Gold Stock Cycles / Commodities / Gold and Silver Stocks 2020

Gold stocks are the crazy ride in the markets. The swing are so great it does not matter if you miss a bullish the break out as another deep pull back allows you to enter with ease.

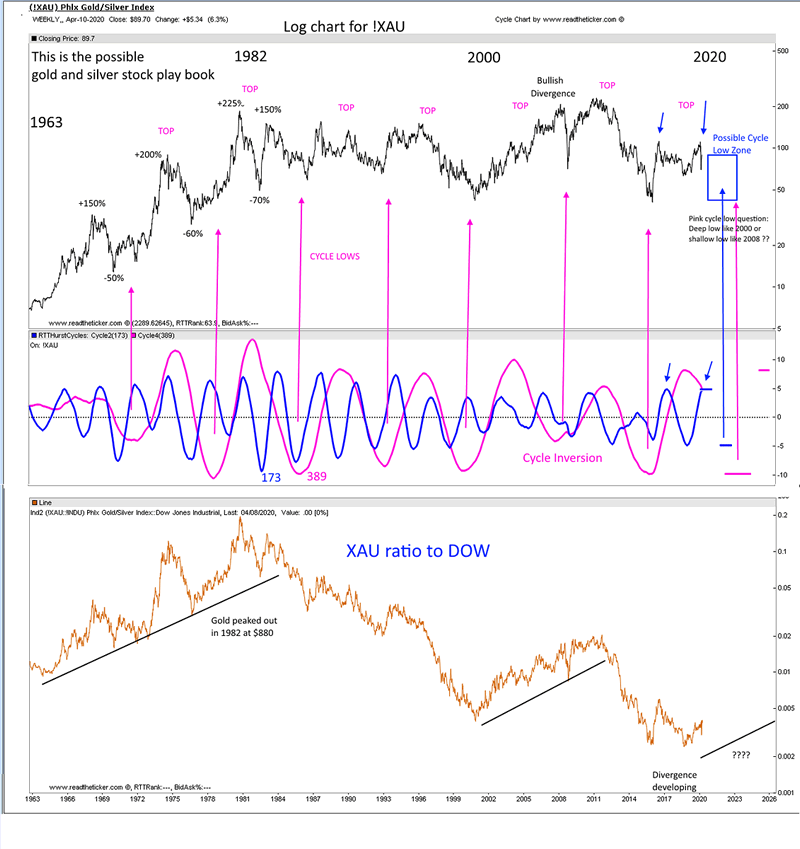

The good news is the (!XAU) PHLX Gold/Silver Index (in the chart below) is very friendly to price cycles. These cycles can be used for timing markets, it also makes it clear if you fight the price cycle you may be in line for a heavy draw down.

At the moment XAU price is making new 52 week highs and the blue cycle line suggest a cycle top is due, therefore it may be wise to wait for price to peak and pullback before building positions. A tactical reason (Richard Ney logic) is the big boys have been accumulating in the friendly institutional stocks and this will attract profit taking [as they do not want to get too far ahead of the wider market] easily sending down the gold stock index and components of the XAU.

The judder bar for a XAU rally is expectation of a US dollar rally. A decent US dollar rally will see gold and gold stocks pullback, but as we all know the US dollar biggest short position is the US Government (they want a lower dollar), and the biggest long position is non US dollar assets in crisis (selling assets forces the buying back of US dollars). Hence the bail outs of dollar assets in crisis.

How well the FED defends their US dollar short position will influence how well the US dollar is capped under $105 on the DXY. This is the only game in down for the next 6 months, nothing else matters.

If price has regular cycles, why fight the cycle. readtheticker.com charting science allows you to find and monitor the cycle better and cheaper than most. Check it out via our subscription service.

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combinationof Gann Angles, Cycles, Wyckoff and Ney logicis the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logica wealth of knowledge is available via our RTT Plus membership. NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.netInvesting

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticke

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2020 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.