My Precious! Time To Buy Silver

Silver has suffered massive consequences of the 2011 bubble.

The current drop has decimated the bulls and metal is grinding along the bottom.

We explain why Silver is a great option on inflation and monetary madness coming in the next recession and why you should be accumulating now.

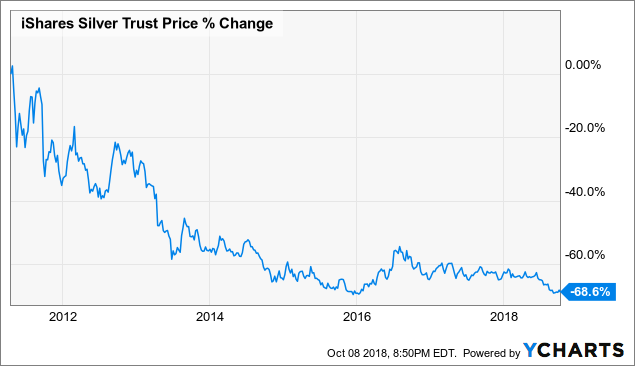

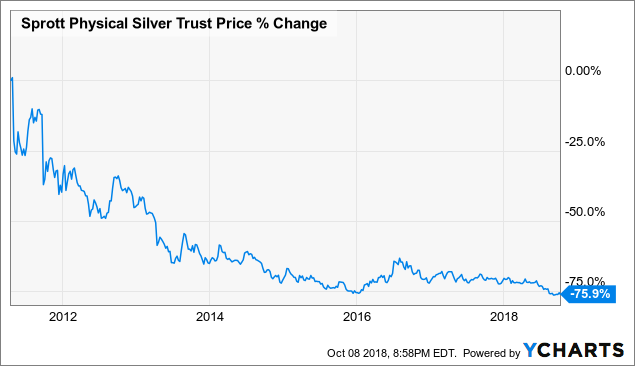

The silver bear market has carted off many bulls in bodybags. Since the 2011 peak iShares Silver Trust ETF (SLV) is down a rather gut-wrenching 68.6%.

SLV data by YCharts

SLV data by YCharts

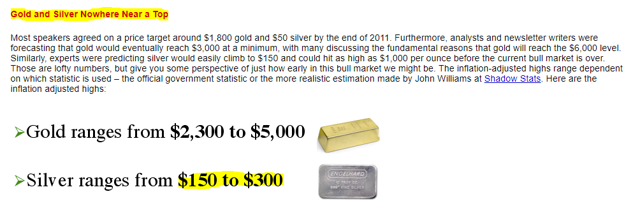

Of course the outcome seems rather obvious in hindsight. The euphoria and complete denial of the massive increase in prices that had taken place was evident in some of the news releases at the time.

Source: Marketoracle Feb 2011

Brett Arends correctly identified that the collective crowd had gone mad and posted 6 signs in a brilliantly timed article identifying the top. At the time one thing that told us this goose was cooked was this little snippet from the article:

Sprott's assets consist of silver bullion. Value: $18.11 per share. In other words, anyone buying the stock is paying 22% above net asset value. So even while silver has zoomed to $44 an ounce, someone buying shares in Sprott is effectively paying $54 an ounce.

On the other hand, look at the boring old CEF, -1.28% It's the grand-daddy of bullion funds. It's been around for 50 years.

The Central Fund holds silver and gold (and a little cash) worth $24.32 per share. Just over half of that is in silver. The Central Fund's stock is selling for $24.80.

That's a more modest 2% premium to net assets. But the silver bugs don't want it, because it isn't just silver, and because you can't redeem your shares for bullion.

Who pays a 22% premium when they could pay 2%?

If the loss in SLV seems horrendous just visualize the loss in Sprott Physical Silver Trust (PSLV) as it swung from a premium to a discount.

PSLV data by YCharts

PSLV data by YCharts

With bears firmly in control and no price recovery in sight, why are we sticking our necks out?

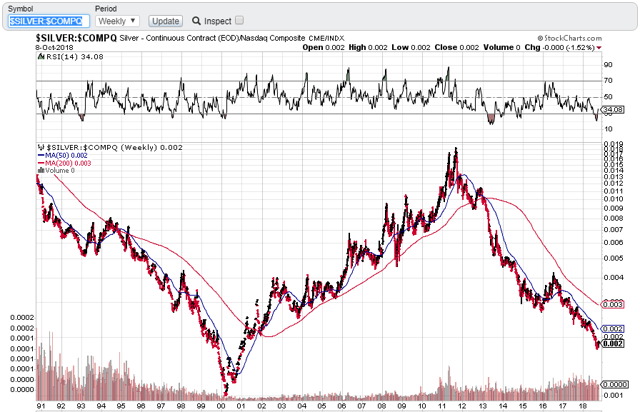

1) Silver is cheap!

