International Demand Bullish For Gold

Gold has not performed well as of late, especially when compared to other assets such as the S&P 500.

One of the reasons for this is the strong dollar and the rising interest rate policy being embarked on by the Federal Reserve.

There are several demand-side pressures on gold right now that should cause the price to move upward.

It's possible that all of the major gold deposits worldwide have been discovered, which could cause supply to fall going forward.

The US is currently exporting all its new production to Hong Kong, but still exports a sizable quantity of gold to various European markets as well.

The market has not been especially good to gold (GLD) so far this year, with the price of the yellow metal being down slightly year-to-date and exhibiting strong volatility around the $1,300/oz. level. This is likely a factor of the strength that the U.S. dollar has been exhibiting as the two assets typically move inversely of one another. However, we have seen several items over the past few weeks that could prove highly bullish for the metal going forward and as such a smart investor may want to keep at least some portion of their portfolio exposed to the metal in order to capitalize on these trends.

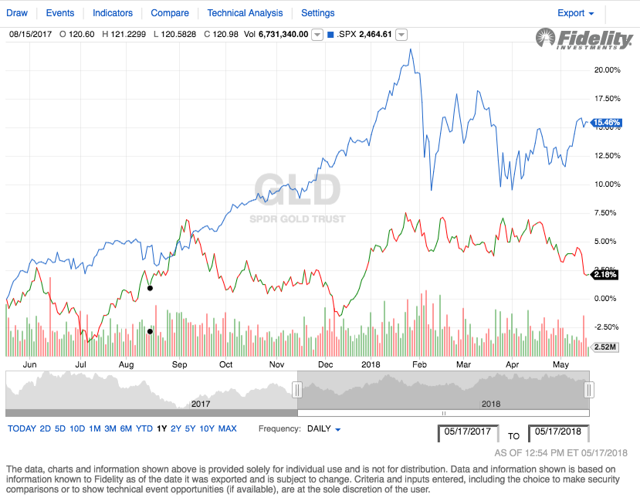

As just mentioned, gold has been something of an underperformer this year relative to other assets:

Source: Fidelity Investments

While the stock market as a whole has been benefiting from strong economic performance and the impact of the Republican tax cuts, gold has suffered due at least partly to the strong dollar. It is not exactly a secret that the Federal Reserve is pursuing a rising interest rate policy. As a general rule, a nation's currency strengthens when the interest rates in that nation rise due to the increased demand for that currency internationally (and domestically since holding cash suddenly begins to look more appealing). In addition, the Federal Reserve has been selling U.S. Treasuries that it purchased during the successive rounds of quantitative easing, which also increases the demand for U.S. dollars and thus raises the price. These factors have overall applied downward pressure on gold, which is widely considered to be a hedge against a weakening dollar.

Eventually, gold will find itself pushed higher by the same economic law of supply and demand that's pushing the dollar upward now. Earlier today, Goldcorp (GG) Chairman Ian Telfer stated that all of the major deposits of gold in the world have been discovered and that the world has reached peak gold. He further predicted that gold production would begin to decline from this point forward. While this is a controversial statement with some opponents pointing out that lower exploration activity may be making it appear that there are no significant gold deposits left, production at Goldcorp, Newmont Mining (NEM), and Barrick Gold (ABX) have all been declining in recent years. This does give some support to Mr. Telfer's argument. If he is correct, this would be a positive for gold prices going forward. The worldwide demand for gold is satisfied from two sources - new supply from mines and existing stockpiles. If the supply of new gold declines then either the demand for gold must go down as well or some of the demand that was previously satisfied by new supplies will be shifted to existing stockpiles. Of the two, the latter is more likely. The economic law of supply and demand tells us that when demand increases for a limited quantity of goods, the price must also increase.

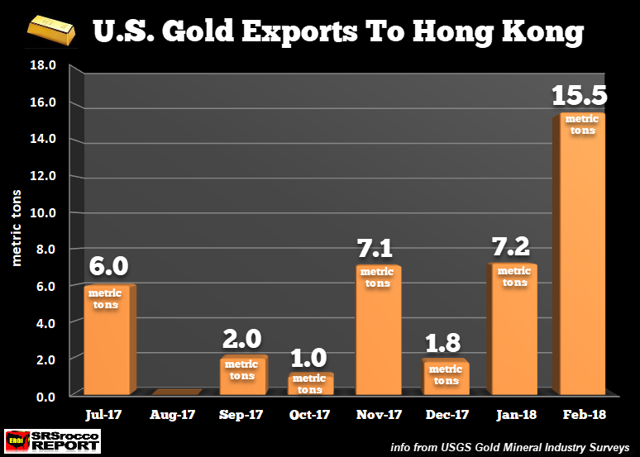

There's further evidence that there's currently mounting demand pressure on gold. A few weeks ago, the US Geological Survey reported that gold exports from the United States to Hong Kong doubled in February compared to January's levels. In fact, at 15.5 metric tons, it was substantially higher than in any previous month:

