What the USDX Shows Will Happen to Crude Oil Price Soon / Commodities / Crude Oil

By Submissions / November 09, 2022 / www.marketoracle.co.uk / Article Link

Less than a month from now – onDecember 5 – an embargo on maritime exports of Russian crude oil to theEuropean Union will come into force, as I explained in mylast article.

As a result, global oil supply isexpected to tighten significantly, with Russia being the world’s largestexporter of oil and fuels.

Therefore, energy markets are bracing forturbulence, as they may face a new storm of volatility.

On the macroeconomic view, the US DollarCurrency Index – still weakening against a basket of major currencies – startslooking down from the balcony to revisit some lower floors:

US Dollar Curency Index – 2021-2022 (zoomed out)

While currently moving slightly outsidethe lower band of the 2022 regression channel, its previous swing low fromOctober has just been taken over as the DXY is now progressing within a newlyforming downward regression channel starting from the end of the last quarter.

US Dollar Currency Index (DXY) CFD (daily chart) for 2022 (zoomedin)

Let’s zoom into a 4H chart to get alarger picture:

US Dollar Currency Index (DXY) CFD (4H chart)

Here is the big picture for the WTI CrudeOil chart, after zooming out over the weekly timeframe:

WTI Crude Oil (CL) Futures (Continuous, weekly chart)

The long-term structure looks ratherbullish for the black gold – with an upward trend that could be triggered asthe greenback may start to explore lower floors.

At the moment, if we consider the pasttwo sessions this week alone, both assets are correlated rather positively(both falling at the same time).

But this short-term correlation may startto turn negative if we see further weakening on the US dollar, which would havethe effect of propelling commodities, starting with energy. But gold can alsobenefit from this, as investors may switch to the yellow metal as a new safe-haven.

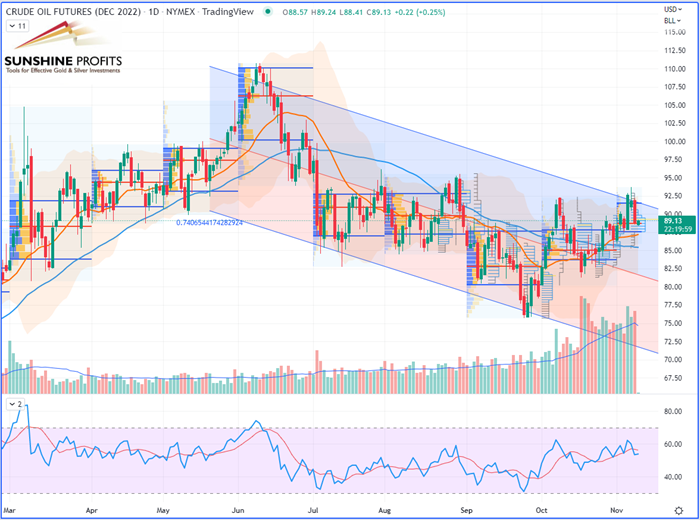

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)

If oil prices fell on Tuesday (Nov 8th),it was mainly because they were weighed down by disappointing indicators inChina and a resurgence of the epidemic which threatens demand in the country,one of the engines of global demand.

Demand in China – the country thatimports the most crude in the world and also the second consumer of oil (afterthe United States) – is particularly unstable since the health authoritiesassured that the strict zero-Covid health policy would continue to be applied.

Moreover, as financial market players areincreasingly concerned about the state of the global economy, the latestcommercial data from China, which also highlighted a significant slowdown, seemsto have proven them right.

WTI Crude Oil (CLZ22) Futures (December contract, 4H chart)

Thisis the scenario I’m expecting will play itself out. Now, please tell me aboutyours!

Like what you’ve read? Subscribe for ourdaily newsletter today, and you'll get 7 days of FREE access to our premiumdaily Oil Trading Alerts as well as our other Alerts. Sign up for the free newslettertoday!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of SebastienBischeri, & Sunshine Profits' associates only. As such, it may prove wrongand be subject to change without notice. At the time of writing, we base ouropinions and analyses on facts and data sourced from respective essays andtheir authors. Although formed on top of careful research and reputablyaccurate sources, Sebastien Bischeri and his associates cannot guarantee thereported data's accuracy and thoroughness. The opinions published above neitherrecommend nor offer any securities transaction. Mr. Bischeri is not a RegisteredSecurities Advisor. By reading Sebastien Bischeri’s reports you fully agreethat he will not be held responsible or liable for any decisions you makeregarding any information provided in these reports. Investing, trading andspeculation in any financial markets may involve high risk of loss. SebastienBischeri, Sunshine Profits' employees, affiliates as well as their familymembers may have a short or long position in any securities, including thosementioned in any of the reports or essays, and may make additional purchasesand/or sales of those securities without notice.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Recent News

Mawson driven by Sunny Creek exposure through SXG holding

May 20, 2024 / www.canadianminingreport.com

Gold stocks driven up by metal and equity gains

May 20, 2024 / www.canadianminingreport.com

Gold stocks propelled by gain in metal and equities

May 13, 2024 / www.canadianminingreport.com

Big Gold producers report strong Q1/24 results

May 13, 2024 / www.canadianminingreport.com

Gold stocks decline as metal drop offsets equity risk on

May 06, 2024 / www.canadianminingreport.com