February 19, 2021

A look at the major TSXV Canadian junior gold miners

Author - Ben McGregor

Another dip below US$1,800/oz

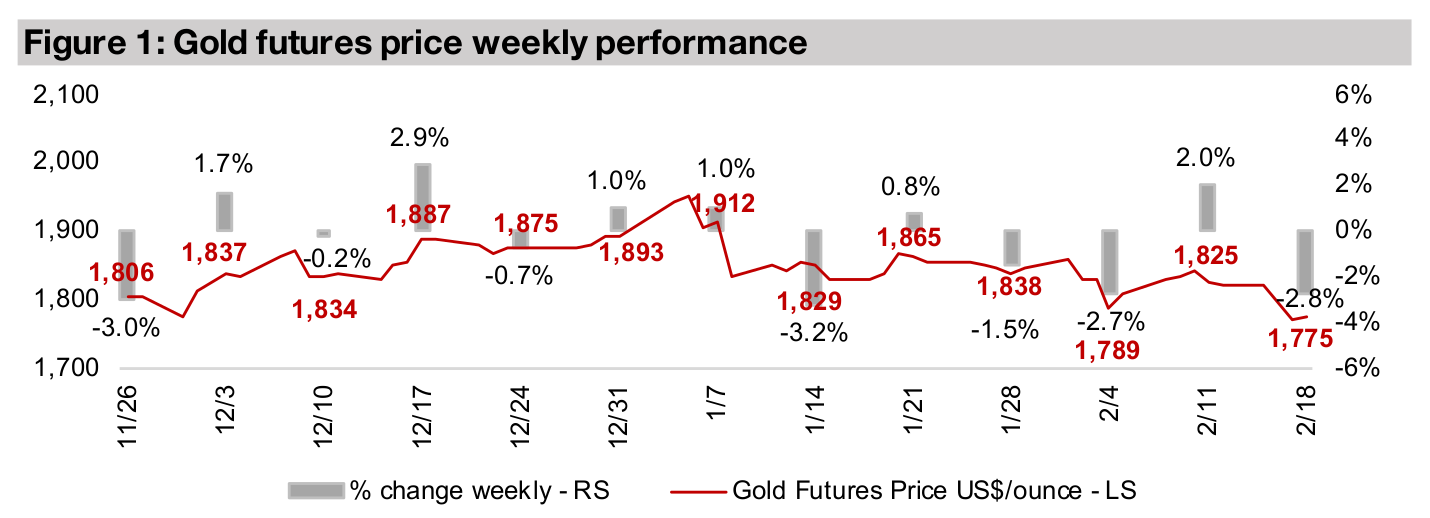

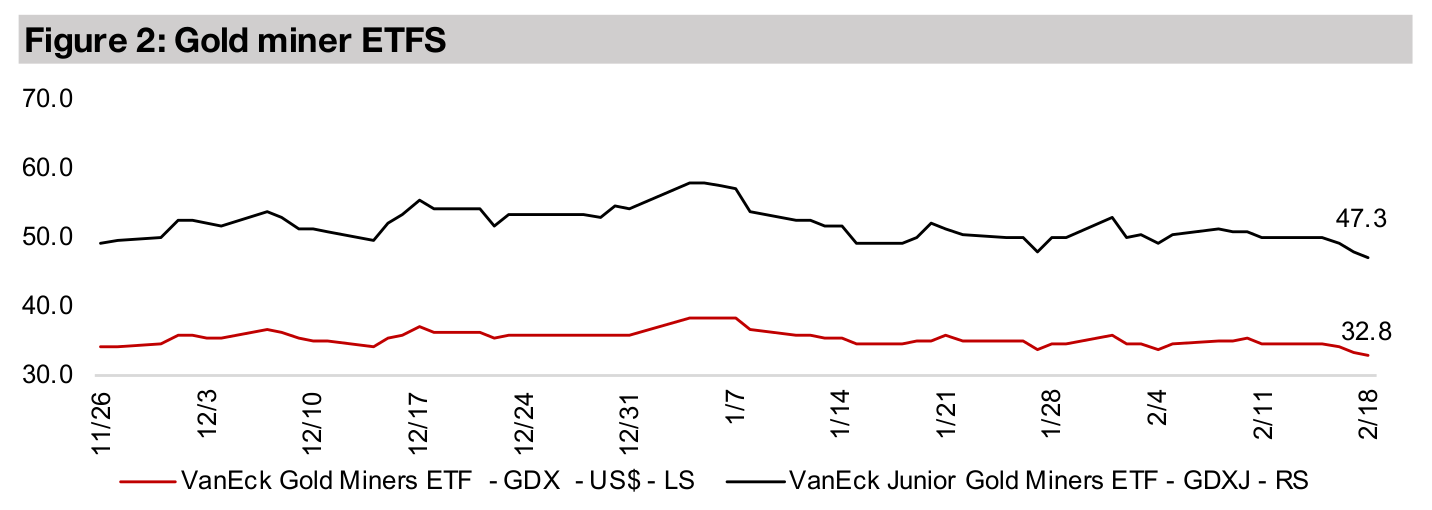

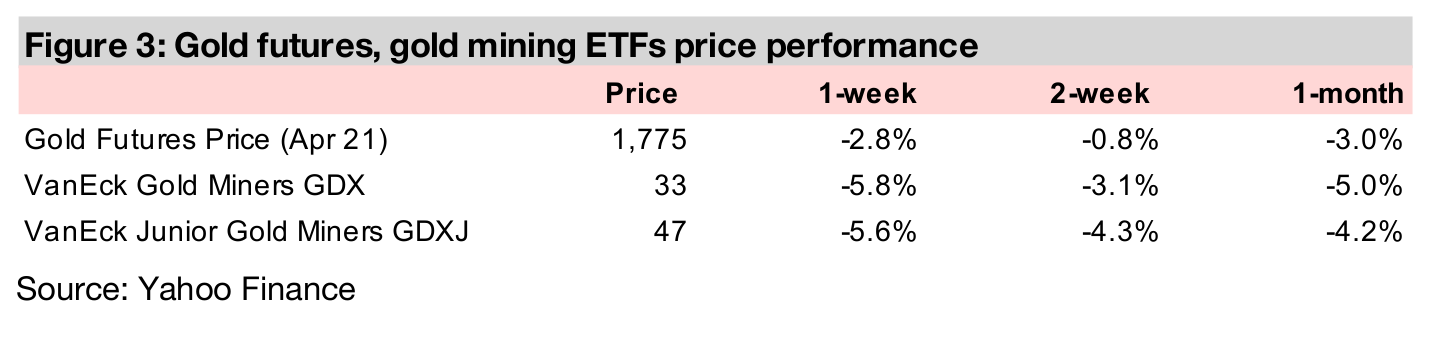

Gold dipped below US$1,800/oz for the second time in two weeks, down -2.8% to US$1,775/oz, on a strengthening dollar; please see last week's report for our thesis on why