Gold Mining Stocks Are About To Embark On A Huge Run

The gold miners have had two solid years of returns in a row.

Despite the strong gains over the last 2 years - and the spirited finish to 2017 - bearishness is still quite high in the gold stock complex.

The final part of this consolidation is wrapping up (or has already) and this sector is about to enter Phase 2 of the bull market.

This still oversold reading in the gold stocks, in combination with the current technicals for GDXJ and the HUI, makes for the perfect setup.

For the record, I believe that gold stocks entered a bull market in January 2016. Technically this could be considered a resumption of the bull that began in 2000-2001, and 2011-2015 was just a cyclical bear within a secular bull. This interpretation isn't highly relevant, all that matters is the brutal downtrend in the sector has been broken.

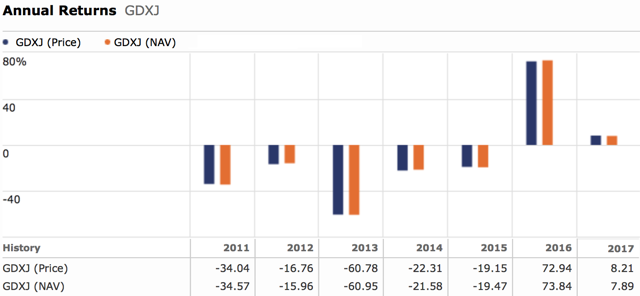

GDXJ - Up 112.55% In The Last Two Years

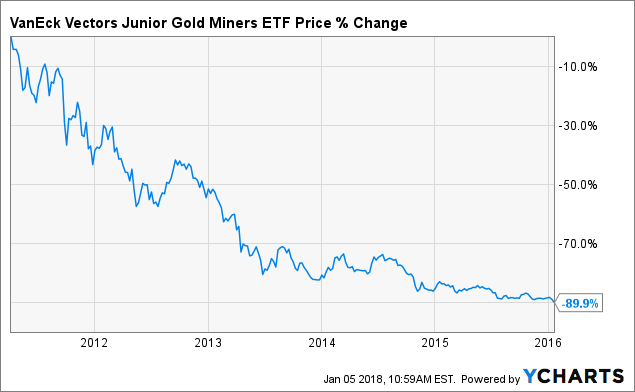

From peak to trough, the VanEck Vectors Junior Gold Miners ETF (GDXJ) lost 90% of its value. This decline took place over a period of 5 years - 2011 to January 2016. This isn't a stock that lost all but 10% of its value from the high - which unfortunately isn't an uncommon occurrence - this is an ETF that holds a large and diverse quantity of junior gold and silver miners.

GDXJ data by YCharts

GDXJ data by YChartsThe HUI - which is a major gold stock index - lost almost 90% from its peak as well. Investors in their lifetime will rarely see a stock index (in any sector or market) lose nine-tenths of its value. To put it in perspective, that's how much the Dow crashed during the Great Depression.

After that level of decline for GDXJ, the only way to go was up. That's exactly the direction it has been headed since 2016. The gold miners have had two solid years of returns in a row, with 2016 being extremely robust as GDXJ increased 72.94%. While the gains in 2017 were far more tame (at just 8.21%), considering this return was coming on the back of a stellar 2016, it shows the true strength of this market and the momentum behind it.

Before I move on, I just can't help but highlight the severity of the annual negative returns in this ETF from 2011-2015. A 34.04% drop in 2011 was followed up by a 16.76% decline in 2012, which was followed up by a -60.78% waterfall collapse the following year. And it still wasn't over as the next two years were down as well.

By mid to late 2015, it became clear to me that this bear market was almost over. After a 90% decline in GDXJ, one had to ask how much downside could be left at that point? The gold mining sector certainly wasn't going to zero. This was a complete washout as you had companies (good companies too) trading below cash value in some instances. Which is why at the start of 2016, I started to buy this sector aggressively. So far everything is proceeding according to schedule as there has been a significant rebound.

GDXJ has increased 112.55% since the bottom. Returns in gold stocks have trounced the S&P 500 since the bear market lows. A trend which I expect will continue.

Bearishness Is Still High

Despite the strong gains over the last 2 years - and the spirited finish to 2017 - bearishness is still quite high in the gold stock complex. Many are unconvinced that this sector will keep increasing from here - simply believing this is a countertrend rally and GDXJ and the HUI will be going back to the lows over the next year or so.

Why is that considering the gains that have accumulated since the January 2016 bottom? Well, of course bull markets, in particular early stage ones, always climb that wall of worry. It takes time for investor sentiment to change. So that could be part of the explanation. But there are some other factor involved that have also negatively impacted perception and contributed to such a dour outlook:

There hasn't been much participation by investors in this bull run. Most were very late to the party in 2016 and they were left holding the bag when GDXJ and the HUI started to consolidate the enormous gains that were racked up in the first half of 2016. It's been a long consolidation process, with a fair amount of back and forth action and some extreme highs and lows in the mining stocks. Many investors keep getting whipsawed and haven't seen much in the way of profits over the last 1-1.5 years. 2017 was more of a stock pickers market when it came to the gold (and silver) miners. There was inconsistency across the sector as some stocks did quite well, while others lost a significant amount of value. These mining company shares were trading mainly off of their own internal fundamentals and how their operations were performing. The fact that the gold price was moving up 5-10% wasn't helpful for some as their own businesses were struggling. Investors that have gotten caught up in some of these stock specific downturns certainly don't feel that this is the typical action that a bull market displays.2017 really did a number on many gold stock bulls. The grinding and grinding, back and forth price patterns and overall unevenness simply wore them down. The bears took the price action as signal that the sector would be - at best - stuck in this rut. I believe the sector is about to enter Phase 2 of the bull market.

