November 17, 2025

Big Gold Continues Earnings Rise

Author - Ben McGregor

Gold rebounds after two flat weeks

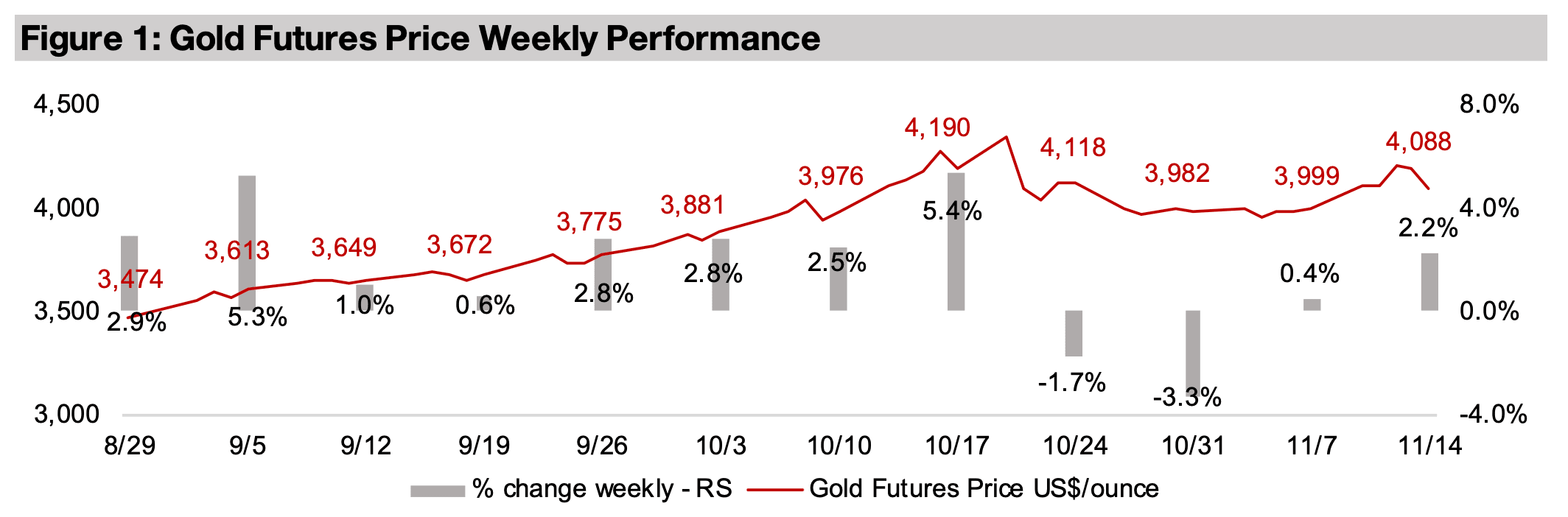

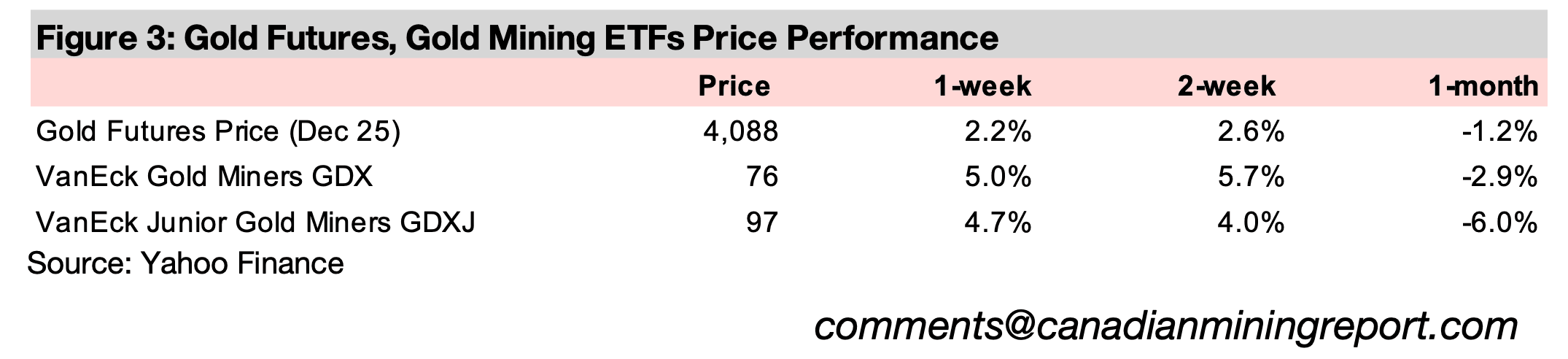

Gold rose 2.2% to US$4,088/oz, rebounding from two flat weeks following the metal’s first slump in four months, which may have been from hedging of a decline in equities, as there were no economic data releases likely to drive large market moves.

Big Gold Q3/25 earnings continues two-year increase

The largest gold producers reported Q3/25 earnings, continuing a two-year trend of qoq increases, with a significant jump in revenue yoy on the rising gold price, and net income surged for all the majors given strong leverage to the gain in the metal.

