Gold, Silver, Mining Stocks Teeter On The Brink Of A Breakout / Commodities / Gold & Silver 2020

This week has been a wild and emotional one and it’s just started!

With Monday’s big pop in the stock indexes, the big rally was based on vaccine news and bullish comments from the fed, convincing most traders and investors to be overly bullish this week.

My volume flow indicator showed a reading of 10 all day yesterday, which means ten shares were being bought on the NYSE at the ask, to everyone share being sold at the bid. Any reading over 3 is considered bearish short term, so ten was extreme. After the pop on Monday, stocks/indices closed lower by 1-2% on the session respectively the following session.

I have reiterated over and over, big moves (and gaps) in the price in the stock indexes that occur from the news are generally given back within a few days. This is still what I feel is going to happen in the coming days, albeit the last hour on Tuesday may have started that retracement.

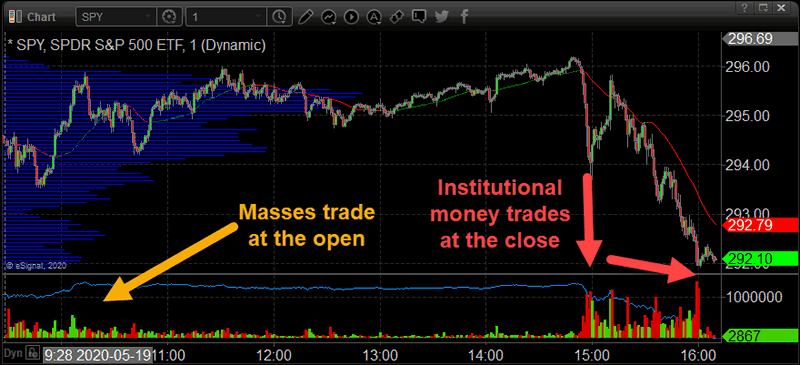

The saying in the trader’sworld is that novice traders typically trade at the open and experiencedplayers trade at the close. This continues to hold true. The chart below showsyou what the BIG money payers are doing, which is selling/distributing sharesto the masses, evidenced by the volume in the final hour. It is this theory whywe always base our new trades to have their stop loss triggered on the closingprice, and not intraday swings. Utilizing this strategy has saved many tradesover the years from being stopped out, and subsequently to turn into profitablewinners. It is where the price closes that counts.

Precious Metals & Gold Miners

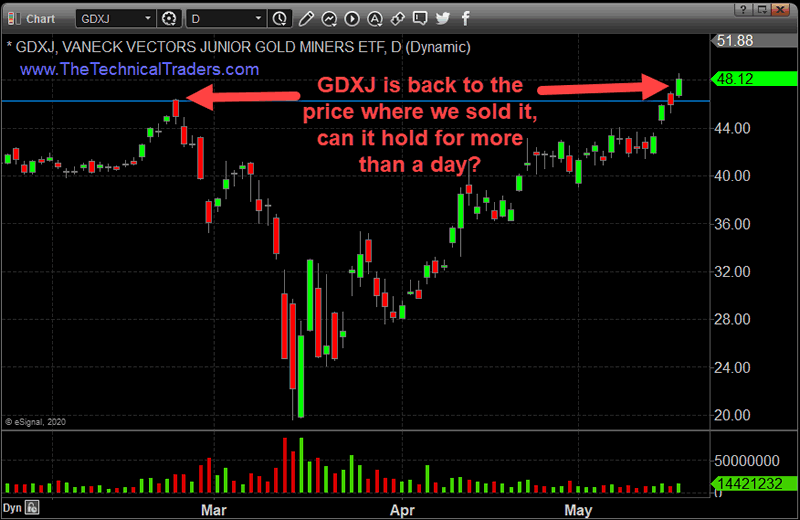

Metals and miners have been coming to life. In February, we sold our GDXJ position at the opening bell on the high of the day to lock in gains. We saw weakness in the market and took action to avoid any temporary selling, which ended up turning into a 57% market collapse. Tuesday for the first time, GDXJ is trading back to where we sold it for a nice profit with our Swing Trading ETF Trading service, and I’m getting excited again for this group of stocks.

