The Alio Gold-Coeur Mining Deal: A Win-Win?

Alio Gold sells its non-core Nevada assets to Coeur Mining.

Coeur gets a large land package close to its Rochester mine.

The properties contain low-grade resources of 2.44 million toz gold and 36.5 million toz silver.

Alio gets $19 million in Coeur's shares.

Alio Gold (ALO) today announced the sale of its non-core Nevada assets to Coeur Mining (CDE). Alio will sell its Lincoln Hill Project, Wilco Project, Gold Ridge Property, and other nearby claims for $19 million. The sum will be paid in shares of Coeur Mining.

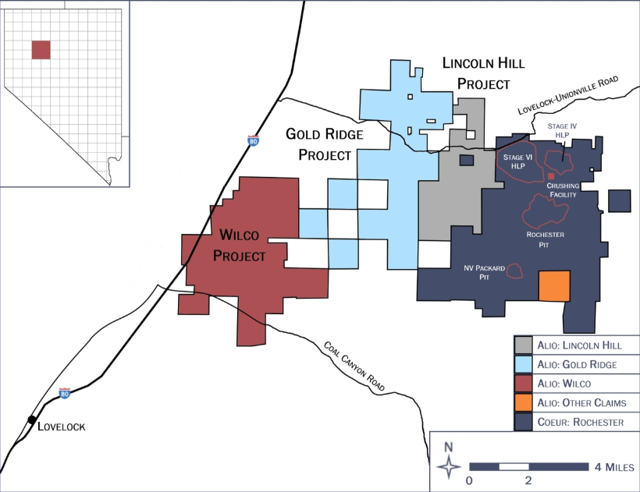

Alio Gold acquired the assets earlier this year when the company merged with Rye Patch Gold (OTCPK:RPMGF). The transaction valued whole Rye Patch Gold at $98 million. As Alio was interested especially in the producing Florida Canyon mine, the management has decided to get rid of the other non-core assets formerly owned by Rye Patch. The assets are located near Coeur's open-pit heap leach Rochester mine (map below). According to BusinessWire, the acquisition will increase Coeur's land position at Rochester from 6,600 to 16,300 hectares or almost by 150%.