Big Gold Continues Earnings Rise

The gold price rose 2.2% to US$4,088/oz, rebounding from a flat two weeks following

the major pullback in the second half of October 2025. The metal price overall has

settled into a range around just under US$4,000/oz to US$4,100/oz for the past

month after a move from July 2025 to mid-October 2025 had gone increasingly

parabolic and had started to look unsustainable. That gold declined without sliding

into a severe downtrend indicates that the market continues to see fundamental

backing for the metal at the current level. While the silver price saw even stronger

gains, up 5.2%, platinum and palladium slumped, down -2.8% and -4.3%,

respectively, after they had seen even stronger gains than gold in mid-2025.

The rise in gold and silver seems to have been partly hedging of the decline in the

equity markets, given no major economic releases that would have likely driven the

move. The drop in stocks was mainly on a weak tech sector, where valuations

especially of AI companies have started to look excessive, while the fundamental

outlook for the industry appear to have weakened considerable. The market seems

to have started to focus more on the lack of profitability in the short to medium-term

across much of the AI industry, than the potential for very high growth long-term,

leading to comparisons with the dot.com boom and bust of the late 1990s early 2000s.

The base metals were relatively weak, with the copper and aluminum prices declining

by -1.1% and -1.5%, respectively, potentially on lower expectations for demand from

the tech sector, while the iron price was near flat. The tech decline pulled down the

Nasdaq -1.9%, and in turn the S&P 500, but by only -0.8%, indicating strength in

other sectors. However, the Russell 2000 dropped -2.6% showing that there was a

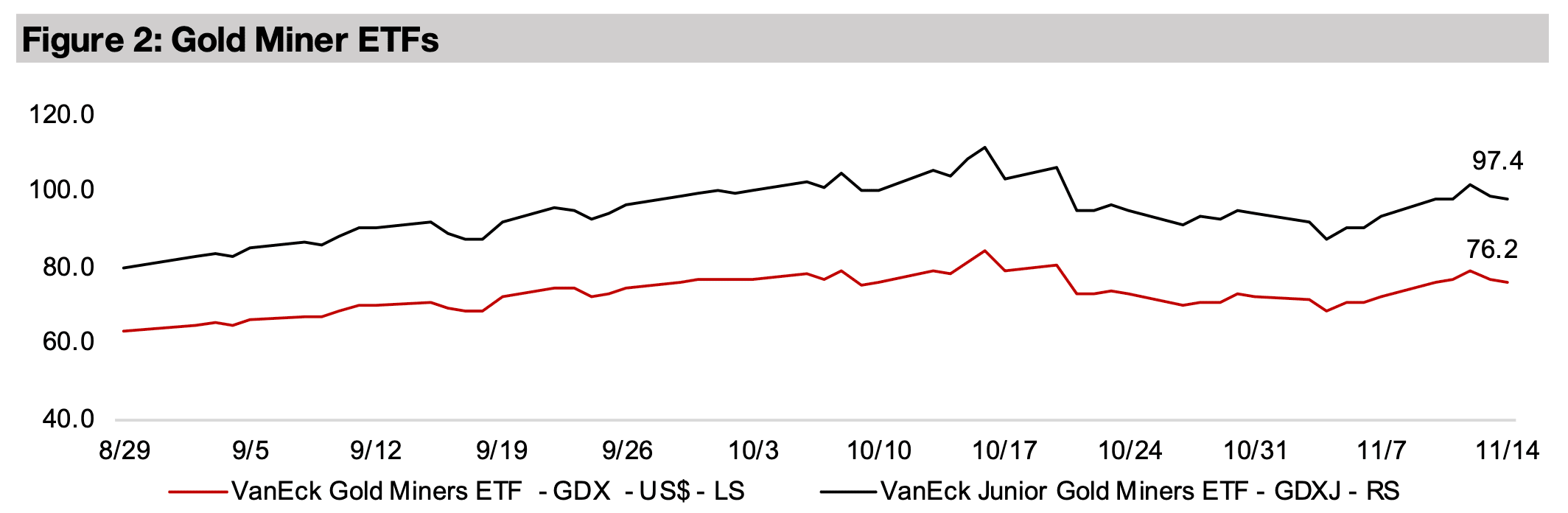

broader risk off move beyond just the tech sector. The gold stocks outperformed on

the metal price rebound, with the GDX up 4.7% and GDXJ gaining 5.0%.

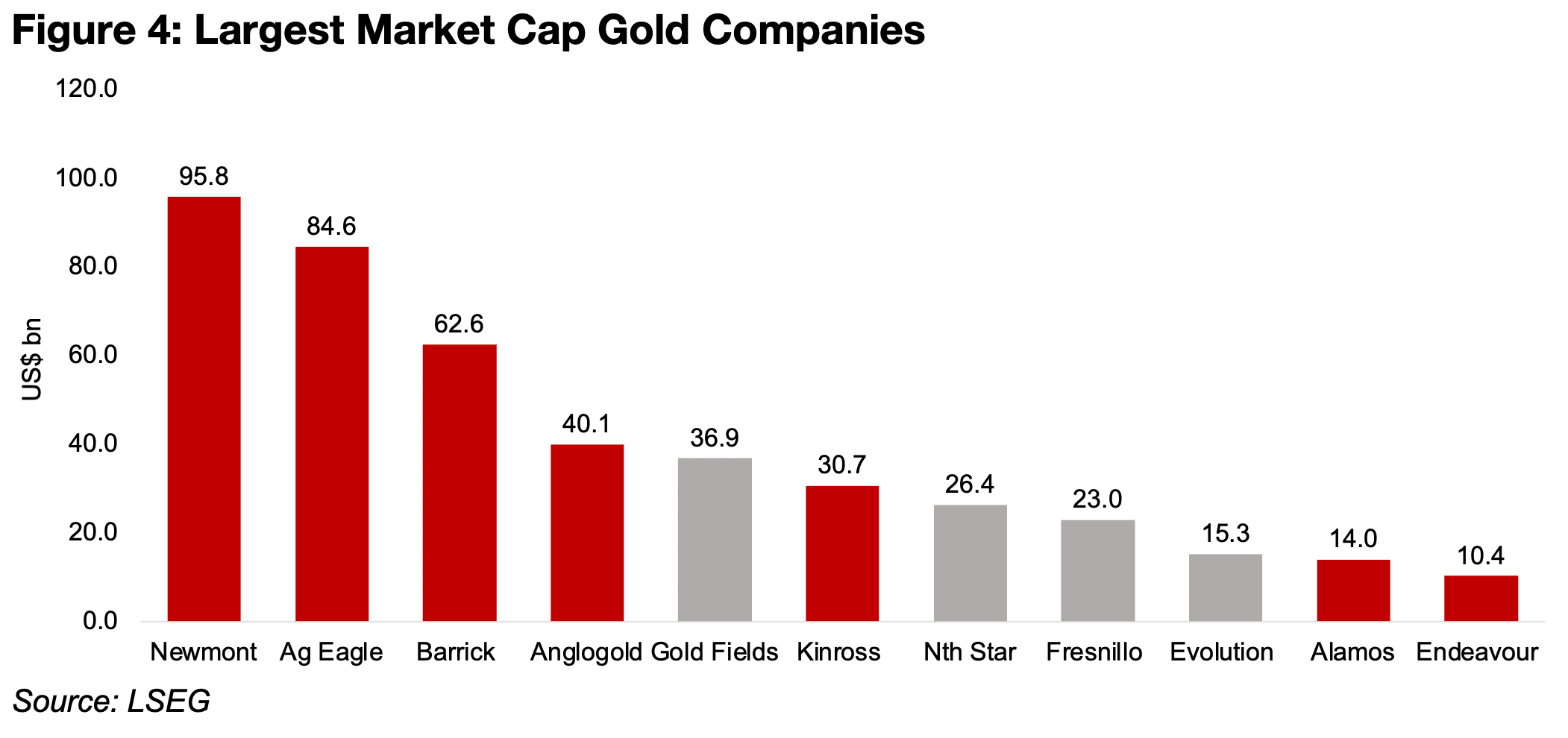

Largest gold producers see strong Q3/25 earnings

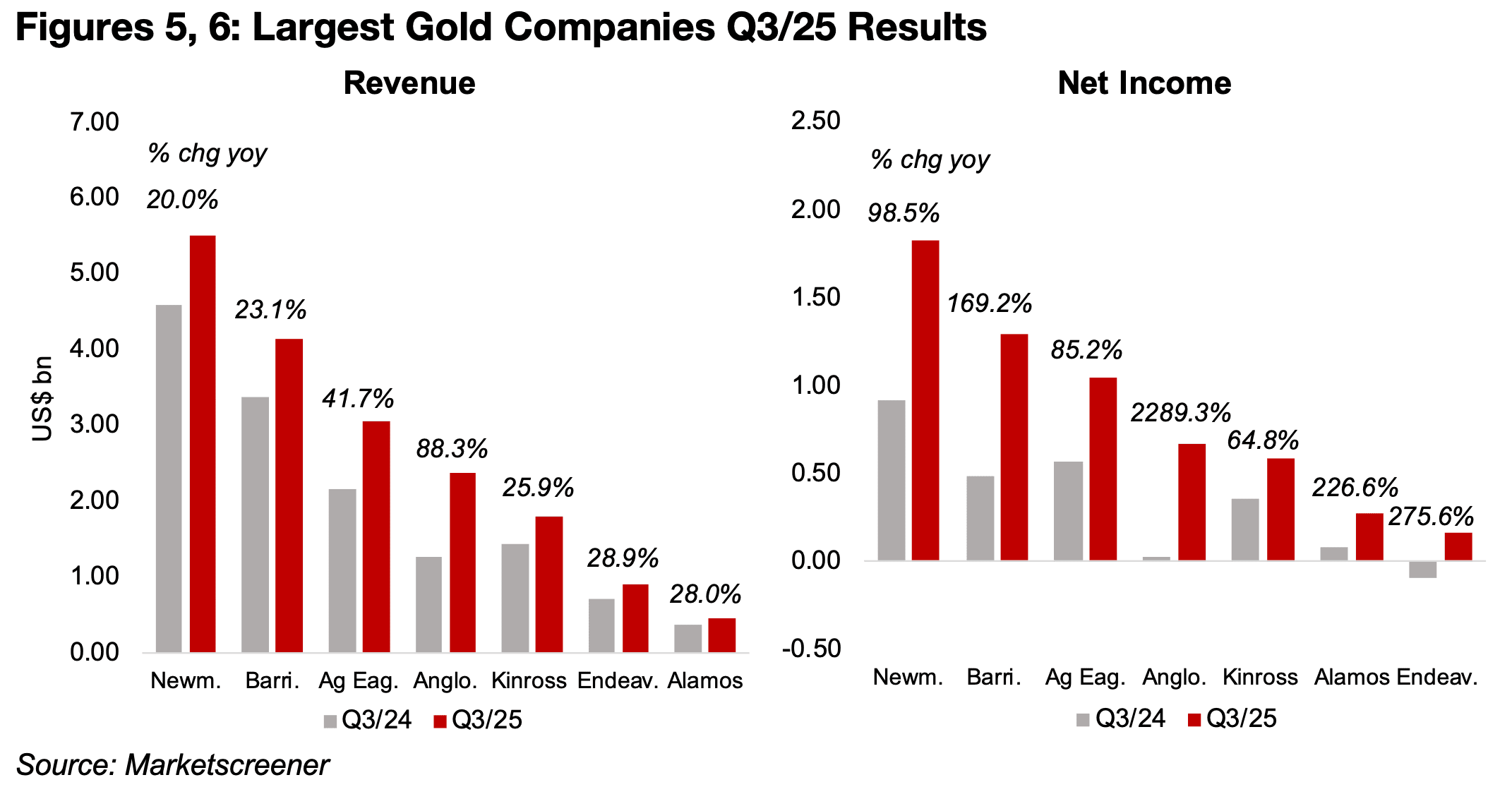

The largest global gold producers have now all reported their Q3/25 results with an unsurprisingly strong quarter given the high gold price and still relatively low inflation. Some of these companies only report half yearly results, including South Africa’s Gold Fields and Fresnillo and Australia’s Northern Star and Evolution Mining (Figure 4). However, seven of the top eleven gold companies by market cap had a release, including the top three producers Newmont, Agnico Eagle and Barrick. The revenue growth for most of the group ranged from 20%-30%, with Anglogold and Barrick standing out for increases of 88% and 42% respectively (Figure 5). The strongest net income growth yoy was from Anglogold, up over 2000%, but this was mainly because Q3/24 was low, near zero, with the next two highest gains from Alamos and Endeavor, with both up well over 200% (Figure 6). Both Barrick and Newmont saw strong increases in earnings, up around 100% and over 150%, respectively, and even the relatively moderate growth of Agnico Eagle, up over 80% and Kinross, rising about 65%, was still high.

