Pretium Resources: Gold Surge Is An Excellent Tonic

Pretium Resources released its second-quarter results on August 2, 2019. It was the eighth full quarter of commercial production. Revenues were $113.202 million, down from $146.48 million in 2Q'18.

In the second quarter of 2019, the Brucejack Mine produced 90,761 ounces of gold, and the company sold 85,953 ounces at an all-in sustaining cost of $940 per ounce.

This quarter is not changing the overall strategy and I still recommend trading about 40% of your position short term based primarily on the future price of gold.

Image: The Brucejack - Source: Mining.com

Investment Thesis

The Vancouver-based Pretium Resources (PVG) is a junior gold and silver miner in Canada nearly completing its second year of commercial production. Initially, the mine was developed by Robert Quartermain on October 28, 2010, for a price of $450 million.

Pretium Resources released its second quarter of 2019. It was a straight quarter overall with a decent production that beat analysts' expectation. However, when I look at the numbers, I am still not impressed and can hardly justify a $2.2 billion in market capitalization for the miner. In short, PVG is now overbought and overvalued like any other stocks in this segment.

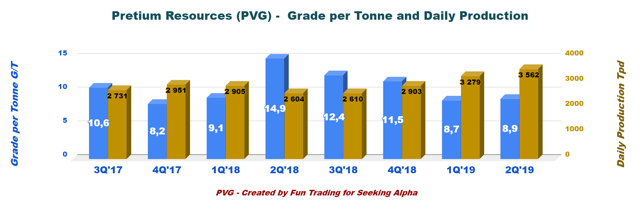

Gold production is still below 100K Au Oz, despite an ore production reaching a record of 3,562 TPD. To meet guidance of 10.4 G/T in 2019, the company must show an average grade for 3Q and 4Q at or over 12 G/T, and it is hard to imagine how Pretium can manage a jump of nearly 4 G/T sequentially?

Data by YCharts

Data by YCharts

Thus, the investment thesis is quite elementary here. Investors ought to trade PVG short term using technical analysis and bet only a small portion for the long term until the planned production will be sufficiently controlled to offer a stable outlook which investors can safely use.

Furthermore, investors will have to trade the stock in correlation with the gold price.

Note: Again, in this article, I will not comment on the Snowfield prospect that the company owns.

Pretium Resources - 2Q'19 results and financial snapshot

| Pretium Resources | 3Q'17 | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 |

| Total Revenues in $ Million | 70.88 | 107.06 | 89.42 | 146.48 | 110.06 | 108.6 | 103.12 | 113.20 |

| Net Income in $ Million | ?^'6.98 | ?^'2.72 | -8.06 | 31.10 | 10.734 | 2.85 | 4.17 | 10.44 |

| EBITDA in $ Million | 14.79 | 31.92 | 24.62 | 81.28 | n/a | 36.51 | 33.76 | 42.72 (Estimated by Fun Trading) |

| EPS diluted in $/share | ?^'0.04 | ?^'0.01 | -0.04 | 0.17 | 0.06 | 0.01 | 0.02 | 0.06 |

| Operating cash flow in $ Million | 47.24 | 33.41 | 24.72 | 77.28 | 52.36 | 42.89 | 39.94 | 41.18 |

| Capital Expenditure in $ Million | 56.12 | 36.51 | 9.74 | 5.77 | 10.8 | 6.58 | 5.40 | 7.29 |

| Free Cash Flow In $ Million | ?^'8.9 | ?^'3.1 | 15.0 | 71.51 | 41.56 | 36.3 | 34.5 | 33.9 (Estimated by Fun Trading) |

| Cash and short-term investments in $ Million | 53.77 | 56.29 | 70.54 | 142.50 | 190.32 | 45.4 | 50.9 | 34.3 |

| Total Long-term Debt + Conv. note in $ Million | 715.2 | 744.6 | 758.9 | 771.4 | 789.2 | 624.4 | 612.7 | 572.1 |

| Shares outstanding (diluted) in Million | 181.3 | 182.0 | 182.4 | 183.5 | 183.1 | 183.9 | 185.0 | 185.5 |

| Gold Production K Oz | 3Q'17 | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 |

| Gold ounce Production Oz | 82,203 | 70,281 | 75,689 | 111,340 | 92,641 | 96,342 | 79,180 | 90,761 |

| Silver Production in oz | 83,233 | 96,004 | 94,730 | 118,205 | 92,458 | 113,886 | 108,234 | 135,797 |

| Gold price realized $/ Oz | 1,281 | 1,211 | 1,271 | 1,276 | 1,169 | 1,204 | 1,257 | 1,252 |

| AISC by-product $/Oz | 788 | 893 | 1,004 | 648 | 709 | 784 | 868 | 940 |

Source: Company filings and Morningstar

1 - Pretium Resources posted $113.20 million in Revenues in 2Q'19

Pretium Resources released its second-quarter results on August 2, 2019. It was the eighth full quarter of commercial production. Revenues were $113.202 million, down from $146.48 million in 2Q'18, with a net profit of $10.44 million, or $0.06 per diluted share. Meanwhile, adjusted earnings were $17.0 million, or $0.09 per share.

Joseph Ovsenek, the CEO, said in the conference call:

"In the second quarter, the Brucejack Mine produced 90,761 ounces of gold, and we sold 85,953 ounces at an all-in sustaining cost of $940 per ounce of gold sold, keeping us on track to achieve our annual guidance. We generated $113.2 million in revenue in the quarter, resulting in $17 million in adjusted earnings, equivalent to $0.09 per share. Operations generated over $41 million in cash. This continued cash generation allowed us to reduce our debt by nearly $45 million this quarter."

