February 07, 2026

A Critical Minerals Opportunity of the Decade

Contents

- An Overlooked “Copper Kingdom”

- Midnight Sun’s (MMA.V, MDNGF) IMMEDIATE Value Proposition

- The Imminent Catalyst for Midnight Sun

- Dumbwa’s Economic Potential Could Exceed Its MASSIVE Neighbor

- Key to Great Economics: Ore Starts Right at Surface

- A Clear Vision for a Profitable Endgame

- Optionality at Play

- The Midnight Sun Thesis

The global trade war continues. And it has been pushing commodity prices higher and higher.

Gold and silver are trading at all-time highs. Critical minerals such as copper have joined this once-in-a-generation bull market.

Investors can choose how they want to play it.

They can go the common way and get exposure to commodities through ETFs. It’s easy to do, but ETFs have a limited upside.

If you want to give your portfolio an extra boost, there are only a few options available outside of the resource junior space.

World’s wealthiest people, such as Amazon’s founder Jeff Bezos and Microsoft’s Bill Gates, chose a different path. They are investing in a private resource junior working in this specific country… Zambia.

A company linked to the United Arab Emirates, the global oil leader, has invested over USD 1.1 billion in a Zambian mine in 2025.

And these billionaires and wealthy investment funds have chosen copper as their investment of preference.

Now, there are many copper companies operating in the world… even in Zambia.

The problem here is that it’s not easy to tell future winners from potential losers.

This is why here at Canadian Mining Report, we bring our investors opportunities that they don’t learn about anywhere else.

The resource junior we will discuss in a moment works in the copper space, owns projects in Zambia, and it has one of the most distinguished geologists on its team.

His past discoveries created billions of dollars in shareholder value.

A deposit he and his team discovered resulted in a CAD7.3 billion acquisition.

And now, he is working to advance a project that looks just like the one that created that wealth.

Same commodity, same country… but a much better copper price environment.

We believe that the company on our radar today, Midnight Sun (MMA.V, MDNGF), is one of the rare “right place, right time” situations.

Let’s start with the “place” part…

An Overlooked “Copper Kingdom”

Few investors have Zambia as their top-of-mind copper jurisdiction. Yet they should.

The country has been one of the world’s top copper producers for over 100 years. Its geology created large and scalable copper deposits billions of years ago… yet it takes a specific kind of expertise to find them.

Zambia remains a world-class copper producer and hosts some of the largest mining companies, such as First Quantum, Barrick (and its Lumwana mine, which Midnight Sun’s geologist helped discover), Ivanhoe, Rio Tinto, and others.

The country takes mining seriously. The industry represents 75% of its exports. Zambia’s government has an ambitious goal of tripling its copper output between 2025 and 2031.

It is also a stable and predictable mining jurisdiction.

And investment has been flowing in. For example, the United States and the European Union plan to build a multibillion-dollar Lobito railway that would start in Congo and help Western companies bring copper to the Atlantic Ocean. The partnership plans to add a branch line to Zambia’s mines.

First Quantum, one of the global mining giants working in Zambia, is building its own 371-kilometre railway to cut transit times for its operations. The company expects the line to be ready within two years.

First Quantum and Barrick are pouring billions of dollars into Zambia. First Quantum is working on a USD1.25-billion production expansion at its Kansanshi mine, and Barrick is investing USD2 billion in Lumwana.

China, the United States, and the European Union have earmarked billions of dollars to improve the country’s infrastructure and get its copper to the international markets as quickly as possible.

One resource junior looks poised to benefit from this investment frenzy, regardless of which global superpower comes out first.

Midnight Sun’s (MMA.V, MDNGF) IMMEDIATE Value Proposition

Before the Zambian copper rush began, Midnight Sun realized that it could get positioned in one of the most prolific copper regions in the world—and potentially create billions of dollars in shareholder value.

The company’s CEO, Al Fabbro, who has over 45 years of experience in mining and finance, has been implementing a strategy of focusing on projects with ultra-large-scale potential.

Dumbwa, Midnight Sun’s flagship property, has the potential to rival the only two other basement-hosted projects in the Zambian-Congo copper belt… Kamoa Kakula and Lumwana. These are the two largest deposits in the whole belt area. And Dumbwa may be even larger than that.