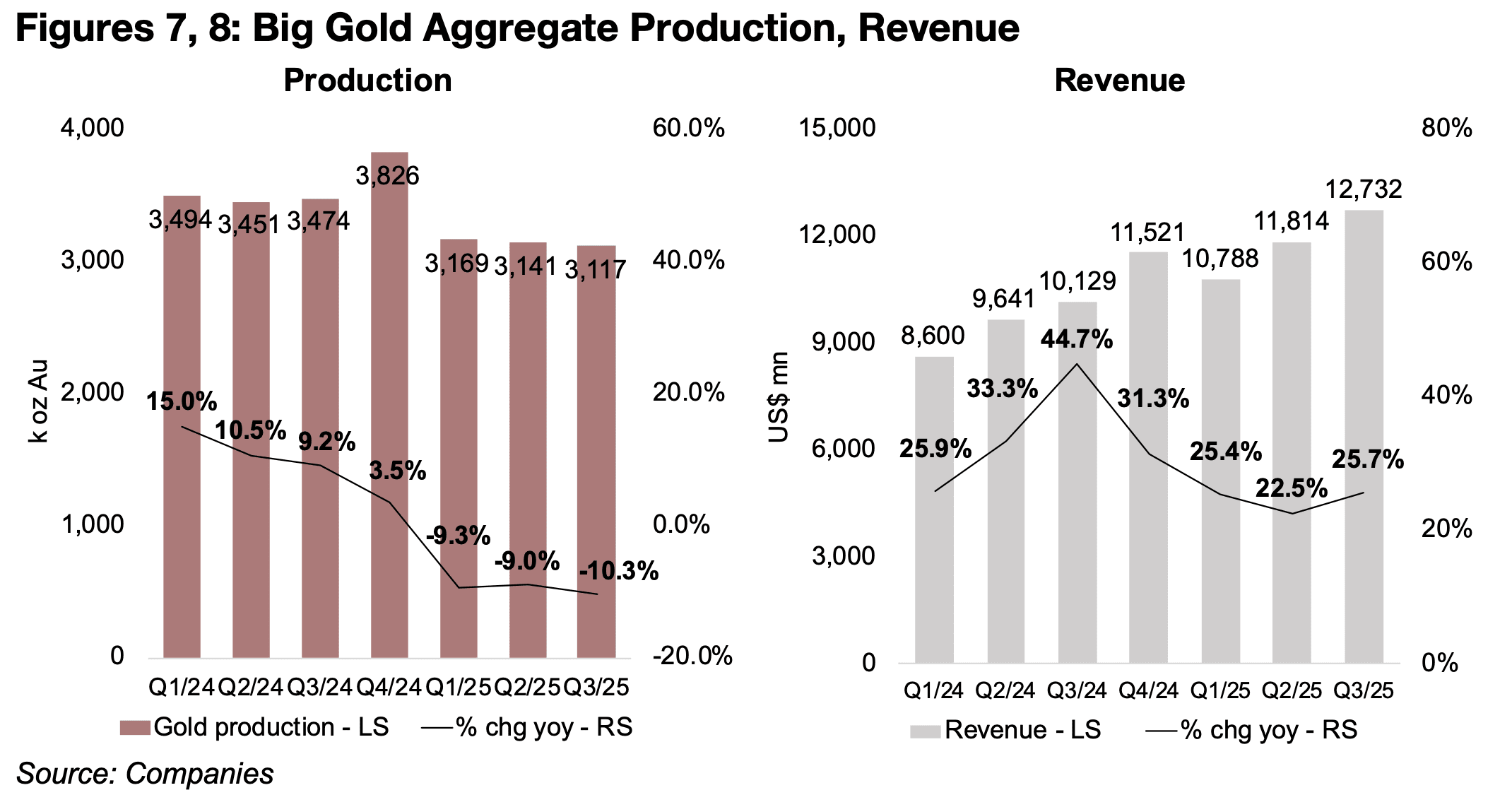

For Big Gold, including Newmont, Barrick and Agnico Eagle, gold production declined significantly in Q3/25, down -10.3% yoy, following falls of –9.3% and -9.0% over the first two quarters (Figure 7). Production growth has been weak this year compared to 2024, when it peaked at 15.0% in Q1/24 and slowed to just 3.5% by Q4/24. Gold output from the three companies peaked at 3.8 mn oz in Q4/24 and for the last three quarters has been around 3.1-3.2 mn oz. Revenue growth rose, however, on the gain in the gold price, to 25.7%, after trending down for three quarters from a peak of 44.7% in Q3/24 to a low of 22.5% in Q2/25 (Figure 8). The expansion of the topline has been consistently strong for since late 2023, with the most recent quarter of relatively weak growth in Q3/23 at 5.8%.

