Gold Prices Then March 2020 and Now March 2021 / Commodities / Gold and Silver 2021

A year ago this past week marked the onset of the Covid-19 Pandemic. It also was the last full week of trading in the financial markets preceding crashes in all markets and a near-complete, albeit temporary, shutdown of economic activity.

Subsequent rebounds in stocks, bonds and real estate took valuations to levels as high or higher (much higher for stocks and gold) than before the turbulence took hold. Some might refer to those valuations as nose-bleed levels, although the summit for peak ascension is always moving when the effects of inflation are factored in.

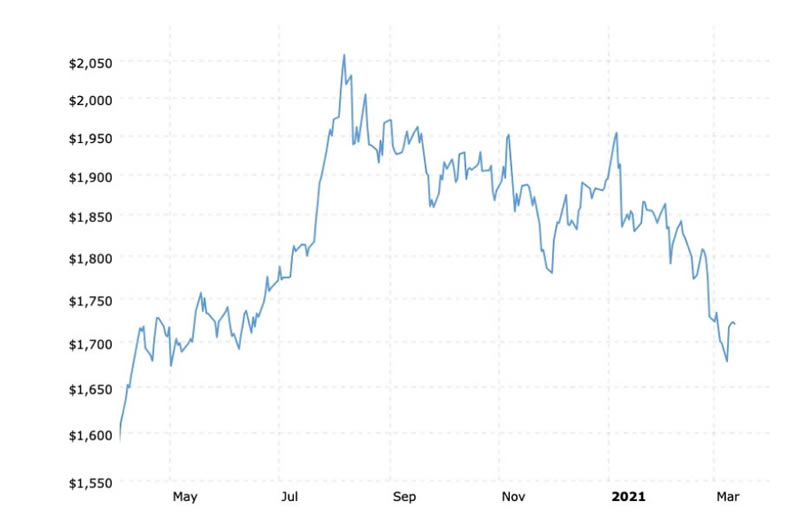

Gold had its day in the sun, too. After falling sympathetically with other markets, gold’s price began an aggressive climb of more than 40% in just four months time.

IS THAT ALL THERE IS?

It seemed like a runaway win for gold over everything else. Then something changed. While stocks and real estate continued their climb to lofty levels, gold began a seven-month slide back to its pre-pandemic price.

Over the past seven months, from its peak price in August 2020 at $2070, gold has dropped four hundred dollars per ounce back to $1683, its closing price last Monday on March 8th.

Almost exactly one year ago, on the inauspicious day of Monday March 9, 2020 gold closed at $1680.

After three huge monetary stimulus bills, ongoing new money creation by the Federal Reserve on a daily basis to support the bond and money markets, amidst expectations for rejection and repudiation of the US dollar, and possible runaway inflation; after all of this and more, the net gain for gold for the entire year March 9 2020 to March 8 2021, is a paltry $3 per ounce.

This is pictured on the chart (source) below…

It is what it is.

(If you’re interested in trading gold and other commodities, check out this review of AxiTrader)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2021 Copyright Kelsey Williams- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.