December 10, 2021

Who's Cashed Up?

Author - Ben McGregor

Gold rebounds as markets shake off new health crisis fears

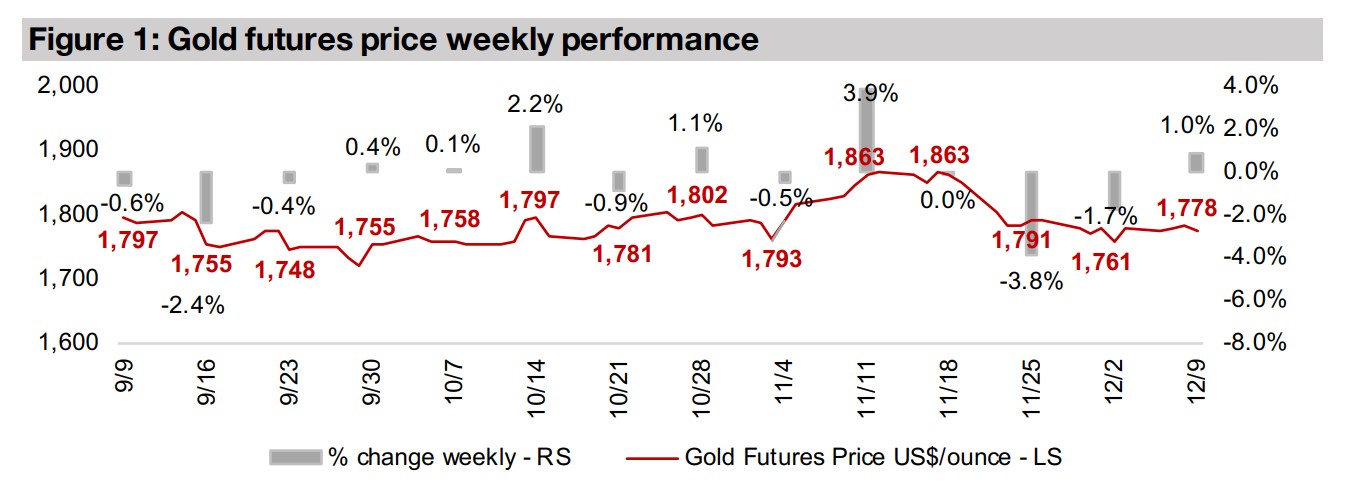

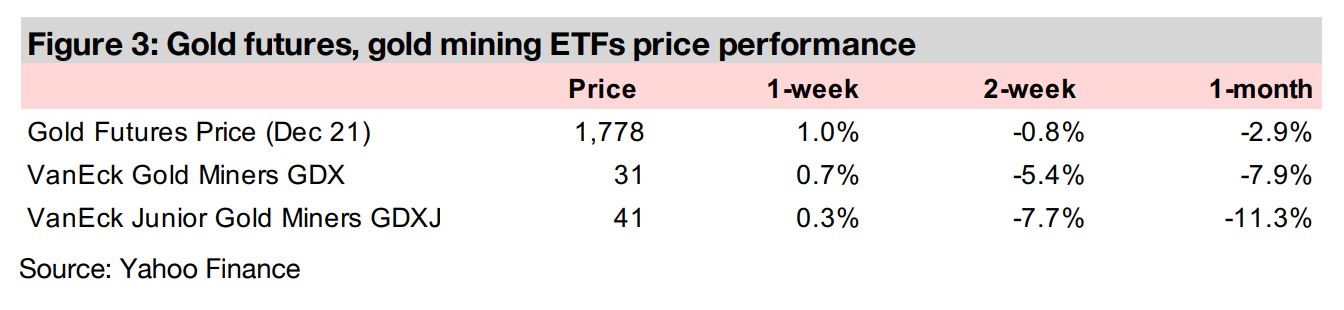

Gold rose 1.0% this week to US$1,778/oz and equity markets also rebounded as fears investors had regarding a new wave of the global crisis that drove last week’s selling subsided, with the dip pricing in a more dire situation than is occurring.

Looking at the cash position of TSVX gold juniors

As the dip may have increased concerns of a more substantial decline in markets to come, which could hit junior miners, this week we look at the cash position of the TSXV gold companies to see which can withstand an extended downturn.

Who's Cashed Up?

Gold rebounded this week 1.0% to US$1,778/oz, and equity markets also recovered

after the dip last week as the immediate fears from the new wave of a global health

crisis eased. However, as this is the second substantial dip in the markets over the

past few months, these periods of volatility may be starting to make investors a bit

more wary than they have been in the market ramp up over the past year. We believe

that investors across most sectors could benefit by an increasingly cautious stance,

especially given the extreme valuations of the equity market in the US.

