Gold Bulls Finally Show Some Spirit

Increase of geopolitical concerns increases gold's safety demand.

Gold rallies impressively to an important price level.

A push behind this level should spark additional short covering.

Gold benefited from the latest instability in Russia and Syria on Wednesday and finally lived up to its potential as a safe-haven asset. A significant rally to a multi-week high gave the bears a scare but emboldened the gold bulls. Today we'll look at gold's growing supports for what should be a productive month ahead.

After what has seemed an interminable period of consolidation, the gold price finally rallied to its 3-month trading range ceiling on Wednesday. Despite only a slightly lower dollar, the gold price was able to feed off escalating tensions over Syria and U.S. sanctions on Russia. Although gold prices retreated from their session highs on Wednesday, they closed higher after threats of military conflict in Syria.

Spot gold gained 0.8 percent to close at $1,349 while June U.S. gold futures settled up $14.10, or 1.1 percent, at $1,360. Meanwhile the actively-traded gold ETFs managed to test - and briefly exceed - the upper boundary of a 3-month trading range.

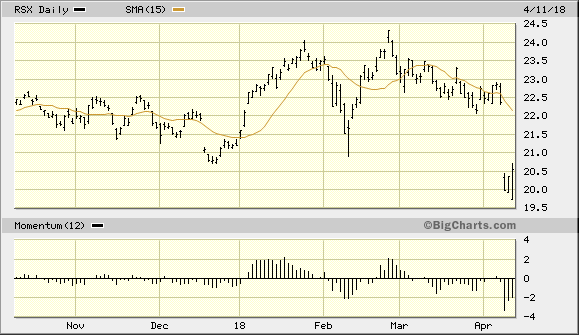

Another factor that has helped to bolster gold's safety demand in recent days has been a plunge in the Russian ruble's value along with a sell-off in Russian stocks. Russia's stock market came under serious selling pressure in the last two days after President Trump responded to a warning by Russia that it would shoot down any missiles fired at Syria by stating, "get ready" because air strikes "will be coming." The subsequent heavy selling pressure among Russian stocks is reflected in the graph of the VanEck Vectors Russia ETF (RSX) shown below.

Source: BigCharts

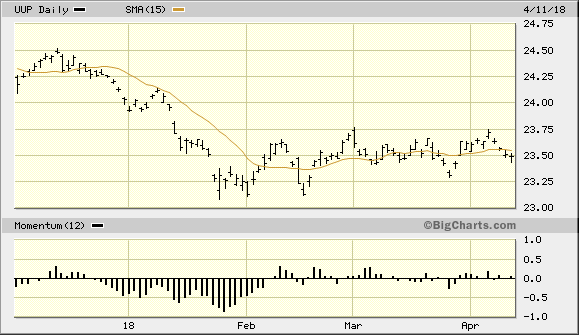

Meanwhile the U.S. dollar index languished near a two-week low, which also gave gold a measure of strength due to its currency component. As we've discussed in recent commentaries, however, the dollar isn't gold's primary catalyst right now. Instead, it's the ever-increasing number of geopolitical concerns that have resulted in a risk-off mentality among investors and a revival of safe-haven demand for the yellow metal.

Shown here is the PowerShares DB US Dollar Index Bullish Fund (UUP), my dollar proxy. UUP is below its 15-day moving average but clearly hasn't shown enough weakness to serve as a major driver for gold's immediate-term (1-4 week) rally attempt. A continuation of the Syria/Russia saga, however, would suffice to keep the gold price buoyant.

Source: BigCharts

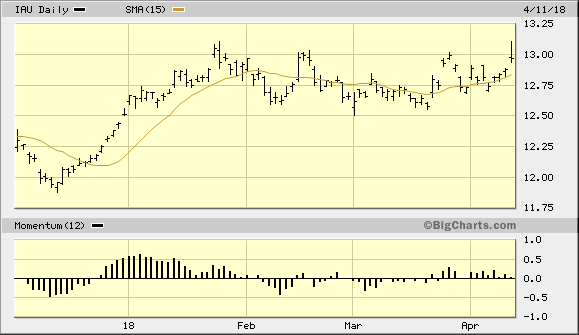

Turning our attention to our preferred gold ETF, the iShares Gold Trust (IAU) rallied sharply above its pivotal $13.00 level trading range ceiling on Wednesday but retraced most of those gains by the end of the session. IAU still managed a healthy 0.70% gain for the day and, more importantly, showed us that the bulls are finally starting to flex their muscles. Another decisive push above the $13.00 level should spark some short covering among the nervous bears. This in turn could carry IAU's price to the next long-term chart resistance/benchmark at the $13.25 level or above.

Source: BigCharts

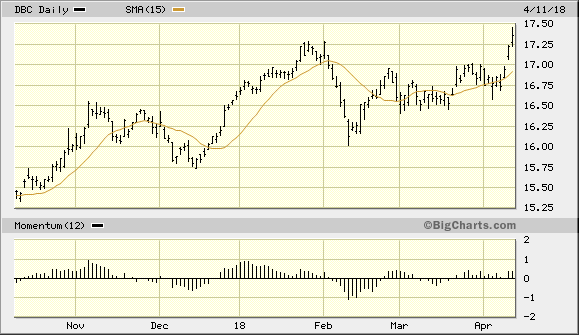

Yet another potential support for gold's near-term outlook is the return of the inflation trade. This was discussed in Wednesday's report when we looked at the improvement in the crude oil price trend. The basis behind the gold-oil connection is the tendency for commodity fund managers to buy gold when they see sustained strength in the crude oil price due to oil's leadership as a barometer of future commodity price inflation.

Oil has been rallying lately along with other commodities. This returning strength of commodity prices is seen in the chart shown here of the PowerShares DB Commodity Index Tracking Fund (DBC). A sustained rise in DBC's price line tends to lead rallies of the gold price.

Source: BigCharts

On a strategic note, IAU confirmed an immediate-term buy signal per the rules of the 15-day MA trading method nearly three weeks ago. This signal is predicated on a 2-day higher close above the rising 15-day moving average. I've purchased a conservative trading position in the iShares Gold Trust after it confirmed the immediate-term (1-4) breakout signal on Mar 23. I'm using the $12.55 level as the initial stop-loss on an intraday basis for this trade. Meanwhile longer-term investment positions in gold should be maintained as the fundamentals underscoring gold's two-year recovery effort are still favorable.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts