December 18, 2023

A HIDDEN Crisis Could Set This Metal’s Price SOARING

Contents

- Copper Is the “Red Gold” of the 21st Century

- The Copper Supply CRUNCH Created a Superbull Market

- Consolidation In Safe Jurisdictions

- A Double Bet on Copper Supercycle

- The Upside Potential

In August 2023, the world’s largest economies went to an economic war…

The United States, the European Union, China, Japan, and India are now fighting to secure supply of this critical element…

The States, which is the world’s largest economy, added copper to its critical minerals list.

And make no mistake… this is huge news.

The Department of Energy, which published the list, is like the Federal Reserve for commodities.

You can’t overstate its importance in the commodities market…

While the Fed controls interest rates and money supply… the Department of Energy decides who will be eligible for billions of dollars in tax credits.

It can single-handedly create industry leaders in the clean transition space.

And other countries follow suit.

Between the Department of Energy and its overseas counterparts… It’s like a tsunami of incentives for any company that is part of the green transition process.

For example, Canada announced billions of dollars to support the production of critical minerals…

And copper is on the list.

But it’s not only about the government.

After the DoE announced a massive tax credit program, private capital started flowing in.

After the Inflation Reduction Act was passed, private investors put over $270 billion dollars into various clean energy enterprises.

We will not be surprised to see billions of dollars flowing into the Canadian junior mining space as a result as well.

After all, Canada remains one of the world’s leading commodities markets.

But copper in particular appears to be the most well-positioned commodity for the coming decade.

As we said earlier, the world’s largest economies are going to an economic war over copper and other critical minerals.

We will elaborate in just a moment… but the main point is that the copper market is facing a severe supply crisis while the demand for the metals is poised to soar.

This means that any producing company wants to increase its output as much as possible.

But there is only so much they can do without adding new properties to their portfolios.

This is why today we are focused on a little-known company with TWO copper properties located close to active mines.

In our opinion, they could become primary acquisition targets in the future… the majors operating nearby are hungry to add more pounds of copper to their resource bases.

The demand for copper is there… it’s insatiable.

And this company could be one of the best ways to play the ongoing copper “superbull” cycle.

We’re talking about GSP Resource Corp. (GSPR.V), a Vancouver-based junior focused on the most important commodity of this decade.

Copper Is the “Red Gold” of the 21st Century

The clean transition can’t happen without copper.

It plays a massive role in energy generation and transmission. Wind turbines, solar installations, power lines… everything involved in the decarbonization trend depends on copper.

An offshore wind turbine needs about 8 tonnes (or over 17,000 pounds) of copper per megawatt of energy generation capacity.

An electric vehicle contains about 66 pounds of copper on average… and by 2030, the world is about to add over 300 million EVs to its fleet…

That would roughly translate into almost 20 billion pounds of copper needed for the EV revolution alone.

But there are also power transmission lines, energy storage, wind and solar installations…

The demand for copper is soaring.

These days, the world consumes about 25 million tonnes of copper every year. By 2031, this number could grow to almost 37 million tonnes, or 48% higher… and we’re talking about annual consumption. Year after year, the world is going to need more copper as the clean transition continues.

And this projection itself could be an understatement.

If the world is to hit its “net-zero” targets, even this increase in demand won’t be enough.

To reach net zero emissions, copper demand should increase by a further 54% by 2030, according to Goldman Sachs.

The farther into the future you go, the wilder these demand forecasts become.

According to S&P Global Market Intelligence, by 2035, the global demand for copper could increase to 50 million tonnes per year.

This is exactly two times higher than the amount of copper the world consumes per year these days.

Even in 2023, the copper market is estimated to run a deficit of about 114,000 tonnes.

This deficit could widen in the coming years…

And there’s another problem… (or an opportunity, depending on how you see it).

The States, Canada, the European Union, and other major global economies that need every single pound of copper they can get would rather buy it locally.

They have ambitious climate goals… they want to achieve net-zero emissions in the coming decades… they need billions of pounds of copper to do that…

But they also want to buy from local sources.

This is one of the best opportunities for a copper-focused company such as GSP Resource Corp. (GSPR.V).

The market for copper is expanding, and government subsidies and tax breaks are introduced pretty much in every developed country with ambitious climate goals…

But the supply quite simply isn’t there.

Let us explain…

The Copper Supply CRUNCH Created a Superbull Market

The copper market is already in a state of deficit.

It runs in the hundreds of thousands of tonnes… but it’s going to get worse.

McKinsey, a consultancy, says that by the start of the next decade, the copper market will be short of MILLIONS of tonnes of copper every year.

While the demand is going to grow to about 37 million tonnes per year, mine supply will only add about 30 million tonnes annually.

And, as we said, the actual demand could reach about 50 million tonnes per year… leaving a potential annual gap of about 20 million tonnes.

S&P Global Market Intelligence projects that at the current rate, mine supply will grow at about 2.7% each year.

That’s not enough. And miners can’t just increase production based on their existing mines.

S&P Global vice chair Daniel Elgin says that even if copper miners manage to optimize their production, there will still be a gap.

In other words, copper miners need to add more projects to their portfolios…

Organic growth isn’t enough. And despite growing demand, copper supply is growing at an alarmingly slow rate.

The International Copper Study Group estimated that global mine production would grow at a rate of about 5.3% this year.

Now, this estimate has been revised down to 3%.

One of the key reasons is that about HALF of the global copper supply comes from jurisdictions that the S&P categorizes as “unstable” or “extremely unstable.”

What does it mean?

Pretty much anything, from bad weather conditions to landslides, equipment failures, labor strikes, nationalizations, adverse tax reforms…

This is a crisis… the world needs more copper every year, yet half of the metal’s supply today comes from unreliable countries.

This is why the United States, Canada, Japan, the European Union, and others are willing to spend billions of dollars to build a reliable domestic supply chain for copper.

The metal is critical for the green transition, and the countries that supply about half of the copper available on the market are either unfriendly or unreliable.

Chile, for example, is estimated to produce the exact same amount of copper this year as it did three years ago…

Chile is the world’s number one copper producer, but the quality of the ore that’s being used is going down. And the country’s water restrictions made it impossible to run mining operations located in the areas affected by droughts.

This situation is not sustainable… and there is only one way out of it.

Consolidation In Safe Jurisdictions

The only way copper miners can increase their output is by expanding it in stable jurisdictions.

Bloomberg forecasts a wave of consolidation in the copper mining sector as global commodity giants diversify away from the less stable countries and into the more reliable and friendly ones.

And they have the money to do so…

Bloomberg says that to boost copper supply and lower costs, copper miners could potentially spend billions of dollars.

For example, the world’s top 11 copper mining companies are sitting on about $54 billion dollars in cash and equivalents…

That’s more than any government program announced either in the States or Canada made available for the critical minerals market.

And on top of this massive cash reserve global miners have access to billions of dollars in debt.

Keep in mind as well that as interest rates are expected to start falling next year, corporate lenders will be able to go back to the debt markets and raise funds in the billions—and at attractive rates.

Between government programs and corporate capital, we are talking about tens, if not hundreds, of billions of dollars that could flow into the critical minerals sector.

GSP Resource Corp. (GSPR.V) could potentially benefit from this trend in several ways.

But before we get to the company’s catalysts, let’s talk about its value proposition.

A Double Bet on Copper Supercycle

GSP Resources is a junior mining company with two properties in British Columbia.

In a moment, we will explain why, in our view, this company could be one of the strongest—and still overlooked—players in the copper market in North America.

But first, we need to mention the properties’ location.

British Columbia is one of the most mining-friendly jurisdictions in the world. The global Fraser Institute survey ranked it 15th out of the 62 jurisdictions surveyed.

This Canadian province improved its tank compared to the previous survey conducted in 2021.

So not only is it one of the best places in the world to operate a mining company, it’s also working to improve its investment attractiveness.

GSP Resource Corp. (GSPR.V) has two properties in British Columbia.

Its flagship property is the Alwin Mine. And, as the name suggests, this is a past-producing mine. GSP has an option to purchase 100% of the property.

Its history goes back over 100 years. During the early 20th century, small-scale mining was conducted where the property is.

More recently, exploration and mining activities happened in 1967-1982 and between 2005-2008.

When the mine was closed by a previous owner due to low copper prices, the company that operated it released a resource estimate. Note that this estimate isn’t NI43-101 compliant.

However, knowing that a previous owner outlined a resource of 390,000 tonnes (or 860 million ounces) of mineralization grading around 2.5% copper isn’t insignificant.

The company will need to upgrade this resource to modern standards, of course. But the very fact that it exists gives a clue as to what investors could expect from the company in the future, provided that its exploration yields successful results.

Best of all, the property is located next door to Teck Resources’ Highland Valley copper-molybdenum-silver ore body.

To give you a perspective on how huge Highland Valley is, in 2022 it generated almost $1.5 billion in revenue by selling 127 thousand tonnes of metals.

As we said, Highland Valley is located next door to GSP Resource Corp.’s (GSPR.V) Alwin property.

The image below gives you a sense of how close the two properties are.

In other words, if the GSP team proves that Alwin has a high potential to become economically viable, Teck might take notice.

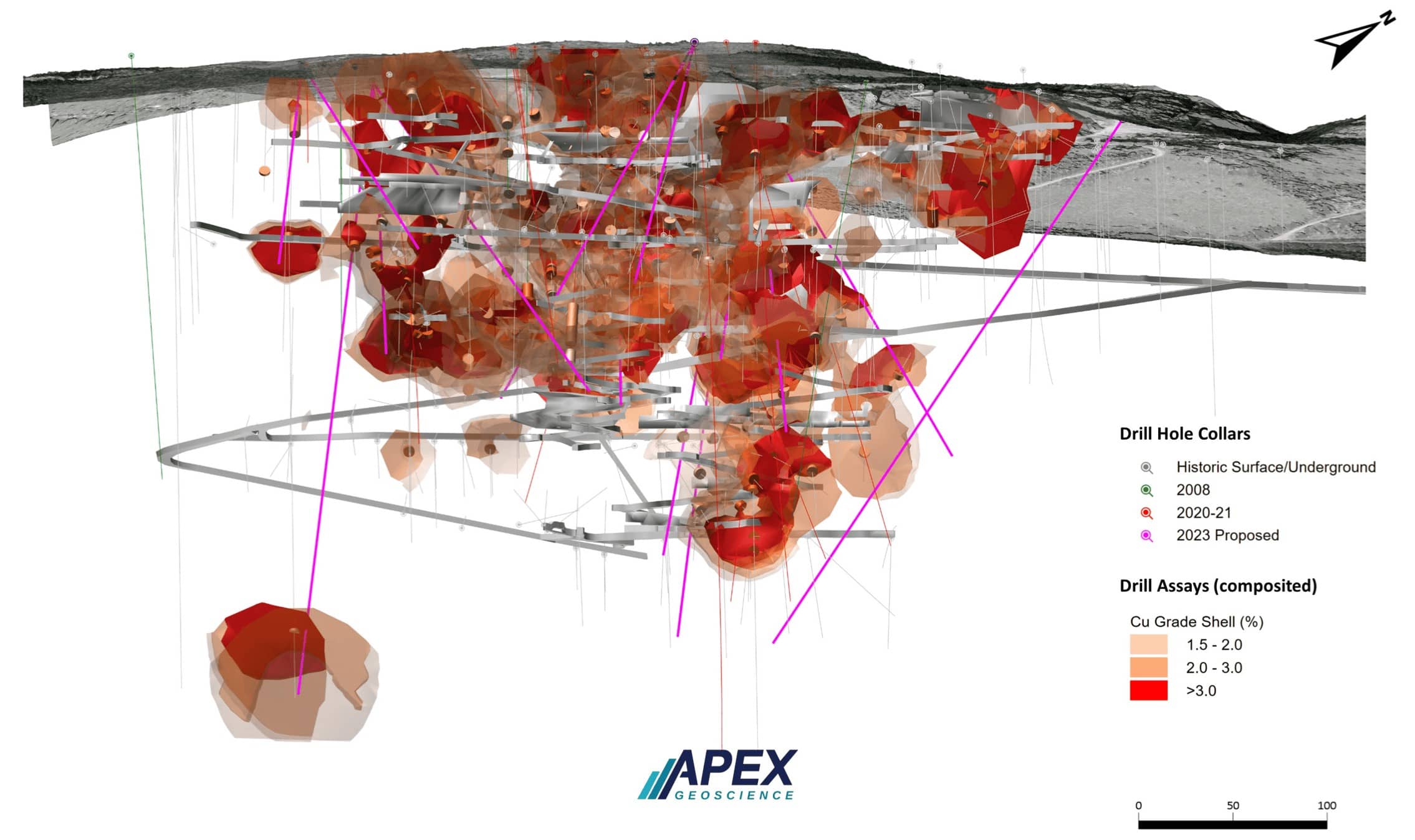

So far, exploration at Alwin has delivered excellent results.

After compiling data on 50,000 meters of historical exploration, the company started its own drilling campaign.

Some of the drill holes delivered high-grade intercepts:

- 2.71% copper equivalent (or CuEq) over 35.5 meters in hole AM21-05;

- 4.66% CuEq over 6.4 meters in hole AM21-01;

- 6.13% CuEq over 1.6 meters in hole AM21-08B.

The company now plans to generate a bulk tonnage open-pittable, underground, or block cave resource at the Alwin Mine.

Notably, the company has access to a historical database that was put together by previous owners who spent an estimated $20 million on exploration. It includes 452 drill holes.

During the 2020-2021 exploration season, GSP drilled 28 holes totaling 5,600 meters.

The company says that the high-grade mineralization zones remain open at depth. Both historical data and GSP’s own exploration activities generate follow-up drilling targets.

This is one of the catalysts we see for the company. It identified three new copper mineralization zones that hadn’t been previously discovered.

On top of that, it identified other targets, defined by the 3D mineralization model the company created for Alwin.

In other words, we see a lot of exploration potential here, based on both historical information and recent drilling.

The company’s other project, Olivine, is also a past-producing mine.

It’s located in South-Central British Columbia, 25 kilometers away from the town of Princeton.

It is also close to the Copper Mountain Mine.

GSP optioned the Olivine Mine project to another mining junior. Which means that it gets to share the potential upside of its partner’s exploration activities without putting its own resources at risk.

This allows it to focus on Alwin, its flagship property.

In our view, this is the right strategy, created and communicated by the company’s leadership team.

GSP’s CEO is Mr. Simon Dyakowski. Mr. Dyakowski has over 12 years of experience in corporate development and capital markets. In the past, he advised TSX Venture-listed companies on their corporate development strategies.

He holds an MBA from the University of British Columbia; he’s also a CFA charter holder.

Mr. Dyakowski’s experience in corporate development and capital markets will be critical for GSP to reach its 2024 milestones.

On the technical side, the company works with A. David V. Heyl who has over 40 years of experience in the mining industry. Mr. Heyl was the exploration manager for Southern Peru Copper. He worked at operating mines in grade control, mine design, construction supervision, and oversight.

As GSP Resource Corp. (GSPR.V) works toward re-activating the Alwin mine, Mr. Heyl’s experience will be instrumental. His relevant expertise in exploration at copper-focused properties is also a major asset for GSP.

Overall, the company’s team is well-rounded, with experienced professionals in the most critical areas, from corporate finance and capital markets to mine design and exploration.

The Upside Potential

GSP Resource Corp. (GSPR.V) positioned itself as a relatively low-risk bet on the copper supercycle.

The company has access to millions of dollars’ worth of data for its main Alwin property. (Keep in mind that previous owners have also outlined a historical resource there, even though it’s not NI43-101 compliant).

The value proposition here is clear.

Both properties the company has in its portfolio are located either next door or close to an existing mine. This makes them potential acquisition targets.

(We need to make the necessary disclaimer here that we are not aware of any plans of either Teck or Copper Mountain to engage in any M&A activity in regard to these properties.)

And the company has already done quality work to increase any potential bidder’s confidence in its potential.

2024 will be a critically important year for GSP Resource Corp. (GSPR.V).

And we urge investors to put this C$3-million company on their radar.

The company’s market capitalization could change dramatically based on how its future drill results look.

So far, the company has not only delivered solid drill results from the previously known areas but also improved its understanding of where to look next.

We believe that this exploration upside and potential future advancements toward production (regardless of whether a potential takeover happens) could create value that far outweighs the company’s current market cap.

GSP Resource Corp. (GSPR.V), in our view, should be on the radar of every commodity investor.

The Canadian Mining Report Editorial Team

SEE DISCLAIMER & DISCLOSURE BELOW

Sign up to receive our future articles and updates.

The Canadian Mining Report has been retained by GSP Resource Corp. to provide various digital marketing and advertising services. We have been paid to provide editorial and marketing services to profile the company and its project. The preceding Article is PAID FOR CONTENT sponsored by GSP Resource Corp. and produced in cooperation with CanadianMiningReport.com. The publisher of CanadianMiningReport.com owns securities positions in GSP Resource Corp. and may trade on their own behalf at any time without prior notice, however, it is our general policy to not sell any shares while we are currently engaged with a client.

The Canadian Mining Report's business model includes receiving financial compensation to carry out various services for companies which may include advertising, marketing and dissemination of publicly available information. This compensation is a major conflict of interest in our ability to be unbiased.

Disclaimer

The material in this article should not under any circumstances be construed as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed, and is to be used for informational purposes only. Neither Canadian Mining Report (the "Publisher", "we", "us", or "our"), nor any of its principals, directors, officers, employees, or consultants ("Publisher Personnel"), are registered investment advisers or broker-dealers with any agencies in any jurisdictions. Canadian Mining Report ("Canadian Mining Report", "Us", "Our" and/or "We") is a Canadian based media company that typically works with publicly traded companies and provides digital marketing strategies and services.

At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research. We do not provide personalized or individualized investment advice or advice that is tailored to the needs of any particular recipient. Read More