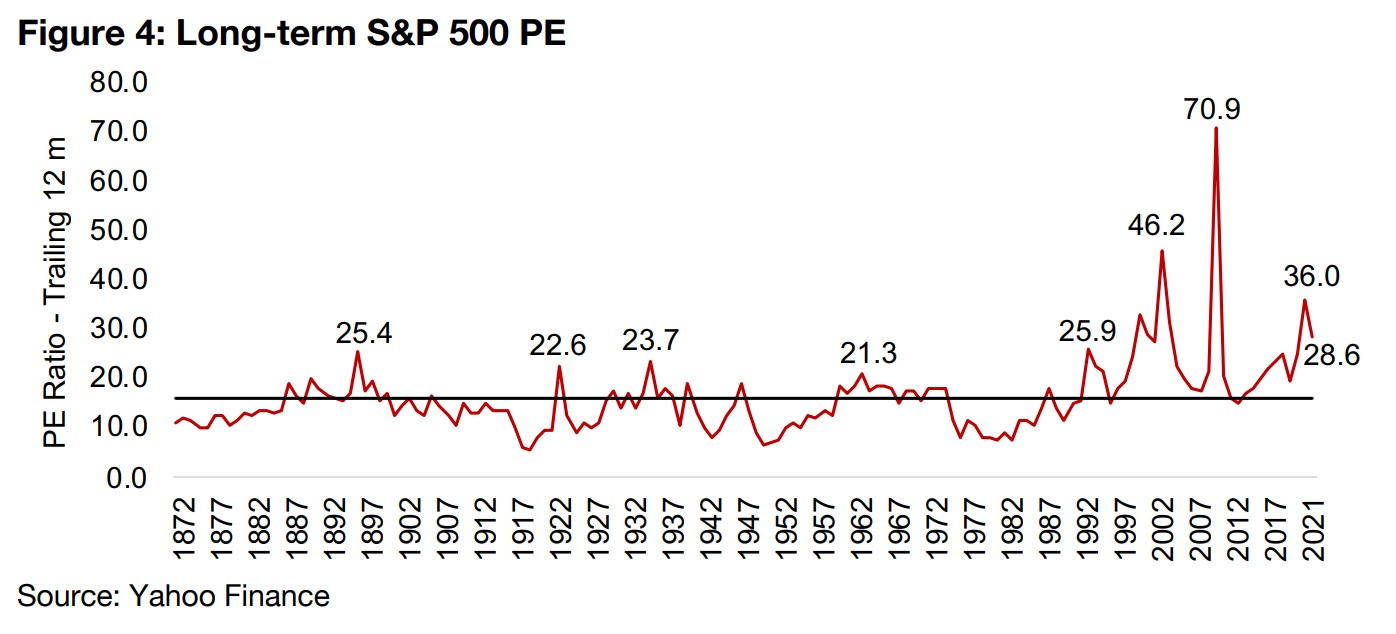

The P/E ratio of the S&P 500 at 28.6x is very high levels in a long-term historical

context, with only the dot-com mania of the late 1990s-early-2000s and the financial

crisis of 2008-2009 seeing a higher multiple (Figure 4). While calling a market peak is

always difficult, we can safely say that we are much closer to the top of the cycle than

we are to the bottom. Considering that; 1) the big gains in economic data off the low

base set in 2020 are probably nearing an end, 2) the Fed is starting to slow its stimulus,

which we believe has been fundamental in driving the rebound in the economy and

equity markets, the current valuations look quite risky in our view.

We see four stages for gold stocks in recent years. First was the late-2019 to mid-2020 boom with the rise in gold driving up most gold stocks. The second phase saw

many gold stocks under pressure from H2/20 to early 2021 as the gold price declined.

The third was a period of stagnation for most gold stocks with gold price flat, but

equity markets overall rising. We believe we are entering a fourth period now, with

gold continuing to hold up, but equity markets likely to become more volatile. Given

this, we believe that it is particularly important now to consider the risk levels of

individual junior miners, and expect that those with strong cash positions allowing

them to weather a downturn could see increasing interest from investors.

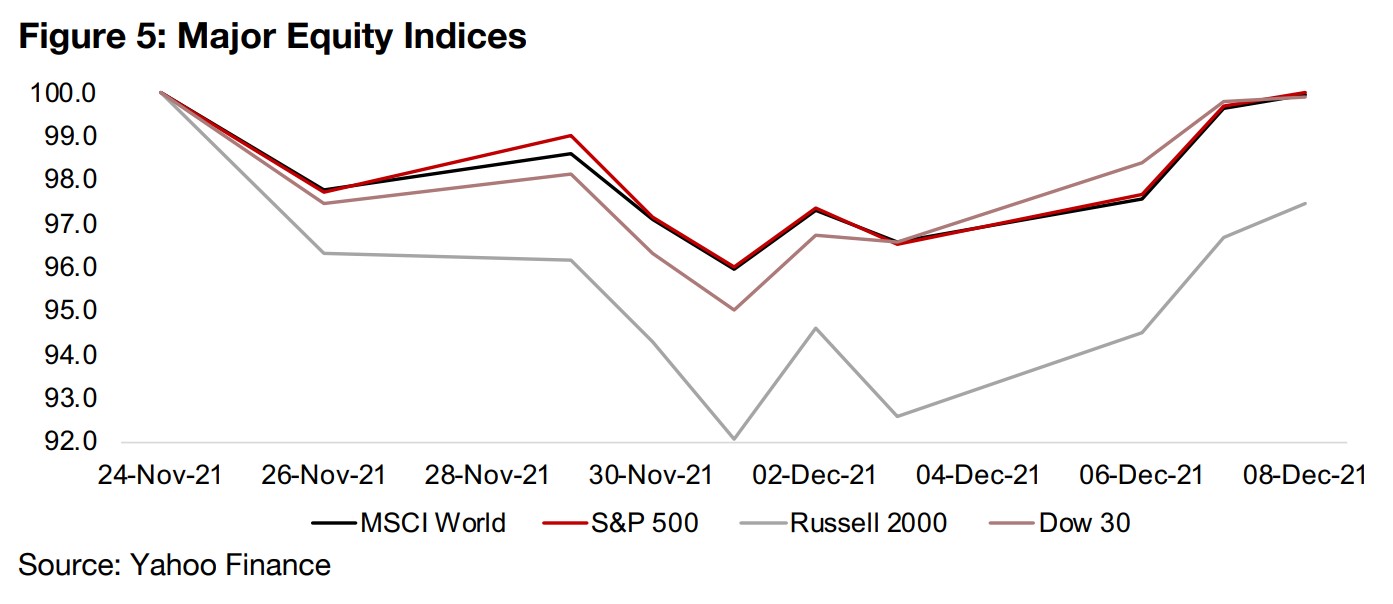

Investors tend to sell off the riskier parts of their portfolio in downturns, as we saw

last week, with the Russell 2000 index of smaller companies selling off more severely

than the larger cap S&P 500, Dow Jones and MSCI World Indices, which have mostly

already recovered their losses, while the Russell has not regained its highs (Figure 5).