we believe that gold is very likely to (again) rebound from these levels.

A look at the development stages of major Canadian juniors

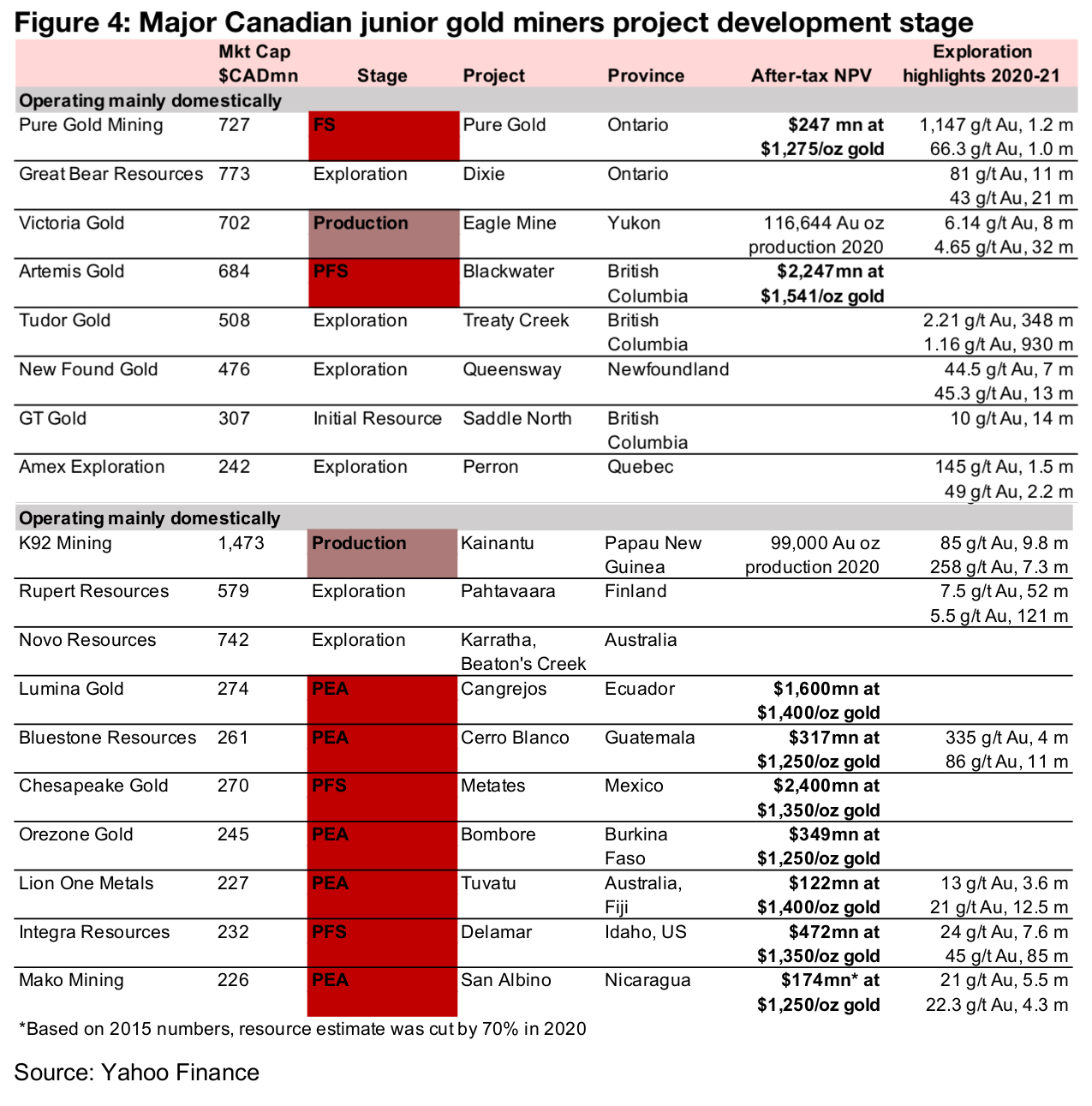

This week we take a look at the larger TSVX-listed juniors that we track to show their stage of development, whether having ascended to junior producer, in the late exploration stage with an PFS or PEA, or at an earlier stage of exploration.

Another gold dip below US$1,800/oz unlikely to last in our view

Gold dipped below US$1,800/oz for the second time in two weeks, down -2.8% to US$1,775/oz, mainly on a strengthening of the US$ and perceived progress on the global health crisis. We have seen this type of price action before, and we believe that the market just simply doesn't believe that gold is reasonably valued much below US$1,800/oz, and that we will see another rebound off the current levels. First, the global health crisis is still far from solved, and even as global vaccinations begin, reports of new strains continue to come through, so we hardly expect the fear premium to be entirely driven out of gold any time soon. But more importantly, the fear premium is only a small component of gold's valuation in our view. We believe that a historical spike in money printing, especially in the US, will simply demand a much higher valuation for gold over the medium to long-term. For more on this, please see last week's report, where we go into detail on the ongoing 'monetary-mania' that we believe will continue to be the critical driver of the gold price.

A look at the major TSXV listed junior gold miners

This week we take a look at all the major TSXV listed junior gold miners that we track,

as shown in Figure 4, in regards to their stage of development. Two of these, Victoria

Gold (operating the Eagle Mine in the Yukon) and K92 Mining (operating the Kainantu

mine in Papua New Guinea) have shifted well into production over the past year, and

thus moved from being junior explorers to junior producers, but still continue to

explore to expand their resources. Seven are at a more advanced stage of exploration,

with Pure Gold (operating the Pure Gold Mine in Red Lake, Ontario) the most

advanced, having already reached the feasibility study (FS) stage, and having its first

gold pour at the end of 2021, and Artemis (with the Blackwater project in British

Columbia) and Integra (with the Delamar project in Idaho, US) having reached the

pre-feasibility study (PFS) stage on key projects. Lumina (Cangregjos in Ecuador),

Bluestone (Cerro Blanco in Guatemala), Orezone (Bombore in Burkina Faso),

Chesapeake (Metates in Mexico), Lion One (Tuvatu in Fiji) and Mako (San Albino in

Nicaragua) all have all completed Preliminary Economic Assessments (PEA) for their

core projects.

The other companies are at an earlier stage, with GT Gold (Saddle North in British

Columbia) the most advanced of this second group, having released an initial mineral

resource. Great Bear (Dixie in Red Lake, Ontario), Tudor (Treaty Creek in British

Columbia), New Found Gold (Queensway in Newfoundland), Amex Exploration

(Perron in Quebec) and Rupert Resources (Pahtavaara in Finland) have all shown

continued exploration progress, releasing a series of drilling results over the past year.

The remaining firm, Novo, is more mixed, having projects ranging from early sampling

stages to much later stages, including its Beaton's Creek project in Western Australia,

where first gold was poured this week, and it also saw considerable acquisition

activity over the year.

Two producing mines, K92 and Victoria Gold

Two of the mines in our group have shifted from junior explorers to producers in recent years, and critically, in 2020, shifted from a TSXV listing to a full TSX listing, for Victoria Gold in February 2020 and K92 Mining in August 2020. However, as these companies are continuing major exploration activities around their producing mines, we still include them here for the time being. K92 Mining began commercial production at its Kainantu mine in February 2018, and reached record production in 2020 of 98,872 oz AuEq, up 20% yoy, sending its market cap to nearly double the level of other large players in the group. Victoria Gold achieved commercial production at its Eagle Mine in July 2020, and produced 77,748 oz over H2/20.