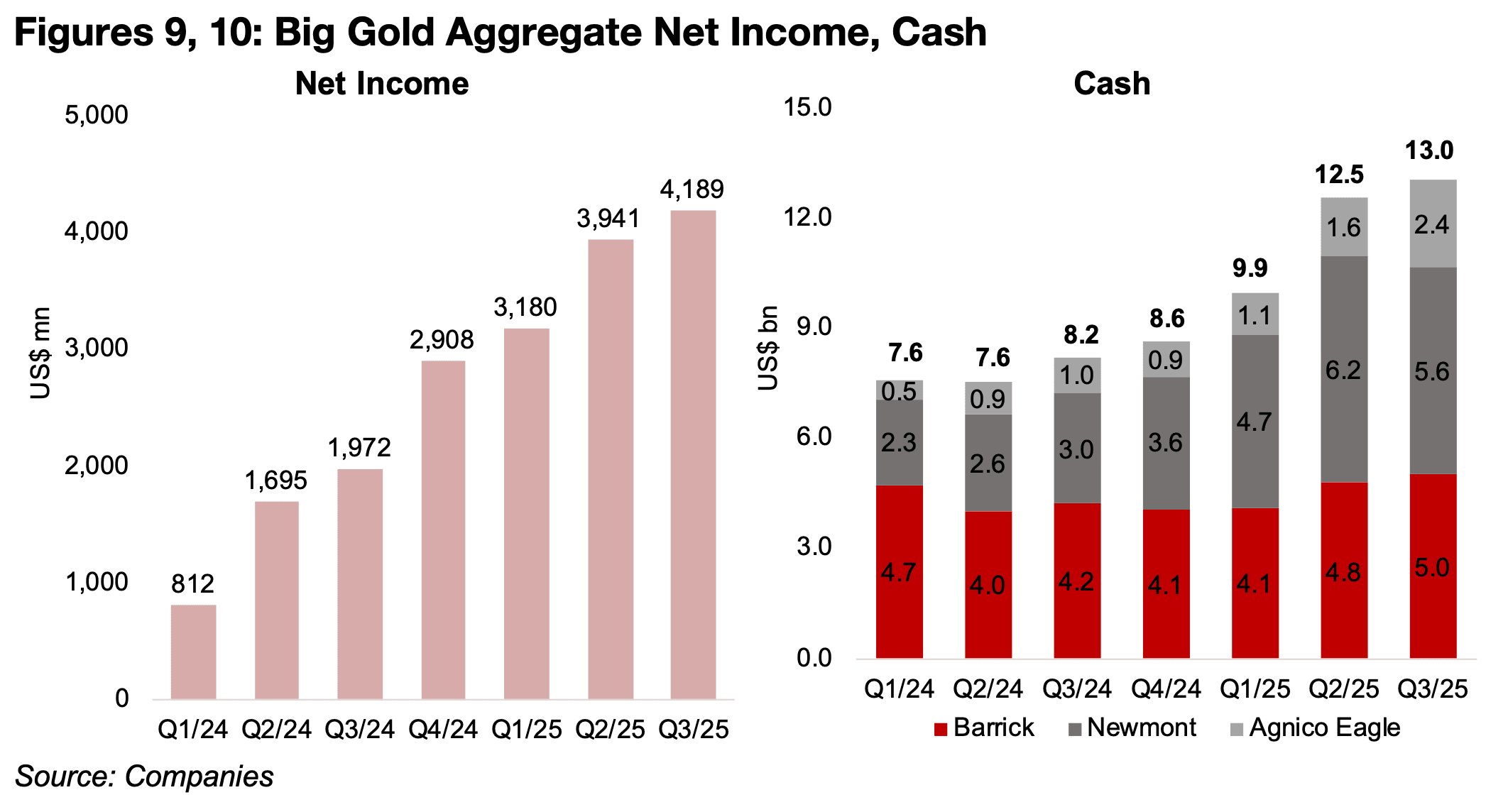

The revenue growth has flowed through to the bottom line, with net income surging for the seventh consecutive quarter to US$4.2bn, up from just US$0.8bn in Q1/24 (Figure 9). The large loss in Q4/23 was not generated from core operations, but from non-recurring items from some of the companies, and these issues had affected the three companies aggregate net income substantially to both the up and downside in 2022 and 2023. However, as there have not been any extremely large extraordinary items over the past two years, the sector’s net income increase has reflected mainly a strong core operational improvement.

The companies have built up substantial cash from the strong growth over the past few years, which has reached US$13.0bn, with Newmont at US$5.6bn, Barrick with US$5.0bn and Agnico Eagle US$2.4bn (Figure 10). This cash is already 25% of the total CAD$74bn TSXV Mining market