Gold Investors Should Look at Past Elections / Commodities / Gold & Silver 2020

Election Day has finally arrived. Whowill win, and why gold will remain the biggest winner of them all?

So, today is the day! It's Election Day.For quite some time, national pollsindicate that Biden has a significant advantage . He is also pollingscarcely close ahead of Donald Trump in key battleground states, but, in somestates, the lead has recently narrowed. So, in many places, the race is stilltoo close to call, making them toss-up states. Hence, although according topolitical pundits, polls, and bets Biden will become the next POTUS, anything could happen .

And we mean - anything. Everyone knowsthat back in 2016, Hillary Clinton also led in the polls. However, Trump wonthe election, to everyone’s surprise. Of course, the polling methodology hasbeen improved since. But now, Biden has a much wider advantage than Hillary didin 2016, and he is much more conservative and more moderate in his approachthan Clinton (historically, more moderate presidential candidates generally dobetter in presidential elections).

Additionally, the election results mightnot be known right away, and there are indications that they might becontested. Who knows what could happen if that’s the case? According to someanalysts, contested elections should increase the geopolitical uncertainty andboost the safe-haven demand for gold. On the other hand, some analysts alsobelieve that the contested elections would put downward pressure on the stockmarket, dragging gold down in the process. The fact of the matter is thatcontested elections would undoubtedly delay the fiscal stimulus package, whichshould be negative for gold prices.

So, who is right? It is true thatrecently, gold has been moving in tandem with the stock prices, responding tothe stimulus expectations. But, in times of stress and reduced faith in theAmerican institutional system, gold could decouple from equities and behavemore like a safe haven asset.

In any case, tomorrow, the elections willalready be behind us. Hopefully, we will get the results quickly. No matter whowins, the new administration and the new Congress will have to deal with thesecond wave of the coronavirus and fragile economic recovery.

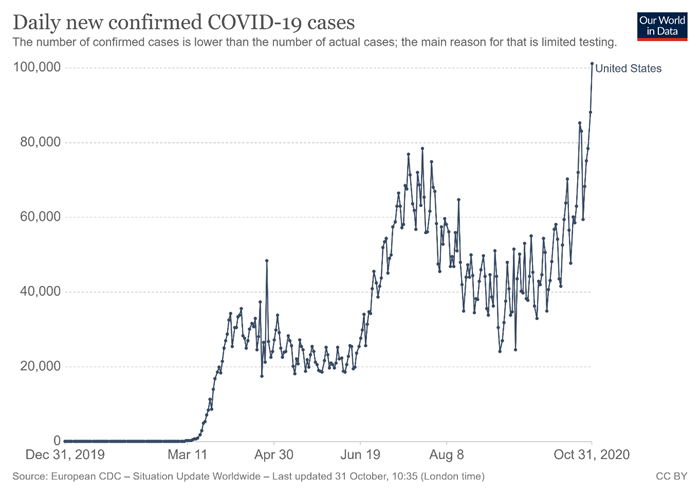

Oh, by the way, as the chart below shows,the US reported 101,273 new Covid-19 cases on Saturday, the daily record not only for America, but for any country! Andaccording to some epidemiologists, the worst is yet to come –that is, if theupward trend in cases continues, which could overwhelm the health system.

No matter whether red or blue, the newgovernment is likely to pump more liquidity into the economy. So, gold couldthrive under either Trump or Biden, although we could see increased volatilityin the short-term precious metals market.

Implications for Gold

What does all the above mean for thegold market? Well, investors should look past the elections already. Theymatter less than many people believe. The 2016 presidential election is thebest example of that. The price of gold indeed declined in the aftermath ofTrump’s victory, but the downward trend was eventually reversed.

So, yes, you should be prepared forelevated volatility this week. After all, we are about to witness not only theelections, but also the FOMC meeting and equally important economic reports, including the nonfarmpayrolls .

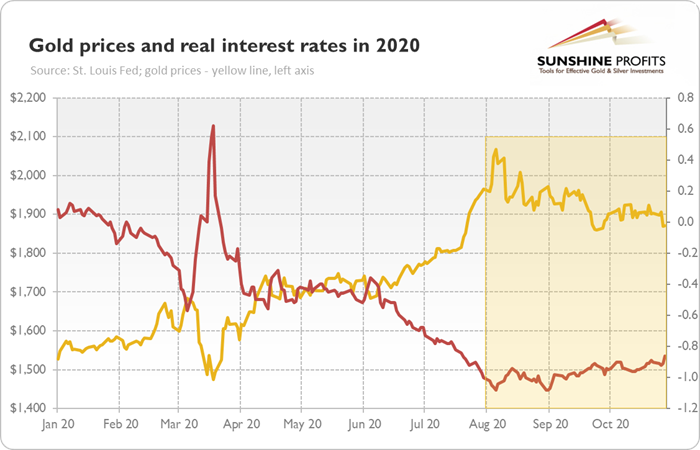

However, as I have repeated many timesbefore, gold’s responses to geopoliticalevents are relativelyshort-lived . In the long run, what drives gold prices are the fundamentalfactors. And the fundamental outlookremains positive for the yellow metal . Both the monetarypolicy and the fiscalpolicy are extremely dovish. The publicdebt is ballooning, while the US dollar is weakening. The realyields remain negative.

Yes, as the chart below shows, the realinterest rates have stabilized or even increased slightly sinceAugust, which explains gold’s struggle in recent months.

Nevertheless, the Fed will maintain its policy of ultra-low nominal interestrates for years, while inflation will accelerate at some point, possibly when the economic recovery sets in forsure. This means that the real interest rates should remain very low or evendecrease further, supporting the gold prices in the process.

Thank you for reading today’s free analysis. We hope youenjoyed it. If so, we would like to invite you to sign up for our free goldnewsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all ourpremium gold services, including our Gold & Silver Trading Alerts. Signup today!

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.