Monster Gains in Mining Stocks Bode Well for Gold and Silver / Commodities / Gold and Silver Stocks 2020

April marks a second month of truly extraordinary developmentsin markets – from negatively priced crude oil futures to a record spike inunemployment claims to a lockdown-defying rally in stocks.

The financial media is touting the S&P 500’s surge of morethan 13% in April – the biggest one-month gain for the index since 1974.

While stock market investors have made up a big chunk of their2020 losses, the major averages and nearly all sectors within them are stilldown significantly for the year.

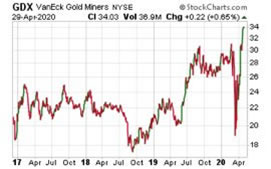

One exception is the mining sector. The GDX Gold Miners ETF(NYSE:GDX) exploded 42% higher in April to make fresh new 7-year highs.

For the first time in a very long time, mining stocks areshowing leadership. That has profound implications for precious metals markets.

For one thing, it suggests that gold and silver are back in favoras alternative, non-cyclical, safe-haven asset classes. Oftentimes during amajor rally in the broad equities market, precious metals and mining shares getleft behind – or even sold off.

Not during these times. Gold itself rallied to a multi-year highof $1,775/oz mid-month before taking a breather. A break from its currentconsolidation pattern to the upside would likely entail a run toward gold’sformer all-time high above $1,900.

Relative strength in the GDX compared to gold has persistedthroughout the month, which suggests mining stock investors are anticipatingfurther upside in gold.

There is plenty of technical and fundamental evidence to supportthe thesis that gold is in a major bull market versus all fiat currencies andthat it will soon trade up to new record highs in U.S. dollar terms.

The monetary backdrop has never looked worse for holders of U.S.dollars.

Interest rates have been pushed down toward zero at the sametime as the Federal Reserve has embarked on an infinite asset-buying campaign.

At this week’s policy meeting, the Federal Open Market Committeepledged to maintain interest rates near zero for as long as necessary.

Policymakers also vowed to keep using any and all availabletools to support the economy, which is currently contracting at a double-digitrate amidst nationwide COVID-19 lockdowns.

Fed Chairman Jerome Powell said the central bank is prepared touse its powers to push even more stimulus into the economy and “will do it tothe absolute limit of those powers.”

The ultimate consequences for inflation are difficult to predictand won’t become clear until after the economy is allowed to begin functioningagain.

The potential exists for a lot of pent-up demand to be unleashedand a lot of newly created Federal Reserve notes to push consumer and commodity prices sharplyhigher.

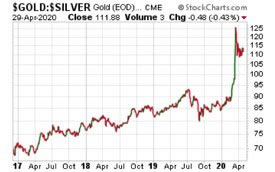

So far this year, gold has gained less on inflation fears andmore on fears that everything else is at risk of collapsing. That showed upquite clearly in the gold:silver ratio spiking to over 125:1 in March – amountainous peak never previously reached in modern recorded history.

The ratio didn’t come down as much in April as might have beenexpected given the rapid unwinding of the fear trade in the stock market andthe upside breakout in high-risk mining equities. The gold:silver ratio closedWednesday at 112:1 – still an extraordinarily wide spread between the two moneymetals.

A narrowing in favor of silver seems inevitable over time (yearsahead). But as long as we remain in a crisis environment with an intentionallystunted economy, the gold:silver ratio can remain stubbornly elevated.

A major component of silver demand comes from industry, and muchof the world’s industrial productive capacity has been taken offline.

At the same time, nearly half of the world’s silver mines havebeen shuttered during this crisis.

Even though the industry is contracting, investors areapparently optimistic that it can also become more profitable. Lower energycosts plus higher metal prices could certainly do the trick.

The mining sector as a whole has been forced to drasticallydecrease its production volumes instead of stupidly selling as much as it canat ridiculously low prices. In other words, it has been forced to adoptsound business practices in spite of its own apparent natural inclination to dootherwise!

Better profit margins and diminished output should bode well forboth mining equities and the metals themselves.

Stefan Gleason isPresident of Money Metals Exchange, the national precious metals company named 2015"Dealer of the Year" in the United States by an independent globalratings group. A graduate of the University of Florida, Gleason is a seasonedbusiness leader, investor, political strategist, and grassroots activist.Gleason has frequently appeared on national television networks such as CNN, FoxNews,and CNBC, and his writings have appeared in hundreds of publications such asthe Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2020 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.