cap as of September 2025, and excluding CAD$2.1bn Snowline Gold, which will soon graduate to the TSX, and the CAD$8.2bn Artemis Gold, which is also likely to move to the TSX, these companies could currently purchase nearly a third of the sector. This could support M&A especially for companies already producing or with more advanced development projects.

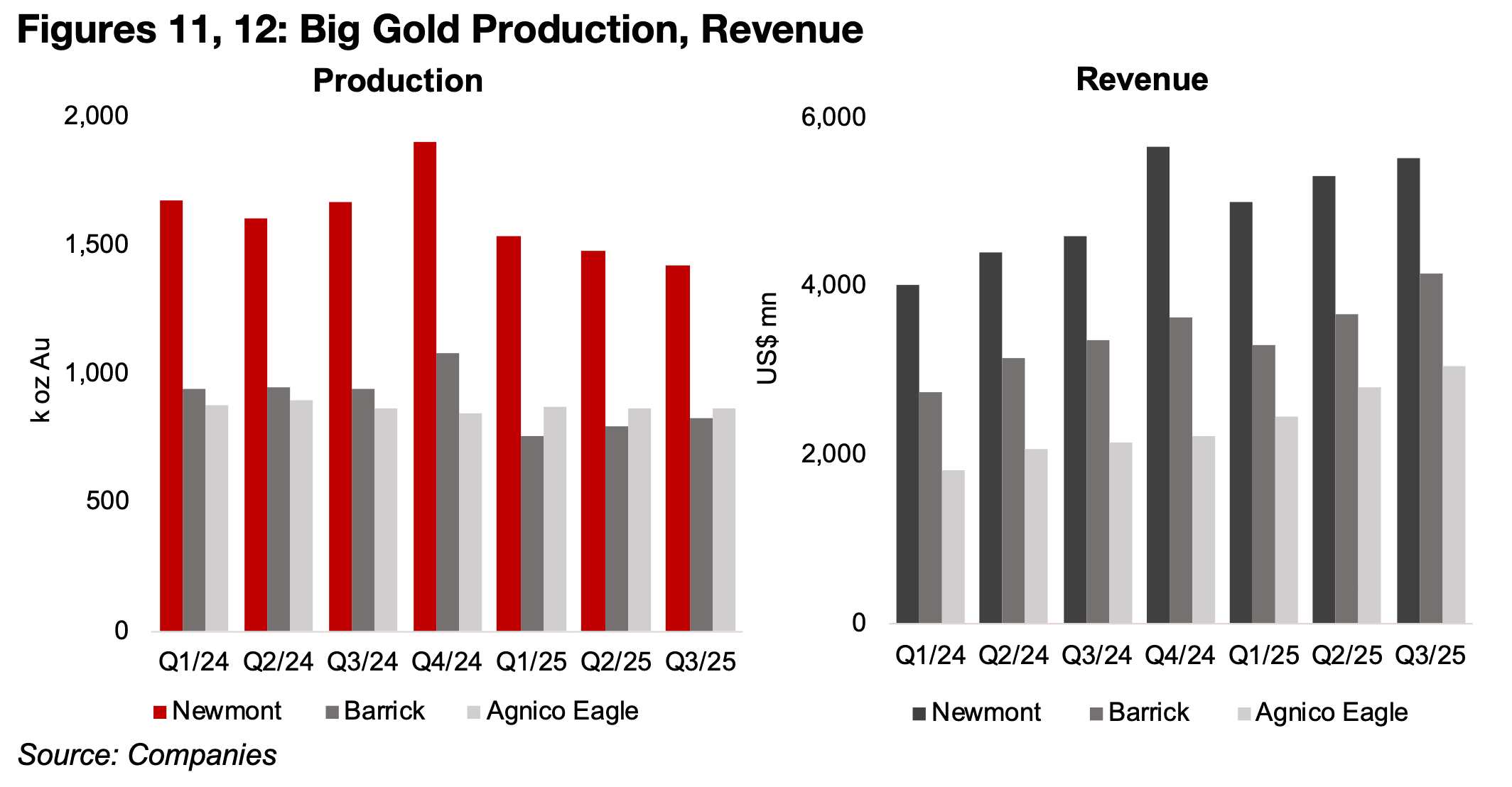

Production for Big Gold is still nearly half from Newmont, and its output has declined

over the past three quarters from a peak in Q4/24, and was down yoy in Q3/25 (Figure

11). Agnico Eagle has become the second largest producer this year, coming in

marginally ahead of Barrick’s output, although the former’s production has been

relatively flat this year and the latter has seen an increase. However, Newmont’s

revenue neared its Q4/24 peak in Q3/25, and both Agnico Eagle and Barrick set new

highs in the quarter (Figure 12).