Nine have moved to the PFS or PEA stage

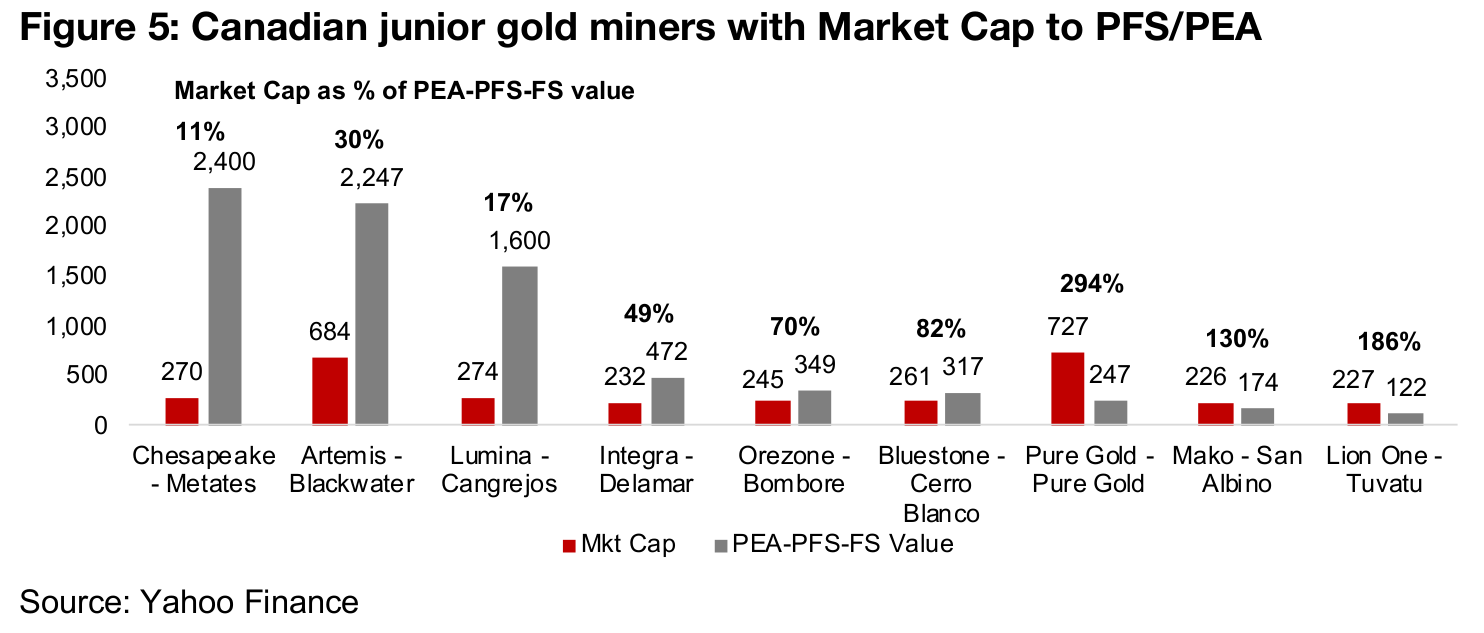

Nine companies have reached the FS, PFS or PEA stage, as shown in Figure 5, which

compares the project value estimates to the current market cap. This percentage

could be considered the market's best estimate of the probability of the project's

proposed value being realized. If the market cap is lower than the estimated project

value, the market sees risks along the development path, if it is higher, the market

expects the company to add value beyond just the one project. For the larger value

projects in Figure 5, the market looks skeptical that the PFS/FS/PEA value will be

realized, compared to some smaller projects trading at a premiums.

One issue to note is that the value of the projects shown are based on different gold

prices, which are outlined in the PEA/PFS/FS, ranging from US$1,250/oz to

US$1,541/oz, as shown in Figure 3. Therefore, the project values shown in Figure 4

are not perfectly comparable across company, although they are close enough to

show the overall differences between the group. The other issue is that these gold

price estimates are nowhere near the US$1,769/oz average gold price of 2020.

Adjusted for this new gold price, the project to market cap value would widen further.

Pure Gold reaches first gold pour

One of the more advanced in this group has moved beyond the FS stage, with Pure Gold Mining, achieving first gold pour at the very end of 2020, meaning that it has entered the early stage of production. While technically the company has now made the leap from junior explorer to junior producer, we still include it, as it has yet to reach full commercial production, and continues exploration activity to expand its potential resource. The company's market cap of $727mn is 294% of its $247mn Feasibility Study value for the Pure Gold Mine, partly because of the low $1,275/oz gold price applied in the FS, but also because the very high-risk phase of the project has clearly passed, and there is the opportunity to both expand the project through exploration, and it could also potentially be acquired for a premium.

Chesapeake, Artemis and Lumina with very large PEA/PFS values

Three companies stand out for particularly large projects, Chesapeake, with its pre- feasibility stage Metates project valued at $2,400mn, the highest of the group, followed by Artemis, with the Blackwater project, which also has a PFS, valued at $2,247mn, and Lumina, with its Cangrejos project at the PEA stage, with a $1,600mn estimate. As mentioned above, the market caps of these companies are nowhere near the value imputed in the PFS/PEA for any of these three, with the market cap/project value at just 11%, 30% and 17%, for Chesapeake, Artemis and Lumina, respectively. The market obviously perceives a great deal of risk for the companies in realizing the potential value in the projects.

Five companies with smaller PEA/PFS values

The other five projects in the group have much a higher market cap/project value ratio. Integra's Delamar project in Idaho US is the most advanced of this group and largest, with a PFS value of $472mn, with its current market cap at 49% of this level. Orezone and Bluestone have market caps that are only at a small discount to the value of their Bombore and Cerro Blanco project PEAs, valued at $349mn and $317mn, respectively. Mako and Lion One have market caps that are at premiums to the value of their San Albino and Lion One project PEAs, at $174mn and $122mn, and Lion One especially so, with the current market cap nearly double the value of PEA. Again, we note that all of these PFS and PEAs are based on relatively low gold prices, and adjusting to more recent averages would see the values of the projects rise considerably, and in turn shift the discount or premiums we outline in Figure 5.