This, in a nutshell, is what Midnight Sun is on to. The company has started exploration at Dumbwa, and the early drill results have delivered excellent progress. (More on that in a moment.) The market has noticed the company’s progress, too… Over the past 12 months, Midnight Sun’s share price has soared by 135%.

But, most likely, this is just the beginning of the Midnight Sun story. Here’s why…

The Imminent Catalyst for Midnight Sun

The company has reported the results of just 10 of the 88 holes it has drilled so far at Dumbwa. The rest are sitting at an assay lab, waiting to be released.

Here’s what we expect to happen when they see the light of day…

The market will likely realize that, just as the management predicted, there could be a close connection between the soil anomaly the company identified earlier and the underlying copper mineralization.

And here’s why it matters…

The soil anomaly at Dumbwa that Midnight Sun was drilling out continues unbroken for another 12 kilometers… There could potentially be massive growth built into the company’s projections.

And so far, Dumbwa has proven to be highly consistent. Management expects the project to potentially host a large-tonnage, near-surface deposit that could contain over one billion tonnes of ore.

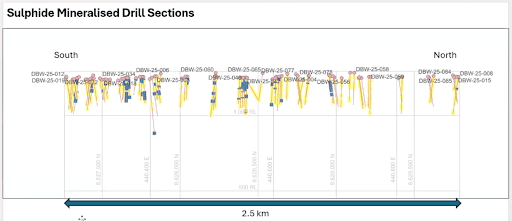

The map below shows how consistent the deposit really is over the 2.5-kilometer stretch that the company has focused on so far. It is a long section facing West. The company’s geological model has predicted—correctly—that the deposit is aligned from south (on the left) to the north (on the right).

The yellow intervals show sulphide observations. That’s the type of mineralization that hosts copper at this particular deposit. Now the important part is…

You can see the yellow color in every hole drilled so far. And keep in mind that this mineralization could potentially stretch not for 2.5 kilometers but for 12 or possibly 13. The company has outlined a soil anomaly with a strike length of over 20 kilometers with soil samples of up to 0.73% copper.

With this consistency, the company’s claim that Dumbwa could become one of the largest Tier 1 bulk-tonnage near-surface deposits in Congo’s Copper Belt makes complete sense.

In fact, this consistency shows that Dumbwa’s position in the prolific Zambian copper belt is “as good as it gets,” according to the company’s geologists.

Dumbwa’s Economic Potential Could Exceed Its MASSIVE Neighbor

As to the grades and widths that the company has seen so far… they are close to those of the Lumwana mine located just 65 kilometers away.

Lumwana is operated by Barrick Mining Corp., one of the world’s leading resource companies.

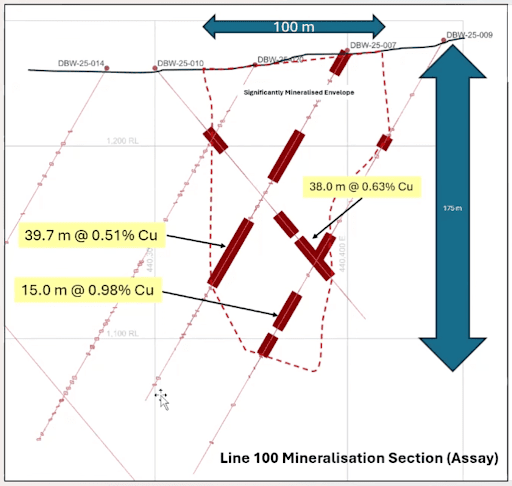

The widths and grades at Lumwana are in the range of 40 meters of 0.3–0.5% copper. The assays that Midnight Sun has received so far show richer intervals and higher grades. The image below shows a snapshot of some of the results seen to-date.

Midnight Sun expects that drill results with similar lengths and grades could continue for another 11 kilometers.

Even without the high-grade sub-intervals (red bars in the image below), the longer and lower-grade intervals that contain them are comparable to the ones economically mined at Lumwana. For example:

- Hole DBW-007: 136 meters of 0.26% copper, starting from four meters down hole;

- Hole DBW-009: 60 meters of 0.40% copper, starting from 119 meters down hole;

- Hole DBW-010: 80 meters of 0.36% copper, starting from 42 meters down hole.

This tells investors that the company has likely defined one part of an already economically looking deposit. If similar mineralization continues for another 10 or 11 kilometers, Dumbwa will look like a world-class asset…

And it may not take too long for Midnight’s neighbor Barrick to notice… In fact, Midnight Sun’s geologist, Dr. Kevin Bonel, was Exploration Manager at the Lumwana mine and Freeport McMoRan, another copper major.

While working at Lumwana, Dr. Bonel transitioned the project from about 900 million tonnes at 0.55% copper to 1.6 billion tonnes at 0.52% copper.

He and his team almost doubled Lumwana’s tonnage while keeping its grade intact.

Of course, we cannot predict which strategic investors may get as excited about Dumbwa as the company’s team already is, but we know that majors are starved of new discoveries… and Dumbwa has started looking like a major one.

And the company has enough liquidity to continue its exploration effort. Midnight Sun has about CAD38 million in its treasury.

The company's plan for 2026 is ambitious, and it could change the way the market perceives Midnight Sun. Management says that it plans to drill 70,000 meters this year.

Just by the third quarter of this year, the company plans to drill over eight kilometers of the projected 12- to 13-kilometer expected strike length. If mineralization at Dumbwa remains consistent, this campaign will quickly triple the deposit’s footprint… and Midnight Sun will have about CAD20 million left in the bank to continue advancing Dumbwa and its other assets.

Management pointed out that, on average, the company spends about CAD160 per meter of drilling. This is one of the lowest numbers we have seen. In other words, Midnight Sun can do much more work with the capital it has than some of its rivals, who face higher costs.

This benefits investors who see their money going toward getting more work done—and potentially creating more shareholder value in the process.

Key to Great Economics: Ore Starts Right at Surface

The best thing about these drill results is how close to the surface they are. Usually, if a deposit lies deep in the ground, it is expensive to mine. An operator would need to remove a lot of “waste,” or non-economic material, before it gets to the good stuff.

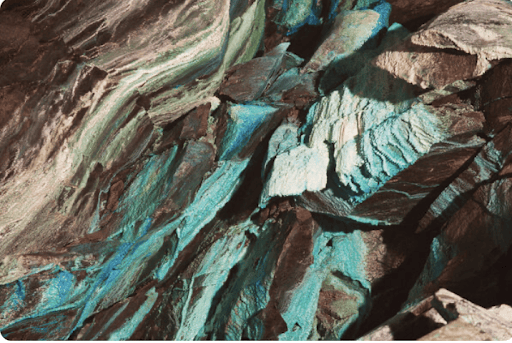

In the case of Dumbwa, as the company’s recent drill results show, the good stuff starts almost at the surface. This is fantastic news for the project’s potential economics.

Another advantage that Dumbwa has is its potential low strip ratio… in other words, the ratio of economic-looking ore to waste.

In fact, Dumbwa’s low strip ratio, as estimated by its geological team, is lower than that of Barrick’s Lumwana. Lumwana is scheduled to produce 240,000 tonnes of copper per year starting in 2028. It’s a massive mine with a life of over 30 years.

A Clear Vision for a Profitable Endgame

A lot of resource juniors don’t have an exit scenario. They plan to deliver the next batch of assay results or an economic study and see what happens.

Often, nothing does.

Midnight Sun has its eyes on a potential acquisition by a mining major. The company expects that Dumbwa will be too large to ignore by the biggest players in the mining space.

Management makes a comparison to Lumwana, which we mentioned above. It was purchased 20 years ago for CAD7.3 billion. At the time of acquisition, it had about 900 million tonnes of ore at 0.5% copper. If Midnight Sun outlines a mineralized zone over 12 or more kilometers, Dumbwa could potentially be larger than that.

Plus, copper was trading at USD1.50–1.80 when Lumwana was purchased. For reference, as of this writing, copper has closed at USD5.70–5.90, which is over three times higher.

In other words, Midnight Sun might have a larger deposit available for purchase in a much better copper price environment than what Lumwana’s previous owners had to work with. Investors should make their own conclusions about where Dumbwa’s acquisition value might stand.

On top of that, Dumbwa doesn’t have any “deleterious,” or bad, elements in its mineralization. Lumwana, which was purchased for CAD7.3 billion, did. But Midnight Sun’s team assured its investors that there’s no uranium, cadmium, or arsenic present.

This, among other features, shows Dumbwa’s advantage over its neighbor, owned by the multi-billion-dollar mining major.

Plus, Dumbwa’s mineralization is copper-only. This makes it easier to work with than would be the case with a polymetallic deposit. Copper could be trickier and costlier to extract from one, damaging project economics. Dumbwa’s mineralization is straightforward and should be easy to process once the project reaches its production stage.

optionality

Optionality at Play

Even though Dumbwa could shape up to be a multi-billion-dollar deposit, the company has other assets in its portfolio.

For example, the near-surface Kazhiba copper deposit, which is also in Zambia.

The company has recently announced a mineral resource estimate for Kazhiba. It outlined a NI43-101-compliant Indicated resource of 2.3 million tonnes at 1.41% copper. The deposit contains 72.3 million pounds of copper.

The resource was modeled to a depth of just 30 meters, meaning that its strip ratio will likely be very low, just like Dumbwa’s. Kazhiba also has access to excellent infrastructure. Kazhiba is just 6.8 kilometers away from the Kansanshi mine operated by First Quantum. First Quantum is a global mining major with a market capitalization of CAD34.7 billion.

Midnight Sun plans to turn Kazhiba into a producing mine and use its future cash flow to finance exploration and development at Dumbwa, the company’s crown jewel.

This plan, when executed, will allow Midnight Sun to continue advancing Dumbwa without the need to raise funds through private placements. This will protect existing shareholders against potential dilution.

In other words, Midnight Sun has developed a non-dilutive plan to bring a world-class copper deposit to the stage where it will be nearly impossible for the world’s largest mining companies and potential acquirers to resist.

The Midnight Sun Thesis

The trade war continues raging. America’s latest salvo, the threat to take over Greenland, tells investors everything they need to know to understand how serious the Trump administration is about taking control of mineral resources.

China, the United States’ archrival, is doing everything it can to get hold of critical minerals all over the world, too.

The two superpowers have their eyes on Zambia and its vast copper resources.

Access to the country’s critical minerals is so valuable that the world’s most powerful political players and its richest people compete to take control of Zambia’s copper wealth.

Donald Trump, Xi Jinping, Jeff Bezos, Bill Gates, and others have invested billions of dollars in Zambian copper projects and the country’s transport infrastructure.

Meanwhile, established players such as the multibillion-dollar First Quantum and Barrick look for growth opportunities.

Midnight Sun (MMA.V, MDNGF) has positioned itself to benefit from this competition.

The company is advancing a project that could potentially rival the largest copper mines in the country.

It has discovered a consistent, near-surface sulphide copper-bearing target that is several kilometers long… and it can potentially increase its size by almost five times.

Midnight Sun (MMA.V, MDNGF) plans a massive 70,000-meter drill campaign this year, and the company is fully funded to execute it.

New drill results will be coming in shortly… and so far, they have confirmed management’s geologic theory. Dumbwa, the company’s flagship property, may indeed be a monster-sized near-surface deposit located close to one of the copper majors’ mining infrastructure.

Sophisticated investors have noticed, and the company had no problems raising tens of millions of dollars from them.

It received a vote of confidence from some of the “smartest” money in the business.

But the Midnight Sun (MMA.V, MDNGF) story is still in its earliest stages. If the company continues delivering consistent and economic drill results, its market value may change.

And the company has one of the best executive and technical teams in the industry, perfectly matched to the task at hand.

As we said earlier, this is one of the “right place, right time” situations. And, we would argue, the right time to pay attention to this story is now. This once-a-decade opportunity should be at the top of every resource investor’s watch list.

Sign up to receive our future articles and updates.

Disclaimer: This report is for informational use only and should not be used as an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.