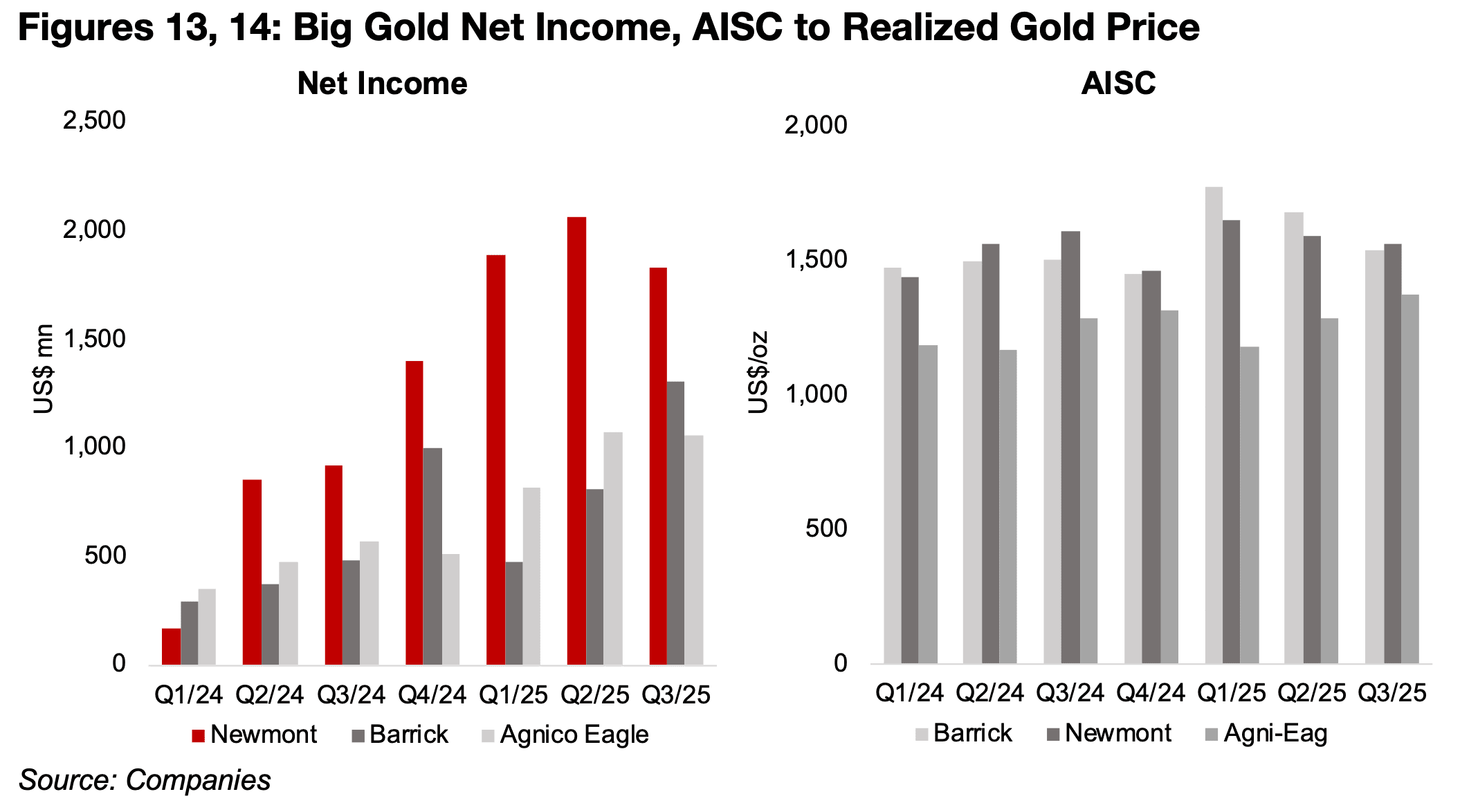

Net income for Newmont peaked last quarter, and was down in Q3/25 back to near

Q1/25 levels on the production decline, but profit for Barrick surged past previous

highs in Q4/24 and Agnico Eagle was near flat versus Q2/25 (Figure 13). The all-in-

sustaining-cost (AISC) per ounce for both Barrick and Newmont have actually

declined over the past two quarters from peaks in Q1/25 that had caused some

concerns over cost inflation, although Agnico Eagle’s AISC has increased over the

past two quarters (Figure 14).