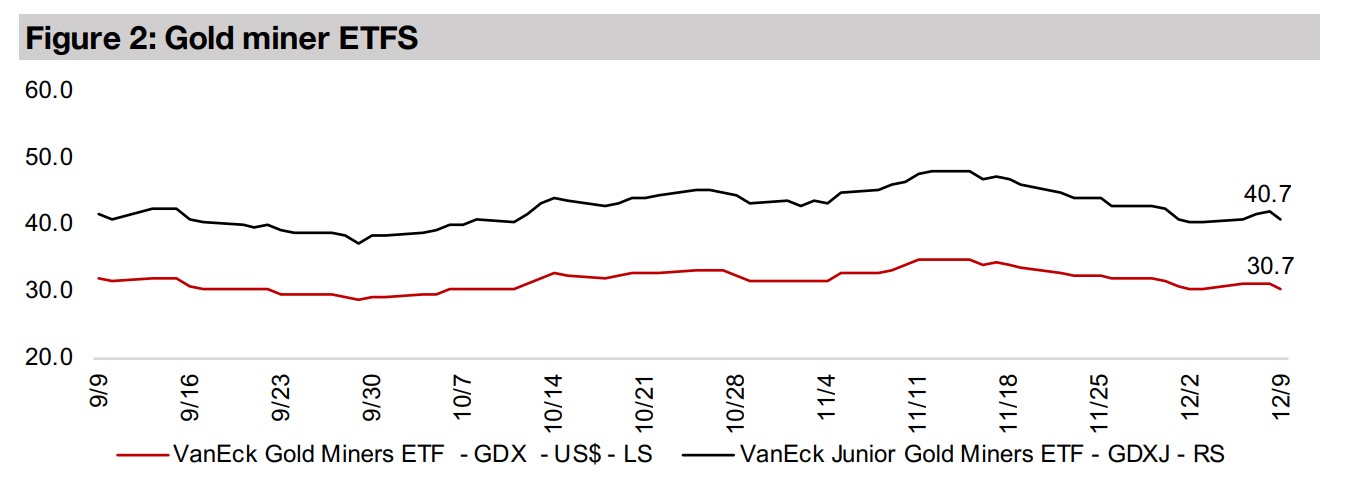

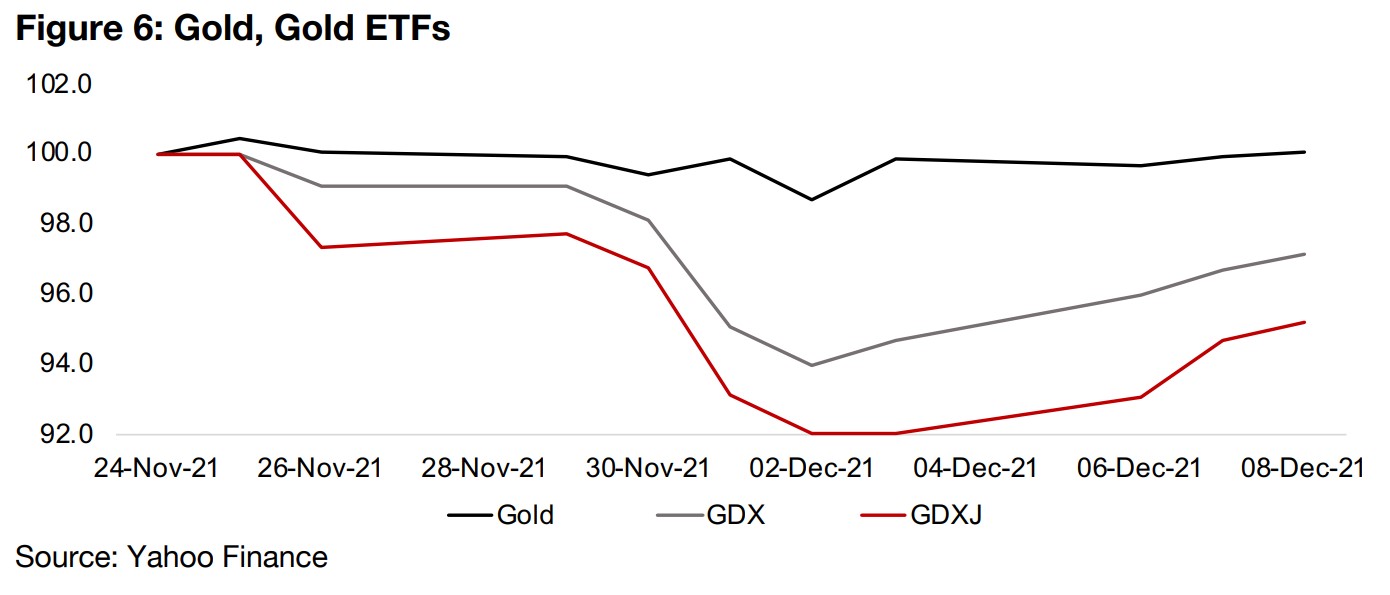

We also see that the junior gold miners, using the GDXJ ETF as a proxy, took much

more of a hit than the producers, with the GDX as a proxy, while both have failed to

regain their pre-dip levels, even as gold itself held up quite well (Figure 6).

The junior miners see much more pressure in downturns than the producers because they generally have no revenue and even if they have mineral resources, the economic value may be still highly uncertain. They also need to constantly be raising capital all the way through the process of exploration through to mine development, which can take many years. In downturns, even for a strong junior gold miner with a promising deposit, investors can become concerned that its will not be able to raise enough cash if it becomes more difficult to source capital in a downturn.

An example of this is the long bear market for gold and other metals from 2013-2018 where it became very difficult for junior miners to raise capital, and only the most promising projects would see funding, and marginal products were abandoned. With the sustained rebound in the gold price from mid-2019, juniors have been seen access to abundant capital over the past two years. However, if we see an economic slowdown or a substantial equity market decline, risk premiums will rise, and it may be difficult for juniors to raise capital.

Another 2013-2018 gold bear market unlikely with inflation taking off

While the gold stocks may be at risk currently, we are not bearish on the gold price

itself, and do no see a repeat of the 2013-2018 bear market as likely. That was a very

rare period when central banks pumped up the money supply, but inflation remained

extremely low. In contrast, currently we are already seeing multi-decade highs in

inflation, and we expect that inflation will remain elevated through 2022. While the

current supply chain issues are a factor contributing to inflation, we believe that the

main driver is the huge increase in money supply over the past year and a half. We

believe that inflation, as well as rising economic risks, will continue to support gold at

least at current levels, and the metal could even continue to rise.

While a strong gold price would certainly be a driver for both the gold producers and

the gold juniors, this could be offset by an equity market decline, where the valuations

for all companies come down, regardless of sector. This could also drive a general

risk-off sentiment in markets, making many investors less willing to support riskier

companies, and even if gold holds up, they may be less willing to fund the gold juniors

that they have been strongly supplying capital to since mid-2019.

Having said all this, we believe that with any such market decline, that the Fed will go

right back to monetary expansion as a solution, and this could halt the market

downturn, and make capital once again widely available. However, we do need to

consider a potential dip before the Fed steps in, and which companies are best

positioned to weather such a period. The number one issue for juniors in such a

situation is cash, and how long their cash balances will allow them to keep operating

should a difficult period to raise capital last for an extended time.