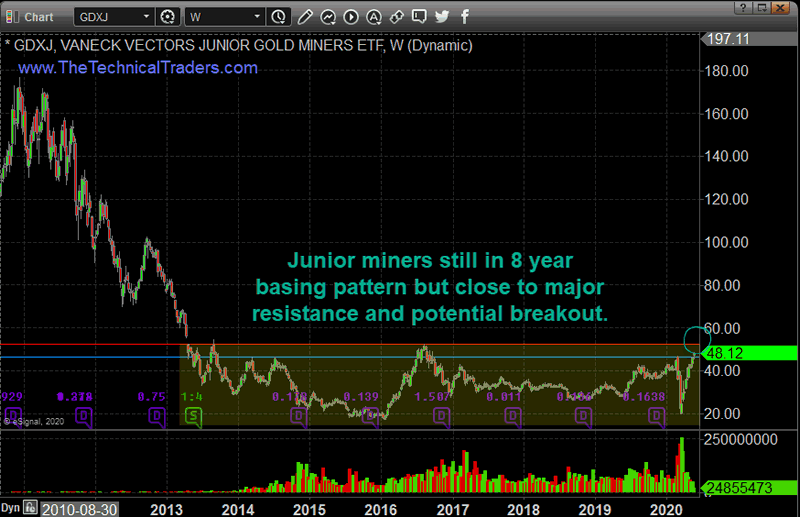

Junior Gold Stocks (GDXJ) Close To Breakout

The Junior gold stocks (GDXJ) is showing signs that they are headed to test the major breakout level of this 8-year base. The price still has to run a little higher, and it could be met with some strong selling once touched. Be aware that junior gold miners are not in the clear, just yet. Once they clear resistance they are a long-term investment position.

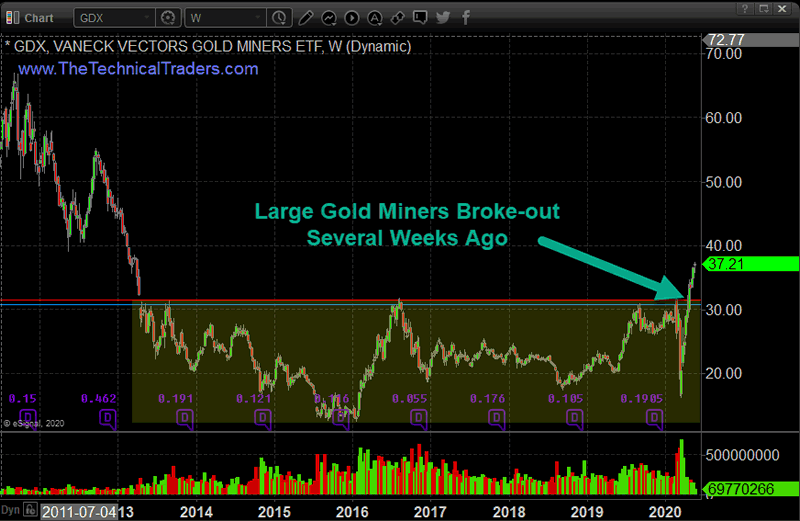

Large-Cap Gold Miners (GDX) Already Broke Out

If you take a closer look at the large-cap gold miners (GDX), they have already broken out and started to rally. This is a new bull market for this particular group of stocks. We got long this new bull market a few weeks ago in my Technical Investor Portfolio which focused on long term position with a much wider stop loss than swing trading positions.

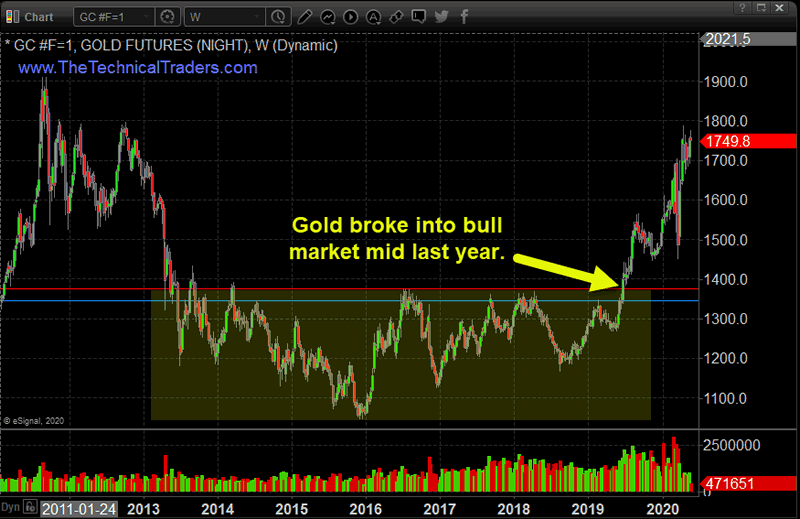

Gold Bullion in Full Blown Bull Market

Gold also broke out and started a new bull market mid last year. We are also long gold in our Technical Investor portfolio as well. Gold has completed its initial move but is on the verge of popping to the $2000 market if we get just the right market conditions over the next couple of months.

