Mining's Q1: The best it's gonna get?

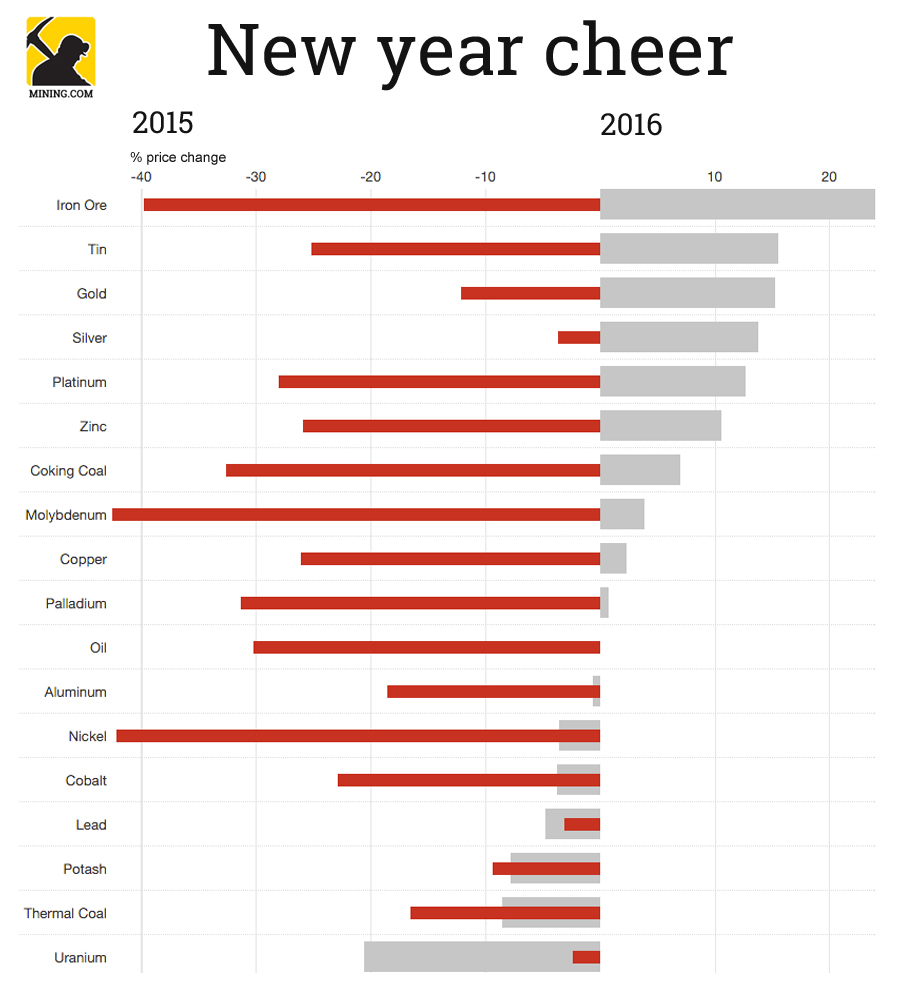

Against expectations and in some instances seemingly in defiance of fundamentals, commodities managed to climb a wall of worry during the first quarter of 2016.

While nervousness returned to the sector with a vengeance this week, many metals and minerals have clung to year-to-date gains.

It's down sharply from an insane 19% jump in a single day to above $60 a tonne, but iron ore remains the top performer for Q1 2016. The steelmaking raw material arguably has the biggest oversupply problems of the lot, but despite many bear calls have stayed firmly above $50. Iron ore's rebound is even more impressive considering it's up 44% from its near decade low hit in December.

Gold held onto 15% gains in the first quarter (its best showing going back to the 1980s), but the pullback today is re-awakening fears of a replay of Q1 2015 when the price briefly topped $1,300 an ounce only to spend the rest of the year sliding towards triple digits. This time around ETF investors appear more convinced of the robustness of the gold rally however, snapping up more tonnes during the quarter than left funds in 2014 and 2015 combined.

Bellwether copper is in danger of wiping out its gains for the year, but the red metal can still boast of double digit gains from seven-year lows below $2.00 a pound struck mid-January. Today's drop in oil puts the commodity back to square one for 2016, but like iron ore crude's been swinging wildly - the dip to $26 on February 11 already seems like ancient history.

Among industrial metals tin is the clear winner and while the metal has been drifting lower recently is up 15.5% for 2016 and up 26% since hitting multi-year lows of $13,300 a tonne in January. Nickel, last year's worst performer, showed signs of a revival but in February crashed through $8,000 a tonne. The comeback since that 13-year low has been less than convincing and it's astounding to think that the volatile metal peaked at $51,780 a decade ago.

Returning to a six month high this week, coking coal has enjoyed some support from iron ore's advance, but thermal coal's long term decline looks inevitable. Uranium, last year's strongest performer - that is, showing the smallest decline - is being demolished this year. Friday's spot price of $27.30 a pound is pushing U3O8 towards its lowest in a decade on a weekly basis.

Source: Steel Index, LME, Comex, Nymex, UX, Infomine, MINING.com, World Bank

SEE ALSO: Mining bulls twisting in the wind