IMF Issues Dire Warning - 'Great Depression' Ahead?

- "Large challenges loom for the global economy to prevent a second Great Depression" warn IMF- Massive government debts and eroded fiscal buffers since 2008 suggest global dominos await a single market crash- 2008 crisis measures cast long, dark "terrifying" shadow

by William Pesek via Asia Times

Is another "Great Depression" on the horizon?

It would be easier to dismiss these words from Nouriel Roubini, Marc Faber or other doom-and-gloom prognosticators. Coming from Christine Lagarde's team, though, they take on a new dimension of scary.

The International Monetary Fund head isn't known for breathlessness on the world stage. And yet the IMF sounded downright alarmist in its latest Global Financial Stability report, stating that "large challenges loom for the global economy to prevent a second Great Depression."

Even some market bears were taken aback. "Why," asks Michael Snyder of The Economic Collapse Blog would the IMF use this phrase "in a report that they know the entire world will read?"

Perhaps because, unfortunately, the findings of other referees of global risks - including the Bank for International Settlements - hint at similar dislocations.

Ten years after the Lehman Brothers crisis, these worrisome warnings that will be explored in depth at this week's annual IMF meeting in Bali. The tranquil setting, though, will offer few respites from cracks appearing in markets everywhere - from Italy to China to Southeast Asia, where currencies are cratering like it's 1998 again.

Source: Wikipedia

Potential flashpoints and a long line of dominos

Italy is the current flashpoint - and the latest target of "domino effect" chatter in frothy world markets. China's shadow-banking bubble, and the extreme opacity and regulations that enable it, also came in for criticism. And, of course, the 800-pound beast in any room where global investors gather these days: Donald Trump's assault on world trade.

But the real worry is the health of foundations underpinning these and other risks.

As the BIS warned on Sept. 23, the global economy faces a potential "relapse" of the "Lehman shock" of 2008. "Things look rather fragile," says BIS chief economist Claudio Borio. Equally worrying, he adds: "There's little left in the medicine chest to nurse the patient back to health or care for him in case of a relapse."

A similar connection of dangerous dots runs through the IMF's latest report. The big problem, says Malhar Nabar, deputy chief of IMF research, is the one that investors tend to ignore or explain away: how much of the Lehman fallout is still with us.

"There are many countries, even today, that are operating below pre-crisis trends," Nabar says. "And what's interesting is not just countries that suffered banking crises in 2007-2008 but also other countries outside of that epicenter that were affected through trade links or through financial links."

Increased inequality is one troubling side-effect. Yet Nabar highlights, "possible long-lasting effects of the crisis on potential growth" that might seem tangential to Wall Street's crash - lower birth rates, lower fertility and even "some evidence of slower technology adoption." All this, he says, "can affect productivity growth and potential growth going forward."

There is no doubt that many of the official policy actions taken since 2008 "seemed to have helped limit the harm." But the costs of those efforts are only beginning to get calculated.

2008 crisis measures cast long, dark shadow

Excessively loose monetary policies have exacerbated the widening inequality trends unfolding pre-Lehman crackup. At the same time, there's been, in the words of the IMF, a "large accumulation of public debt and the erosion of fiscal buffers in many economies following the crisis point to the urgency of rebuilding defenses to prepare for the next downturn."

Yet all the diplomatic speak in the world can't sugarcoat the roughly $250 trillion crisis unfolding in slow motion. That's the level to which the world's debt burden ballooned since the Lehman crash. That's 18 times China's annual gross domestic product.

And with official rates from Washington to Tokyo still at ultra-low levels historically, there's little ammunition to battle the next reckoning.

Italy's debt woes are an obvious weak link. One reason: just as with US officials after 2008, Europe did more to treat the symptoms of its woes than address underlying causes.

So is China's unbalanced economy, one being trolled by US President Donald Trump's tariffs arms race. This year's 6.4% drop in the yuan is raising eyebrows for good reason. For one thing, it coincides with a marked slowdown in exports, industrial production, fixed-asset investment and an 18% plunge in Shanghai stocks this year. For another, it raised the specter of sizable defaults on dollar debt, which would reverberate through the global economy.

And therein lies Asia's problem.

