USDX, Gold: The Hunter and the Prey / Commodities / Gold and Silver 2021

Just before the hunt begins, thehunter needs to be sure its prey feels safe. Will we see a promising short-termrally in gold?

After the USD Index reasserted itsdominance once again, its bellowing howl sent shivers down the spine ofcurrency traders. When the U.S. Dollar Index is on the hunt, the preciousmetals are often its prey. The alpha wolf is poised to lead the pack over themedium term, and the sheep will likely be sent to the slaughter, but thepredator needs to gather force first; a peaceful period of prosperity shouldensue over the next several days. And this short-term decline could help upliftgold, silver, and mining stocks.

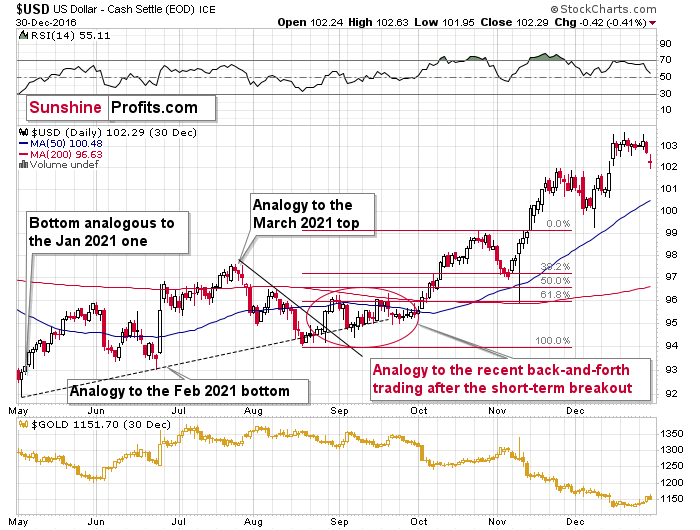

To explain, I warned last week that ashort-term decline was likely after the USD Index’s RSI (Relative Strength Index) jumped above 70. And after eliciting some weakness,another pullback to the 38.2% Fibonacci retracement level also aligns with theprice action that we witnessed in 2016.

Please see below:

To that point, after the USD Index brokeabove its short-term declining resistance line in 2016, it followed that up byretreating a bit below its rising support (dashed) line and then consolidatedfor about a month before rallying sharply. In the process, the USD Indexcorrected to approximately its 38.2% Fibonacci retracement level beforerallying once again (in fact, it moved slightly below it). For context, therewas also a huge intraday reversal in the following days, but it was anevent-driven one (it was when Donald Trump won the elections), so it’s unlikelyto be repeated. As of today, with the 38.2% Fibonacci retracement level atabout 91.3, the USDX could bottom close to this level. Now, this might not seemlike a big deal, but it becomes quite important once one considers whathappened in gold during the final part of the move to the 38.2% retracement in2016. That was when gold made most of its gains.

However, given the yellow metal’sinability to bounce after its profound decline, the forthcoming rally willlikely be weaker than originally expected. For context, the initial projectionwas based on the similarity to gold’s behavior in 2012. However, with theyellow metal struck in neutral and failing to gain any traction, the currentenvironment seems more bearish than it was in 2012. The bearish goldprice forecasts currently seem justified , in the medium term.

Moreover, if the USD Index can surpass93, the greenback will complete its inverse head & shoulders pattern, and the milestoneimplies a short-term target of roughly 98.

Let’s keep in mind that the near-termdecline in the USD Index is likely to be small – and nothing more than a blipon the radar screen, when viewed from the long-term point of view. The USDIndex often records material upswings during the middle of the year. If youanalyze the chart below, you can see that summertime surges have been mainstayson the USD Index’s historical record. Likewise, double bottoms often signal theend of major declines and often ignite significant rallies. For example, in2004, 2005, 2008, 2011, 2014 and 2018, a retest of the lows (or close to them)occurred before the USD Index began its upward flights. In addition, back in2008, U.S. equities’ plight added even more wind to the USD Index’s sails. Andif the general stock market suffers another profound decline (along with goldminers and silver ), a sharp re-rating of the USDX is likely in the cards.

Please see below (quick reminder: you canclick on the chart to enlarge it):

If that wasn’t enough, the thesis is alsosupported by the USD Index’s long-term chart. To explain, the USDX’s long-term breakout remains intact, and if we steady thebinoculars, the greenback’s uptrend is clearly in place.

Please see below:

Moving on to the Euro Index, the recentsymmetrical decline mirrors the drawdown that we witnessed in mid-2020. And ifthe Euro Index breaks below the neckline of its bearish head & shoulderspattern, the slide could be fast and furious. For context, completion of theright shoulder signals a decline to (roughly) the June 2020 lows or even lower.However, with a short-term corrective downswing in the USD Index likely tousher the EuroIndex higher, the development should help support gold, silver, and miningstocks this week.

Please see below:

For context, I wrote previously:

Thecompletion of the masterpiece could have a profound impact on gold, silver andmining stocks. To explain, gold continues to underperform the euro. If youanalyze the bottom half of the chart above, you can see that material upswingsin the Euro Index have resulted in diminishing marginal returns for the yellowmetal. Thus, the relative weakness is an ominous sign. That’s another point forthe bearish price prediction for gold.

Circling back to the 2016 analogue, theUSD Index has already hopped into the time machine. And with the flashback elicitingmemories of past glory, a reenactment won’t be applauded by the PMs.

As you can see on the above chart, whatwe saw this year was quite similar to what happened in 2016. The analogy that Idescribed previously worked just like in the past. Namely, the back-and-forthmovement after the breakout was followed by a quick rally.

The bottom line?

Once the momentum unfolds , ~94.5 is likely the USD Index’s firststop. In the months to follow, the USDX will likely exceed 100 at some pointover the medium or long term. Keep in mind though: we’re not bullish on thegreenback because of the U.S.’ absolute outperformance. It’s because the regionis outperforming the Eurozone and the EUR/USD accounts for nearly 58% of themovement of the USD Index – the relative performance is what really matters .

In conclusion, while wolves will likelycircle gold, silver and mining stocks over the medium term, the leader of thepack – the USD Index – is well-fed for now and shouldn’t disrupt the preciousmetals’ short-term corrective upswing. However, when its stomach growls and thehunt continues, the alpha’s bared teeth, fixed stare, and horizontal ears mayscare gold, silver and mining stocks to death. Thus, while the precious metalsare likely safe in the short term, the nights might grow colder and darker evenamid the summer sun.

Today's article is asmall sample of what our subscribers enjoy on a daily basis. They know aboutboth the market changes and our trading position changes exactly when theyhappen. Apart from the above, we've also shared with them the detailed analysisof the miners and the USD Index outlook. Check more of our free articles on our website, including this one – justdrop by and have a look. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Signup for the free newsletter today!

Thank you.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.