Stocks Ends Hectic Day Higher, Log Worst Week Since March

Wall Street's "fear gauge," the VIX, enjoyed its best week since mid-March

Wall Street's "fear gauge," the VIX, enjoyed its best week since mid-March

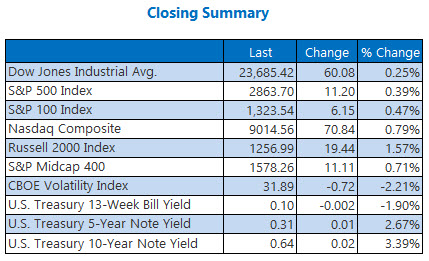

A big comeback for the retail sector -- despite this morning's devastating data -- just barely saved the Dow today. The blue-chip index capped off a week of dramatic dips 60 points north of the breakeven. The S&P, also turned its luck around during the 11th hour, ending with a shallow gain, while the Nasdaq also enjoyed a modest move higher. All three major indexes saw harsh weekly losses, their worst in nearly two months, though the Cboe Market Volatility Index (VIX) enjoyed its best week since mid-March.

Continue reading for more on today's market, including:

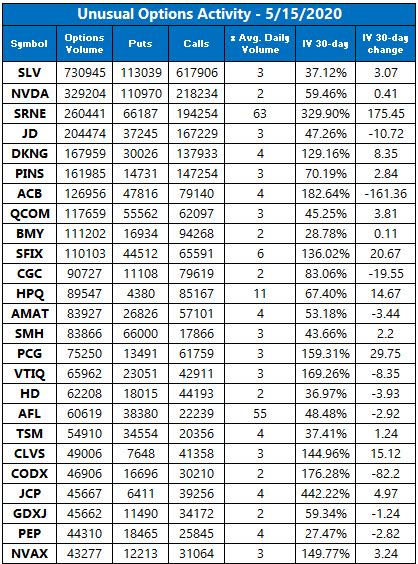

The $12 billion dollar buzz didn't exempt TSM from the semiconductor sector selloff. And another falling chip stock that options players went wild for today.Plus, last-minute TWTR bulls strike higher; a mining stock to watch; and SE gets hit with a bear note.

The Dow Jones Industrial Average (DJI - 23,685.42) tacked on 60 points, or 0.3% on Friday. Half of the 30 index members finished higher, with Walt Disney (DIS) leading the charger and Raytheon Technologies (RTX) sliding to the bottom on a .3% loss. For the week, the Dow 2.9%

The S&P 500 Index (SPX - 2,863.70) added 11.2 points for the day, or 0.4%, and lost 2.3% for the week. Meanwhile, the Nasdaq Composite (IXIC - 9,014.56) ended 70.8 points, or 0.8%, higher, with a 1.2% weekly drop.

The Cboe Volatility Index (VIX - 32.61) lost 0.7 points, or 2.2%, but gained 14% for the week.

5 Items on Our Radar Today

U.S. President Donald Trump brushed off the need for a coronavirus vaccine during an event, while revealing his administrations' ramped up efforts to find and distribute an effective treatment for COVID-19. Trump stated the disease will "go away at some point," with or without a vaccine. (CNBC)The Securities and Exchange Commission (SEC) filed charges against two more companies for making false claims related to the pandemic. The SEC has already temporarily stopped trading on roughly 30 publicly held companies for misleading statements made by officers or third parties regarding testing, treatments and equipment. (MarketWatch)Digging into some last-minute options trading on Twitter monthlies. Why WPM stock could go for the gold. Stifel bids farewell to Sea stock before earnings.

Data courtesy of Trade-Alert

Oil, Gold Notch Sizable Weekly Wins

Oil futures got another blast of wind at their back today, with cuts in crude output and an expected uptick in demand continuing to be the two driving factors.June-dated crude added $1.87, or 6.8%, to settle at $29.43 a barrel, with a 19% pop for the week.

Lackluster economic data, hit hard by the pandemic, is giving gold yet another boost today. Gold for June delivery added $15.40, or 0.9%, to settle at $1,756.30 an ounce, its highest settlement since April 14. For the week, gold futures tacked on 2.5%.