2 - Analysis of the all-in sustaining costs (AISC) on a by-product basis

AISC is calculated based on the gold sold. For the third quarter, Pretium Resources sold what it produced. Generally, gold sold and gold generated are quite similar, and it makes no difference, in general.

| Gold ounces sold/produced | oz | 90,761/85,953 |

| Silver ounces sold/produced | oz | 135,797/104,442 |

The company indicated an AISC of $940 per ounce on a by-product basis ($648 per ounce in 2Q'18), which means that the production of silver is deducted from the costs.

The last three quarters are showing a steady increase well above the LOM average AISC of $539 per ounce, indicated on April 4, 2019, where the company confirmed that LOM is now 14 years. My question is how the company intends to average an AISC of $502 per Oz after looking at the performance indicated in the chart above?

Source: PVG Presentation August 2, 2019

3 - Free cash flow estimated at $33.9 million in 2Q'19

Free cash flow situation is improving with the gold production. Yearly free cash flow ("TTM") is now $146.3 million, with an FCF of $33.9 million in 2Q'19 estimated by Fun Trading.

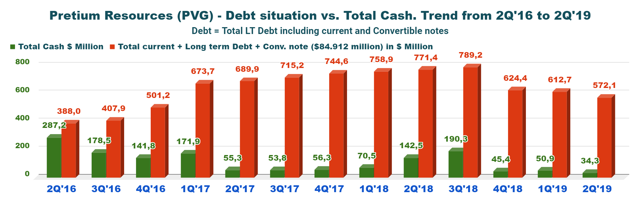

4 - Net debt is $562 million as of June 30, 2019

Net debt is now $538 million, down sequentially.

Also, it is essential to indicate that the company has an extra ~$65-$70 million in liability related to the "offtake agreement." However, this obligation can be repaid at the end of 2019.

"The Company entered into an agreement pursuant to which it will deliver 100% of refined gold up to 7,067,000 ounces. The final purchase price to be paid by the purchaser will be, at the purchaser's option, a market referenced gold price in USD per ounce during a defined pricing period before and after the date of each sale. The Company has the option to reduce the offtake obligation by up to 75% by paying $13 per ounce effective December 31, 2019 on the then remaining undelivered gold ounces."

Note: The company indicated that it reduced debt by $47.0 million this quarter. Tom Yip said:

"During the quarter, we paid $44.7 million under debt facility, spent a total of $7.2 million on CapEx and $6.9 million on interest. We ended the quarter with $34.3 million in cash. Our syndicated bank debt totaled $480 million at the beginning of the year. At June 30, the facility totaled $415.3 million. This consists of a term facility with $233.3 million outstanding, representing another 14 quarterly installments and about a $180 million on the $200 million revolver. The facility matures in December of 2022."

5 - Gold and silver production analysis

In the second quarter of 2019, the Brucejack Mine produced 90,761 ounces of gold, and the company sold 85,953 ounces at an all-in sustaining cost of $940 per ounce of gold sold, keeping Pretium Resources on track to achieve annual guidance.

Tom Yip said in the conference call:

"Included our revenues were TCRCs related to our concentrate sales, which reduced our revenues by approximately $66 per ounce for the second quarter and $62 per ounce for the first quarter of this year. Factoring in the TCRCs, we realized $1,319 per ounce for both quarters."

Production details: Grade per Tonne and Daily Production Tonne per day

Grade per tonne this quarter is still well below what was expected with 8.9 G/T while daily production increased to 3,562 TPD. However, the company believes that the H2 2019 will bring better grade and production. Let's hope that the company will deliver on this commitment.

If we look at the chart above, the grade was ~12.0 G/T in 2018. Now, the company is indicating that the grade for 2019 will be 10.4 G/T or over 13% lower. Furthermore, the grade for H1 2019 is only 8.8 G/T (12.0 G/T in H1 2018), which is much lower than I was expecting.

Also, gold production is averaging now 89,731 Au Oz/Quarter ("TTM").

Conclusion and Technical Analysis

Pretium Resources released its second quarter of 2019. It was a straight quarter overall with a decent production that beat analysts' expectation. However, when I look at the numbers, I am still not impressed and can hardly justify a $2.2 billion in market capitalization for the miner. In short, PVG is now overbought and overvalued like any other stocks in this segment.

Gold production is still below 100K Au Oz, despite an ore production reaching a record of 3,562 TPD. To meet guidance of 10.4 G/T in 2019, the company must show an average grade for 3Q and 4Q at or over 12 G/T, and it is hard to imagine how Pretium can manage a jump of nearly 4 G/T sequentially?

However, the story here is not about the boring technicals, but the euphoria that has embraced the entire gold sector, with spot gold reaching nearly $1,450 per ounce last Friday.

Pretium Resources would have released 30% lower production, and still, PVG would have jumped nearly as much.

In my preceding article, I said that PVG was an excellent proxy for gold, and it did not disappoint me. I was expecting a double bottom in May and the stock, while reaching the $7, did not make it to the $6.75 expected.

This quarter is not changing the overall strategy and I still recommend trading about 40% of your position short term based primarily on the future price of gold.

Technical Analysis (short term)

PVG is forming an ascending channel pattern, in my opinion.

Line resistance is now $12.0 (I recommend selling about 25% of your position unless the price of gold continues to climb above $1,450 per ounce).

Line support is more tricky to define but could be around $10.75.

However, the volatility is now extreme and could create sharp moves up or down. On the downside, I see support at $8.80 if the gold price suddenly retraces unexpectedly. Conversely, on the positive side, PVG could reach $13 or more if the price of gold continues its tepid ascension.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade short term PVG occasionally

Follow Fun Trading and get email alerts