Long-Term Options Bull Bets $5 Million on UPS Stock

Delivery expert United Parcel Service, Inc. (NYSE:UPS) has been grinding higher since the financial crisis, touching a record high in late 2016. And while UPS stock experienced a significant bear gap in early 2017, the shares have been rising fast in recent months, as rival FedEx trades near all-time highs. Options traders appear extremely hopeful of the security's continued ascent, too.

Starting in today's trading, calls are trading at 10 times the expected pace, with volume pacing in the 98th annual percentile, due to one massive call spread. Specifically, 20,000 January 2020 160-strike calls were sold to open for 70 cents each earlier, helping fund the purchase of 20,000 January 2020 140-strike calls for $3.20 each, creating a net debit of $2.50.

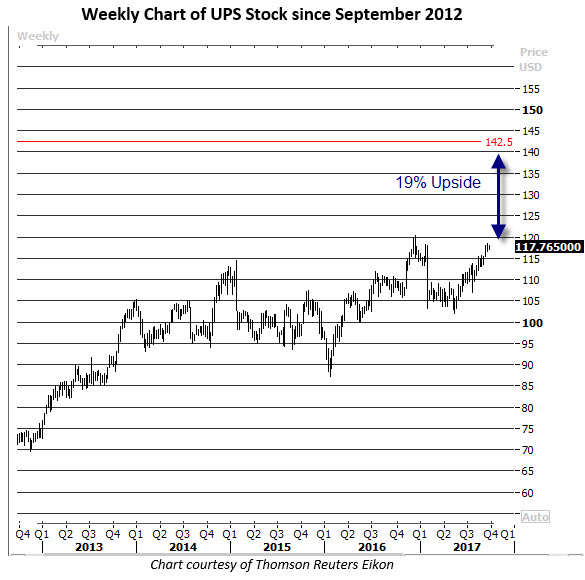

Accounting for 100 shares per contract, this translates into an initial cash outlay of $5 million even, and assumes UPS stock will rise above breakeven at $142.50 (bought strike plus premium paid) before the contracts expire in January 2020 -- but not so far above they regret not buying a call outright. The shares were last seen trading at $117.75.

While this trade is certainly massive, it's not out of the norm for UPS options traders. In fact, back on Sept. 14, one trader initiated a call spread using 15,000 February 130 and 145 calls. Plus, the security's 10-day call/put volume ratio at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) now stands at 10.15 -- a 52-week high.

Clearly, options traders are expecting a breakout from the equity, but despite its positive performance on the charts, analysts have remained hesitant to support it. By the numbers, shares of United Parcel Service are still up 7.5% year-over-year, even with the aforementioned bear gap back in January. But just two of 16 covering analysts say to buy the stock, and its average 12-month price target of $115.68 sits below current price levels. As such, UPS could be a candidate for upgrades and/or price-target hikes going forward, which would provide tailwinds.