Rupert, Pure Gold, Bluestone, Great Bear drilling results stand out

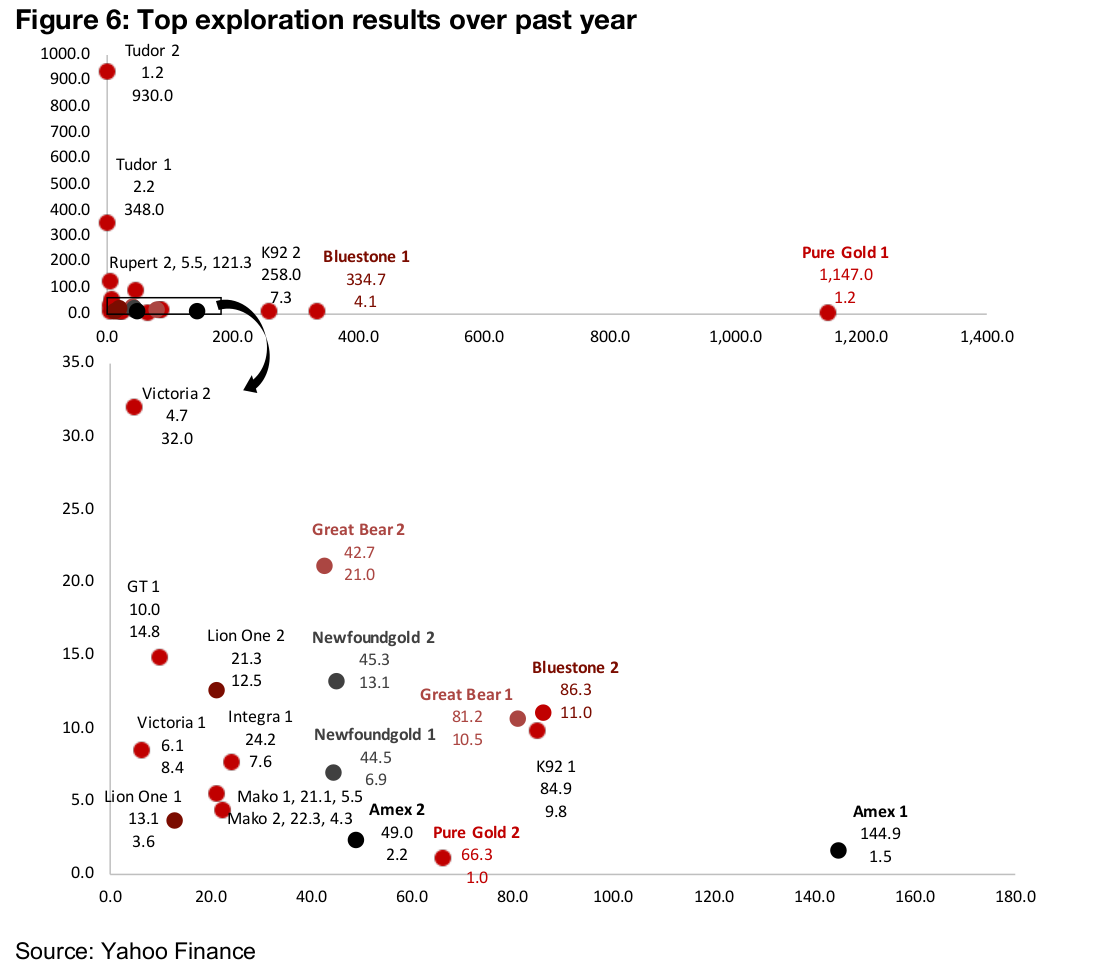

The rest of the companies are in earlier stages of exploration, with most progressing

drilling campaigns over the past year. Figure 6 shows the two most outstanding

drilling results for each company since 2020, with the gold quality in g/t shown on the

X axis, and the width of the find in metres on the Y axis. The first panel zooms out to

1,400 g/t Au, and 1,000 m to show outliers, and the second panel zooms in to a range

where most of the results are concentrated, below 180 g/t Au and 35 m. Pure Gold

had the stand-out drilling result of the group over the past year, with 1,147 g/t Au

over 1.2 m, in October 2020.

Rupert and Great Bear, both at drilling stage of their respective projects, have made

a high number of strong drilling results releases over 2020. Neither has reached the

initial resource stage, and they seem to want to make sure they have maximized the

potential resource before releasing an estimate. Bluestone has also seen strong

results versus the group from the PEA stage Cerro Blanco project and Amex saw one

reasonably strong exploration result. Other companies in the drilling phase of

exploration, Tudor and New Found Gold and Mako saw decent drilling results, but not as outstanding as for the other firms.

Two companies have seen limited, or no, drilling results over the past year, GT Gold

and Novo Resources. While GT Gold released an initial mineral resource for its Saddle

North project in July 2020, a major milestone, there has recently been some internal

management strife, with some shareholders looking to oust some members of

management, and a meeting regarding the issue to be held in April 2021. Novo has

two main projects, Egina and Beaton's Creek projects, with Egina that at the earlier

sampling stage of exploration, but its Beaton's Creek project at a very advanced

stage with its first gold pour just this week, and it saw extensive acquisition activity

in 2020, so there was substantial progress over the past year, although not

specifically through major drilling programs.

