What's Next for the Silver Price Roller Coaster? / Commodities / Gold and Silver 2021

After a frenzy of Reddit inducedactivity that captivated everyone, silver painfully gave back what it gained.What’s next for the white metal?

As the precious metals’ version of moralhazard, silver tipped over the flowerpot, and left gold to clean up the mess.After silver’s short squeeze mania ended in tears on Feb. 2, the white metalgave back 97% of its squeeze -induced gains. Conversely, bearing the brunt of the market’s wrath, gold gaveback 237% of the momentum-induced gains.

Please see below:

Figure1

As a result, silver is doing what itnormally does near market tops: outperforming among comments regarding silvershortage .

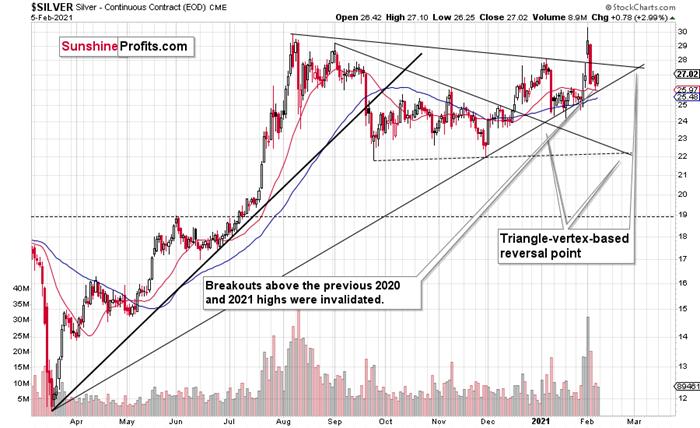

Positioning itself for an epic blow-offtop, silver’s Feb. 1 surge ended in less than 24 hours. In addition, silver isapproaching two triangle-vertex-based reversal points – which could come to ahead by the end of February or early March. However, given the two set ups,they could be signaling one climactic reversal or two separate reversals ofdiffering magnitudes. As it stands today, it’s still too early to tell.

Figure2 - COMEX Silver Futures

However, supporting the argument of asingle blow-off top, I mentioned last week that the iShares Silver Trust ETF(SLV) took in nearly $1 billion in daily inflows on Jan. 29. For context, thatwas nearly double the previous record.

Please see below:

Figure3 - Source: Bloomberg/Eric Balchunas

But because too much of a good thing can often be bad, the frantic buying mirrored an ominous period inSLV’s history.

Please see below:

Figure4 - COMEX Silver Futures

If you analyze the volume spikes at thebottom of the chart, 2021 and 2011 are a splitting image. To explain, in 2011,an initial abnormal spike in volume was followed by a second parabolic surge.However, not long after, silver’s bear market began.

SLV-volume-wise, there's only one similarsituation from the past - the 2011 top. This is a very bearish analogy ashigher prices of the white metal were not seen since that time, but the analogygets even more bearish. The reason is the "initial warning" volumespike in this ETF. It took place a few months before SLV formed its final top,and we saw the same thing also a few months ago, when silver formed its initial2020 top.

The history may not repeat itself to theletter, but it tends to be quite similar. And the more two situations arealike, the more likely it is for the follow-up action to be similar as well.And in this case, the implications for the silverprice forecast are clearly bearish.

Based on the above chart,it seems that silver is likely to move well above its 2011 highs, but it’s unlikelyto do it without another sizable downswing first.

In conclusion, if silver meets its maker,the white metal is likely to lead gold and the miners to slaughter. Moreover,silver is well known for its false breakouts and its relative strength is oftena precursor to substantial declines. As a result, last week’s short squeeze wasmuch more semblance than substance. In contrast, once the metals rebase andtrade at more appropriate levels, an attractive buying opportunity will emerge.

For more insight, let’s look at therelative performance of gold, silver and the gold miners, and compare howthey’re impacted by the USDX and the SPX. If you analyze the chart below, youcan see that the precious metals all broke down in September, after the USDXbroke above resistance.

Figure5

To explain, I wrote on Jan. 18:

Liketraffic lights flashing red, notice how the HUI Index (proxy for gold stocks)is trading well below its early 2020 highs? In stark contrast, gold remainsmoderately above its early 2020 highs, while silver is significantly above itsearly 2020 highs. The misaligned performance – with silver outperforming andgold miners underperforming – puts a bow on this bearish package.

Thebottom line?

Itis not only the case that silver was strong and miners were weak in the lastseveral days – it’s been the case over the past several months as well. The implicationsare bearish.

Alsotroubling is that the stock market that’s soaring in the medium term, hasn’tshined its light upon the PM market. Contrasting the mantra that ‘a rising tidelifts all boats,’ equity market strength hasn’t triggered a sustainable rallyin silver or the gold miners. And this “should have” been the case – both aremore connected to stocks than gold is. Gold stocks because they are, well,stocks. Silver, due to multiple industrial uses

Allin all, based on what we saw in silver recently, it doesn’t seem that we’relikely to see much higher precious metals prices without seeing a major declinefirst.

Thank you for reading our free analysistoday. Please note that the above is just a small fraction of today’sall-encompassing Gold & Silver Trading Alert. The latter includes multiplepremium details such as the targets for gold and mining stocks that could bereached in the next few weeks. If you’d like to read those premium details, wehave good news for you. As soon as you sign up for our free gold newsletter,you’ll get a free 7-day no-obligation trial access to our premium Gold &Silver Trading Alerts. It’s really free – sign up today.

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Toolsfor Effective Gold & Silver Investments - SunshineProfits.com

Tools für EffektivesGold- und Silber-Investment - SunshineProfits.DE

* * * * *

About Sunshine Profits

SunshineProfits enables anyone to forecast market changes with a level of accuracy thatwas once only available to closed-door institutions. It provides free trialaccess to its best investment tools (including lists of best gold stocks and best silver stocks),proprietary gold & silver indicators, buy & sell signals, weekly newsletter, and more. Seeing is believing.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.