Yamana Gold: The Higher Gold Price Is A Dominant Healing Factor

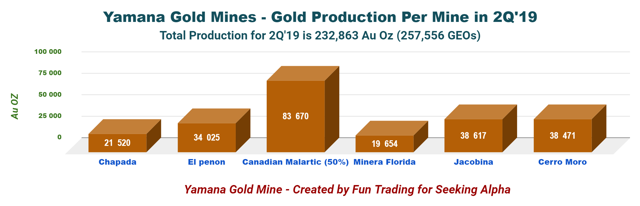

Total production for the first quarter was 257,556 GEOs from Yamana's six producing mines, down 5.3% sequentially.

Revenues were $463.5 million with net income of $14.1 million or $0.01 per share.

I am not super-excited by the miner and its less than stellar results. However, I recognize that the stock could eventually wake up from its long dormancy.

Image: Cerro Moro Mine in Argentina. Courtesy: Mining

Investment Thesis

The Canadian-based Yamana Gold (AUY) is a mid-tier gold, silver producer operating five mines throughout the World.

The investment thesis is changing a little because of the gold price bullish momentum.

I am not super-excited by the miner and its less than stellar results. However, I recognize that the stock could eventually wake up from its long dormancy and could finally start a slow recovery.

However, it is crucial to allocate about 30-35% of your position to trade short-term the gold volatility, which has reached a record due to political instability.

Data by YCharts

Data by YCharts

Note: This article is looking a little bit at the rearview mirror. I have indicated six producing mines while the company owns only five if we take away Chapada. Chapada has been sold recently and was the only producing gold and copper mine of the company.

As a reminder, Yamana Gold announced on October 25, 2018, that it had sold its Gualcamayo mine in Argentina to Mineros S.A.

Also, the company sold on April 15, 2019, the gold-copper Chapada mine in Brazil to the Swedish Lundin (OTCPK:LUNMF). I discussed the matter on Seeking Alpha.

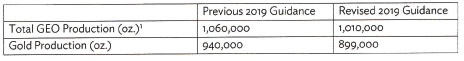

The Chapada mine sale closed on July 5, 2019, and consequently, the company adjusted its full-year guidance. The purchase also includes a 2% net smelter return royalty on the Suruca gold project and the right to receive extra cash consideration of up to $125 million based on the gold prices over five years from July 5, 2019.

After the sale completion of the Chapada mine, the company will cease to produce copper, which represented almost 19% of the revenues. Hence, the second quarter of 2019 is the last quarter in which gold and copper production from the Chapada mine will be indicated.

As a result of the sale of Chapada, the company has adjusted its full-year 2019 guidance:

Daniel Racine, President, and CEO said in the conference call:

The second quarter was a strong one for Yamana. Earnings per share was $0.01 and adjusted earnings per share $0.02. Cash flow from operating activities before change in net working capital adjustment were 156 million. This exclude deferred revenue from our copper advanced sales program of 24.9 million. Free cash available before dividend and debt repayment during the quarter was 51.2 million.

Yamana Gold - Balance Sheet in 2Q'2019. The raw numbers

| Yamana Gold | 1Q'18 | 2Q'18 | 3Q'18 | 4Q18 | 1Q'19 | 2Q'19 |

| Total Revenues in $ Million | 449.7 | 431.5 | 416.8 | 500.5 | 407.1 | 463.5 |

| Net Income in $ Million | 160.1 | 18.0 | -81.3 | -61.4 | -4.1 | 14.1 |

| EBITDA $ Million | -9.3 | 172.9 | 37.0 | 136.3 | 144.4 | 191.3 |

| EPS diluted in $/share | -0.17 | 0.02 | -0.09 | -0.06 | 0.00 | 0.01 |

| Cash from operations in $ Million | 122.4 | 102.4 | 64.3 | 114.7 | 12.4 | 147.6 |

| Capital Expenditure in $ Million | 149.8 | 104.0 | 102.6 | 108.4 | 70.0 | 86.2 |

| Free Cash Flow in $ Million | -27.4 | -1.6 | -38.1 | 6.3 | -57.6 | 61.4 |

| Total Cash $ Million | 137.2 | 114.4 | 120.7 | 105.9 | 115.0 | 97.4 |

| Total Debt in $ Million | 1,638 | 1,697 | 1,778 | 1,757 | 1,793 | 1,764 |

| Dividend per share in $ | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 | 0.01 |

| Shares outstanding (diluted) in Million | 948.7 | 949.0 | 949.1 | 949.3 | 949.9 | 951.1 |

| Gold Production | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 |

| Gold Equivalent ounce ("GEO") Production K Oz | 248,088 | 248,177 | 268,843 | 292,483 | 271,987 | 257,556 |

| Silver Production M oz | 0.90 | 1.31 | 2.55 | 3.26 | 3.02 | 2.17 |

| Copper Production Mlbs | - | 31.1 | 28.6 | 39.0 | 28.1 | 31.2 |

| Gold price realized $/ Oz | 1,328 | 1,304 | 1,213 | 1,226 | 1,301 | 1,307 |

| Silver price $/Oz | 16.93 | 16.53 | 15.14 | 14.59 | 15.52 | 15.03 |

| Copper Price $/lb | 3.13 | 3.09 | 2.93 | 2.90 | 2.91 | 2.88 |

| AISC co-product $/Oz | 840 | 928 | 849 | 801 | 865 | 941 |

Sources: Company filings and Morningstar

Gold production details and commentary

Production of gold equivalent was 257,556 Au Eq. Oz, by applying the coefficient 85.87:1 between gold and silver. The output in GEOs for the second quarter of 2019 is down 5.3% sequentially.

