Have the Ides of March Come for Silver? / Commodities / Gold and Silver 2021

Gold’s volatile little brother had aninteresting run thus far, with internet forums buoying its price. But willfundamentals prevail? Where is silver headed?

“The Ides of March are come,” saidCaesar. “Aye Caesar; but not gone,” replied the soothsayer. The Ides of Marchquotation is often bandied about in financial articles midway through themonth. Caesar was assassinated on March 15 th in 44BC (or BCE), at ameeting of the Roman Senate. Written about by Plutarch and further popularizedby Shakespeare (who dramatized the event), the day has been used as a harbingerof ill fortune. So, if we’re to look at silver, should we be concerned aboutanything at this time?

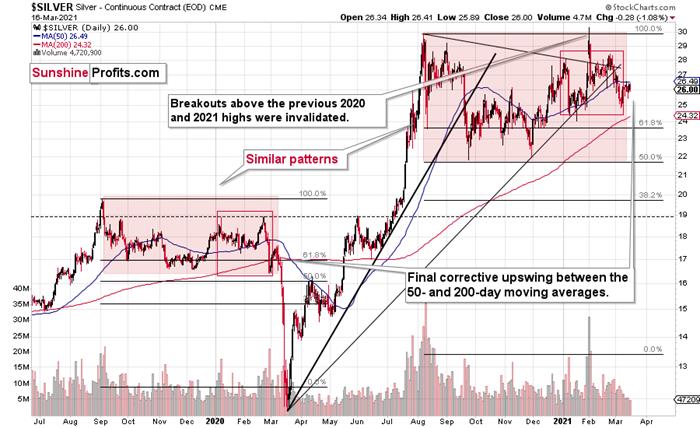

Silveris moving similarly to what we saw in the second half of 2019 and early 2020,before the huge slide. I marked the very broad topsthat followed a quick rally in the red-shaded rectangles, and I also createdsolid-line red rectangles based on the last two – normal – tops and the initialdecline that followed them.

Based on the sudden increase in silver’spopularity, it spiked 1.5 months ago, but this move to new highs was quicklyinvalidated. The nature of this move was more or less random – it didn’t stemfrom a change in fundamentals or from a specific technicalpattern , but rather from a sudden growth of interest in silverbased on forum posts. Because of that, and because this upswing was quicklyinvalidated, this quickupswing didn’t really break the self-similarity pattern .

Right now, we see a corrective upswingbetween – approximately - the 50- and 200-day moving averages (marked with blueand red). This upswing corresponds to the corrective upswing in gold and miningstocks (which allowed us to profitably go long in case of the latter). We saw –approximately – the same thing about 12 months ago, right before the hugeslide.

And speaking of time, please note thatthe final corrective upswing of early 2020 took place in very late February andearly March, while the two – normal – tops that created the red-line rectangleformed more or less at the turn of the year and in late February. This year,it’s all taking place at almost exactly the same time of the year.

If this self-similar pattern is indeedmaterializing, then the implications are very bearish, and we can expect amajor downturn any day or week now.

Let’s be realistic - so far, the analogymight seem too unclear to be viewed as a reliable base for making a silverforecast .

But what if… What if there was a very similar pattern in the past that also precededa massive decline? This would greatly increase the reliability of the aboveself-similarity.

There was indeed such a pattern!

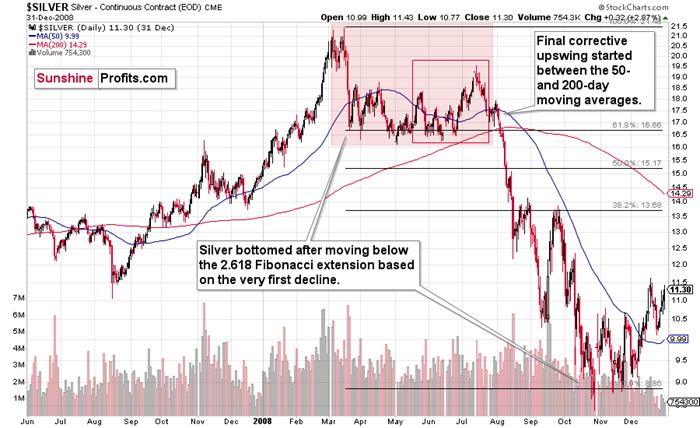

That’s what silver did in 2008 before itdeclined.

The August 2007 – March 2008 rally(please note the interim top in November 2007 that was followed by a zigzagdecline, more or less in the middle of the rally) is similar to the March 2020– August 2021 rally (please note the interim top in June 2020 that was followedby a zigzag pattern, more or less in the middle of the rally).

Afterwards, we saw a double top in bothcases that was followed by a sizable slide. Then silver formed a specificU-shaped broad top, where the final top was below the initial one (exception:in this case the forum-based rally took silver slightly above the previoushigh, but due to the specific / random nature of the move, it “doesn’t count”as something that invalidates the analogy).

After the top, silver declined, and thefinal corrective upswing took place approximately between the 50- and 200-daymoving averages.

Please note that in both previous (2008and 2020) cases silver then truly plunged, and it kept on declining until itmoved below the 2.618 Fibonacci extension based on the initial downswing. Theabove charts illustrate that by showing the first decline at the 38.2%retracement (1 / 0.382 = approximately 2.618). Applying the same to the currentsituation (the initial decline took silver from below $30 to below $24)provides us with the minimum decline target at about $13.50. Will silver reallydecline as low? In my view, it’s imperative to watch other markets forindications as they might have more reliable targets (for instance gold), but Iwouldn’t say that this target (or lower price levels) is out of the question.Of course, that’s just on a temporary basis – silver will likely soar in thefollowing months and years (after this decline).

Before summarizing, please note silver’s tendency to decline sharply in March – that’swhat happened in 2008 and 2020. Even if the entire self-similar pattern doesn’tcontinue, based on this seasonality, silver is likely to decline soon, anyway.

Summing up, if the similarity to whathappened in 2020 and 2008 is upheld, then it seems that we’re about to see a big decline in the price of the white metal . Naturally, that’s not the only reason to expect silver’s weakness in thefollowing weeks and months (not necessarily days) – you will find other reasonsin my previousanalyses .

Thank you for reading today’s free analysis. Itsfull version includes detailed upside targets for our long positions in miningstocks that we entered in the last 25 minutes of Friday’s session (based onyesterday’s closing prices the UNLEVERAGED positions in GDX and GDXJ are about 50%profitable). We currently offer 10% discount for the first subscription period(even for the yearly subscriptions). Given how volatile the markets are, howprofitable our trades just were and currently are, and how much is likelyaround the corner, the time to subscribe was never better – subscribeat a discount today.

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.