July 11, 2022

Base Metals Under Pressure

Author - Ben McGregor

Gold continues to slide

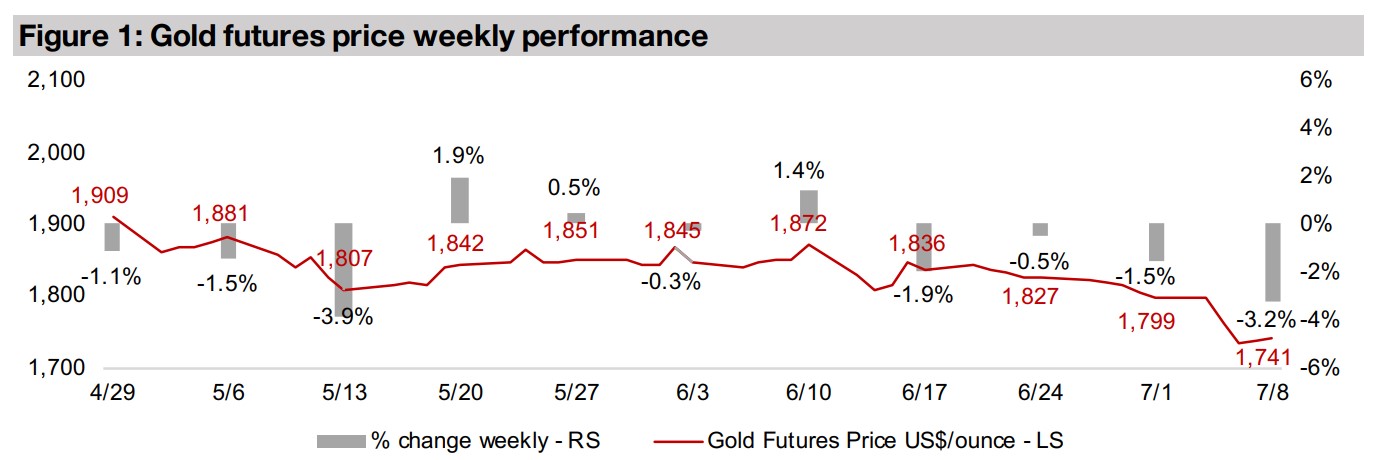

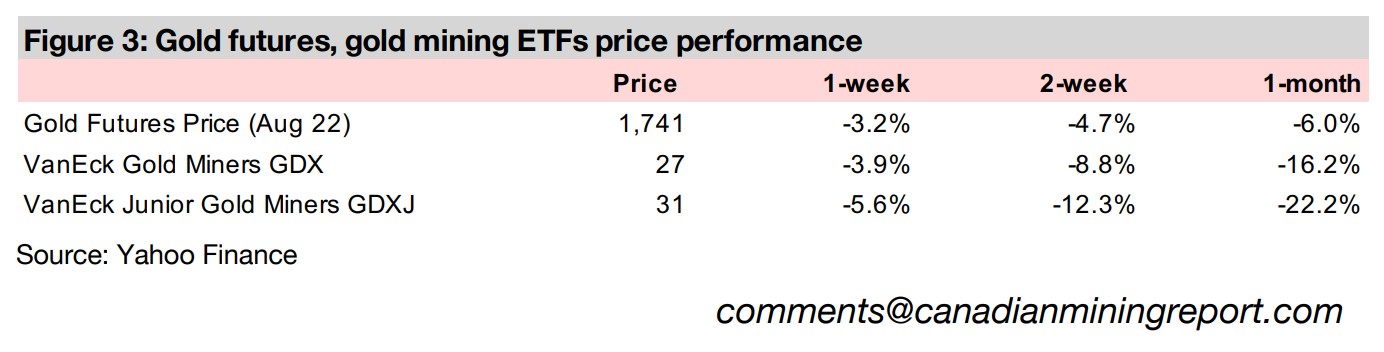

Gold declined -3.2% to US$1,741/oz as major rate hikes by the US Fed to drive down inflation are expected to continue, likely leading to less negative real yields for bonds, making them relatively less unattractive versus gold, and driving up the US$.