One important production highlight is that the Jacobina Mine recorded its 11th consecutive quarter of more than 30K ounces of gold production.

Canadian Malartic, El Penon mines achieved strong performance during the second quarter as well. However, production in the Minera Florida mine suffered from lower productivity during the second quarter as the company arranged new collective bargaining deals with several unions.

As a reminder, the Leagold (OTCQX:LMCNF) transaction closed in the second quarter of 2018. Upon completion of the arrangement and following the recently announced planned equity issue by Leagold, Yamana owns approximately 20.5% of Leagold.

GEO AISC co-product was $941 per ounce in 2Q'19, which is satisfactory.

Total silver production for 1Q'19 was 2.17 M Ag Oz, down 28.1% sequentially. Total copper production was 31.2M lbs from Chapada mine, the only mine producing copper for Yamana, which is now sold.The company has changed its guidance after the divestiture of Chapada. Please see the graph below.

Source: AUY Presentation

Second-quarter of 2019 financials. Commentary

1 - Revenues of $463.5 million in 2Q'19

Revenues were $463.5 million with net income of $14.1 million or $0.01 per share (please look at the data table above). Revenues were up 6.4% from the prior-year quarter. The company received $1,307 per Au Oz this quarter compared to $1,304 per Oz a year ago.

Jason Leblanc, CFO, said in the conference call:

we had a reduction in net debt during Q2 of $13 million which is a trend we continue to expect in coming quarters. Beyond the one-time reduction of debt from the Chapada disposition proceeds, we are focused on delivering regular free cash flow and further reducing our debt levels.

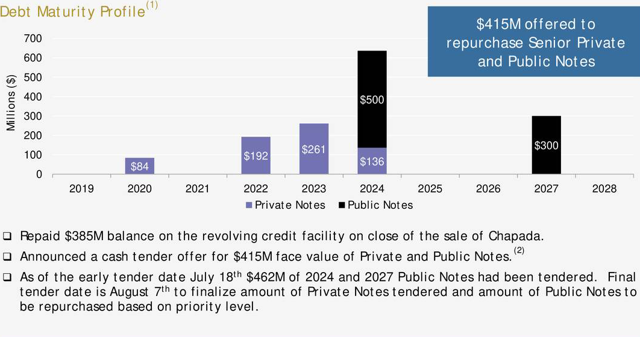

2 - Net debt is $1.75 billion in 2Q'19

As of June 30, 2019, Yamana Gold had $97.4 million in cash on hand and securities with total liquidity at $695.4 million. Net debt is now $1.75 billion. However, the company intends to use the $800 million that it will receive from Lundin to repay the debt.

The goal is to reduce net debt to EBITDA to 1.5x after the sale of Chapada is completed with a target to 1.0x later.

Source: AUY Presentation

The early retirement of debt will provide an annualized interest savings of more than $35 million per year. In the conference call, Daniel Racine said:

Our debt reduction initiative to immediately lower our net debt to EBITDA to 1.5 turns and we continue to target 1 turn by the end of 2021. Even before the Chapada sale closed, we moved quickly to reduce corporate overhead by aligning G&A costs to our remaining portfolio of assets. These reductions simplify our organizational structure while further strengthening our balance sheet and financial flexibility.

On July 5, 2019, Yamana Gold announced a cash tender offer.

3 - Free Cash Flow

The company's free cash flow is negative $28 million yearly. Free cash flow for 2Q'19 was $61.4 million, which is now supporting the dividend of $0.04 per share after the Chapada sale is completed.

With the Cerro Moro starting to produce, it is logical to expect a reduction of CapEx shortly. In 2019, the most significant capital spending will be Canadian Malartic extension project with $34 million price tag (Yamana Gold 50% share) and Jacobina mine.

Conclusion and Technical Analysis

The sale of Chapada has drastically changed the debt profile (the company expects a debt-to-EBITDA ratio to be 1, by 2021). But, on the other side, selling a solid mine like Chapada comes at the cost of lower reserves and lower production.

The company expected free cash flow positive in H2 2019 (in-line with projection), and it delivered free cash flow the second-quarter. While results were not stellar, they were encouraging, especially with the price of gold that may reach over $1,400 per ounce in Q3'19.

The Agua Rica project is potentially the key to free cash flow improvement, but it is still far from an immediate outcome. A pre-feasibility study will be ready in 2020. So far, Agua Rica's measured and indicated copper reserves at 11.5 MM Lbs with annual production in the first ten years of operation to average approximately 533 M Lbs Cu Eq.

Source: AUY presentation Q2.

As mentioned last week, we announced the results of Agua Rica pre-feasibility study and those results were very positive. Proven and probable copper mineral reserves increased by 21% to 11.8 billion pounds while gold mineral reserves increased by 12% to 7.4 million ounces. Initial mine life is anticipated at 28 years. And while production for the first 10 years has increased to 533 million pounds of copper equivalent, cash costs decreased to $1.29 per pound and all-in-sustaining costs were lower to $1.52 per pound for the first 10 years. (conference call).

As I said, the higher price of gold is a dominant healing factor.

Technical Analysis

AUY experienced a decisive break out of its descending channel pattern early in July and has risen to about $3.20-3.25 with a close at $3.16 last week.

I see an intermediate ascending channel pattern now. Line resistance is at $3.30 (I recommend selling about 10-20% depending on the gold price). Long-term line support at around $2.80 (I recommend buying slowly at this level assuming a positive momentum in place for gold).

AUY is now acting as a proxy for gold. If gold continues its momentum, AUY may trade higher, but on any gold weakness, the market will respond to a selloff with a retracement to lower line support around $2.55.

Thus, it is crucial to trade AUY in correlation with the future gold price.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Fun Trading and get email alerts