Options Traders Swarm PG&E Stock Amid Wildfire Allegations

Options volume has been exploding on utility stock PG&E Corporation (NYSE:PCG) during the shares' three-day slide. Before last Thursday, PCG had an average daily options volume of just 237 contracts, a number that's jumped to 1,936 over the past three days. Today alone, more than 40,000 PG&E options have already been traded, as speculators react to headlines surrounding the company's involvement in the California wildfires.

A number of strikes are seeing heavy trading in today's action. Right now the top spot belongs to the October 60 call, and buy-to-open activity looks likely -- meaning a number of bulls expect the stock to rebound back to the round $60 level before Friday's close, when the front-month contracts expire. But the 50-strike put from the same series is seeing potential buying activity as well, so others expect PG&E stock to slide further on the charts this week. Already today, PCG stock fell as low as $49.83 -- a new two-year low.

The newfound demand for short-term options has driven up volatility expectations. Just today, the security's 30-day at-the-money implied volatility has jumped 19.3% to an annual high of 50.1%. This is also reflected in PCG's Schaeffer's Volatility Index (SVI) of 37%, which is at least an annual high. This means volatility expectations for near-term contracts are much higher than normal.

Outside the options arena, brokerage firm RBC weighed in bearishly on Friday by trimming its price target by $2 to $68, saying the company is at risk of being sued for property damages from the wildfires in California. And today, J.P. Morgan Securities and Wells Fargo dropped their respective price targets to $66 and $67, while Jefferies said, "We expect this to remain an overhang on the stock for some time."

Still, most analysts remain bullish on the equity. Of the eight brokerages tracking the shares, six have issued "buy" or "strong buy" recommendations, and PCG sports an average 12-month price target of $68.36.

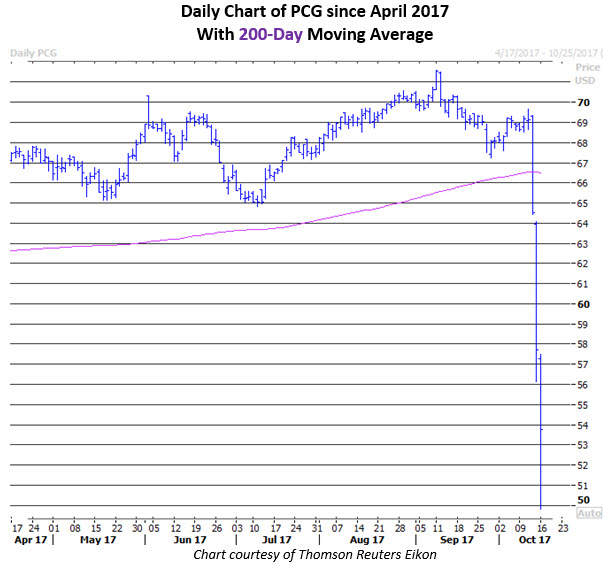

PG&E stock has shed almost 23% since last Wednesday, including a more than 7% decline today to trade at $53.48. As alluded to above, the shares -- currently short-sale restricted -- earlier bottomed at $49.83, their lowest price since September 2015. As a point of reference, PCG's 200-day moving average stands at $66.50, and the stock was trading at a record high of $71.57 just over one month ago.