Where Gold Stocks Are At In The Current Cycle

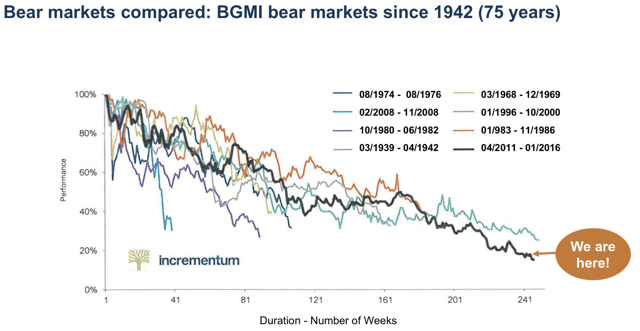

It's highly doubtful that the worst bear market in history for gold mining stocks is suddenly going to re-assert itself given how far they fell and for how long. It was the deepest, darkest bear market in history for this sector. The graph below shows all of the routs in the Barron's Gold Mining Index that have taken place over the decades.

(Source: McEwen Mining/Data By Incrementum)

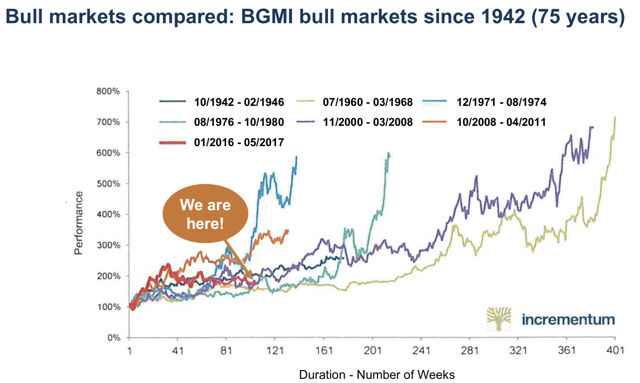

If you look at how this rally has played out since the January 2016 low, you can see that it's right in line with previous bull markets in the BGMI. This has been a long consolidation but it's certainly not abnormal and shouldn't be construed as bearish. If this is anything like the run from 1960-1968 and 2000-2008, then gold stocks have a significant amount of appreciation left in them and this bull market has many years to go.

(Source: McEwen Mining/Data By Incrementum)

Typically, the worst bear downdrafts in history are followed up by some of the strongest bull runs on record as markets will revert back to the mean (at minimum).

One has to ask how likely is it that GDXJ/HUI would collapse 90%, have a countertrend rally for a few years, and then fall back down to their lows again? I would never rule anything out, but this scenario just seems far fetched - a pipe dream for the bears if you will. Anybody trying to short this market and keep this bearish narrative going has been taking a pounding, yet their voices are still heard above the rest.

I'm of the opinion that the final part of this consolidation is wrapping up (or has already) and this sector is about to enter Phase 2 of the bull market. That is where we will see consistent gains for this sector - and it will be over a period of several years. This is the real heart of the bull run.

The chart below shows the three "typical" phases of a bull market. Granted, every bull market is different in terms of longevity and overall pattern, but history shows that there is some similar basic structure to bull runs. That being an initial surge off the lows (Phase 1), followed by consolidation, followed by protracted slow and steady move higher (Phase 2), then another consolidation, followed by the final stage of the bull run which oftentimes turns into a bubble and there is a blow-off top (Phase 3). If you compare the bull markets shown above for the BGMI to this chart below, there are clear similarities (particularly the run from 2000-2008). There are still many years of strong gains left for gold stocks and we are closer to the beginning than to the end.

(Source: Vivek More)

The Current Setup Looks Promising

There is still a chance that the gold mining stocks consolidate a bit more, but the current setup certainly is indicating that GDXJ and the HUI could have already wrapped this up and are now about to start that next phase of the bull market.

GDXJ has a nice symmetrical rounding bottom, as an inverse head and shoulders pattern has formed. This could be extended to the right side of the chart more, but the action over the last few weeks indicates a likely continuation of this upward price trajectory.

(Source: StockCharts.com)

When it comes to GDXJ, the key really is to get back above the 100-week moving average, which has been clear support since the bull market began. GDXJ has surged almost 15% since early December 2017 and is attempting to retake this level. It's been turned away over the last few days but it remains just a touch below and is still knocking on the door. If GDXJ can get above $35.04, and then gain further momentum and climb above $37.50, then that will really get the ball rolling.

(Source: StockCharts.com)

The Gold Miners Bullish Percent Index is still showing that conditions are far from overbought, and in fact, reflect a more bearish tone in the market. This still oversold reading in the gold stocks, in combination with the current technicals for GDXJ and the HUI, makes this the perfect setup for a major increase in the mining shares and the official start of this next phase.

(Source: StockCharts.com)

The Gold Edge - 50 Stock Round Up

I just posted a 3-part round-up series for subscribers of The Gold Edge that covered almost 50 gold and silver stocks. Join my premium service on Seeking Alpha to find out which companies I'm bullish on and which ones that I'm avoiding.

I believe this strong surge in the gold market will continue for the foreseeable future. While we are in this surge, there will be lots of volatility, which means lots of opportunities.

If you would like to read more of my thoughts, ideas, and research on the gold sector, including which companies I believe are best positioned for outsized returns in this bull market, you can subscribe here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.