Warming up to bad news stocks

In my Thursday interview with Jim Goddard, I try to answer the question is now a time to hitch a ride on the polar bear value express? While stock valuations have improved on the recent pullback, we still do not believe it is a slam dunk to jump on board yet. With the US market trading like an emerging market, something has changed.

Markets are now moving to a new destination, and the ride may not be so pleasant. Consequently, the ideal entry into stocks would be at the point of maximum pessimism. The challenge is to assess when we are there.

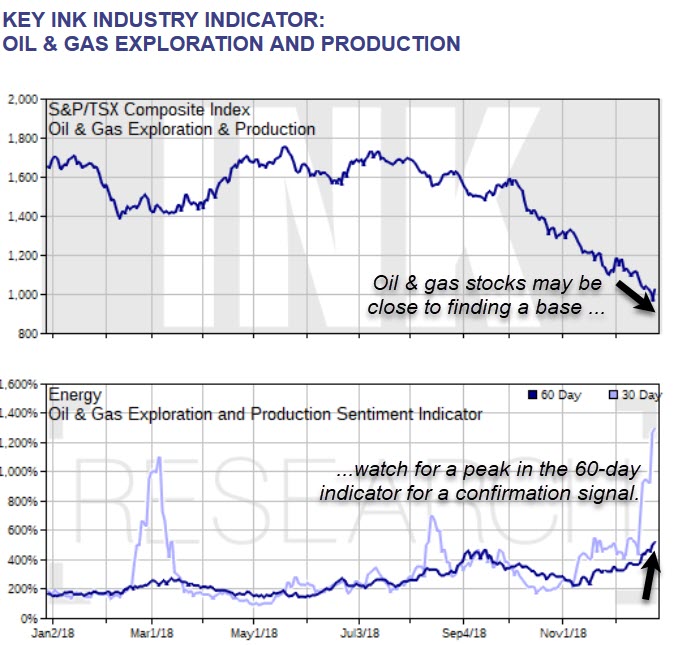

In the interview I make the case that we are closer to that point with Canadian oil & gas stocks than we are in the broad US market. We are waiting for our Oil and Gas Exploration & Production Indictor to peak as that will signal peak insider buying which often happens around stock price lows. As of Thursday, we are still not there. However, it is worth keeping in mind that we will only be able to assess an indicator peak with a lag, which could be anywhere from a few days to a couple of weeks.

Consequently, risk-tolerant value investors interested in the oil patch should be compiling candidates now to potentially enter when the risk-reward trade-off on the stock becomes acceptable.

In contrast to the Canadian oil patch, we do not believe all the bad news is near to being broadly priced into US stocks as there continues to be a loud positive narrative about the strong US economy. Until it becomes consensus to dismiss good news as no longer relevant, we will not be at the point of maximum pessimism with US stocks.

Looking ahead to the New Year, the American market is going to have to confront three key challenges:

A face-off between a hostile House of Representatives and the U.S. PresidentTrade warHas the Fed overdone it on rate hikes?If there is some type of settlement between the US and China on trade, based on the NAFTA experience, any ensuing rally may be fleeting. In terms of the Fed overtightening, we unfortunately will not know until this grand tightening experiment comes to an end.

The Canadian economy will see its share of challenges in the New Year, including Bill Morneau's payroll tax hike. Nevertheless, the key factors driving stock prices will be found in the United States.

This post first appeared on INKResearch.com.