Gold Confounds Skeptics With Rate-Driven Rally

Gold rallies in spite of rising interest rates, perplexing the pundits.

A healthy increase in inflation is also boosting gold demand in the U.S.

Meanwhile, improving prospects in Europe have abetted overseas gold demand.

Gold prices edged higher on Thursday, reaching their highest level since September and buoyed by a weaker dollar and rising oil prices. The yellow metal is on track for its fifth straight weekly gain. In today's commentary I'll explain why gold is ignoring the conventional wisdom about rising interest rates being detrimental the precious metals prices. We'll also examine the seasonal factors which support a rising market for the gold price.

The event which has garnered most of the attention in the financial arena in early 2018 has been the spike in U.S. Treasury bond yields. The precipitous fall in bond prices and corresponding rise in interest rates is an event that many financial pundits prophesized would take place this year, yet few seem to have anticipated the results. Instead of hurting equities and precious metals prices, investors have been nonplussed by the event and are taking it in stride. In fact, many stock market and gold bulls view rising rates as a confirmation that the U.S. economy is improving. This has provided them with an extra incentive to increase their holdings in both asset categories.

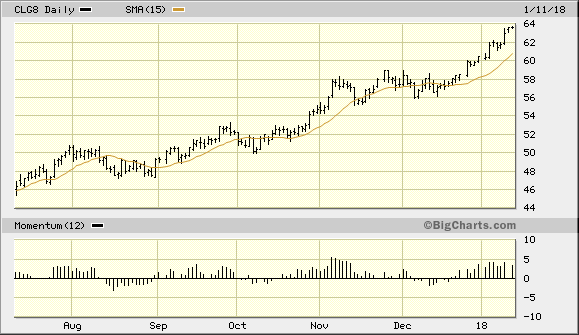

Gold, however, is also benefiting from the gradual increase in inflation. This steadily rising inflationary pressure is clearly reflected in the extended rally in crude oil price (below) and has only recently begun to be reflected in gold and other commodity prices. As we've discussed in previous commentaries, a rising oil price is a leading indicator for gold prices since commodity fund managers view the oil market as a barometer for future inflation expectations. Consequently, when oil prices are on the upswing gold prices normally follow the lead soon thereafter.

Source: www.Bigcharts.com

Another indication that inflation is on the upswing is the 10-year breakeven rate. The Wall Street Journal highlighted this indicator on Jan. 8, noting that inflation expectations over the next 10 years leapt above 2% for the first time since March. This indicator is based on the 10-year yield difference between Treasury inflation-protected securities (TIPS) and convention U.S. Treasury notes. The 2% level is considered to be a key threshold for measuring inflation, and the move above 2% reflects increasing economic enthusiasm on the part of investors.

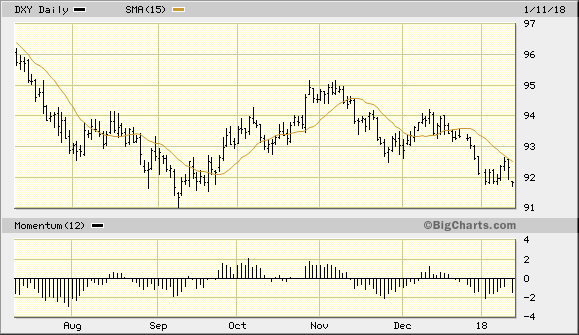

Meanwhile, the U.S. dollar index (DXY) remains in a downward trend and is still under its 15-day moving average. I view the 15-day MA as the dominant immediate-term (1-4 week) trend line, and the fact that DXY has failed to penetrate above the downward-sloping 15-day MA is significant. It further underscores rising inflationary pressures and is another reason for gold traders to remain optimistic on the near-term outlook.

Source: www.BigCharts.com

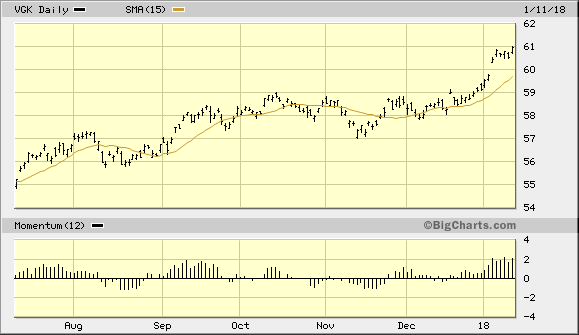

It should also be mentioned that as the dollar's value weakens, the euro currency rises, which also serves to boost demand for gold by making dollar-priced bullion cheaper for European investors. What's more, the strengthening outlook for the euro zone is reflected in the following graph of the Vanguard FTSE Europe ETF (VGK). As it turns out, rising economic and financial market prospects for Europe are providing an additional stimulus to gold demand on the part of foreign investors.

Source: www.BigCharts.com

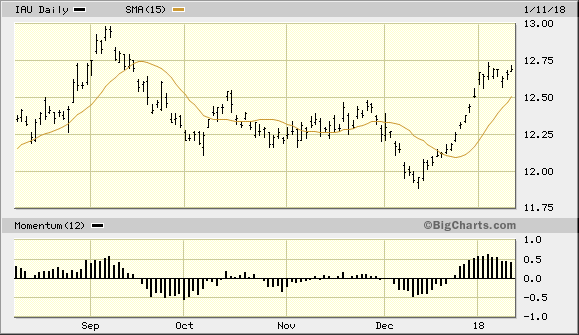

Turning our attention to the gold price trend, February gold remains in a healthy immediate-term condition with the price line above the rising 15-day moving average. This confirms that the bulls have control over the 1-4 week trend, and given the factors discussed above, they aren't likely to relinquish their control of that trend anytime soon. Market forces remain technically favorable for continued rising prices, and the historical pattern for a bullish January for gold is also to the metal's benefit.

On a strategic note, last week I recommended that technical traders book some profit in gold following the 5% rally from the confirmed immediate-term buy signal on Dec. 21 (per the rules of the 15-day moving average trading method). To reiterate, the rules of this discipline state that the first profit in a newly established long position should be taken whenever the price rallies by 4-to-5% from the initial entry point. In gold's case, this equates to the $1,320-$1,333 area. For the iShares Gold Trust ETF (IAU) the 5% area would be approximately $12.75-$12.80. February gold reached an intraday high of $1,323 on Jan. 2, which means that the minimum upside objective of the immediate-term (1-4 week) trading positions has been realized.

Source: www.BigCharts.com

I also recommend raising the stop loss on existing long positions to slightly under the $1,305 level in February gold, which is where the 15-day moving average is currently found in gold's daily chart. For long positions in IAU, the stop loss should be adjusted to slightly under the $12.50 level where the 15-day MA currently is found in the daily chart. From here on, the 15-day moving average will serve as our guide for progressively raising the stop loss on our long position in IAU.

Disclosure: I am/we are long IAU, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.