Silver Market / Commodities / Gold & Silver 2020

Despite recent headwinds,it looks to be clear sailing going forward for silver, according to recentforecasts from three financial services firms.

“A higher gold price, along with the ongoingrecovery in industrial demand, particularly from China, means that the price ofsilver is likely to rise in the year ahead,” Capital Economics said in a reportpublished on Sept. 30.

“All in all, a marketdeficit in conjunction with a higher gold price should lift the price of silverto $25 and $27 per ounce by end-2020 and end-2021, respectively,” assistantcommodities economist Samuel Burman wrote. He added,

“Demand for non-interestbearing safe-haven assets, such as gold and silver, should rise as real yieldsin the U.S. drift a little lower. We forecast that the US ten-year nominalyield will fall to 0.50%, from 0.70% currently, by the end of this year andthat it will remain at this level in 2021. The Fed has already stated that itwill keep policy ultra-loose until at least 2023 and allow inflation toovershoot its target.”

The London-based firmpredicts gold will be back to $2,000/oz by year’s end. CIBC concurs that goldis likely to push higher, reaching $1,925/oz in the third quarter and $2,000 inthe fourth, for a full-year average price of $1,800. The Canadian bank has alsoraised its longer-term gold price forecasts, to $2,300 an ounce in 2021, $2,200in 2022 and $2,100 in 2023.

As for silver, CIBCestimates a run up to $32/oz in 2021, $31 in 2022 and $30 in 2023. This year itexpects the white metal to hit $25/oz in Q3 and finish the year at$28/oz.

“The outlook forcontinued low real interest rates, increasing government debt burdens coupledwith geopolitical uncertainty arising from the upcoming U.S. election are allsupportive of further significant price appreciation,” the bank’s analystswrote in a research note to clients.

Silver, it says, “haspotential to provide investors with even more torque given the relativelysmaller market for silver vs. gold.”

Raymond James also raisedits silver price forecasts for 2021, to $25 an ounce, 37.9% higher than itsprevious call, and to $22.50 in 2022 - a 25% increase. The brokerage firm usesa model that bases predictions on the gold-silver ratio. Its current model usesan 85:1 ratio to estimate silver prices, and an 80:1 ratio for silver prices in2021, 2022 and further out.

“Our price forecastchanges reflect our views that the significant increase in monetary stimulusand Central Banker indications that interest rates are expected to belower-for-longer have created a macroeconomic back drop that supports increasedinvestment demand for gold, driving prices higher,” the Raymond James analystswrote in a research note.

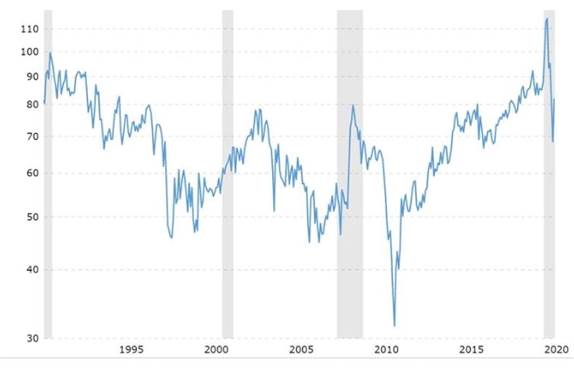

We have seen thegold-silver ratio decline from a multi-decade high of 127:1 in March, to thecurrent 78:1, meaning it takes 78 oz of silver to buy 1 oz of gold. This isstill high by historical standards, meaning silver remains undervalued comparedto gold, and will likely move higher, towards the average historical ratio of55:1.

Burman, of CapitalEconomics, thinks silver prices should gain momentum on the back of ongoingfiscal stimulus in China, and greater industrial activity which drives aroundhalf of annual silver consumption. He points out the latter will be helped bygovernments investing in green energy, including solar panels which containsilver paste.

Thesolar power industry currently accounts for 13% of silver’s industrial demand.

Moreand more silver will be demanded for its use in solar photovoltaic cells, ascountries move further towards adopting renewable energy sources. Around 20grams of silver are required to build a solar panel. The Silver Institutepredicts 100 gigawatts of new solar facilities will be constructedper year between 2018 and 2022, which would more than double the world’s2017 capacity of 398GW.

Accordingto a recent report by CRU Consulting, the amount of electricity generated bysolar power is expected to increase by 1,053 terawatt hours (TWh) by 2025,which is nearly double what was produced in 2019.

All ofthat solar will be a major boon for silver.

CRUexpects PV manufacturers to consume 888 million ounces of silver between nowand 2030. That’s 51.5 million oz more than the combined output from all theworld’s silver mines in 2019.

A study last year by the University ofKent foundthat rising demand for solar panels is driving up silver prices.

5G technology is set tobecome another big new driver of silver demand.

Among the 5G componentsrequiring silver, are semiconductor chips, cabling, microelectromechanicalsystems (MEMS), and Internet of things (IoT)-enabled devices.

The Silver Instituteexpects silver demanded by 5G to more than double, from its current ~7.5million ounces, to around 16Moz by 2025 and as much as 23Moz by 2030, whichwould represent a 206% increase from current levels.

Although weak consumerconfidence because of the pandemic has crimped demand for some of silver’s enduses, including autos and consumer electronics, governments’ recently announced infrastructure investment programs are expected to liftsilver industrial demand.

On the supply side, amonga second wave of covid-19 shutdowns this summer (the first wave was in March)were some of the biggest producing silver mines in the world, although someproduction has come back online.

In July, mining companiesin Peru were forced to keep operations suspended, and halt new ones, as thenumber of coronavirus cases soared. Among the companies affected were Trevaliand its Santander silver mine, Hochschild Mining’s Inmaculada, and Fortuna SilverMines’ Caylloma. Investment projects such as Anglo American's $5 billionQuellaveco, Minsur's $1.6 billion Mina Justa and Chinalco's $1.5 billionToromocho expansion have been delayed by several months.

In Mexico, the world’slargest silver producer, a surge of covid-19 cases in March led to thesuspension of non-essential services. Among the companies forced to temporarilyhalt their operations, were Newmont Mining, Argonaut Gold, Pan American Silver,Sierra Metals, Excellon Resources and Alamos Gold.

The Silver Institute ispredicting a 13% decline in silver production fromLatin America this year - equivalent to 67 million fewer ounces - with global supply setto fall 7.2%.

Given both supply anddemand factors, Capital Economics estimates the silver market will remain in asmall deficit, right through to 2022.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.