A look at the crash performance of large TSXV base metals stocks

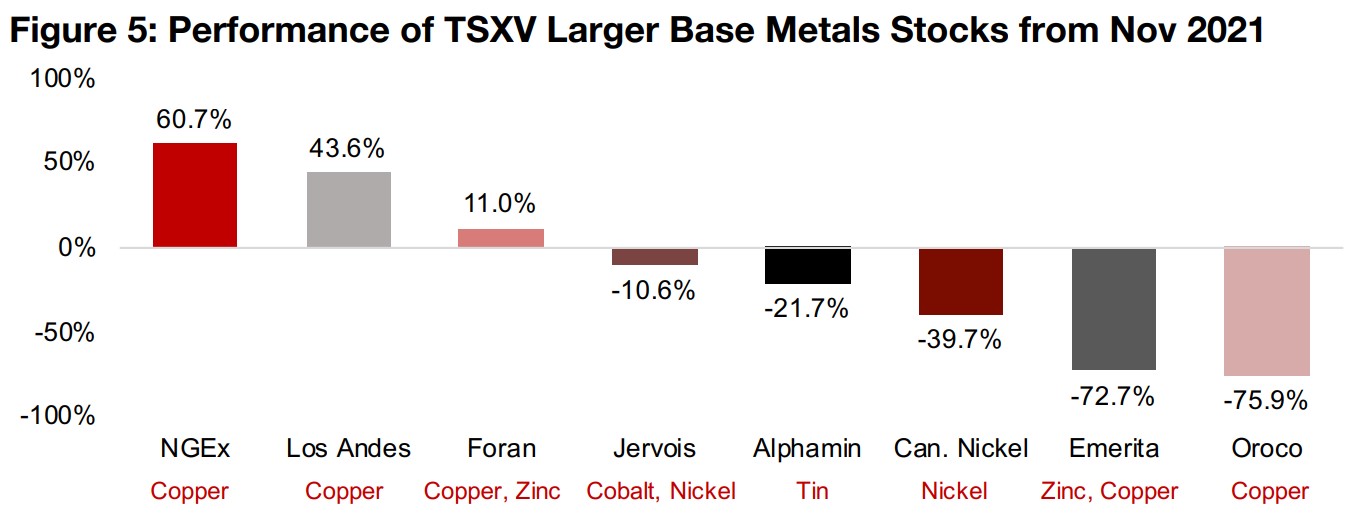

This week we look at the performance of the larger TSXV base metals stocks, with only three of eight up since the equity market correction began in November 2021, as the metals prices have trended down hard since Q2/22 on growing recession fears.

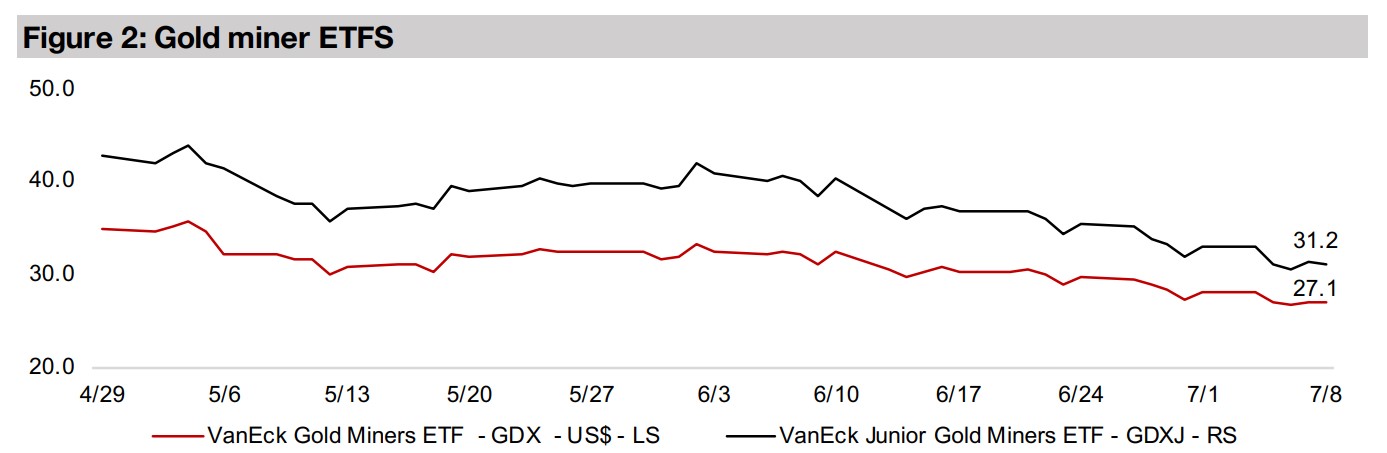

Producers and juniors down as equity markets continue gains

The producing and junior miners were down, with the GDX sliding -3.9% and the GDXJ dropping -5.6%, while the larger TSXV-listed Canadian junior gold stocks were nearly all down, as a rise in equity markets was overshadowed by the gold price fall.

Base Metals Under Pressure

Gold declined -3.2% for the week to US$1,741/oz and is now down -7.0% from its

high of the past two months, at US$1,872/oz four weeks ago. This is as the market's

previous focus on the surge in geopolitical risk with Russia's invasion of Ukraine has

given way to a concentration on the US Fed's aggressive continued rate hike

campaign. These hikes could see heavily negative US real bond yields, which reached

as low as -6.0% this year, ease, with nominal rates rising and inflation appearing to

have flattened in recent months. This could make bonds look less unattractive than

they have for the past two and half years, and potentially divert some fund flows away

from gold. The Fed's hikes are also driving up the dollar as global investors chase the

higher relative yield of US$ assets, and gold and US$ tend to move inversely.

We outlined earlier this year that we expected the gold price could hold up at around

its average of US$1,800/oz since 2020 this year, but that equity markets in general,

and the riskier junior miners specifically, would be under pressure, even with only

moderate rate hikes. However, we didn't expect to see such aggressive Fed moves,

and with them showing no signs of backing down, if US bond real yields head quickly

back up towards zero, we now expect that we could see further pressure on the gold

price short-term.

The junior gold miners could also have an even worse time of it than our earlier already

bearish expectations, as they are hit not only as part of a broader equity market

decline, one which is especially targeting small caps, but also if the gold price

continues to slide. In the end, however, these are likely to be short-term pressures,

mainly through the rest of 2022, as we expect that with the Fed generating such

fallout in stock markets and also in the economy, as expectations for a recession are

rising, that continued hikes may simply become politically untenable by 2023, and we

could even see a reversal to a looser monetary policy.

