Torex Gold: Undervalued And Operational

Torex has traded down significantly on a temporary labor shutdown - a recipe for an undervalued stock.

Long term prospects for production increases and expansion are excellent.

Gold continues to perform well while the gold producers lag behind, a combination likely to reverse before long.

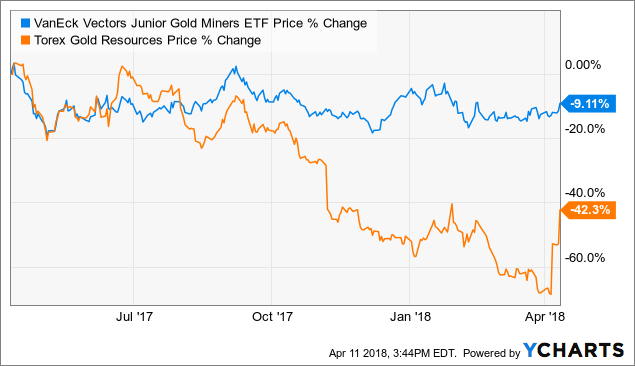

As you can see on the chart below, Torex Gold (OTCPK:TORXF) has had a difficult past year to say the least. The stock was in a solid downtrend, as the market ran up considerable in 2017, and the gold stocks trended flat to down. Torex fell with the sector, and then had a large drop when the mine became temporarily closed due to union issues. The company has done a great job of keeping investors updated on any material changes, with consistent releases throughout the last 3 months. The story of Torex is really one of value, with the mine trading near its book value even though it has one impressive gold producing asset and lots of unexplored property. As you can see below the entire sector has been weak of late, even as gold prices have done well with a weaker US dollar. Torex was under performing only slightly before the mine shutdown was announced on November 6 2018. Since then the stock has take a beating, down below its book value at 0.94 P/B. Any Buffett style investor should be intrigued by this - a working mine in a temporary state trading below its book value. Recently the company announced that while the labor dispute continues, the blockade is gone and the mine is operational. This has heavily de-risked the name and made it an exceptional value play for 2018. You can see the recent spike on the news of the end of the blockade, on extremely high volume. Less than a week after the Los Mineros union has officially backed off, giving the stock clear skies going forward. Look for it to quickly rerate back to the price it had before these issues of 18-22 per share.

GDXJ data by YCharts

GDXJ data by YChartsLabor Dispute

The crux of the reason the shares are trading at such a discount to the 'fair' operating value of the mine is an ongoing labor dispute. A union, called Los Mineros are supporting a continued blockade of the main road to the mine, causing the shutdown. These blockaders have resorts to threats and violence to try to influence the government and Torex to get what they want. This is while many of the employees actually want to return to work, supporting a different union CTM. The local communities are badly hurt by this shutdown, as the workers ceased to be paid on. Several employees have been killed or kidnapped as a result of these union issues. This is a good warning for those investing in any mining company in a risky jurisdiction of these potential issues. As a result they have completely supported the reopening of the mine, even with the labor vote result looming. Luckily, it seems like the worst is behind them, with workers choosing to return to work even after threats by some of the blockaders. March 15 was the expected date of the union vote, and we can expect the result there as the next big catalyst for the stock, potentially sending the share back to normalcy. It is unclear if the vote happened yet but when we hear about the results of that vote, hopefully it will help lift the negative cloud over the shares. The Los Mineros union is using as many stalling tactics as they can, knowing they do not have the support of enough locals to win the vote.