We are in what many considerunprecedented times for businesses and survival. As a long-time trader, Iconsider these exciting stages for stocks, and commodities. Lots of things arehappening and they will be erratic and volatile I expect. How the worldfunctions are changing more rapidly than many of us realize.

The last ten years ofinvesting in stocks have been incredible. We all experienced a Super Cycle BullMarket, and those invested in stocks and who also bought homes early have madea fortune with very little effort. But I fear this may be coming to an endsooner than most people think and feel.

The fundamentals for stocksno longer make any sense with earnings way down and still falling. The Fed isprinting money faster than at any time in history as well as paying everyoneand everything to keep the lights on and the music playing. They couldcertainly keep things going for a while and drive the markets higher with loosemoney policies and prop everything up (including lower-rated corporatebonds).

Can the Fed and othercentral banks support the global economy? Remember, it’s not just North Americaunder pressure, but every other country and nearly everyone and their businessare enduring financial stress.

The bottom line is that nomatter which way the markets go, we will be positioned on the right side withtechnical analysis and sound advice as to what actions, if any, to take. Andboth active trading and long-term investment portfolio positions are morecritical now than they have been in the last ten years. The days of just buyingevery dip and holding will be over in a couple of months.

So far it has been a crazy,unprecedented period. Add to that, over 1,000,000 new trading accounts openedthis year and many new novice traders who have entered the markets. These people are frantically buying up stocks thinking they are going to make alot of money. We believe they are going to have a very rude awakening when/ifthe bear market takes hold over the next 3-8 months.

Trading this year has beenslow for our subscribers but our trading accounts continue to make new highwatermark levels every couple weeks, and that is all that matters. The marketcrash shook things up, and during an unexpected crisis the best play, in ouropinion, was to step back and cherry-pick only low-risk trades until priceaction returns to some normal level, which the market is finally beginning to do.

However slow, I am proudthat we did not take any undue risk and that our model account has remainedpositive throughout 2020 and we are up when most other services, including thebest hedge funds in the world, have negative returns thus far this year.

My staff and I are always scouring for new trading opportunities. Right now, the XLF ETF, which is the financial sector, is breaking down and may present a short opportunity. As you know, we also like silver, gold, and both the junior and large-cap miners, but we will first wait to see if this wave of buying is met with sellers in the near future. Until then, we will keep you posted.

The next few years are going to be full of incredible opportunities for skilled traders and investors. Huge price swings, incredible revaluation events, and, eventually, an incredible upside rally will start again.

I’ve been trading since 1997 and I’ve lived through numerousmarket events. The one thing I teach mymembers is that risk is always a big part of trading and that’s why I structureall of my research and trading signals around “finding profits while reducingoverall risks”. Sure, there are fastprofits to be made in these wild market swings, but those types of trades areextremely risky for most people – and I don’t know of anyone that wants to risk50 or 60% of their assets on a few wild trades.

I’m offering you the chance to learn to profit, as I do with my own money, from market trends that I hand-pick for my own trading. These are not wild, crazy trades – these are simple, effective, and slower types of trades that consistently build wealth. I issue about 4 to 8+ trades a month for my members and adjust trade allocation based on my proprietary allocation strategy– the objective is to gain profits while managing overall risks.

You don’t have to spend days or weeks trying to learn mysystem. You don’t have to try to learnto make these decisions on your own or follow the markets 24/7 – I do that foryou. All you have to do is follow myresearch and trading signals and start benefiting from my research and trades. My new mobile app makes it simple – downloadthe app, sign in and everything is delivered to your phone, tablet, or desktop.

I offer membership services for active traders, long-term investors, and wealth/asset managers. Each of these services is driven by my own experience and my proprietary trading systems and modeling systems. I have a small team of dedicated researchers and developers that do nothing but research and find trading signals for my members. Our objective is to help you protect and grow your wealth.

Please take a moment to visit www.TheTechnicalInvestor.com to learn more. I can’t say it any better than this… I want to help you create success while helping you protect and preserve your wealth – it’s that simple.

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involvedin the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader,and is the author of the book: 7 Steps to Win With Logic

Through years ofresearch, trading and helping individual traders around the world. He learnedthat many traders have great trading ideas, but they lack one thing, theystruggle to execute trades in a systematic way for consistent results. Chrishelps educate traders with a three-hourvideo course that can change your trading results for the better.

His mission is to help hisclients boost their trading performance while reducing market exposure andportfolio volatility.

He is a regularspeaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chriswas also featured on the cover of AmalgaTrader Magazine, and contributesarticles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.