Source: Coeur Mining

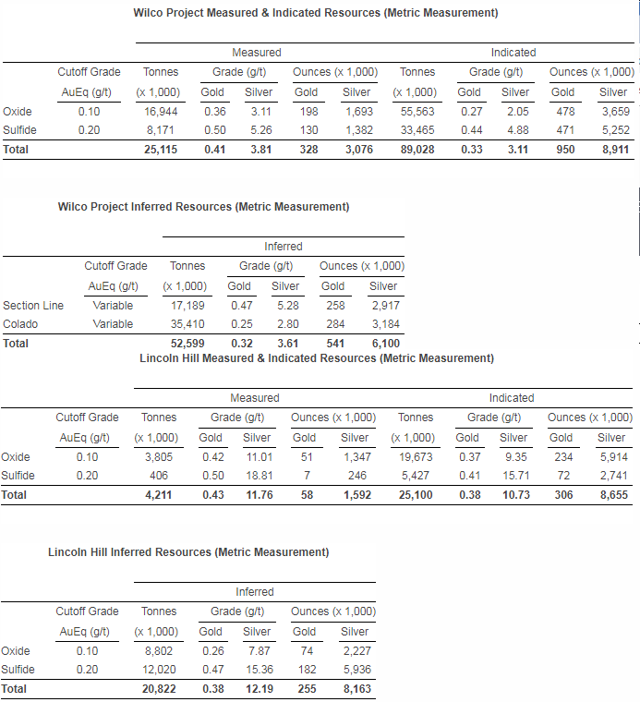

The deal seems to be very good for Coeur. Coeur will not only acquire a big and highly prospective land package but also sizeable resources. Wilco alone contains measured and indicated resources of 1.28 million toz gold and 11.99 million toz silver. Besides this, there are also 0.54 million toz gold and 6.1 million toz silver in the inferred category. The problem is that the gold and silver grades are very low. The measured resources are grading 0.41 g/t gold and 3.81 g/t silver and indicated resources are grading 0.33 g/t gold and 3.11 g/t silver. The inferred resources are grading only 0.32 g/t gold and 3.61 g/t silver. For Alio, the deposits are practically worthless at the current metals prices. However, Coeur's nearby Rochester mine extracts ore with even lower grades. Rochester's proven reserves contain almost no gold (0.003 toz/short ton = 0.1023 g/t) and 0.45 toz/short t silver (~15.4g/t). It equals to 0.77 toz/t silver equivalent (at the current metals prices of $1,230/toz gold and $14.8/toz silver). Wilco's measured resources contain 1.22 toz/t silver equivalent and indicated resources contain 0.99 toz/t silver equivalent. It means that ore from Wilco, although it is a low-grade ore, has notably higher silver equivalent grades compared to the Rochester mine.

Source: Alio Gold

Even better is ore from the Lincoln Hill deposit. Lincoln Hill contains measured and indicated resources of 364,000 toz gold and 10.25 million toz gold. The grades are much better compared to Wilco. The gold and silver grades of the measured resources are 0.43 g/t and 11.76 g/t respectively and the gold and silver grades of the indicated resources are 0.38 g/t and 10.73 g/t respectively. Further 255,000 toz gold and 8.16 million toz silver are classified in the inferred category, with gold grades of 0.38 g/t and silver grades of 12.19 g/t. As can be seen, Lincoln Hill has gold grades very similar to Wilco. The difference is in the silver grades that are approximately 3x higher. Lincoln Hill's measured resources have silver equivalent grade of 1.53 toz/t and indicated resources have silver equivalent grade of 1.36 toz/t.

The current market value of gold and silver contained in measured and indicated resources at Wilco and Lincoln Hill is $2.35 billion. After the inferred resources are included, the final number climbs up to $3.54 billion. What is important to note, all of the resources are situated less than 10 miles from Coeur's Rochester mine which means that the deposits can be extracted relatively easily, using the existing infrastructure and facilities.

As stated by Coeur's CEO:

The Lincoln Hill Project provides higher-grade ounces located near Rochester's infrastructure, which should allow us to generate high returns, higher margins and strong cash flow with little incremental capital. The Wilco and Gold Ridge projects provide additional exploration upside. By consolidating this land position, we look forward to conducting regional exploration in an area with known mineralization that has received little attention historically.

Although the above-mentioned numbers show that it is possible to argue whether Alio shouldn't have asked for more than only $19 million, the deal isn't bad. Especially given the current market situation and Alio's cash needs. Moreover, the majority of Alio's investors don't care about Wilco or Lincoln Hill. They don't even care about the San Francisco and Florida Canyon mines. The majority of them invested in Alio Gold, originally known as Timmins Gold, due to the Ana Paula project that is a real game changer.

The problem is that the high-grade Ana Paula project development was suspended to focus capital expenditures on operating mines. According to Alio's CEO:

Disciplined capital allocation is a priority, particularly in the current gold price environment. As a result, we have made the decision to temporarily suspend development work at Ana Paula while we focus on improving our operations to unlock opportunities to increase efficiencies, lower costs and generate cash flow.

The $19 million capital infusion should improve the financial situation of Alio Gold notably. In Q2, the company recorded negative operating cash flow of -$8.29 million. As of the end of June, it held cash and cash equivalents worth $29.7 million. According to today's news release, Alio reduced its debt by $10 million in recent months. Moreover, given the current gold price, a negative operating cash flow was probably generated also in Q3. It means that $19 million received for the non-core assets may turn out to be pretty important in the near future.

Conclusion

In my opinion, the deal is very good for Coeur Mining. Coeur will get a sizeable land package with identified resources containing gold and silver worth around $3.5 billion, close to its operating mine. Moreover, there is the potential to discover even more resources. And it's all only for $19 million. On the other hand, the transaction isn't that bad even for Alio Gold. The properties were almost worthless for Alio, as Alio doesn't have enough money to develop its flagship high-grade Ana Paula mine, let alone to spend money on some low-grade projects in Nevada. Moreover, given the high production costs at Alio's two operating mines, the capital infusion is pretty important for the company at the current metals prices. The deal can be called a win-win, although, Coeur's prize seems to be a little bigger.

Disclosure: I am/we are long ALO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.

Follow Peter Arendas and get email alerts