Whether measured against its more expensive sibling, Gold, or against the stock market, Silver is trading at a ludicrously low value.

Source: Stockcharts.com

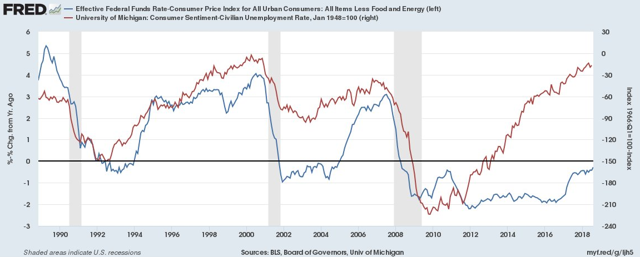

2) We expect inflation to show up (more than it already has)

We have been calling for higher inflation since late 2017 and we have seen rumblings of it as CPI has moved higher.

However we expect this to pick up more steam over time (after pullbacks) as labor market remains incredibly right and productivity incredibly low.

3) The Fed is way behind the curve

At this stage of the economic cycle the Fed is usually sporting a very strong real interest rate. In this cycle, however, the Fed has severely lagged in raising interest rates.

This will likely allow wage inflation to take hold in a much stronger manner than in past cycles.

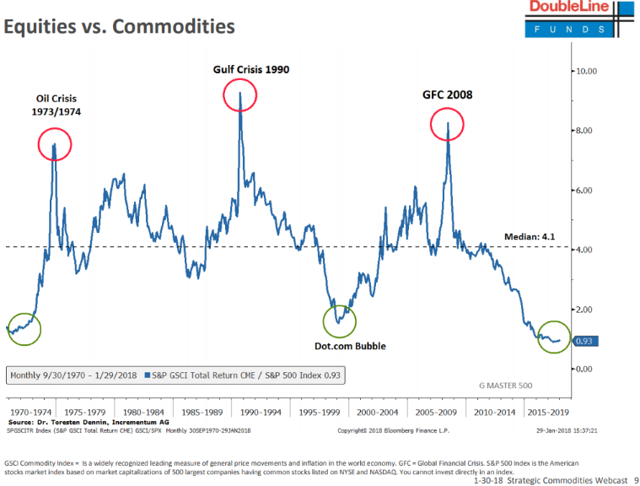

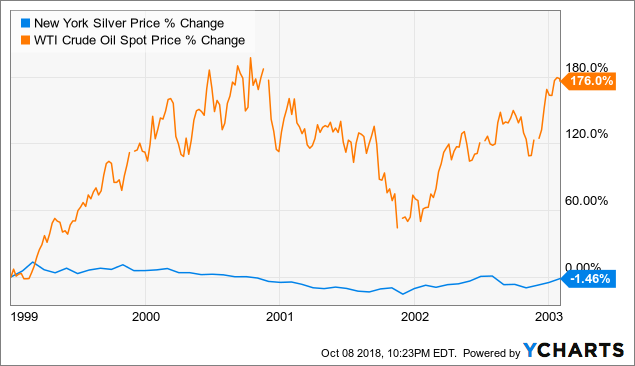

4) We expect a commodity bull market

Commodities have reached a point recently from where outperformance appears increasingly likely.

While oil has been the first one out of the gate, and copper has done well from its bottom, the rest of the commodity complex is mired in doldrums. We saw something similar in the last commodity bull run where oil took off leaving silver in the dust.

New York Silver Price data by YCharts

New York Silver Price data by YCharts

Silver did eventually start its own run and based on the current sentiment we think we are getting close if not there already.

5) We expect extreme monetary problems in the next recession

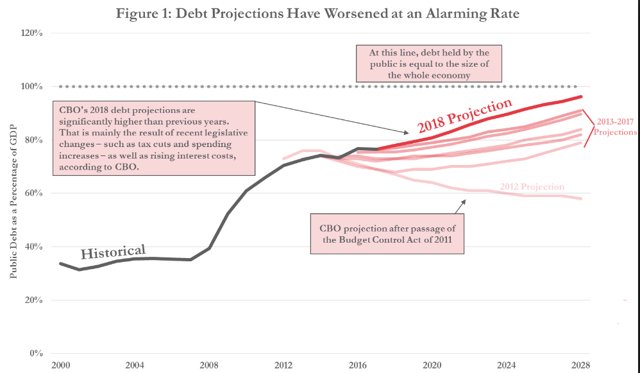

The decision to cut taxes at this stage of the economic cycle and enhance the deficit will likely go down as one of the stupidest decisions from a fiscal perspective. The bipartisan CBO has confirmed the rapid worsening of US deficits and the highest non-war, non-recession deficit is in store for 2018.

