The Top Gold Stock for 2021 / Commodities / Gold and Silver Stocks 2020

Australia’sfirst New South Wales Gold Rush took place over 120 years ago. Back then, prospectorswielded nothing more than pickaxes.

Now,a second NSW Gold Rush is on, with a mad rush to this territory with gold explorerswielding the latest technology.

Hugemining names have now gathered. And a sea of junior explorers is attempting tostorm the venue.

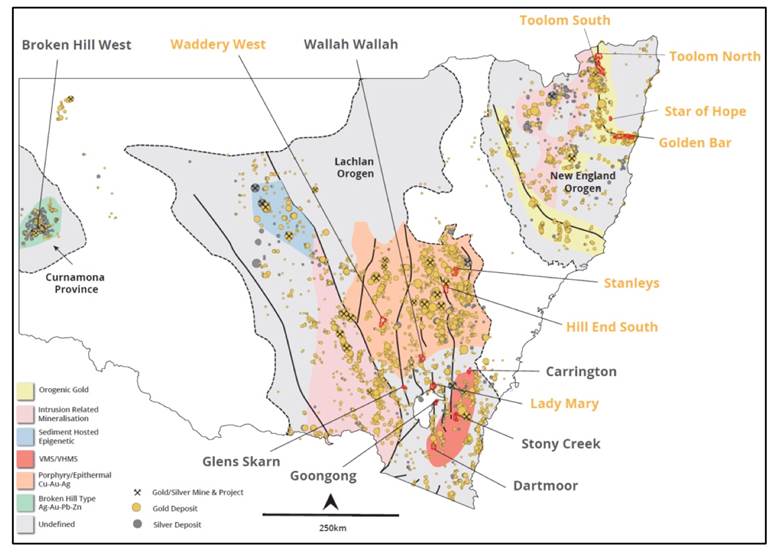

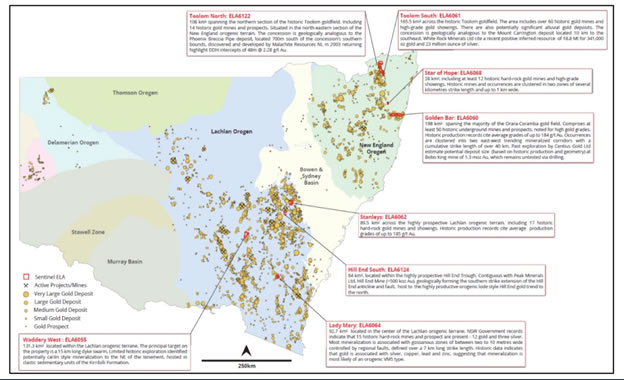

But onestands out: Sentinel Resources Corp. ( CSE:SNL; OTC:SNLRF). It has 8 massive gold projectscovering nearly 95,000 hectares which contains nearly 200 historic, high-gradeGold-Rush-era mines and showings.

Smartgold investors are loading up and sitting on the edge of their seats for whatis potentially the biggest announcement to come out of Australia’s gold scenein over a century ...

Sentinel ResourcesCorp. is already up over 3X (and rising) likely because it’ssitting on an incredibly massive gold land package in one of the most untappedgold rush venues in the world.

Andit may only need one of its ~200 historic, high-grade gold rush-era mines and majorgold showings to hit it big.

Thoseare odds that investors love.

FOR EVERY 1% GOLD GOES UP… GOLD EXPLORERS GO UP AS MUCH AS 10% ORMORE

The world’scentral banks are on an unprecedented money-printing binge.

By Q2 2020 alone, in a frantic attempt to save theeconomy squashed by a pandemic, the Feds have printed some $3.5 trillion in newmoney, out of thin air.

Smart investors are now hedging their portfolios with physical gold and goldETFs…

The biggest banks in the world areeyeing gold prices of around $3,000 in just over a year. Former Citigroup billionaire Thomas Kaplan predicts $5,000 gold.

And the smartest investors are doing the deep research to uncover small-capgold explorers sitting on billions in potential gold.

Why? For every 1% gold rallies... junior mining stocks often rally 10%...20% or more.

Small stocks like this have the potential to hand investors gains of 2,000%...even more.

Especiallywith $126 billion underground in the area…

$126 BILLION UNDERGROUND WITH GOLD CONCENTRATIONS UP TO 184 GRAMSPER TON

Again, Sentinel (CSE:SNL; OTC:SNLRF) has8 huge gold projects in NSW. Some of them could have gold concentrations thatwould have the world’s top miners flocking to the area.

And 17 of those 60 haveshown some intersections with gold concentrations of up to 184 grams per ton(g/t) Au.

Now,Sentinel needs to prove that gold up, and that’s where the news flow promisesto be fast and furious, potentially taking a stock to the heights that mint newmillionaires out of investors in this sector.

