Yamana Gold - Exciting Time Ahead

Yamana released today its preliminary results for the year 2017, which were above forecast.

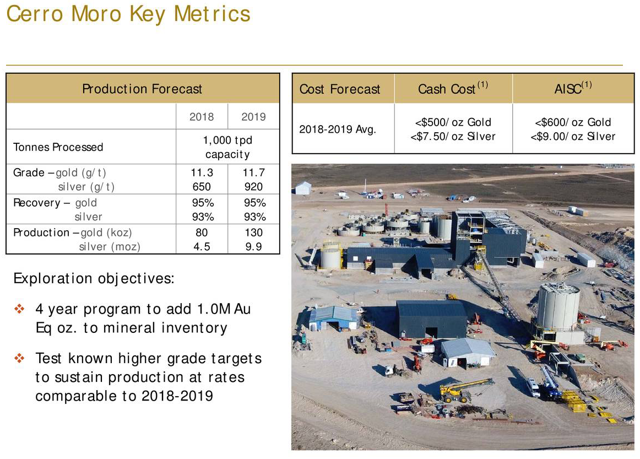

Both gold and silver production are anticipated to surge in 2018-2019 as the Cerro Moro adds to cash flow (production of 80K Oz of gold in 2018).

Yamana has entered into a copper advanced sales program pursuant to which the Company will receive $125.0 million on January 12, in exchange for 40.3 M Cu Lbs.

I believe that Yamana Gold is now bottoming out of its long-term bearish cycle and will slowly rise to a more better valuation, depending on the future gold price, of course.

Picture: El Pe??on. Yamana Homesite.

Investment Thesis

Yamana Gold (NYSE: AUY) is a mid-tier Canadian gold miner operating six mines and now owns a subsidiary at 55.6% (upon completion of the last sale on 06/02/2017) called BRIO Gold.

Historically, this gold miner is trading at nearly 10-year low and has underperformed the sector due to some questionable management decisions in the past, including the last year botched spin-off of Brio Gold.

However, it is perhaps time to consider the stock as an opportunity for the long-term (depending on the gold price), after the stock confirmed in July a strong support at around $2.25 and established a new support at $2.50. A Good project pipeline and a manageable debt are surely helping.

Today preliminary 2017 operational results and an update on construction activities at Cerro Moro mine are another evidence that the company is turning around and the market likes it.

Today news: Preliminary 2017 Operational Results and Update on construction activities at Cerro Moro

1 - Preliminary 2017 Operational Results (Gold, Silver, and Copper).

I think the best way to present the results Quarterly and Yearly, is to use four simple graphs.

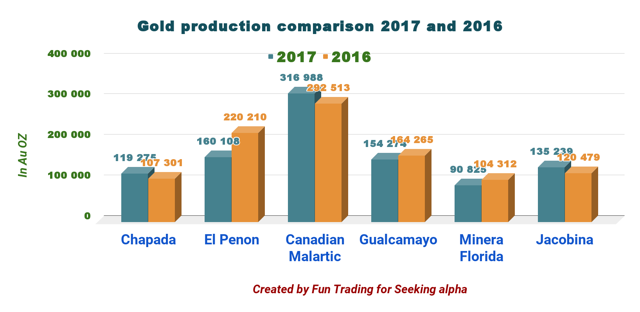

Total Gold Production for 2017 was 976,709 Au Oz down 3.2% from 2016 with 1,009,080 Au Oz.

Total Gold Production for 2017 was 976,709 Au Oz down 3.2% from 2016 with 1,009,080 Au Oz.

Total Silver Production for 2017 was 5,004,718 Ag Oz down 25.4% from 2016 with 6,709,250 Ag Oz.Total Copper Production was 34.0 M lbs.

Preliminary results are beating 2017 Full Year guidance for the three metals.

| Total Gold Production in Oz | 976,709 | 960,000 |

| Total Silver Production in Oz | 5,004,718 | 5,000,000 |

| Total Copper Production in M Lbs | 127.0 | 125.0 |

However, 2017 Production is below the production achieved in 2016.

2 - Cerro Moro construction update.

First, a little presentation on the Cerro Moro.

The Cerro Moro gold-silver project in Argentina, which is the main project for Yamana, remains on track in terms of both cost and schedule. (From company presentation 3Q'17 - October 27, 2017).