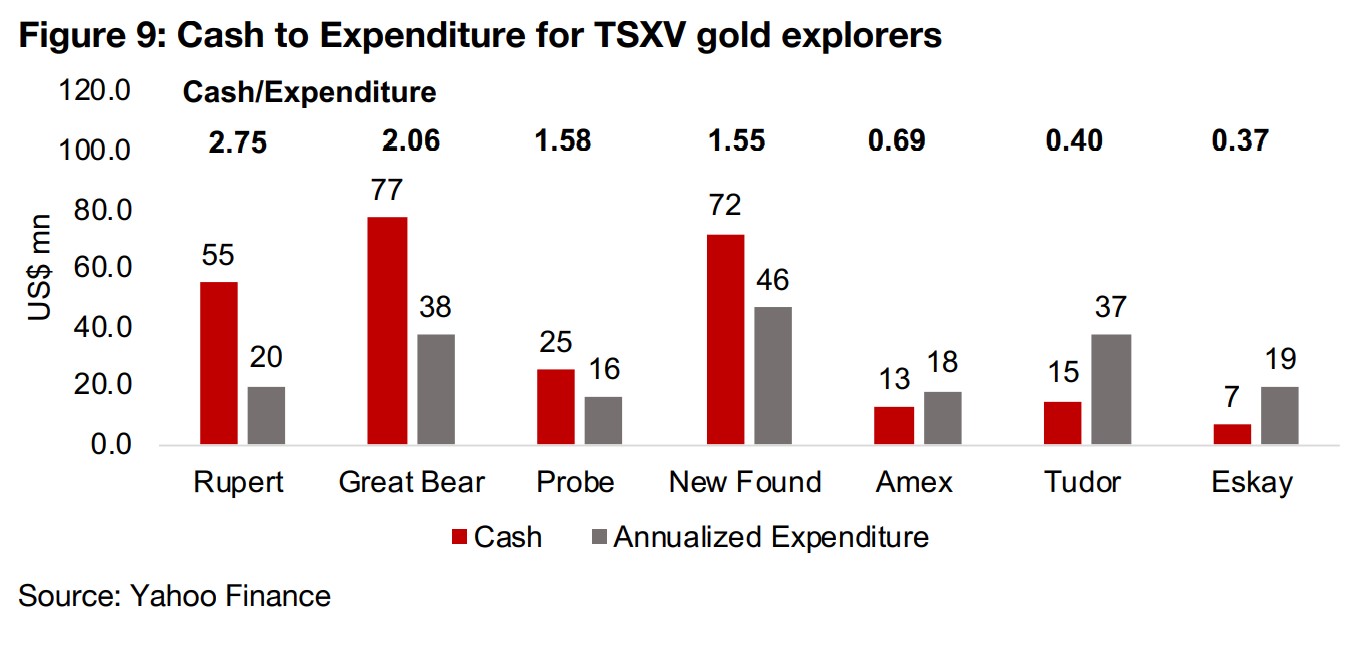

Which TSXV gold juniors have most cash relative to operational requirements

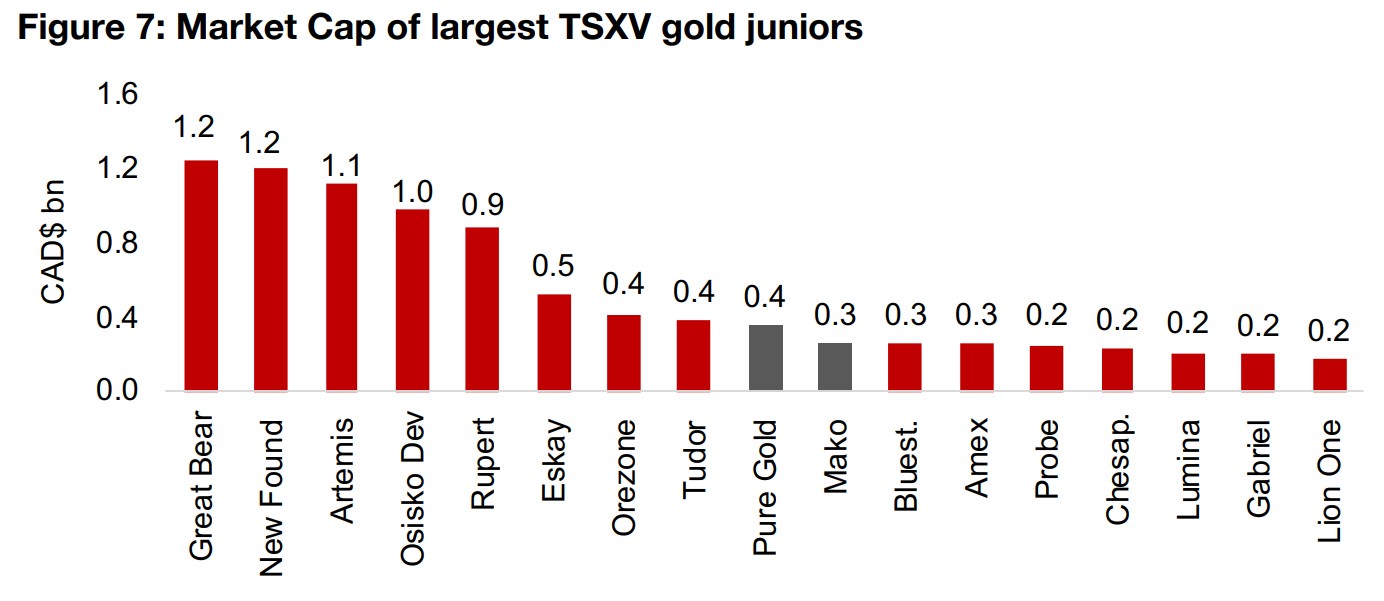

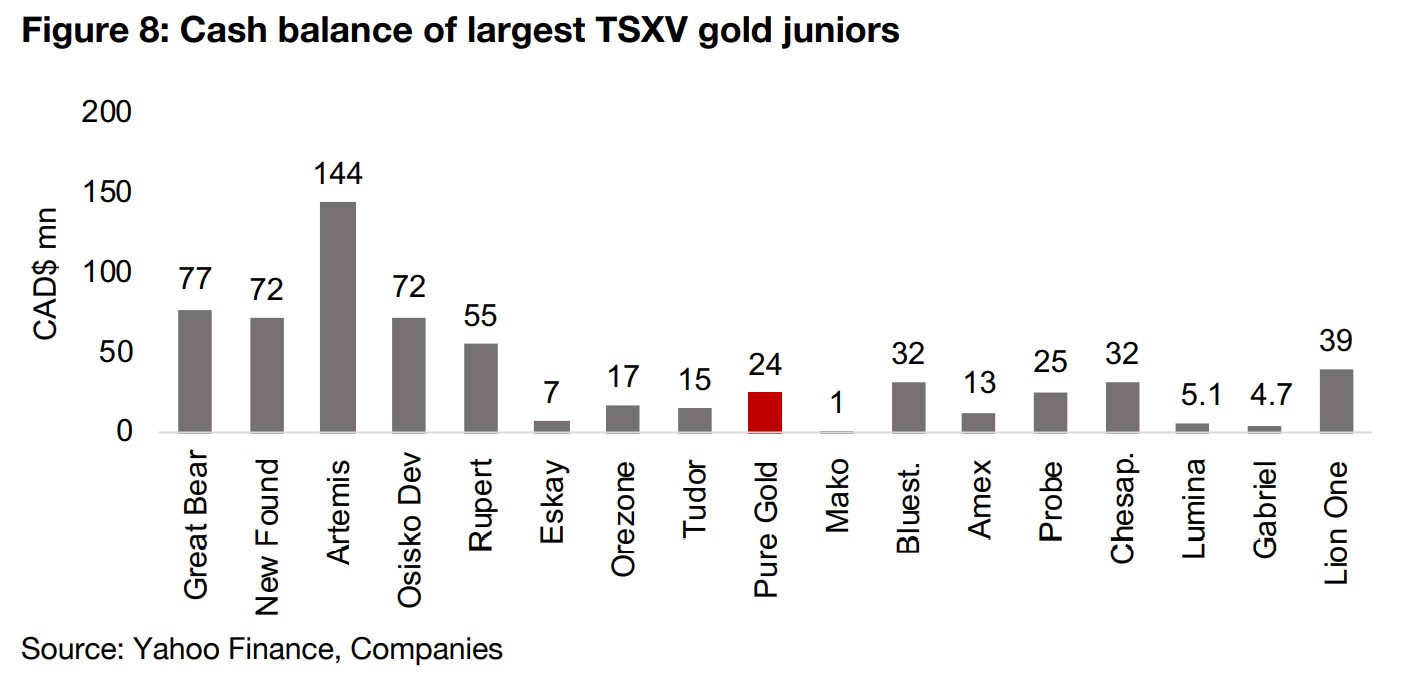

To see which juniors are best prepared for a volatile period in equity markets, we look at the cash balance of the large TSXV-listed gold juniors, compared to their ongoing exploration and development costs, to see who is best positioned for long-term operations with limited capital raising. We may see these companies that stand-out for being well cashed up afforded a premium by the market in the event of a downturn. We first look at the market cap of the companies (Figure 7) and their absolute cash levels (Figure 8).

Cash generation has begun for two producers, Pure Gold and Mako

While generally a higher market cap correlates with a higher cash balance, there are many smaller companies with higher cash balances. We highlight two of the companies, Pure Gold and Mako Mining, which are unique in the group in that they have moved into production in 2021. As they are now generating revenue internally, maintaining their existing cash balance is not the major issue that it would be for the junior explorers and developers. Pure Gold has a reasonable cash balance of $24mn anyway, and while Mako Mining had just a US$1mn in cash, it generated about US$5mn in operating cash flow over Q3/21, and as production continues it should build up a substantial cash balance over the next several quarters.

Larger-cap explorers cashed-up, mid-cap players will need more capital

For the explorers, cash is particularly key because at best they may have an initial

resource estimate, and some have not even reached that stage, leaving the outlook

for these companies quite opaque, as the costs for extracting the potential resource

has not been officially estimated. This can make it difficult for these companies to

raise capital, especially in down markets, and thus we look at them first, as they could

be viewed as the riskiest group. To get a proxy for what these explorers are spending,

we have annualized the 9M/21 expenditure, including both direct exploration

expenditure and general and administrative expenses. While this is not a perfect

measure, as for some companies in more northern areas expenditure can decline

substantially in the fourth quarter, and other companies could pull back on spending

if cash is low, we can view it as a conservative estimate of expenditure.

Taking the companies' cash levels and dividing by this expenditure estimate, we have

the number of years that the companies could continue operating at 9M/21 levels,

which for all these companies has been a period of quite aggressive drilling programs.

Four of the explorers are very well cashed up, with Rupert Resources having nearly

three years of expenses, Great Bear over two years, and Probe and New Found Gold,

about a year and a half worth of operating expenses (Figure 9). For Great Bear,

sufficient cash will no longer be an issue, as it has just been acquired by the major

gold producer Kinross. The other three explorers could need to raise capital much

sooner, with Amex with just over a half a year of cash, and both Tudor and Eskay

under a year. If the capital markets conditions were to deteriorate over H1/22, we

could see the markets potentially become more cautious on these names, assuming

we don't see them raise new capital soon.

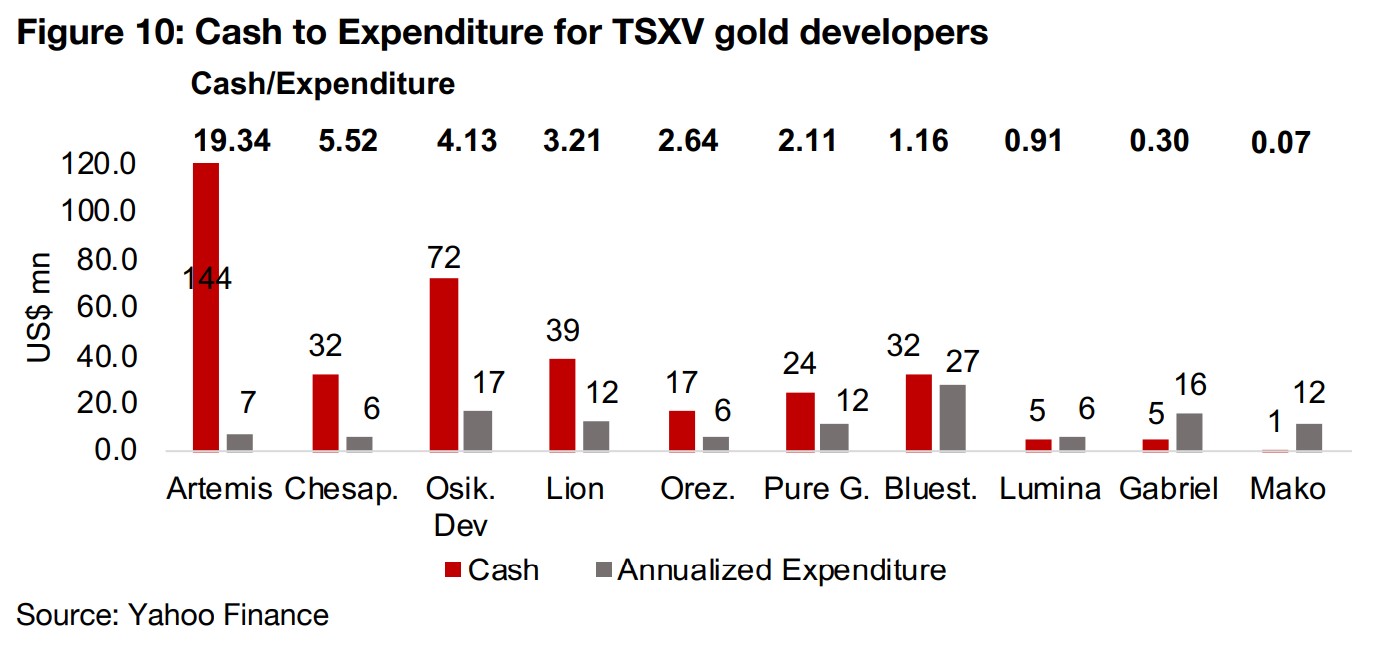

Developers at a range of stages with differing immediate cash requirements

For the developers, the cash to expenditure measure is somewhat less meaningful,

as many have raised substantial cash to move into early stages of mine construction

and have often pulled back on large scale exploration. We see this with Artemis, with

by far the largest cash balance of the group, which is to fund the early stages of mine

construction for its Blackwater production (Figure 10). Chesapeake has a high 5.52

years of cash, but exploration costs at its Metates project are low, as the company

this year has mainly been focused on new technological methods to reduce the costs

of its project. Osisko Development and Orezone are also gearing up for mine

construction at their respective flagship projects, and therefore have high cash

balances relative to expenditure. Lion One, with its Tuvatu project at PEA stage, has

focused on exploration in 2021, and is well funded to continue this for many years. It

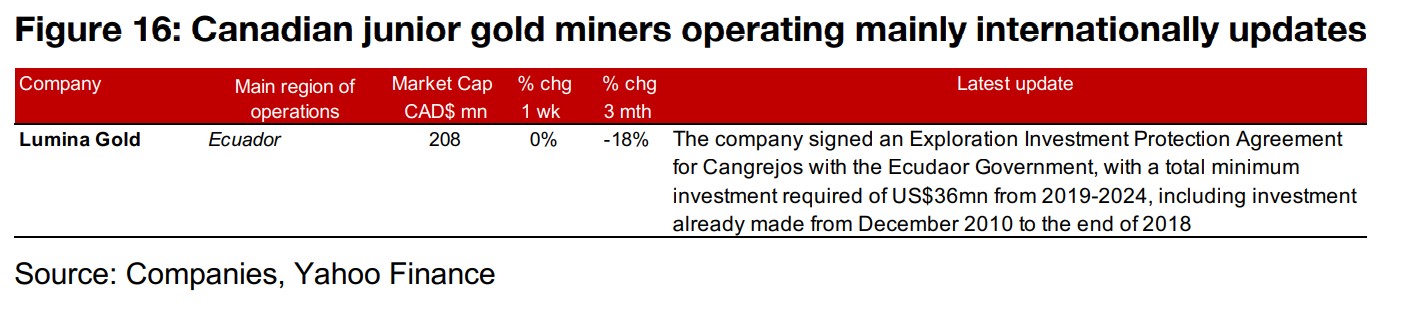

has also agreed recently with the Ecuador government to invest $36mn for the project

from 2019-2024, and with $18mn already invested since 2019, the remaining required

investment out to 2024 would be more than covered by its current cash.

Pure Gold, which is already producing, but also continues exploration, can fund its

current level of exploration two years, and will also have internally generated cash.

Bluestone and Lumina, which both have flagship projects at the PEA stage, but are

continuing exploration this year, have around a year of cash. Gabriel is a special case,

with the company in arbitration with the UN and Romania, as the site of its Rosia

Montana project has been deemed a World Heritage Site, preventing development.

The company has had expenses this year only related to the arbitration case, which

could decline substantially this year and would increase its cash runway, which looks

low based on 2021 expenditure. We have already highlighted Mako above, which has

entered production and will be generating substantial cash over the next few quarters.

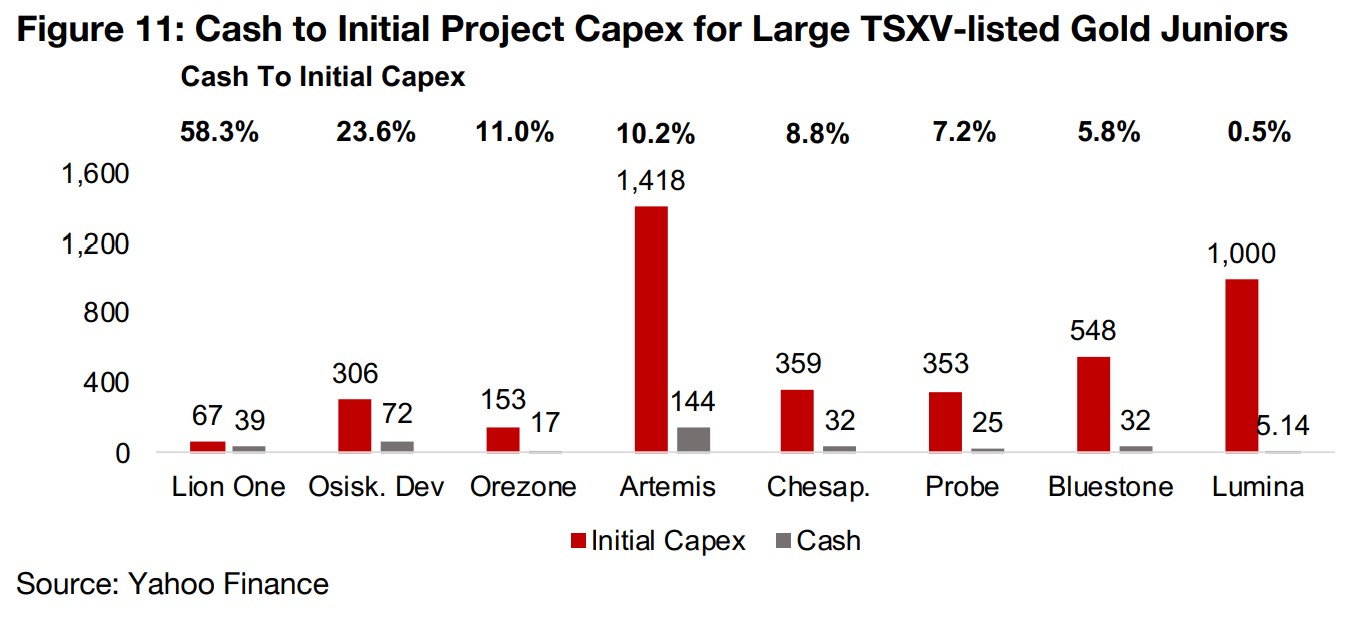

For the developers, the use of cash is split between ongoing exploration and the cost

of the early stages of mine construction. This means that we can also look at the cash

balance of these companies compared to the initial capex for mine construction

outlined in their PEA or FS. While mine construction is usually also partially financed

by debt, having cash to move the project forward is also key. Lion One has the highest

proportion of its initial project capex in cash by far, at 58.3%, and Osisko

Development is also relatively high, at 23.6% (Figure 11). The other companies are at

around 10% or less, with both Orezone and Artemis already having secured major

debt packages for their respective projects, and Chesapeake 'on hold' with Metates,

as discussed above. Probe has only recently released a new PEA, and therefore will

not be moving to mine construction for some time, while Bluestone has continued

exploration this year and will need to use cash for its planned Feasibility Study for a

new open pit development scenario. Lumina has just 0.5% in cash compared to its

large $1.0bn initial capex for the PEA-stage Cangrejos project.

Overall, we could characterize the TSVX-listed gold juniors as being relatively well

cashed up and have taken advantage of the market's strong interest in funding junior

gold miners since late 2019. Most of the explorers are able to continue drilling

operations for over a year, and some well over two years. Most of the later-stage

developers have sufficient cash up to continue advancing their projects to mine

construction, and most of the earlier stage developers can fund further exploration of

their projects and move through the permitting process. However, there are some of

these companies which could certainly do with a cash injection over the next few

months to give the market more confidence in their ability to continue to move

forward with their projects.

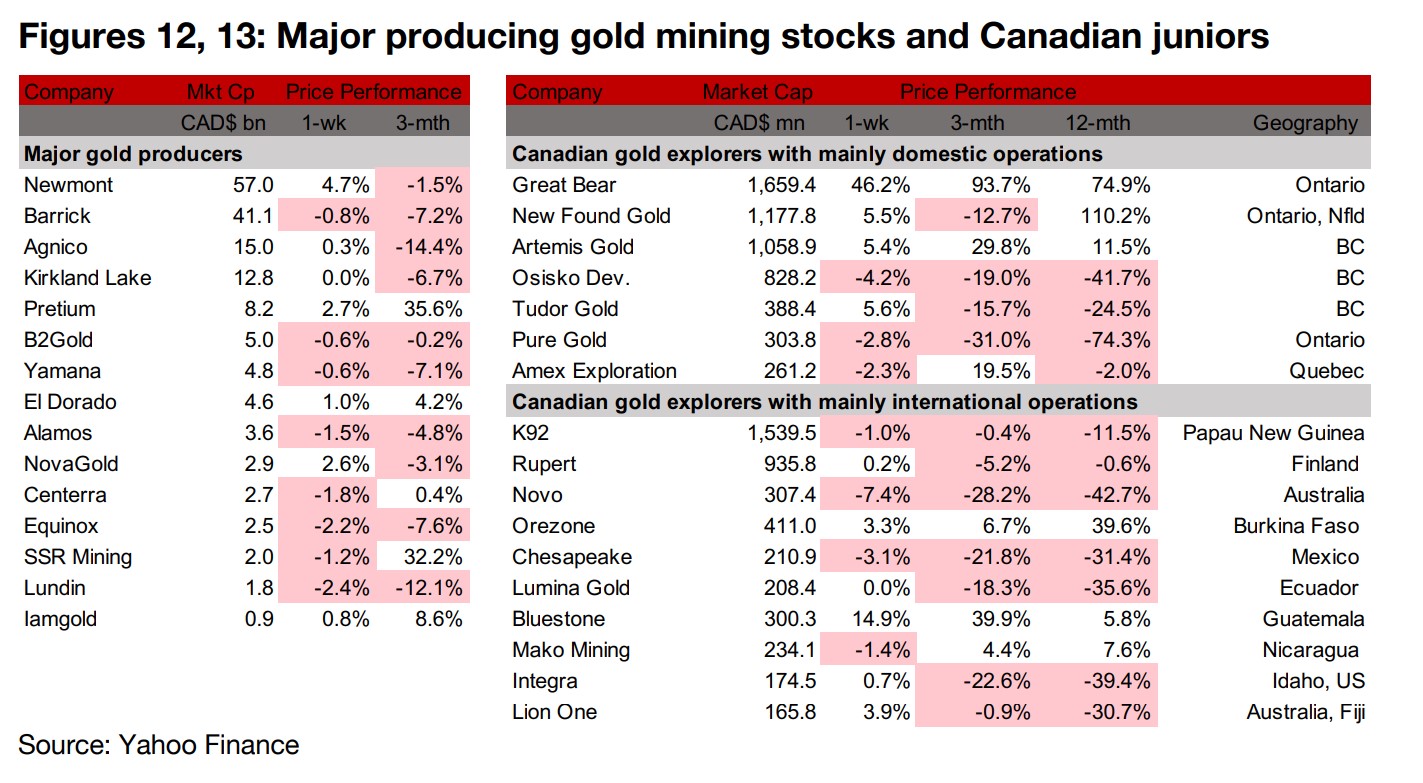

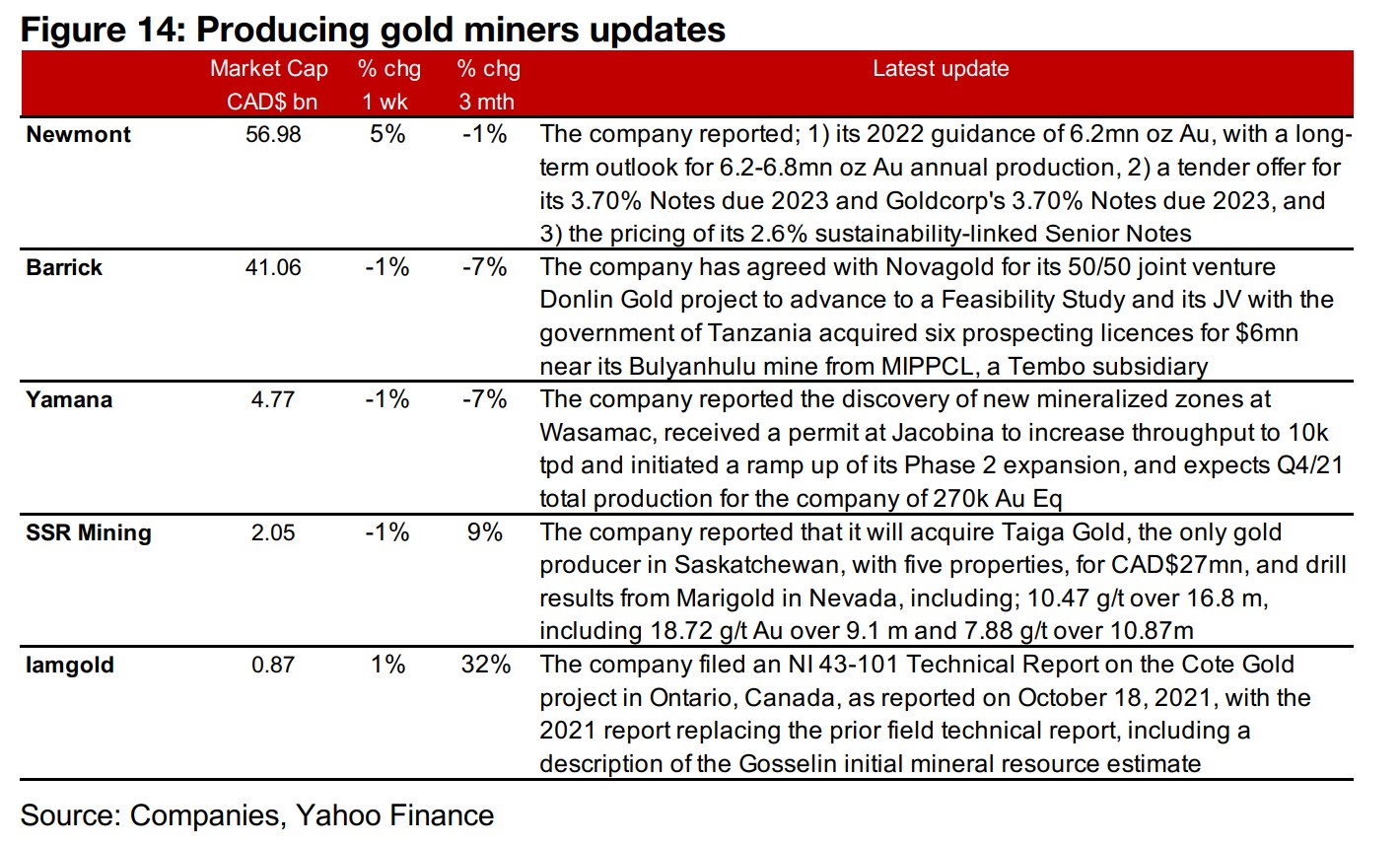

Producers mixed rise as gold rebounds

The producing gold miners were mixed as gold picked up (Figure 12). Newmont provided its 2022 and long-term guidance and announced a tender of its own and Goldcorp's 3.70% Notes, both due 2023, and the pricing of its Sustainability-Linked Notes (Figure 14). Barrick announced that it had agreed with Novagold to advance its 50/50 JV Donlin to a Feasibility Study and the acquisition of six prospecting licenses for $6mn near its Bulyanjulu mine from MIPPCL. Yamana reported the discovery of new mineralized at Wasamac, received a permit to increase throughput at Jacobina and ramped up its Phase 2 expansion, and announced its production guidance for Q4/21. SSR mining reported that it will acquire Taiga Gold, the only gold producer in Saskatchewan, with five properties, for US$27mn, and drill results from Marigold in Nevada, and Iamgold filed a technical report on the Cote Gold project.

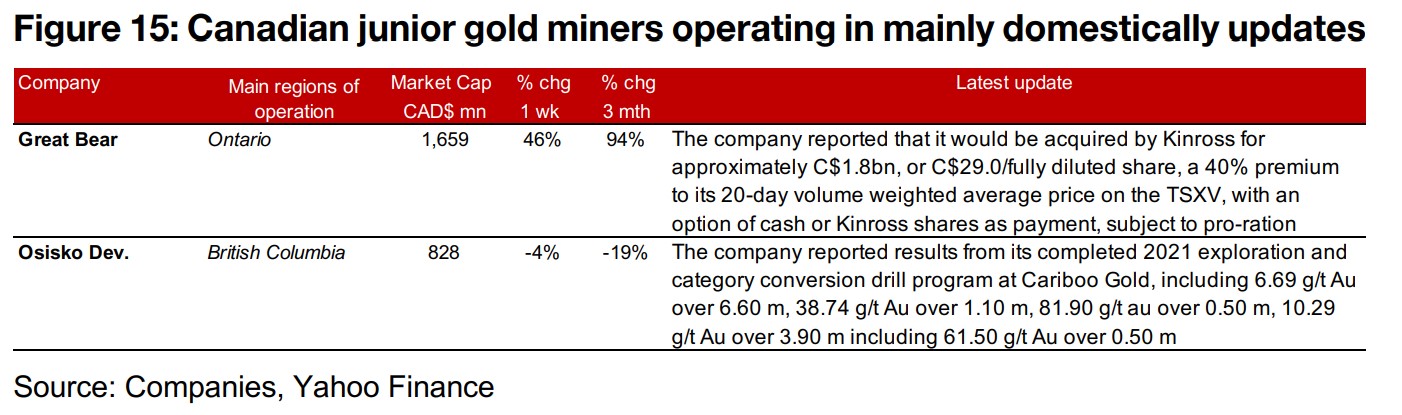

Canadian juniors mixed, Great Bear acquired by Kinross

The Canadian juniors were mixed as the gold price rose (Figure 13). For the Canadian juniors operating mainly domestically, the big news was the acquisition of Great Bear Resources, the largest junior gold miner on the TSXV, by Kinross, for approximately C$1.8bn, or a 40% premium to its average price over the past 20 trading days. Osisko Development announced results from its completed 2021 exploration and category conversion drill program (Figure 15). For the Canadian juniors operating mainly internationally, Lumina signed an Exploration Investment Production Agreement for Cangrejos with the Ecuador Government, with a total minimum investment required of US$36mn form 2019-2024, including that from December 2010 to the end of 2018 (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.