Which is Right: Gold or Real Rates? / Commodities / Gold and Silver 2018

Readers know that I have beaten this drum alltoo often. Gold’s major fundamental driver is declining or negative real rates.There is a strong inverse correlation because Gold is money. That’s what JPMorgan said and he’s far more qualified to understand than quotable celebritieslike Mark Cuban. But I digress. When real rates are increasing or stronglypositive (during most of the 1980s and 1990s and 2011 through 2015) Goldperforms poorly because one can earn a real return on their money unlike withGold. However, when real rates decrease and particularly when they arenegative, Gold flourishes. That being said, right now there is an interestingdevelopment. Real rates have increased over the past year but Gold has heldsteady. Reviewing recent history can help us answer which is right.

Readers know that I have beaten this drum alltoo often. Gold’s major fundamental driver is declining or negative real rates.There is a strong inverse correlation because Gold is money. That’s what JPMorgan said and he’s far more qualified to understand than quotable celebritieslike Mark Cuban. But I digress. When real rates are increasing or stronglypositive (during most of the 1980s and 1990s and 2011 through 2015) Goldperforms poorly because one can earn a real return on their money unlike withGold. However, when real rates decrease and particularly when they arenegative, Gold flourishes. That being said, right now there is an interestingdevelopment. Real rates have increased over the past year but Gold has heldsteady. Reviewing recent history can help us answer which is right.

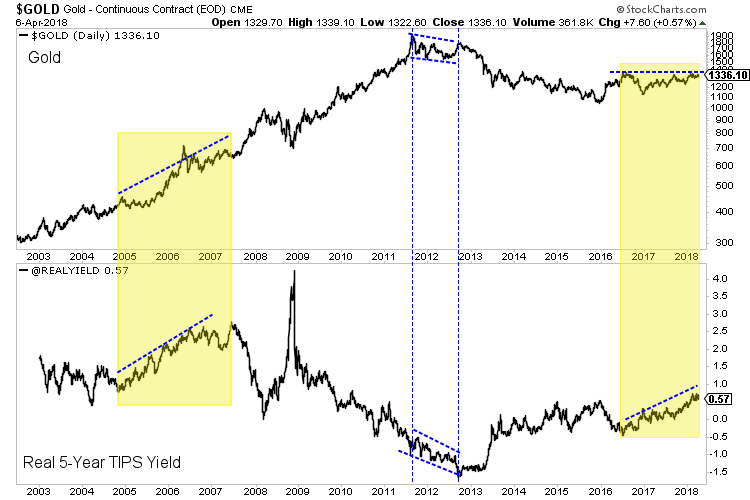

First we look at a market-based indicator forreal rates (yields). The US Treasury publishes this data daily as calculatedfrom the TIPS market. Below we plot Gold along with the real 5-year TIPS yield,which recently touched an 8-year high. Interestingly, Gold has held up well.Note that there were two previous, similar divergences. Gold peaked in 2011even though the real 5-year yield did not bottom until 2012. From 2005 to 2006Gold made a significant break to the upside yet the real 5-year yield alsoincreased during that time. Both times Gold was right.

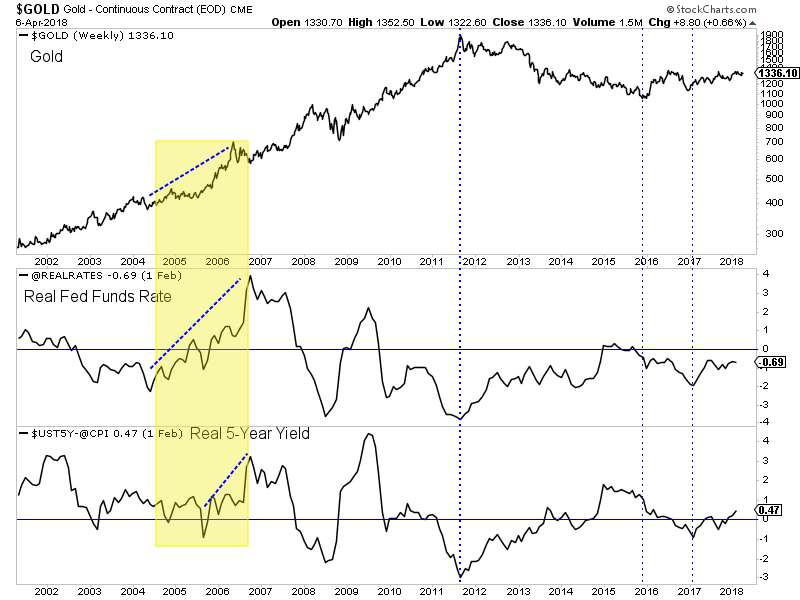

Market-based indicators are great but in thecontext of real rates, the basic calculation has proven to be a betterindicator for Gold. In this chart we plot Gold along with the real fed fundsrate (inflation less the fed funds rate) and the real 5-year yield (inflationyess the 5-year yield). Note that both statistics peaked in 2011 at exactly thesame time as Gold. Both have increased since the start of 2017 (along withGold) but are nowhere close to the 8-year high that the real 5-year TIPS yieldis. The TIPS market is exaggerating the strength of real yields.

Ultimately it remains to be seen which is right (Goldor real rates) but the past tells us to side with the market (Gold) rather thana fundamental indicator. The market is a discounting mechanism. Gold holdingsteady despite an increase in real rates could be a bullish signal just as Golddeclining amid falling real rates would be concerning. Perhaps Gold isdiscounting the likelihood that real rates have peaked and the risk of a sharpdecline in real rates in 2020. In any case, those who focus too much on realrates and not the message of the market could risk missing out on a huge breakto the upside. In anticipation of that move we continue to accumulate thejuniors that have 300% to 500% upside potential over the next 18-24 months.

To follow our guidance and learn our favorite juniors for 2018, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.