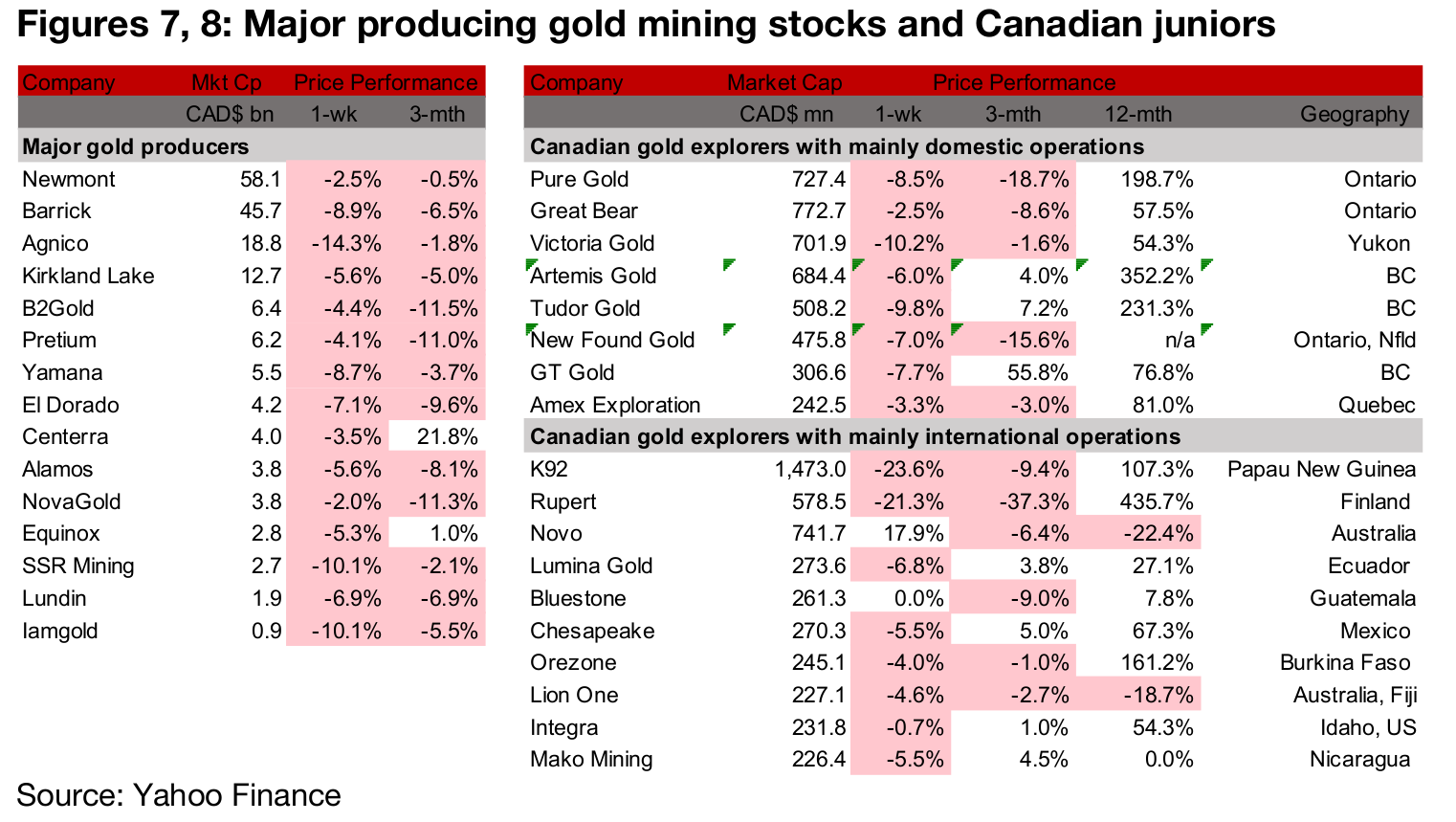

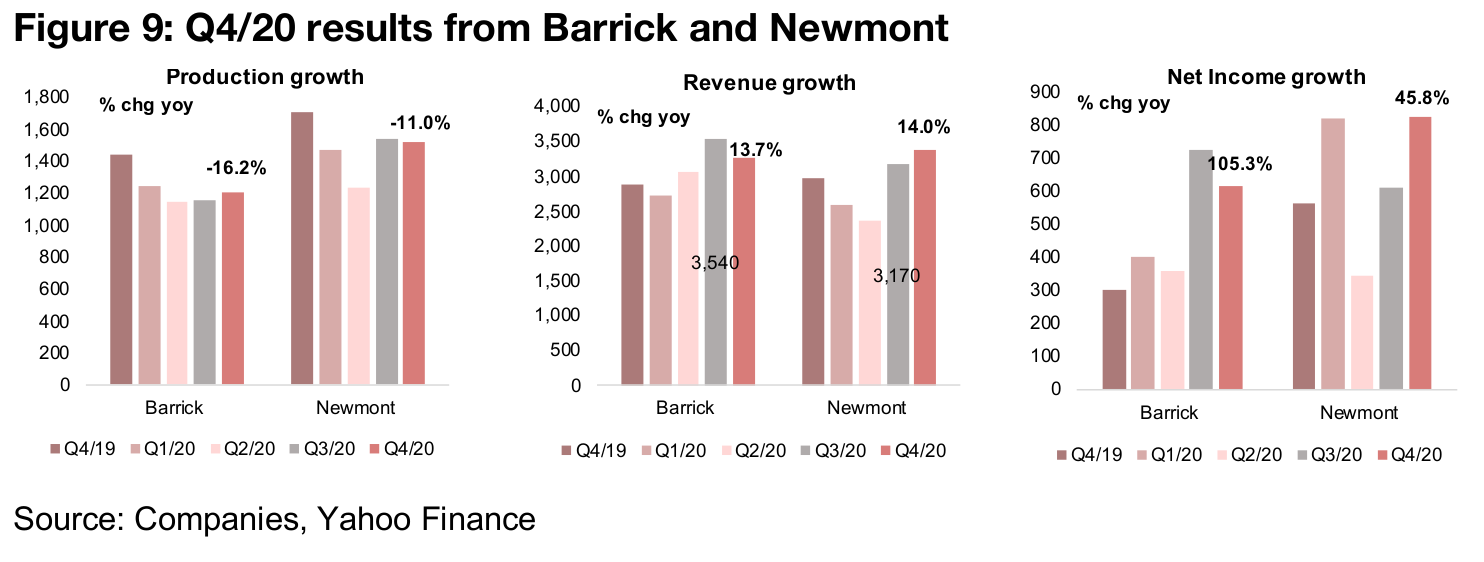

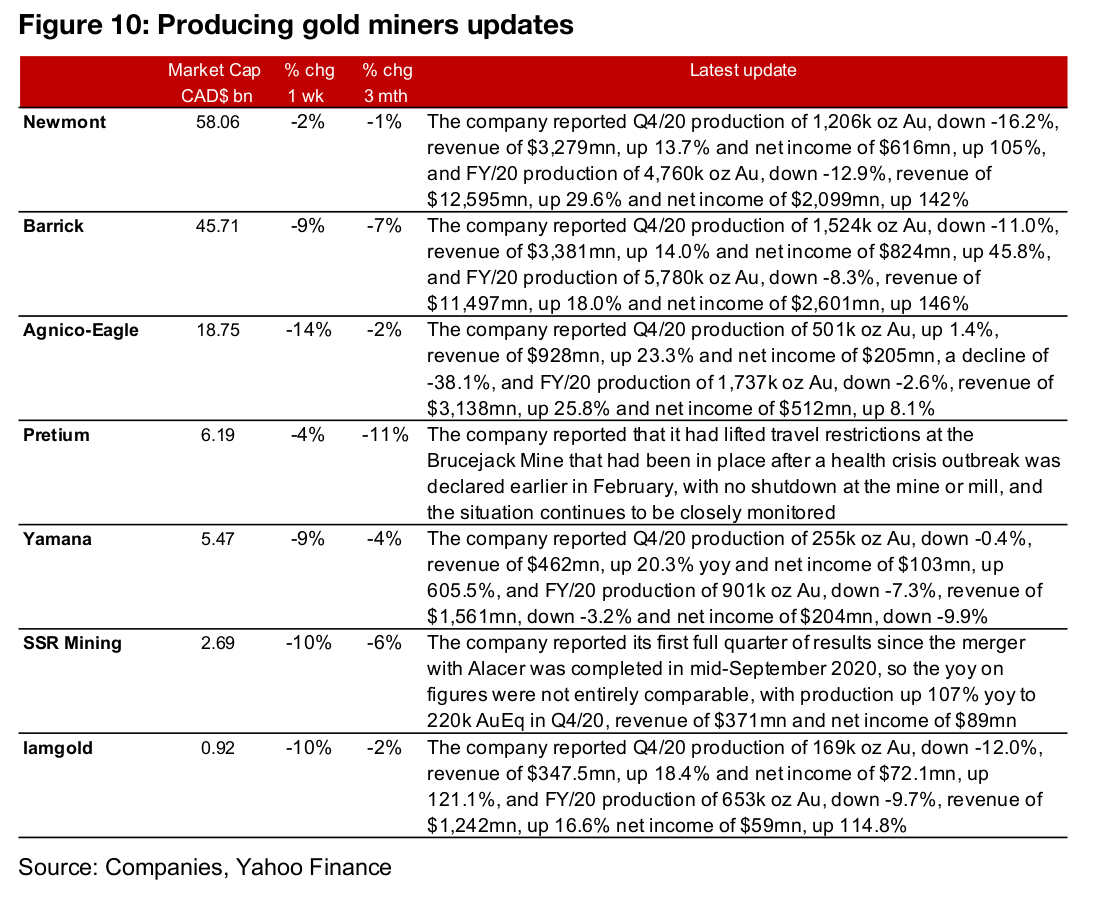

Producers down even as strong Q4/20 results start to come through

The producing miners were all down on the decline in gold, even as an overall strong wave of Q4/20 results started to come through (Figure 7). Industry leaders Barrick and Newmont both reported, and while production declined yoy for Q4/20, revenue was up 13.7% and 14.0% for the two, respectively, and net income jumped 105.3% and 45.8% (Figure 9). Agnico-Eagle, Yamana, SSR Mining and Iamgold also reported, with net income generally seeing strong yoy growth across the companies (Figure 10). Pretium also reported that it had lifted travel restrictions in place since February 10, 2020, after there were some cases of the global health crisis at Brucejack, but production continued even as the issue was solved, and they continue to monitor the situation.

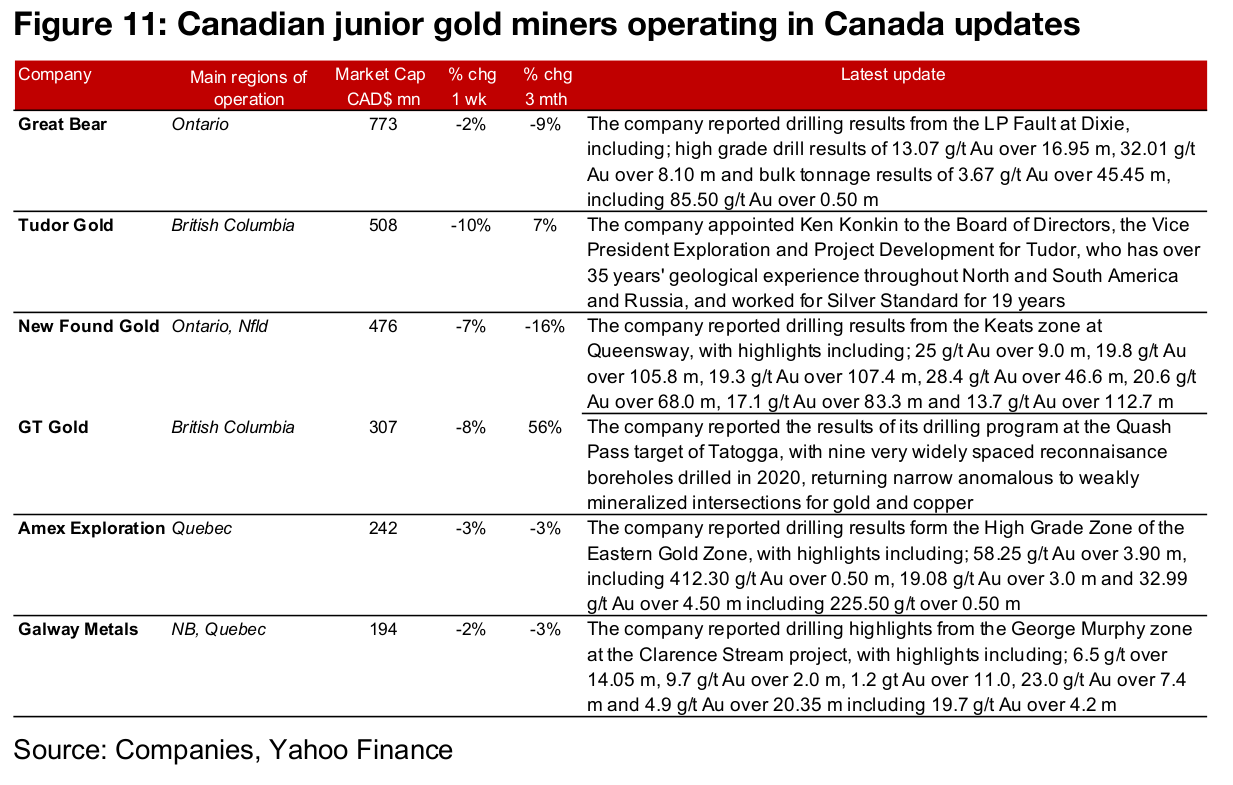

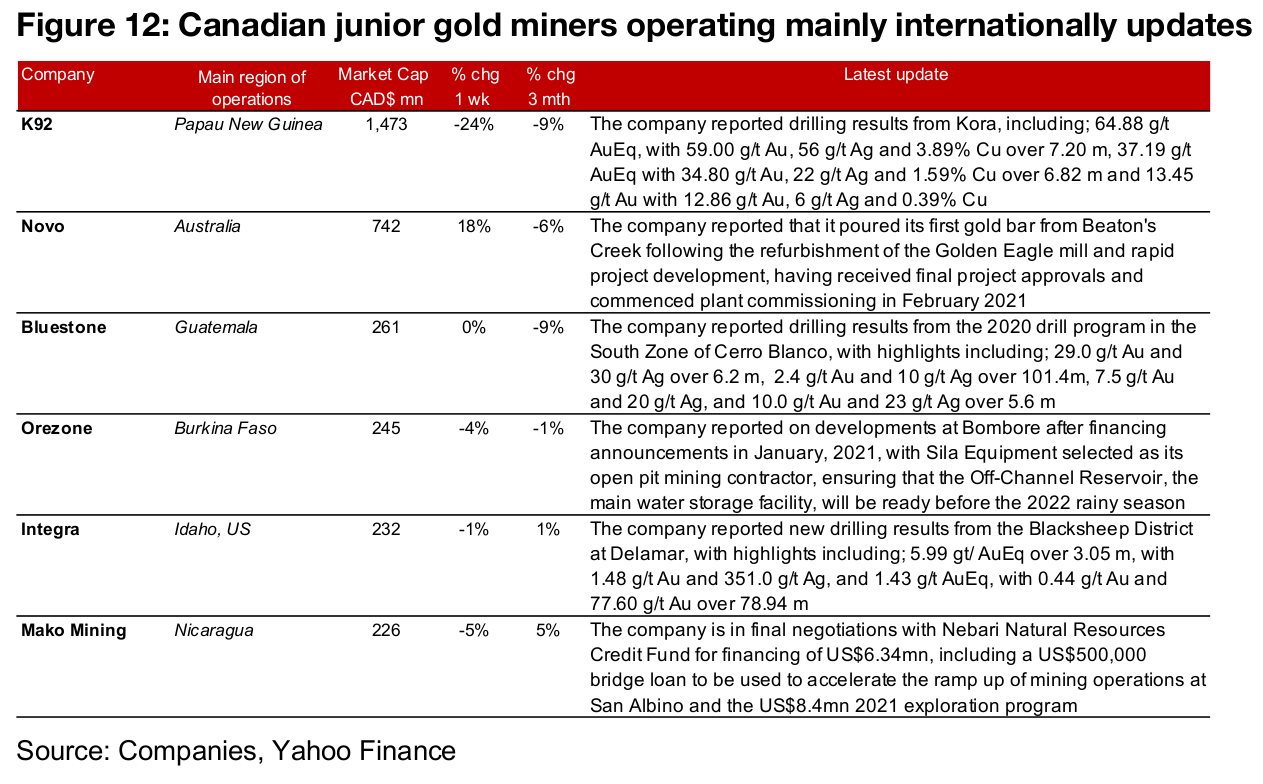

Canadian juniors mainly down

The Canadian junior miners were mainly down on the dip in the gold price (Figure 8). For the Canadian juniors operating mainly domestically, Great Bear, New Found Gold, Amex and Galway all reported drilling results, Tudor appointed a new board member and GT Gold reported an update on its drilling program at the Quash Pass target at Tatogga (Figure 10). For the Canadian juniors operating largely internationally, K92, Integra and Bluestone reporting drilling results, Novo reported its first gold pour at Beatons Creek, Orezone gave an update on new service providers at Bombore and Mako reported that it is in final negotiations for financing to start up mining operations at San Albino (Figure 11).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.