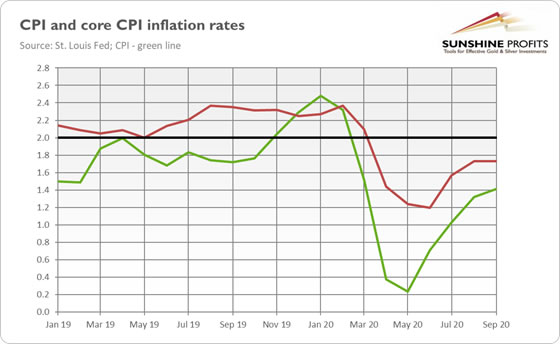

The U.S. CPI inflation rate rose by 0.2 percent in September , following a 0.4 percent increase in August. It was the smallest jump since May. The move was driven by a 6.7- percent spike in the cost of used cars and trucks, and it’s the most significant upward change over half a century. The core CPI rose 0.2 percent, following a 0.4 percent increase in the preceding month.

On an annual basis, the overall CPI increased 1.4 percent (seasonally adjusted), following a 1.3 percent increase in August. The core CPI rose 1.7 percent, much like in the month prior (or a bit less if we abstract from rounding). Therefore, as the chart below shows, the period of disinflation perhaps ended, but the inflation remains low. It seems that even though the inflation rate has reached the bottom in May or June, the outbreak of high inflation in the near future is unlikely.

Indeed, the expectations from the inflation rebounded after a plunge during the coronavirus crisis. But, they have stabilized around the pre-pandemic level, at which market players don’t see an outbreak of inflation, as shown in the chart below.

So, is Mr. Market right that the inflation will remain low, i.e., below the Fed’s target? Well, he might be. After all, the pandemic caused a profound economic shock, and the demand remains subdued. Now, with the new wave of Covid-19 infections and the slow economic recovery within the fourth quarter, inflation could remain tepid for quite some time.

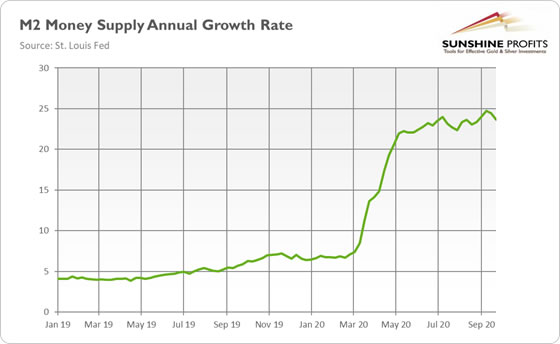

However, it is also possible that both expectations and the inflation itself will be increased over the medium term. This is due to another boost in government spending monetized by the Fed , the delayed respond of prices to the earlier increase in the broad money supply (see the chart below) – there is always a lag here that can last from 6 to 18 months), and the declining confidence in both the government and the central bank.

At some point it should be clear for everyone that the GDP recovery from the coronavirus crisis is driven by massive increases in debt, government spending and the central bank’s liquidity . Thus, although the few winners of the pandemic are clear, most of the small and medium sized businesses remains significantly away from 2019 levels. At some point people should realize that neither the easy monetary policy or fiscal deficits wouldn’t help the Main Street and small business fabric.

Implications for Gold

What does all of the above mean for the gold market? Well, as gold is by many perceived as an inflation hedge (not always correctly), it should welcome the inflation rate acceleration. However, the subdued inflation is not necessarily awfully bad for the yellow metal. This is because low inflation implies that the Fed will remain dovish and won’t hike the federal funds rate for years to come. Yes, the rising inflation could force the central bank to normalize its monetary policy – but under the new monetary regime (I wrote about it in a detail the last edition of the Gold Market Overview ), the Fed will not raise interest rates until the inflation stays above 2 percent for a certain period of time. As long the Fed remains behind the curve, gold should shine.

To put it differently, the lack of higher inflation is not surprising at all. After all, during economic crises and recessions , the uncertainty increase and people decide to spend less of their incomes than previously. So, the demand for money increases, which neutralizes part of the rise in the money supply. However, when the crisis finally ends, people will gradually withdraw their cash balances. Therefore, we could still see a higher inflation. But it will not happen now. Instead, it will occur when the situation normalizes, and the economic recovery sets in for good.

And, who knows, maybe this is a crazy idea, but isn’t is possible that the Fed expects such a scenario, and it is the reason why it changed its monetary regime to allow for higher inflation? In any case, investors should remember that although higher inflation is an upside risk for the gold that would support its prices, gold does not need – as the 2000s and 2020 bull market showed – double-digit inflation to shine.

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.