Somebody Is Wrong - Gold Vs. Bonds

Both long-maturity bonds and gold have performed exceptionally well this year, but gold is generally viewed as an inflation hedge while bonds are viewed as a deflation hedge.

As such, there appears to be a disconnect between gold, bonds, and the overall economy. Either the strength in gold or bonds could be on weak support.

Economic statistics suggest that, between gold and long-maturity bonds, gold will prove to be the better investment over the long term.

In one of our previous articles, we noted several signs of inflation which were presenting themselves in various economic indicators. Since then, we have noticed a strange phenomenon between various asset classes which causes us to wonder whether inflation (and the inflation trade, which includes buying commodities, energy/mining stocks, etc.) is no longer a concern. From the points below and basic economic relationships, we have to conclude that there is a disconnect between the state of economy, gold, and bonds.

Gold

Using SPDR Gold Shares (NYSEARCA:GLD) for this analysis, GLD continues to rise sharply following its May 9th bottom. Since May 9th, GLD is up 5% and is up 10% year to date. It recently pushed above several key resistance levels, including its February and March 2017 highs and its 200-Day Moving Average (DMA). Additionally, GLD has trended higher since December, with GLD's price chart forming a series of higher highs and higher lows over the past six month. This indicates GLD's uptrend is strong, and that a push to new 2017 highs is likely. A similar conclusion can be arrived at by analyzing the chart of the iShares Gold Trust (NYSEARCA:IAU). The economic rationale behind gold's strength would usually either attribute to a rise in expected inflation or fall in consumer confidence (also known as the fear trade). The fear trade is likely not important right now, with fear gauges such as the VIX at their lowest levels in years. The potential for inflation, on the other hand, with promised fiscal expansion from President Trump and a falling dollar, should garner at least some attention.

Bonds

The "long end" of the yield curve, where bonds with maturities of 20-30 years are found, is little influenced by the Federal Reserve. Rather, it is influenced largely by investor's expected trends in inflation and deflation. Two ETFs track movements in the long end of the yield curve, the iShares 20+ Year Treasury ETF (NYSEARCA:TLT) and the Vanguard Extended Duration Treasury ETF (NYSEARCA:EDV). Both of these ETFs are at their highest levels in six months, signaling that bond investors have been concerned with inflation. Remember, when the price of bond ETFs climb, it means that bond yields are falling. So, if TLT and EDV are making new highs, the yields on Treasuries with 20 to 30 year maturities are falling.

Who's Right? The Economy Is The Tie-Breaker

Trends in gold are suggesting higher inflation while trends in bonds are indicating lower future inflation, so who's right? We will use what is going on with economic statistics as our tie-breaker, which should give a definitive "buy bonds" or "buy gold" recommendation for future investments.

Expected Inflation:

Expected forward inflation is calculated by taking the yield of a plain-vanilla Treasury bond and subtracting the yield of its Treasury Inflation Protected Security (TIPS) counterpart. In other words, if a plain-vanilla bond was yielding 5% and a TIPS with the same maturity was yielding 3%, expected inflation would be 2%. In the chart below, one can see that expected inflation had been falling sharply since 2013. This trend reversed in early-October 2016, and expected inflation has since climbed. This would suggest that the inflation trade should be initiated and that gold should be bought and long-maturity bonds should be sold. But, given that expected inflation recently dropped sharply, we'll err on the side of caution and see if other metrics confirm our "long gold, avoid bonds" strategy.

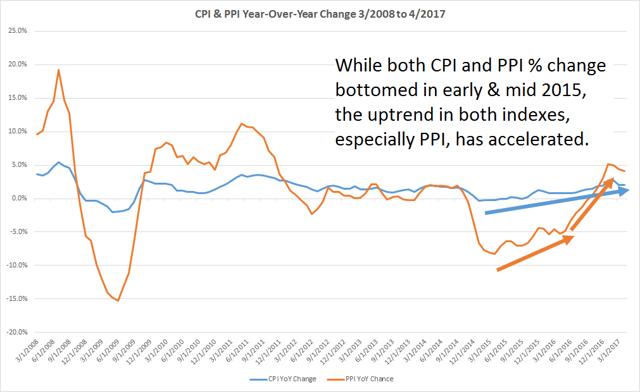

CPI & PPI Year-Over-Year Change

The goal of analyzing both PPI and CPI is to examine if prices are rising for both consumers as well as producers. This captures a much larger part of the price trends of the overall product supply chain than using CPI, which only measures the prices of final, finished products. In the graph below, one can see that the year-over-year change in both PPI and CPI bottomed in the first half of 2015. Since then, the rate of change has accelerated, especially in the PPI since last summer. This concludes again that, without the intervention and rate manipulation by the Federal Reserve, investments which benefit from rises in inflation should perform better than investments which generally suffer due to inflation.

Conclusion

With both long term bond funds and precious metals breaking out to the upside, there appears to be a market disconnect. Precious metals, such as a gold, are generally viewed as a hedge against rising inflation, while bonds with long-dated maturities often perform best when the market expects deflation. The question at the beginning of the article was whether the uptrends in bonds or gold will prove sustainable over the long term. Based on our analysis of expected inflation, CPI, and PPI, it appears gold will prove to be the better investment, and that the uptrends in long-dated bonds and bond ETFs, such as TLT, should be viewed as potentially unsustainable.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.