Butthere’s one more $30-million plus twist that investors will love …

Honingin on just one target area paints a picture of the sheer breadth of this goldpotential:

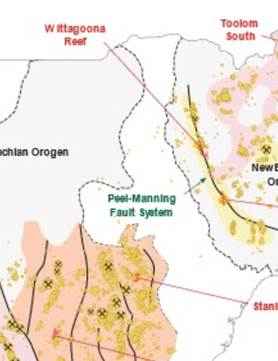

The Peel-Manning Fault System, forstarters, is a structuree between two continental blocks--and it’s a colossalstructure that’s already shed half a million ounces of minerals ( that’s $862 million in today’s dollars). Sentinel is eyeing thepossibility here that in 2 areas of the system alone, they could get more thana million ounces of gold, making it arguably one of the top junior gold playsin the entire world.

That’s$1.7 billion!

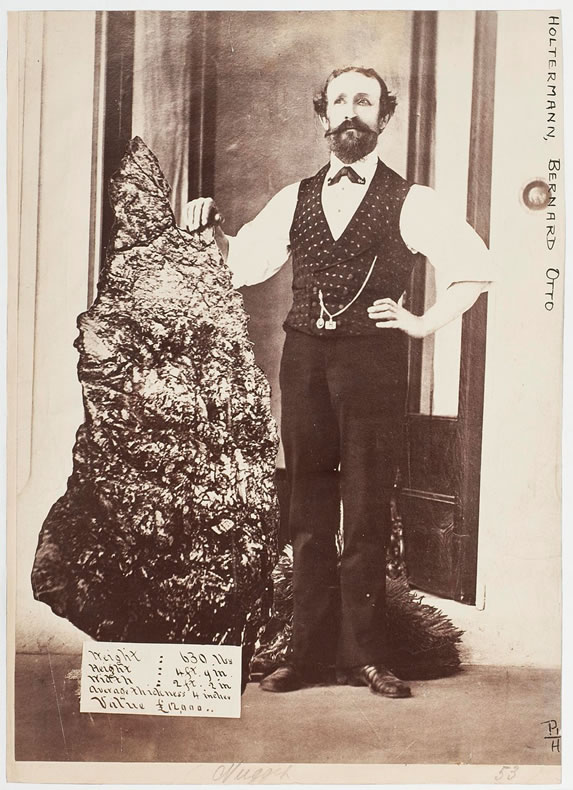

STANLEYS: BONANZA GRADE. 2,720 OUNCE HISTORIC NUGGET

Becauseof the unique geology of the area, gold was formed in high densities. Ahistoric gold nugget worth $17.3million was found at Sentinel’s Stanleys project--120 years ago. It madefront-page news then. It would make a digital explosion today.

But Sentinel (CSE:SNL; OTC:SNLRF) isn’tgoing for a single gold nugget--no matter how big it is. It’s going for … gold… in 8 massive projects littered with almost 200 historic, high-grade mines andgold showings of Gold Rush fame.

Andthey have one of the biggest names in gold exploration behind them.

Dr. Chris Wilson,professional geologist and speacialist mine finder. Dr.Wilson has been direcvtly involved in the development of some of the mostexplosive juniors in recent months, particularly in Australia!

Wilson’s is a name connectedwith almost every major gold-mining success story you’ve heard in the pastthree decades--and particularly on the junior mining scene.

He served as the head ofexploration for Ivanhoe Mines for a decade, leading the company’s Mongoliamining exploration covering a massive 11 million hectares.

He’s worked on majorprojects in over 75 countries--and now he’s jumping in on Sentinel’s NSWexploration in a huge vote of confidence for investors.

And he’s joined by anotherhigh-profile senior advisor to Sentinel--Karl Kottmeier, a force of nature onthe TSX who’s managed and raised over $200 million in equity capital forresource-based ventures, including Rockgate Capital Corp. and American Lithium.

NOW COULD BE A GOOD TIME TO GET IN

Smart investors aregetting in now… ahead of future catalysts.

Sentinelis expecting final exploration drilling approval in less than four weeks.

It’s already gotexploration data to work with, and it’s already identifying targets.

Within three months, thisstory could be out of the bag, and with more exposure this NSW gold rush willbe hard to contain.

Andthis is a true gold rush. Everyone’s congregating here--with big results.

Fosterville South (TSX.V:FSX) just announced multiple high-grade gold assays from its core drilling program at its Golden Mountain project. Kirkland Lake Gold (TSX:KL) showed high-grade intersections at its Fosterville Swan Zone, a new exploration area of its Fosterville mine, the largest gold producer in the Australian state of Victoria. Newcrest Mining (TSX:NCM) just set in motion the “execution” phase of its Cadia Mine Expansion project, one of the largest in Australia. This is one of the largest, lowest cost, long-life gold mines in the entire world.They’resurrounding Sentinel, and their news flow IS Sentinel’s as well. With each newdrilling result from FSX, KL and NCM, Sentinel’s stock can potentially get aboost because NSW is now on almost everyone’s radar as the one of the mostextraordinary gold opportunities, ever.

