MinRex snaps up three promising cobalt-scandium tenements

ASX junior, MinRexResources (ASX:MRR), today revealed that it has entered into an agreement to strategicallyacquire 100 per cent of Clean Power Resources (CPR).

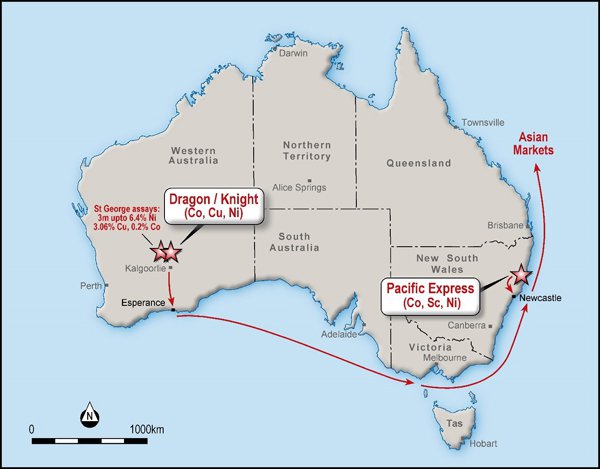

CPR has three high-quality, exploration-stage projectareas in NSW and WA that are highly prospective for cobalt,scandium, copper and nickel. These tenements are also located in close proximityto supporting infrastructure and key ports.

This well-engineered acquisition comes on the back offavourable commodity sentiment, with the speciality and base metal upcycle gainingmomentum. In particular, the cobalt price has recently reached a decade-high ofUS$95,000 per tonne on the London Metal Exchange (LME).

The Pacific Express Project is situated near PortMacquarie in NSW and was previously owned by Jervois Mining (ASX:JRV). Thisproject has confirmed cobalt-scandium-nickel laterite mineralisation fromlegacy drill-holes that were used to historically model and report to a JORC(1996) Indicated Resource of 4.6Mt at 0.09 per cent cobalt, 40 grams per tonnescandium and 0.61 per cent nickel.

Once the acquisition is completed, MMR's priority will beto fast-track a desktop review, legacy database compilation, geologicalmodelling and Resource estimation and reporting to the JORC 2012 code.

Encouragingly, according to the CPR geology team'sanalysis, recent aeromagnetic geophysical imagery of the Pacific Express tenureshows that legacy drilling is over significant magnetic anomalies.

Get the latest articles straight to your inboxkeep me postedThe WA tenements, Knight and Dragon, sit near St GeorgeMining's (ASX:SGQ) tenure, which delivered solid drilling results (3 metres upto 6.4 per cent nickel, 3.6 per cent copper, and 0.2 per cent cobalt), whilelegacy assay results confirm a 7,290 part per million of cobalt hit justoutside the project area.

This region is highly prospective for massivecobalt-copper-nickel sulphide mineralisation, which SGQ has confirmed in its2017 drilling program, while Talisman Mining (ASX:TLM), which has contiguousground to Knight and Dragon, produced 1.6Mt at 2.44 per cent nickel between2008 and 2013.

All tenements to be acquired in both NSW and WA are stillsubject to grant.

MMR will update the market as the due diligence phase isprogressed.

Of course,as with all minerals exploration, success is not guaranteed - consider your ownpersonal circumstances before investing, and seek professional financialadvice.

MMR executive director, Simon Durack, said: "Theopportunistic acquisition of these highly prospective assets delivers exposureto in-demand specialty metals cobalt and scandium in the first instance, thennickel and copper."

"The board was highly encouraged by the geology acrossall three assets, noting the indicated resource for Pacific Express in NSW canbe reassessed under the JORC (2012) code, then potentially deliver an upgrade,as well as the high level of sulphide mineralisation apparent near Knight andDragon in WA," added Durack.

The assets to be acquired by MMR.

Get the latest articles straight to your inboxkeep me posted