'Good' operational performance is no longer enough for the markets

In the meantime, there might be a better buy in price for gold coming up in 2022, and we would suggest that investors could safely avoid most of the larger TSXV junior miners for at least another few months as the equity market bubble likely continues to deflate. As we showed last week in our look at the larger TSXV-listed gold stocks, and further demonstrate this week in a look at the larger TSXV-listed base metals stocks, very few names have been able to sustain gains in this increasingly bearish market. To some degree this may make it easier to pick potential gainers, as they now must have truly 'outstanding' stories to support them, and there have proved to be just a handful of these within the large TSXV-listed junior miners this year. Even just 'good' operational performances, whether they are in form of solid drilling results or obvious forward motion on permitting and toward mine construction, have not necessarily been enough to sustain share prices since November 2021.

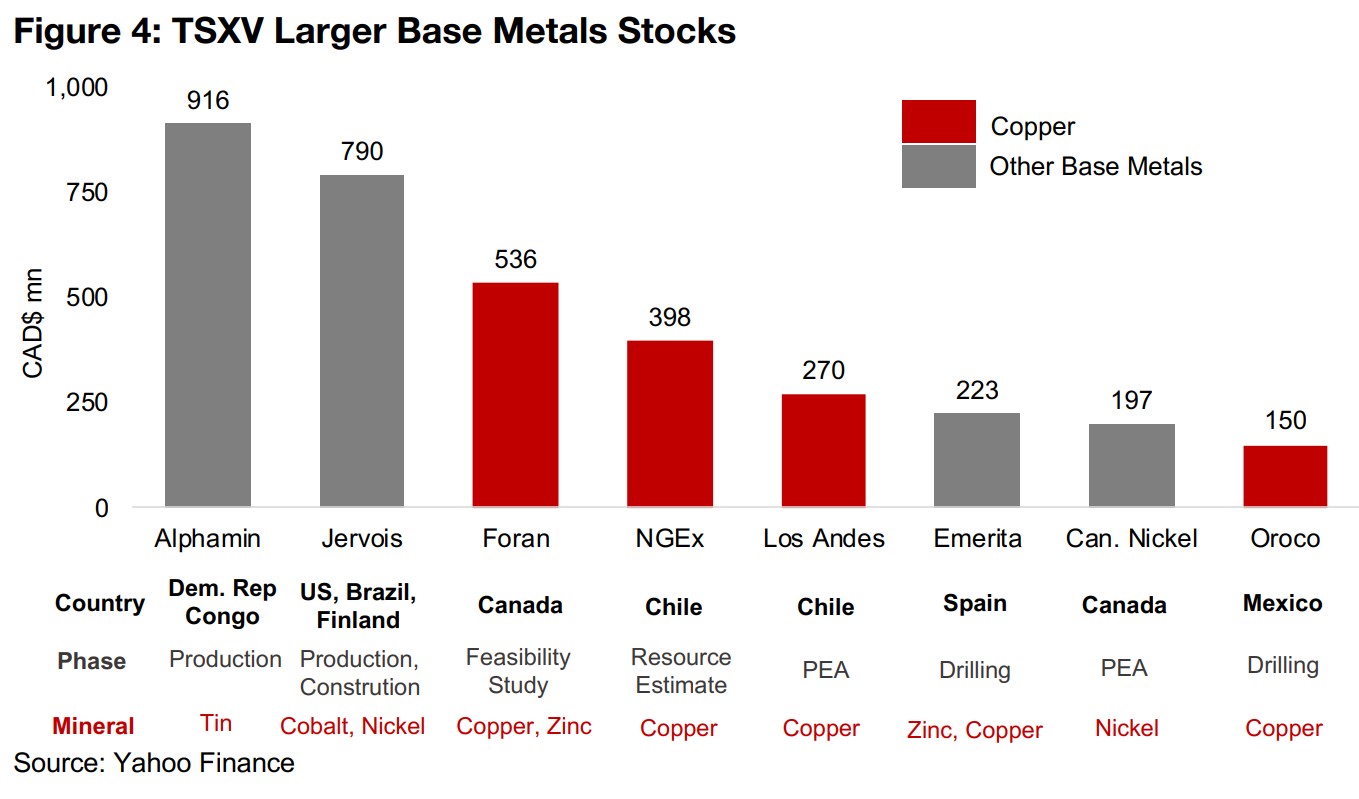

TSXV-listed base metals juniors pressured by underlying commodity price falls

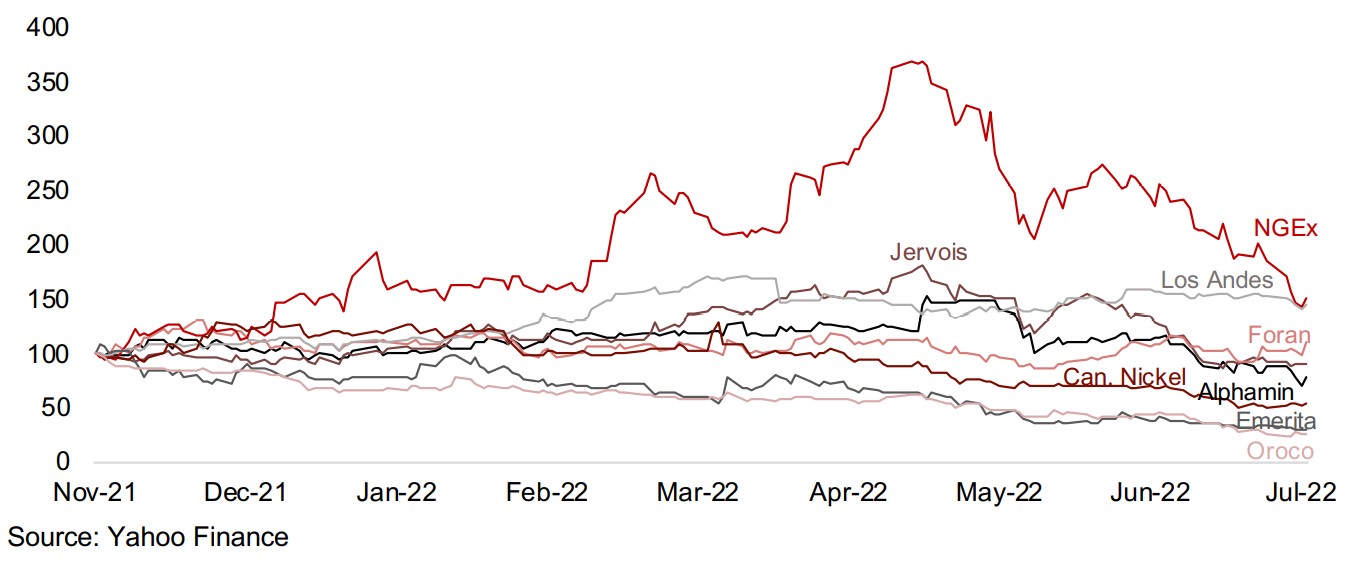

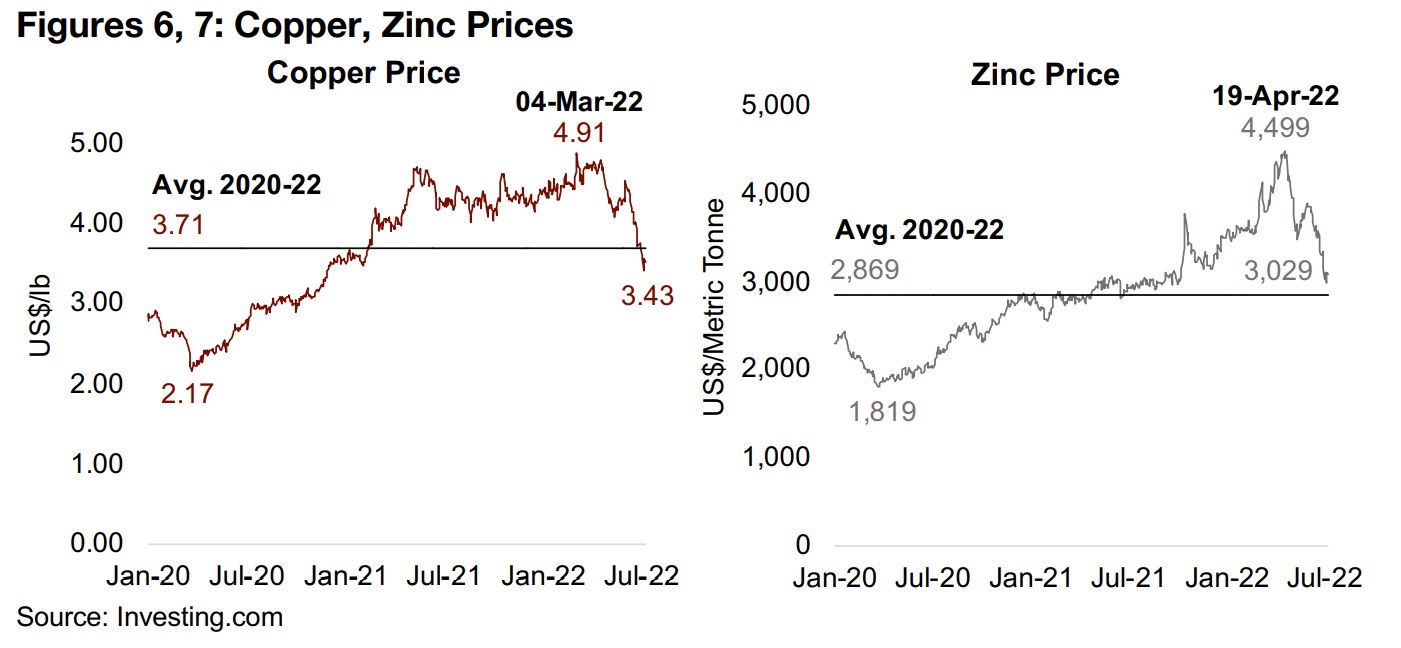

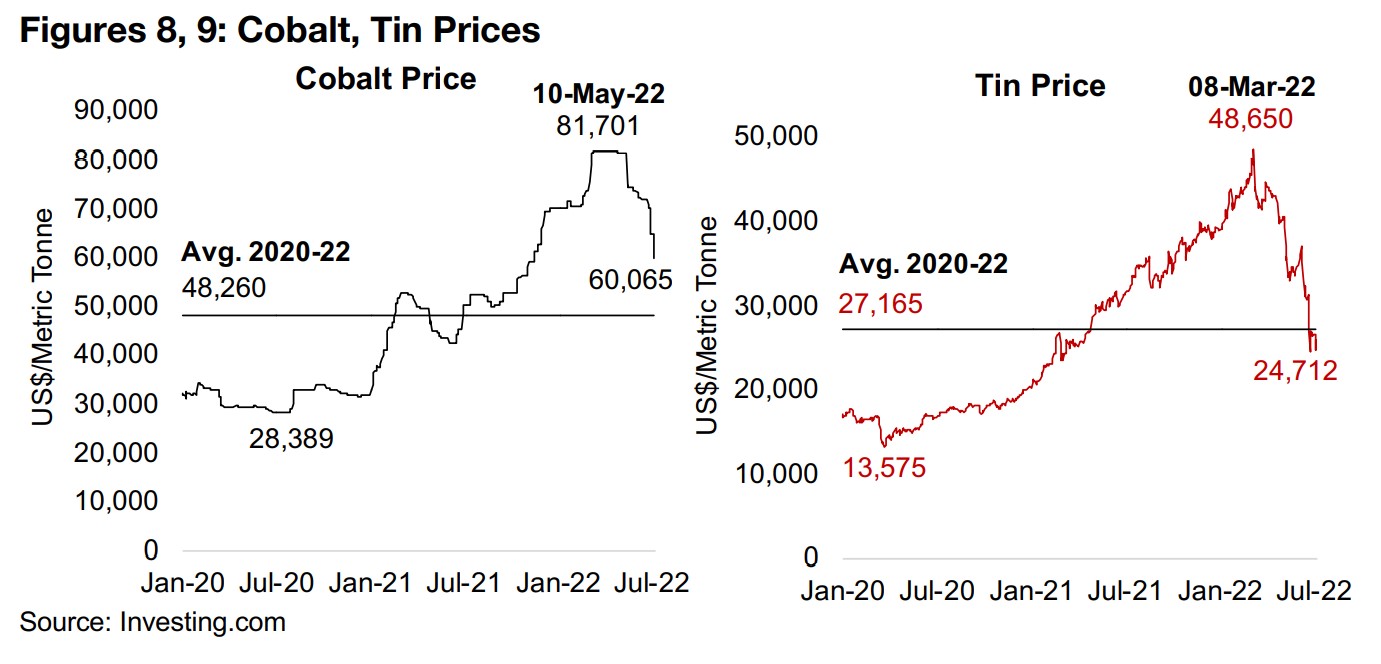

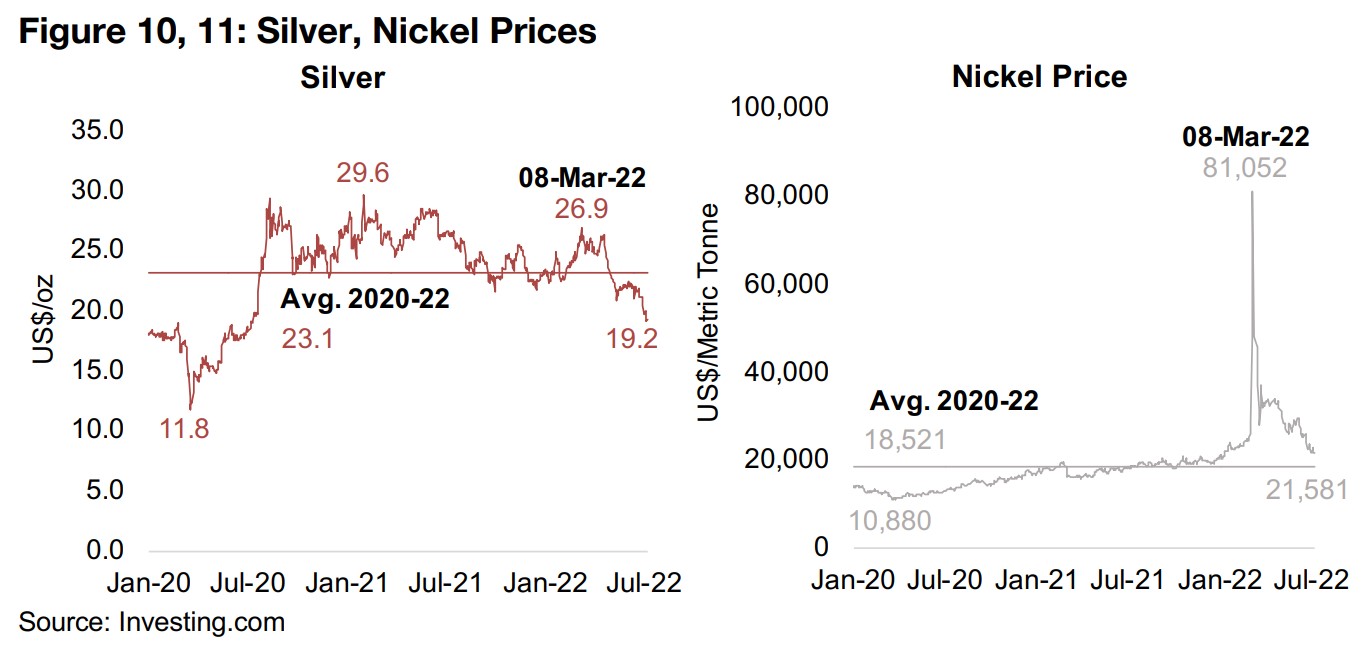

The largest TSXV-listed base metals juniors have seen a mixed performance since the equity market crash began in roughly November 2021, with only three out of the eight stocks shown in Figures 4 and 5 making gains. While the segment has not been spared by the overall equity market pressure, especially on small caps, the underlying base metals commodities prices have also all plummeted, with copper, silver, tin, zinc, nickel and cobalt all seeing substantial declines over the past three months. After the huge gains in all of these metals off their lows around March 2020, somewhere between March and May of 2022 the rebound wave clearly crested, and we expect that these metals prices may flatten at best this year, if not continue downward as fears of a recession grow, and actual data showing one is already underway could follow in the new few months.

NGEx and Los Andes see substantial gains, Foran a moderate rise

Nonetheless, there have been large TSXV-listed base metals stocks completely

bucking the downtrend and making substantial gains, foremost among them being

NGEx Minerals. The company, operating the Resource Estimate-stage Los Helados

copper project in Chile, is up 60.7% since November 2021, and had been up over

260% at its highs as late as April 2022. This has been driven by the strong copper

grade for the project, which has been supported by a series of very strong drill results

this year, including 0.74% CuEq over 875 m reported on April 26, 2022, 0.65% CuEq

over 1,016 m on May 16, 2022 and 0.74% over 1,290 m on May 24, 2022. However,

the stock has seen some offsetting pressure from a decline in the underlying copper

price off its peak on March 8, 2022 (Figure 6).

Los Andes was the only other stock in the group making substantial gains, up 43.6%,

and is also exploring for copper in Chile, at the PEA-stage Vizcachitas project. Similar

to NGEx, the stock has been supported by high-grade copper drill results, including

0.51% CuEq over 732 m on February 10, 2022, 0.50% CuEq over 1,177m on March

8, 2022 and 1.00% CuEq over 152 m on May 16, 2022. In contrast to NGEx, which

was clearly hit by the copper price decline, Los Andes has actually held up well even

over the past three months as its underlying commodity price has dropped,

suggesting that the market continues to strongly support the stock.

Foran Mining, operating the McIllvenna project copper-zinc project in Saskatchewan,

with a Feasibility Study reported in February, 2022, is up a moderate 11.0% since

November 2021, with the share price holding up well until downward pressure from

the copper price decline started in March 2022. The share price has been supported

by the advanced stage of the project, with the company announcing that it received

its initial permit to begin the exploration decline on February 15, 2022 and its Approval

To Operate permit for the decline on May 31, 2022. The company also reported a

new discovery near McIllvenna on June 8, 2022 and exploration results from Bigstone,

to the west, and Marconi, to the east, respectively, on June 28, 2022.

Jervois and Alphamin face moderate declines

Two companies have seen moderate declines, still outperforming the near -30% decline in the GDXJ ETF of junior miners. Jervois, focussed on cobalt at all three of its projects, a producing mine in Finland, a fully permitted mine under construction in Idaho, US, and the Sao Miguel Paulista Refinery in Brazil, which also processes nickel, is down -10.6%. The company had been up as high as 75% this year in April 2022 as the cobalt price remained strong well into May 2022, considerably past the point where the other major base metals started to decline (Figure 8). However, cobalt eventually also succumbed to the metals drop, driving down Jervois' share price. Alphamin, a major global tin producer in the Democratic Republic of Congo, is down -21.7%, as the tin price has collapsed -49.0% from its peak in March 2022, even as the company reached a record level of tin production in Q2/22 (Figure 9).

Canada Nickel, Emerita and Oroco see substantial falls

Canada Nickel, which operates the PEA-stage Crawford nickel sulphide project in

Ontario, is down -39.7%, as the huge spike in the nickel price this year on supply

concerns regarding Russia, to over four times the average since 2020, reversed over

the past three months (Figure 11). The stock was up only 27% since November 2021

at its maximum in March 2022, suggesting that the market was expecting the rapid

reversion back to the average nickel price that has occurred.

Emerita Resources, operating two projects in Spain, with drilling this year focused on

the Iberian Belt West zinc-copper-lead-silver project, is down -72.7%, in part

because of the decline in the prices of the metals underlying the project. However,

the company is also in a legal process regarding its Azancollar zinc-lead project to

determine if the company will eventually be able to proceed with exploration, which

has also likely put pressure on its valuation.

Oroco Resources, exploring the copper porphyry Santo Tomas project in Mexico,

where drilling has continued over H1/22, is down -75.9%. The company's share price

has trended down quite consistently since November 2021 and will have been hit by

the copper price decline since March 2022, and also seen pressure after it needed to

temporarily suspend drilling this year due to increased Federal military operations in

the area of its mine in June 2022.

While it is unclear whether we have seen the end of the drop in these base metals prices, all of them have already had a major mean reversion, with many heading for, or already below, their averages since 2020. However, even if these underlying metals prices do flatten out in the second half of 2022, we still expect to see further US rate hikes hit global markets and continue to drag down small caps, including the junior miners, continuing the trend we have seen so far this year.

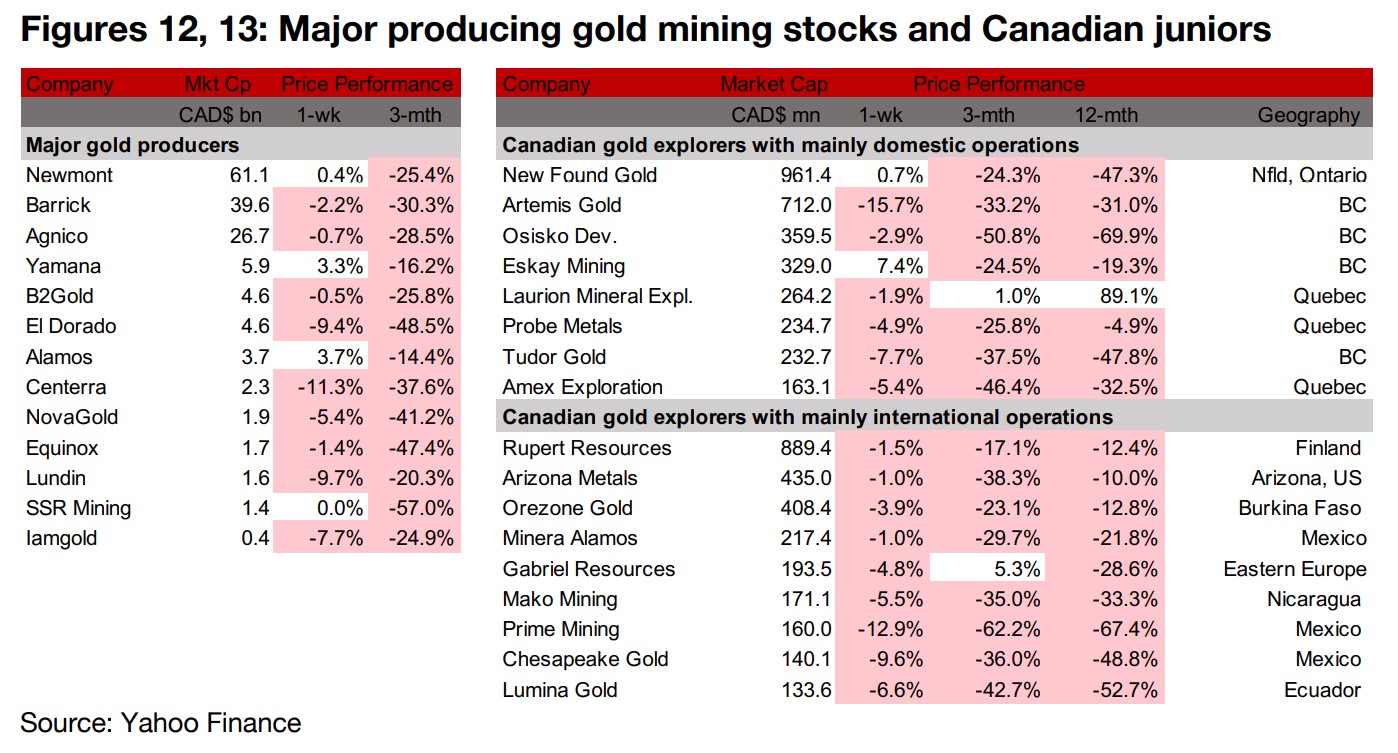

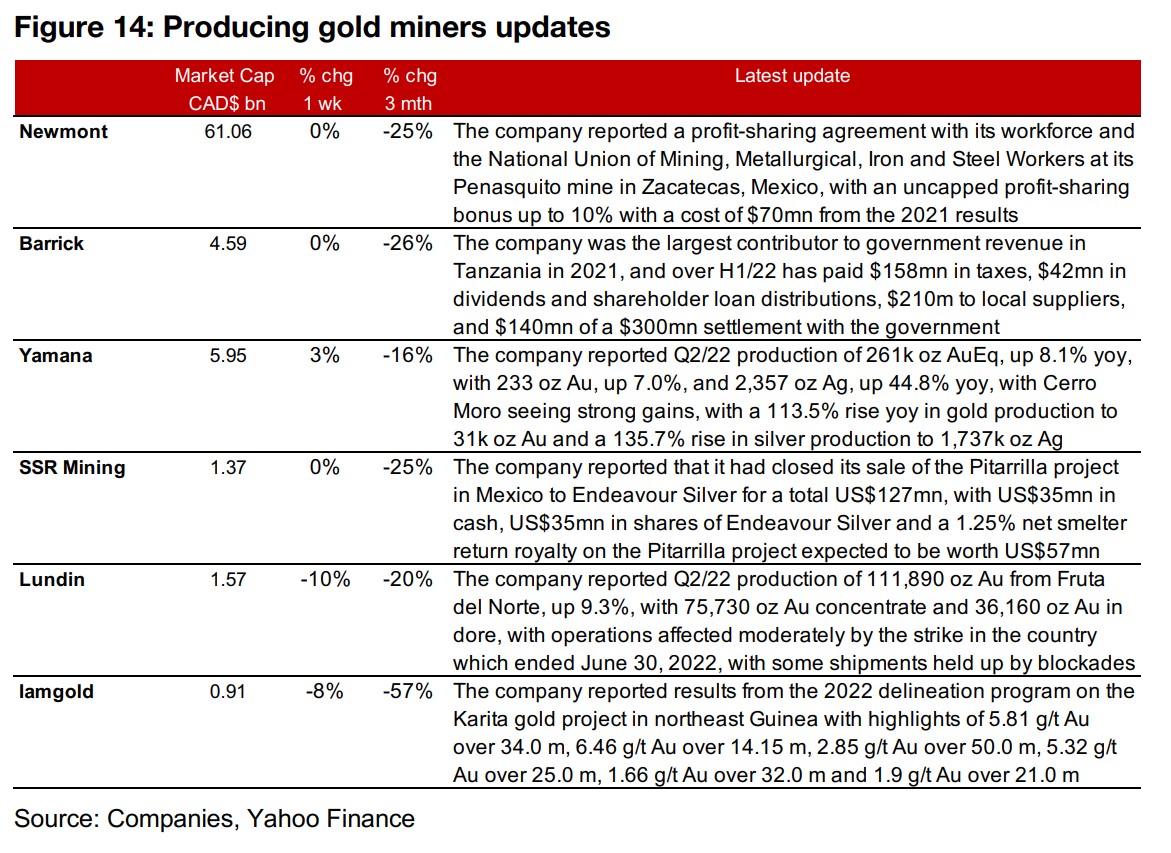

Producing miners mainly decline as gold drops

The producing gold miners were mostly down on the drop in gold (Figure 12). Newmont reported a profit-sharing agreement with its workforce and the local National Union at the Penasquito mine is Zacatecas, Mexico, Barrick reported that it was the largest contributor to government revenue in Tanzania in 2021 and also made substantial payments over H1/22 in taxes and other payments. Yamana and Lundin reported Q2/22 preliminary production, SSR Mining closed its sale of the Pitarrilla project to Endeavour Silver for a total US$127mn and Iamgold reported drilling results from its 2022 delineation program at the Karita gold project (Figure 14).

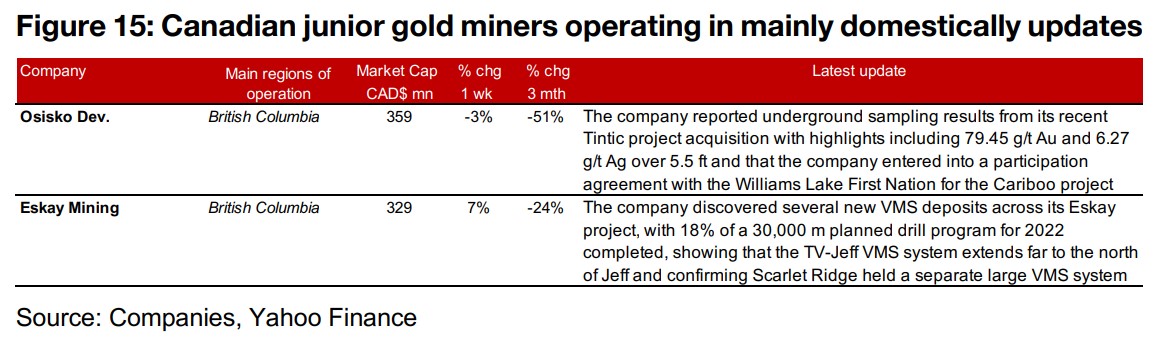

Canadian juniors almost all drop as gold falls

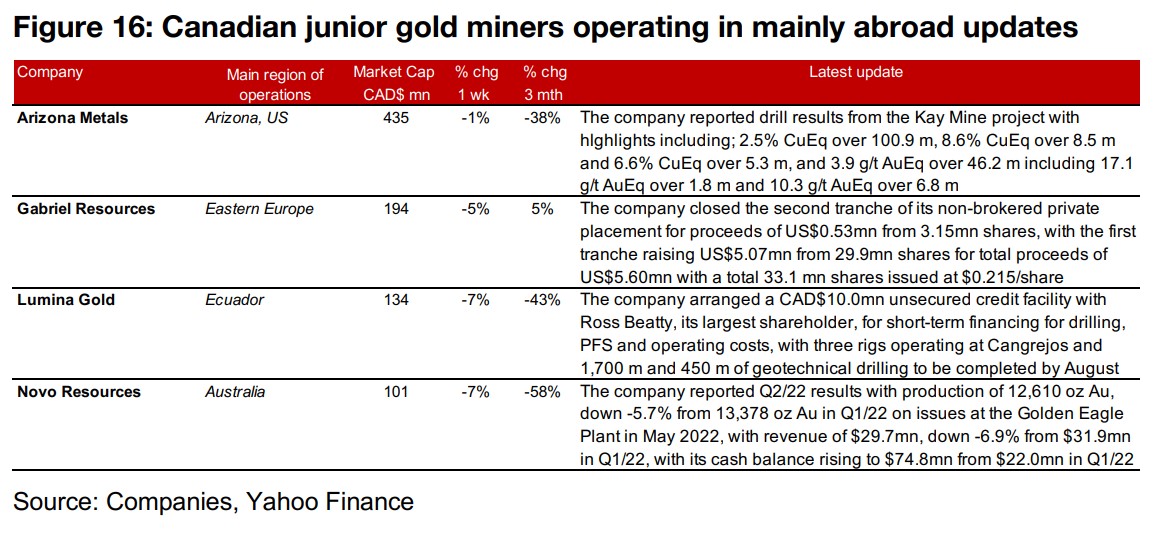

The Canadian juniors were almost all down as gold dropped, even with the continued gains in equity markets (Figure 13). For the Canadian juniors operating mainly domestically, Osisko Development reported underground sampling results from its recent Tintic acquisition and entered into a participation agreement with the Williams Lake First Nation for the Cariboo project. Eskay reported that it discovered several news VMS deposits across its Eskay project (Figure 15). For the Canadian juniors operating mainly internationally, Arizona Metals reported drill results from its Kay Mine project, Gabriel Resources closed the second tranche of its non-brokered private placement, with $5.60mn raised for the total placement, Lumina arranged a CAD$10.0mn unsecured credit facility with Ross Beatty, one of its largest shareholders, and Novo Resources reported Q2/22 results (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.