Sentinel’s8 projects, 200 previous mines and gold showings and 95,000 hectares means anextremely robust approach to gold exploration. It may only have to make adiscovery in one of its former mines to shoot through the roof.

They’re sitting on some ofthe most highly prospective ground in the world with an unbelievable landpackage in Gold Rush territory that’s been forgotten for over a century. Interms of geological addresses, it doesn’t get any better than this. And with some of the biggest names in gold explorationbehind the wheel, the de-risking looks delightful.

Smart investors aregetting in ahead of the next big NSW announcement, Sentinel Resourcesexploration results, or another historic multi-million-dollar nugget shared onTwitter and Facebook worldwide. If that happens, Sentinel Resources Corp. (CSE:SNL; OTC:SNLRF) couldbecome one of the biggest gold explorer stories of 2020.

By. Paul Harton

IMPORTANT NOTICEAND DISCLAIMER

PAIDADVERTISEMENT. This article is a paidadvertisement. GlobalInvestmentDaily.com and its owners, managers, employees,and assigns (collectively “the Publisher”) is often paid by one or more of theprofiled companies or a third party to disseminate these types of communications.In this case, the Publisher has been compensated by Sentinel Resources Corp. toconduct investor awareness advertising and marketing. Sentinel paid thePublisher to produce and disseminate five similar articles and additionalbanner ads at a rate of seventy thousand US dollars per article. Thiscompensation should be viewed as a major conflict with our ability to beunbiased.

Readers shouldbeware that third parties, profiled companies, and/or their affiliates mayliquidate shares of the profiled companies at any time, including at or nearthe time you receive this communication, which has the potential to hurt shareprices. Frequently companies profiled in our articles experience a largeincrease in volume and share price during the course of investor awarenessmarketing, which often ends as soon as the investor awareness marketing ceases.The investor awareness marketing may be as brief as one day, after which alarge decrease in volume and share price may likely occur.

Thiscommunication is not, and should not be construed to be, an offer to sell or asolicitation of an offer to buy any security. Neither this communication northe Publisher purport to provide a complete analysis of any company or itsfinancial position. The Publisher is not, and does not purport to be, abroker-dealer or registered investment adviser. This communication is not, andshould not be construed to be, personalized investment advice directed to orappropriate for any particular investor. Any investment should be made onlyafter consulting a professional investment advisor and only after reviewing thefinancial statements and other pertinent corporate information about thecompany. Further, readers are advised to read and carefully consider the RiskFactors identified and discussed in the advertised company’s SEC, SEDAR and/orother government filings. Investing in securities, particularly microcapsecurities, is speculative and carries a high degree of risk. Past performancedoes not guarantee future results. This communication is based on informationgenerally available to the public and on interviews with company management,and does not contain any material, non-public information. The information onwhich it is based is believed to be reliable. Nevertheless, the Publishercannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. ThePublisher owns shares and/or stock options of the featured companies andtherefore has an additional incentive to see the featured companies’ stockperform well. The Publisher has no present intention to sell any of theissuer’s securities in the near future but does not undertake any obligation tonotify the market when it decides to buy or sell shares of the issuer in themarket. The Publisher will be buying and selling shares of the featured companyfor its own profit. This is why we stress that you conduct extensive duediligence as well as seek the advice of your financial advisor or a registeredbroker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS.This publication contains forward-looking statements, including statementsregarding expected continual growth of the featured companies and/or industry.The Publisher notes that statements contained herein that look forward in time,which include everything other than historical information, involve risks anduncertainties that may affect the companies’ actual results of operations.Factors that could cause actual results to differ include, but are not limitedto, changing governmental laws and policies impacting the company’s business,the degree of success of identifying mineral-rich areas to explore, the degreeof success of drilling excursions, geopolitical issues in the various parts ofthe world in which the company operates, the size and growth of the market forthe companies’ products and services, the ability of management to execute itsbusiness plan, the companies’ ability to fund its capital requirements in thenear term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have readand understand this disclaimer, and further that to the greatest extentpermitted under law, you release the Publisher, its affiliates, assigns andsuccessors from any and all liability, damages, and injury from thiscommunication. You further warrant that you are solely responsible for anyfinancial outcome that may come from your investment decisions.

TERMS OF USE. By readingthis communication you agree that you have reviewed and fully agree to theTerms of Use found here http://GlobalInvestmentDaily.com/terms-of-use. If youdo not agree to the Terms of Use http://GlobalInvestmentDaily.com/terms-of-use,please contact GlobalInvestmentDaily.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY.GlobalInvestmentDaily.com is the Publisher’s trademark. All other trademarksused in this communication are the property of their respective trademarkholders. The Publisher is notaffiliated, connected, or associated with, and is not sponsored, approved, ororiginated by, the trademark holders unless otherwise stated. No claim is madeby the Publisher to any rights in any third-party trademarks.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.