Recent developments continue to have an overhang on the share price. Local media has been used as a tool for the Los Mineros union and those who support its efforts to thwart the mine reopening. They have trespassed onto the Torex mine property to stage a sit in. They have attempted to use this to get the terms of the 30 year lease agreement changed. However, this agreement is legally binding and these groups have no influence over the actual status of the lease which is strong. The company continues to work with the community, using royalties from the main open pit mines to build community facilities. The group supporting the Los Mineros union is "a much smaller group" than initially, a fact supported by the re-opening of the mine operations and the blockade bypass. Now it appears the union group has given up its fight to gain the Torex employees. Mine operations will return to normal and the stock will be able to re-rate back to its old range. This means that the best case scenario has played out, and the salaries of employees may not even increase much as a result of this situation. As noted by Fred Stanford the CEO of Torex "We see this Los Mineros Union withdrawal from the union selection process as a tacit acknowledgement that the incumbent CTM Union has the support of the majority of union eligible employees." The employees just wanted to return to work and provide for their families, and now have the opportunity to do so.

Common Share offering

Part of the reason for the continued weakness in the stock of late was an offering brought on by debt covenants. In order to keep adequate liquidity with the mine closed, Torex had to offer shares at a low price of $10.09 USD. Proceeds of the offering were approximately $49.4M USD on the offering of 5.42 million shares after the over allotment option. This is a significant dilution, but one that in the long term does not hurt the company significantly. Essential they had to offer shares at ~1.25 Price to Book, compared to a more reasonable value of 14-17 dollars before they shutdown. This dilution represents around 6.4% of the current shares but does provide them with the cash to get the mine back to speed. As the chart earlier shows, the stock is 60.6% in just the past year. This is creating an impressive buying opportunity at a price cheaper than anywhere in the past 2+ years. This offering combined with the labor issues have increased the risk considerably and the stock has re-rated as a result. However, the jobs provided by the company are necessary to the neighboring communities and solutions will arise for these problems.

Mine Operations

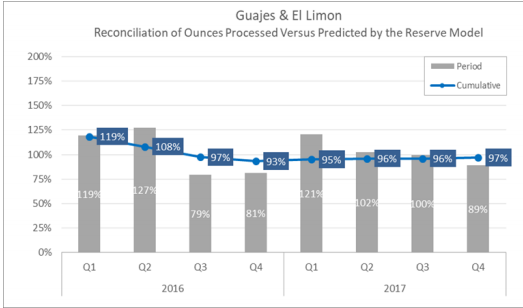

As you can see above the mine outperformed over 2016, which evened out over the past 12 months. The mine should continue to run near the reserve model. Ore throughput for the year was only at 86% of design capacity, meaning improvements in efficiency are coming. The rate while the mine was active for Q4 was 90%, and we should see this ramp throughout 2018.

While the mine was under performing in late 2017 prior to the mine closure, the company are making moves for long term profitability. Management notes on the MD&A that "The SART plant in 2018 and beyond is expected to reduce AISC by $100 per ounce of gold sold by reducing reagent consumption and adding by-product credits resulting from the sale of a copper product." All in sustaining costs is a standard metric of the full cost of mining an ounce of gold, allowing for $100 more profit per ounce in 2018. At AISC (all in sustaining costs) of $989 for the year Torex sees a large benefit from an increase in gold prices also. This leverage should be beneficial for the stock rebound once the labor issues subside into spring. The plant was running at 90% efficiency in 2017 before the shutdown.

A technical report on the Media Luna area was delayed due to the mine shutdown, but should be complete in late Q2 to early Q3. A 25 year land lease agreement means a feasibility study coming in 2019 will act as the blueprint for the mine could add significant future value.

Conclusion

If you have a high risk appetite, Torex is a bargain trading at book value. The company has a profitable mine and additional unexplored property that could be of great value. The tensions will eventually subside, and you are able to profit from a temporary issue that will not cause longer term damage to the company. While earnings may be hurt by changes to wages or programs, the mine will continue to be profitable with expansion in the years to come. It is a situation where you need to ignore the broken looking chart and look under the hood at fundamentals to make an intelligent long term purchase. The two latest developments have sent the stock flying, and given hope that it could double or more this year from its low point. I am still adding to my own position and suggest others do the same for the value it has at these levels.

Disclosure: I am/we are long TORXF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow Jeremy Rowe and get email alerts