Asia's exposure

In general, the region has journeyed a long way since the darkest days of 1997 and 1998. Financial systems are stronger and governments are more transparent. Currencies are more flexible. Foreign-exchange reserves have been rebuilt. That leaves advanced economies from South Korea to Singapore reasonably well equipped to withstand fresh turmoil.

But there are cracks in the region's developing markets, as the ferocity of currency plunges in India, Indonesia and the Philippines show. Investors may argue they've learned from past misstates, but still fall prey to herd mentalities.

It's an urgent wakeup call for India's Narendra Modi, Indonesia's Joko Widodo and Rodrigo Duterte of the Philippines to narrow current-account and budget deficits. Leaders also need to devise macroprudential firewalls against global contagion.

The problem for Asia: contagion could come as much from the West and its own backyard.

Trump's fiscal incompetence - including a $1.5 trillion tax cut America didn't need - could roil global rates and the dollar. A recent spike in 10-year yields to 3.2%, the highest in seven years, could be a bad omen. Trump, too, is publicly dueling with his hand-picked Federal Reserve chairman. And given Trump's legal woes, the odds of new tariffs or even military action to distract voters can't be ruled out.

Any new assault on China could devastate Japan's reflation effort. True, epic Bank of Japan easing and a weaker yen boosted exports. It pushed Nikkei 225 index stocks to 27-year highs. Yet Asia's No. 2 economy is in harm's way if the US-China brawl trumps the region's key growth engine.

Even before most policymakers and financiers arrive in Bali this week, the IMF is signaling that global growth has plateaued. It downgraded output to 3.7% from 3.9%.

That not the end of the world, per se. But with trade battles intensifying and dormant old devils re-emerging, all bets could soon be off.

That is a lot more than depressing: it's terrifying.

IMF Global Financial Stability Report (2018) can be accessed here

News and Commentary

Gold prices hold steady as investors wait for Fed minutes (Reuters.com)

Asian markets jump following Wall Street's big gains (MarketWatch.com)

U.S. industrial output rises, but momentum slowing (Reuters.com)

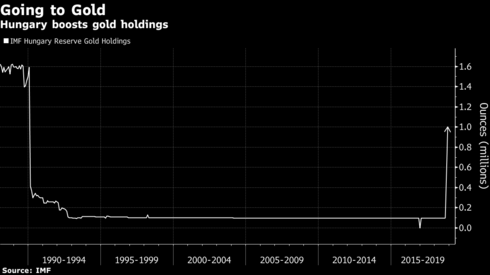

Hungary Boosts Gold Reserves 10-Fold, Citing Safety Concerns (Bloomberg.com)

Hungary raises gold reserves tenfold on safety concerns (RT.com)

Art mania and tech stocks - The financial canary's desperate last gasp (MoneyWeek.com)

China May Have $5.8 Trillion in Hidden Debt With 'Titanic' Risks (Bloomberg.com)

S&P Reveals $5.8 Trillion In "Hidden" Chinese Debt With "Titanic Credit Risks" (ZeroHedge.com)

Your shout: how gold could bring stability to volatile crypto markets (WhatInvestment.co.uk)

October Doesn't Disappoint: Volatility Is Back After a Tranquil Third Quarter (GoldSeek.com)

Gold Prices (LBMA AM)

16 Oct: USD 1,228.85, GBP 931.35 & EUR 1,061.73 per ounce15 Oct: USD 1,233.00, GBP 937.70 & EUR 1,064.45 per ounce12 Oct: USD 1,218.75, GBP 922.11 & EUR 1,052.15 per ounce11 Oct: USD 1,201.10, GBP 910.31 & EUR 1,040.27 per ounce10 Oct: USD 1,186.40, GBP 902.02 & EUR 1,033.00 per ounce09 Oct: USD 1,187.40, GBP 910.26 & EUR 1,036.01 per ounce

Silver Prices (LBMA)

16 Oct: USD 14.76, GBP 11.16 & EUR 12.74 per ounce15 Oct: USD 14.74, GBP 11.19 & EUR 12.71 per ounce12 Oct: USD 14.60, GBP 11.04 & EUR 12.60 per ounce11 Oct: USD 14.40, GBP 10.90 & EUR 12.45 per ounce10 Oct: USD 14.38, GBP 10.92 & EUR 12.50 per ounce09 Oct: USD 14.33, GBP 10.98 & EUR 12.51 per ounce

https://news.goldcore.com/