Gold to Rally Due to Increased Stock Market Volatility? Really?! / Commodities / Gold and Silver 2018

We were recently asked if theprice of gold is likely to rally because of the increased volatility in stocks. This seems believable at thefirst sight, as gold is seen as a safe-haven asset and thus people could bebuying itwhen the stock market’s movement becomes chaotic, scary and/or unpredictable.

We were recently asked if theprice of gold is likely to rally because of the increased volatility in stocks. This seems believable at thefirst sight, as gold is seen as a safe-haven asset and thus people could bebuying itwhen the stock market’s movement becomes chaotic, scary and/or unpredictable.

So,the stock market’s volatile decline in the recent days is likely to become thecatalyst for gold’s breakout above the $1,350 - $1,400 trading range, right?

Wrong.

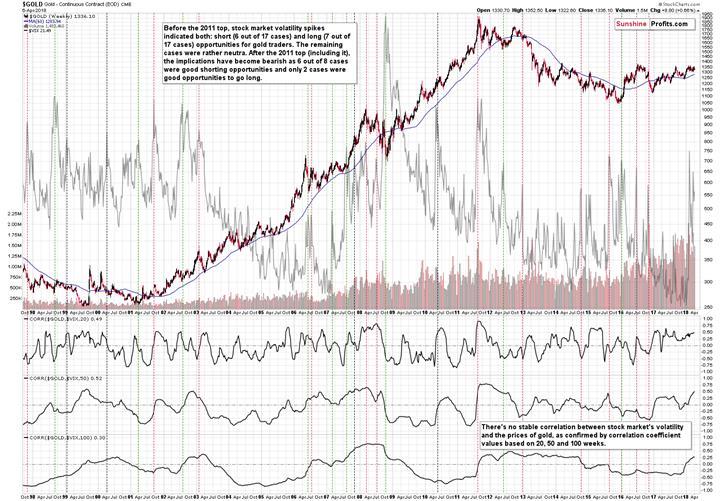

That’ssimply not how things work. The above scenario sounds believable, but it’s nothow gold responds to increased volatility and the above chartproves it.

Let’sstart with the lower part of the above chart that features both gold and theVIX index, which we use as a proxy for the stock market’s volatility. If goldwas to reflect the stocks’ volatility, it should be taking place more or lessall the time – or at least for the significant majority of time. That clearlywasn’t the case and the correlation coefficients reflect that.

Wechecked the relationship between gold and the VIX in terms of correlation inthree versions: based on the 20 weeks of data, based on 50 weeks and based on100 weeks. The value of the correlationcoefficient moves back and forth around 0 in all cases (and in all other cases that wechecked but that we don’t feature on the above chart to preserve itsreadability). This means that there isno stable correlation between the two. This alone is something that shouldmake you think that it’s not safe to base the bullish outlook on stocks’volatility.

Butwait, there’s more.

Puttingcorrelations aside, let’s see what happened when the volatility spiked, justlike what we saw recently. Maybe the relationship is not present at all times,but it’s there during critical times.

Wrongagain. This time a bit less, because there is a mildly strong tendency for goldto reverse its course during the VIX’s spikes. It doesn’t mean that gold alwaysbottoms at that time, though. Remember the 2011 top in gold? It was accompanied by a spike in the VIX – the measure that’ssupposed to indicate breakouts and trigger further rallies.

Wemarked the noteworthy spikes in the VIX with vertical lines on the above chart.Before the 2011 top, there was a similar number of cases that were goodopportunities to go long (7 out of 17 cases) as there were good opportunitiesto go short (6 out of 17 cases). It’s not clear which positions would be betterin the remaining cases (too much depends on one’s individual approach). Inother words, a spike in the volatility of stocks usually suggested that somekind of move was about to be seen, but it didn’t indicate what kind of movethat would be. Consequently, it was not a useful sign for detecting goodmoments to go long or short – at least not on its own.

Since2011 things have changed as 75% of cases (6 out of 8) were good shortingopportunities. The remaining 2 cases were good opportunities to go long. So, onaverage, it seems that as far as the current stage of the gold market isconcerned, spikes in the VIX should beviewed a sell signs for gold rather than buy signs.

Naturally,the above is not strong enough on its own to make the outlook bearish, but it’sa useful confirmation technique that can supplement other,more reliable, signals.

Duringthe most recent spike in the VIX, gold was just after a short-term upswing andthe rally stopped shortly. It seems like it is yet another time, when the increased volatility in the stock marketconfirms that we currently have a great shorting opportunity.

Summingup, increased volatility in the stock market is not a reason for one to expecta rally and a breakout in gold. Conversely, the spikes in the VIX have beenmostly good shorting opportunities since 2011 and based on what has alreadyhappened in gold, it seems that the recent volatility increase is a bearishsign for the precious metals market.

If you enjoyed the above analysis and would like toreceive free follow-ups, we encourage you to sign up for our gold newsletter –it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. Ifyou sign up today, you’ll also get 7 days of free access to our premium dailyGold & Silver Trading Alerts. Signup now.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.