Source: Zero Hedge

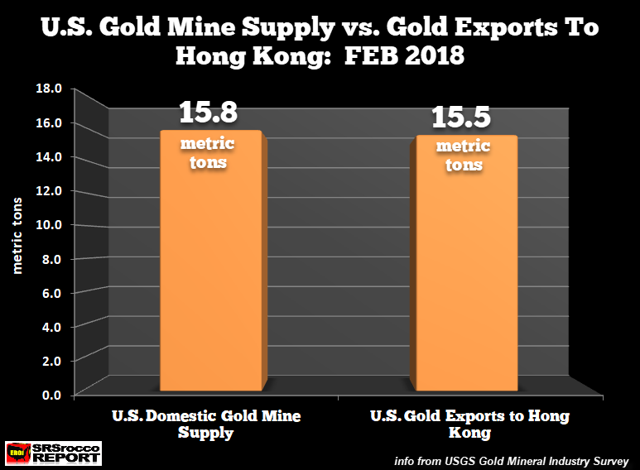

Furthermore, during the month of February, all of the gold mines in the United States extracted a total of 15.8 metric tons of gold from the ground. Thus, the amount of gold that the nation exported to Hong Kong alone consumed almost all of the nation's supply of new gold.

Source: Zero Hedge

This largely leaves only the nation's existing stockpile to meet the remaining domestic demand for gold as well as a sizable portion of the international demand. While China is by far the largest producer of gold in the world, it is clearly consuming all of that and importing more (through Hong Kong). The remaining major gold-producing nations of Russia, Australia, and the United States are all roughly equal in terms of total gold produced. And with Russia also stockpiling gold (as I mentioned in previous articles), that largely leaves Australia and the United States to meet the remaining demand, and of the two the United States has larger gold reserves.

We did in fact see that as Hong Kong was not the only nation that the United States exported gold to in the month of February. The country also exported 12.1 metric tons to the United Kingdom and 11.7 metric tons to Switzerland. Clearly, these exports could not have been made without tapping existing stockpiles of gold. We do in fact see this as the United States had a net gold deficit (exports minus imports plus mine production) during the first two months of the year of 16.6 metric tons. Clearly then, there's strong global demand for gold that exceeds production levels.

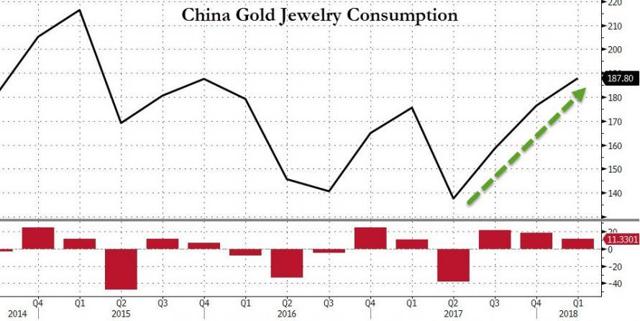

There's further evidence that gold demand in China has been rapidly rising. One need look no further than the Shanghai Gold Exchange, a futures market in which the contracts are actually backed by physical gold, as opposed to the lack of backing on the Western futures markets. As of late, withdrawals of gold from the exchange have been averaging 170 tons per month (Source). In addition, the Chinese demand for gold at the exchange was up 28% in April compared to the year-ago figure. At least some of this was due to demand for gold jewelry, which has been rapidly growing since the beginning of the second quarter of 2017:

It is not exactly a secret that political tensions between the United States and China have been escalating in recent months. The tit-for-tat tariffs that the two countries have been threatening each other with have only exacerbated this problem. Thus, it should come as no surprise that Chinese investors have been turning to gold as a hedge against political risks. In the first quarter of 2018, Chinese investment demand for gold was 78 tons, which is also an increase over the levels for the same quarter of 2017. It is worth noting that this is just Chinese demand and if it alone cannot be met by the new supply emerging from mines, then the world as a whole must be putting substantive pressure on the global supply of gold, which should apply upward pressure on prices. This is especially true if demand continues to grow going forward as seems likely.

In conclusion, there are several demand-side pressures that should cause gold prices to rise going forward. This appears even more likely should we see political tensions between the United States and the emerging powers of China and Russia continue to increase. I have long believed that investors should have a portion of their portfolios allocated to precious metals and the trends that were outlined above reinforce this belief.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Power Hedge and get email alerts