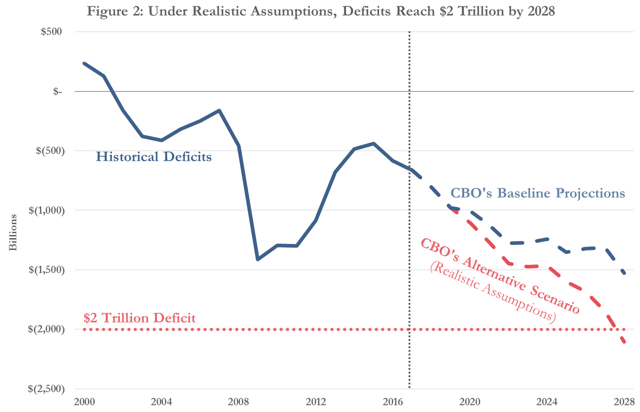

This is projected to worsen to $2 trillion of baseline deficits by 2028.

The incredibly funny (yet sad) thing about those numbers is that they lack forecasts for a recession. An actual recession would have the US reach $2 trillion of deficits in relatively short order. This deficit is going to make things rather interesting for the Federal Reserve trying to combat the coming inflation. In such time, Silver will once again move to a more important role as a monetary asset.

Which one to buy, SLV or PSLV?

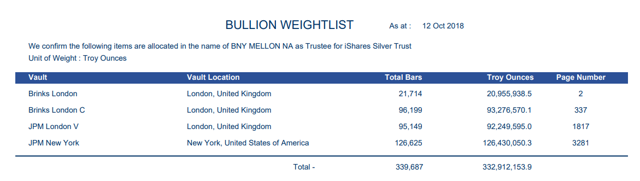

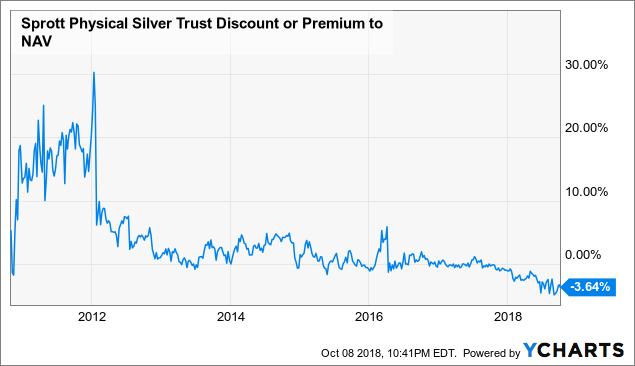

SLV is extremely liquid and trades 8 million shares on average and hold over 330 million ounces of Silver. PSLV trades close 350,000 shares a day but the liquidity is adequate and the bid-ask spreads are within a cent. PSLV holds about 56 million ounces of Silver. SLV is of course an ETF while PSLV is a CEF. So PSLV does trade wider to NAV and the current discount is at close to 3.6%.

SLV stores its bullion in UK and in the US. The updated information along with a complete list of bars held is available from their website.

Source: J.P. Morgan

PSLV stores all its Silver with the Royal Canadian Mint in Canada.

Source: PSLV Fact Sheet

PSLV expense ratio is slightly higher at an average of 0.7% versus SLV's 0.5%. The current discount at 3.6% though represents 18 years worth of that differential making PSLV a better choice for us. It also is one of the widest on record making it a great entry point.

PSLV Discount or Premium to NAV data by YCharts

PSLV Discount or Premium to NAV data by YCharts

Additionally our rationale here is that while PSLV currently trades at a discount, we expect it to move to a premium in the future when the metal eventually starts outperforming. The complete storage with Royal Canadian Mint in Canada and exchange availability for physical bullion will carry the day in the coming bull market and at a minimum we see it trading at NAV. While some fear that PSLV might trade exceptionally wide to its NAV during market meltdowns, and we agree that is possible, a longer term discount is unlikely as large players can force physical redemptions to arbitrage the spread.

One caveat though is that PSLV lacks options. For those wanting to enter their initial position using puts, PSLV will not work. Also for those wanting to leverage the potential bull market with longer term calls, SLV remains a better choice. SLV has longer term options listed all the way to January 15, 2021.

Conclusion

We did not even get into the problems the European Union has with its budget deficits and how they will worsen when the next recession hits. Last time we were aggressive buyers of the commodity complex was in 2004. We believe this bull market will have more legs. We started buying some PSLV at $5.18.

For more analysis such as this, along with real-time alerts on income stocks on both sides of the border along with option income ideas, please consider subscribing to our marketplace service, Wheel of Fortune.

Disclaimer: Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Seeking Alpha has changed its policies. Previously, "following" someone required a ritualistic commitment and an offering of not less than 4 oxen or 3 breeding horses. Now, all it takes is one click! If you enjoyed this article, please scroll up and click on the "Follow" button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the "Follow" button next to my name to not miss my future articles.

Disclosure: I am/we are long PSLV.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Trapping Value and get email alerts