Note: The Cerro Moro mine project is to be completed in 2017 and commissioned by the end of Q1 2018. If this process is successful, this would lead to a ramp-up in 2Q'18.

We learn today that the Cerro Moro was on time and on budget. The company said that the Cerro Moro construction activities advanced in the fourth quarter according to plan. The commissioning and ramp up schedule have placed the mine well to achieve previously provided production guidance.

Expenditures for the 12 months ending December 31, 2017, totaled approximately $172 million with the scope of activities and level of spending in line with the plan of $178 million and the project remains on budget.

The Company expects the balance of planned expenditures to be spent in the first half of 2018 with the majority in the first quarter. In line with plan, mill commissioning is scheduled for the first quarter of 2018 with the ramp-up of operations expected in the second quarter 2018.

Notable Milestones:

1 - Underground development in 2017 progressed according to plan and produced a high-grade stockpile of approximately 16,265 tonnes grading 27 grams per tonne ("g/t") gold and 1,725 g/t silver. This high-grade is very impressive. Underground and open pit mine development is now being managed by Operations having already transitioned from Technical Services.

2 - Open pit operations have commenced with mobilization beginning in December and development activities are now underway at the high-grade Escondida Central pit, where the ore zone starts at the surface.

Finally, the Company is expecting to account for production from Cerro Moro as commercial production before mid-year 2018. As a result, nearly all of the 2018 production contribution from Cerro Moro is expected to contribute to cash flow.

For fiscal 2018, Cerro Moro was forecast to produce 80K Oz at an AISC of less than $600 per ounce of gold.

3 - Copper advanced sales program.

Yamana Gold reported that it has entered into a copper advanced sales program pursuant to which the Company will receive $125.0 million on January 12, 2018, in exchange for approximately 40.3 million pounds of copper to be delivered in the second half of 2018 and the first half of 2019.

This production represents approximately one-third of planned production in the period of the program or approximately 16% of the total production for 2018 and 2019.

Copper is expected to be delivered against these prepaid volumes coincident with planned shipments of concentrate from its Chapada mine.

This is an opportunity to limit the negative effect of the Cerro Moro large CapEx until the mine is providing some cash flow later this year.

Commentary

This is obviously an exciting time for Yamana Gold and for its shareholders.

While it has been one of the worst-performing gold stocks in the past five years, as the chart below is indicating, the company presents definitely the best growth prospects in the gold sector, with much of the excitement still ahead, starting with the commercial production of the Cerro Moro mine.

AUY data by YCharts

AUY data by YCharts

Given a relatively clean balance sheet that I have analyzed in my preceding article, which shows a net debt now at $1.505 billion, with a current debt of $110 million and using total cash which is higher than the cash and cash equivalent.

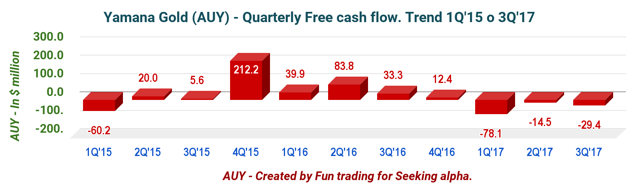

A potential arising future free positive cash flow in 2018-2019

Note: The company intends to lower the net debt-to-EBITDA ratio from 2.8 at the end of 2017 to its short-term goal of 2.0, and then ultimately to 1.5.

And finally accounting for a solid production between now and the end of 2019.

| 2018 | 2019 | |

| Gold | 1.03 M Oz | 1.1 M Oz |

| Silver | 10.0 M Oz | 14.5 M Oz |

Source: AUY

It is natural to believe that Yamana Gold is now bottoming out of its long-term bearish cycle and will slowly rise to a more better valuation, depending on the future gold price, of course.

Technical Analysis

AUY has recently penetrated its long-term resistance (bullish) at $3.20 which is now turning into a support (buy signal).

It is quite challenging to interpret the chart at this present time but the recent rising channel pattern (short-term bullish) may have been penetrated as well today? We need confirmation the next few days. In this case, AUY may eventually re-test the next strong resistance at $4.75 and potentially $5.75 later in 2018.

However, depending on the future gold price which is of a paramount importance for the stock this quick technical interpretation can change.

I recommend a buy and accumulate AUY on any weakness.

Important note: Do not forget to follow me on Yamana gold and other gold miners. Thank you for your support, it is appreciated.

Disclosure: I am/we are long AUY.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I hold a small position now.