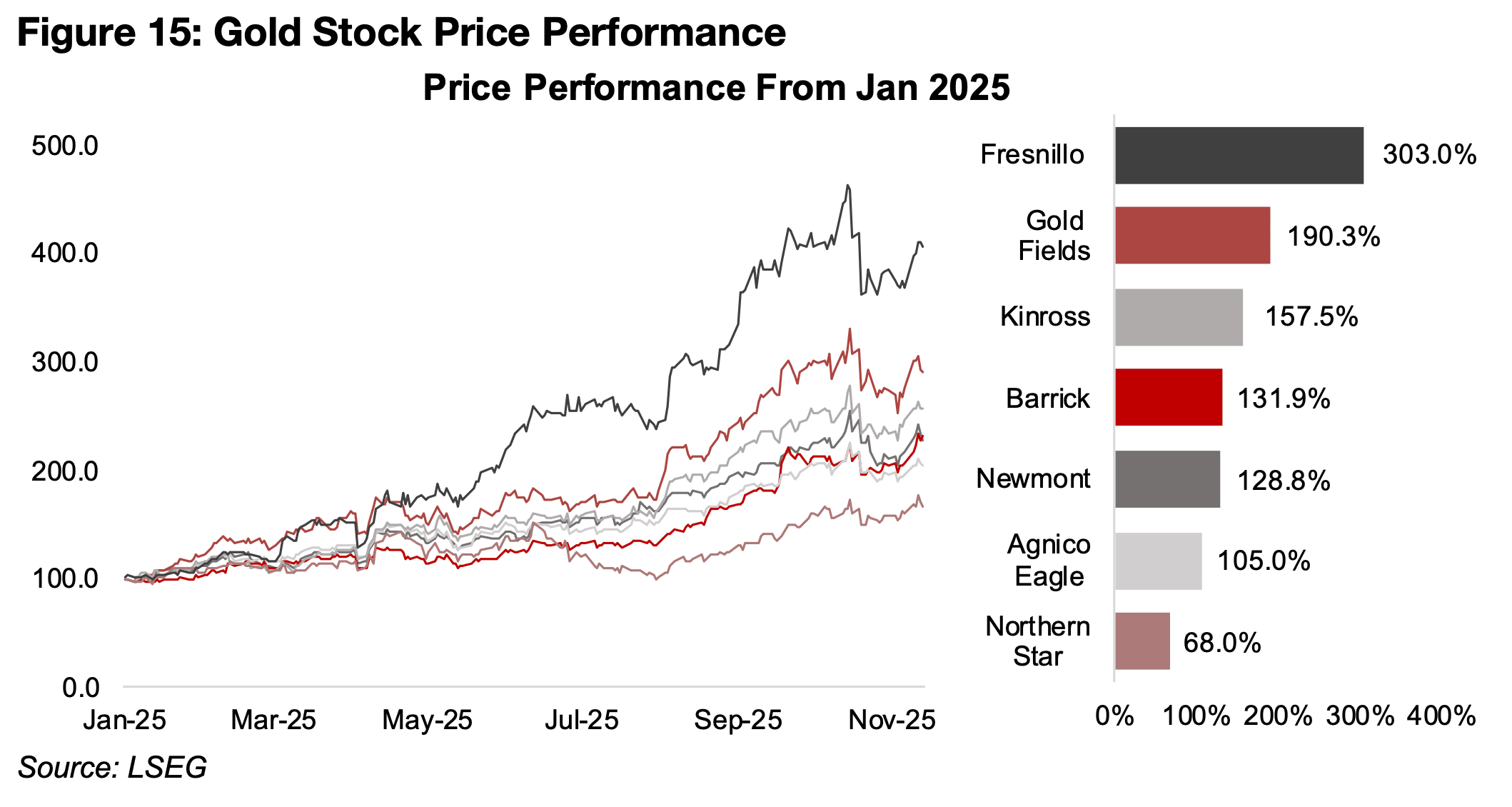

While the share prices of the largest gold companies pulled back significantly in the

second half of October 2025, most have recovered a substantial amount of these

losses. Although only two, Barrick and Northern Star, have reached new highs for the

year, most are down to only their levels of late-September 2024, with the decline

having proved to not be that severe. The South African producers Fresnillo and Gold

Fields have had by far the largest gains this year, up over 300% and 190%,

respectively, with Canada’s Kinross also having outstanding gains of nearly 160%

(Figure 15). Both Barrick and Newmont have seen similar increases in 2025, up

around 130%, and even the relative underperformers Agnico Eagle and Northern Star

have still seen major jumps, up over 100% and nearly 70%, respectively.

With the gold price averaging about US$4,050/oz so far for Q4/25, even assuming

another pullback, it could still average around US$3,900/oz, which would imply that

the large gold companies’ results for this quarter could also be reasonably strong,

assuming that there is no further major decline in aggregate production. While there

has been a decline in the AISC for two the big three gold companies, inflation has

been picking up and the cost per ounce of production could increase for Q4/25.

However, the gap between the realized gold price and AISC for these companies has

become so wide that it would take quite a severe drop in the metal and rise in costs

to close this to a level that is not significantly profitable for the large players in the

sector. The key drivers for the gold price remain an ongoing global monetary

expansion and high geopolitical risk, with neither appearing likely to be diminished

for the rest of the year and into early 2026. The case against gold would be a situation

like the mid-2010s with relatively strong economic growth but very low interest rates,

inflation and geopolitical risk, which has been very rare historically.

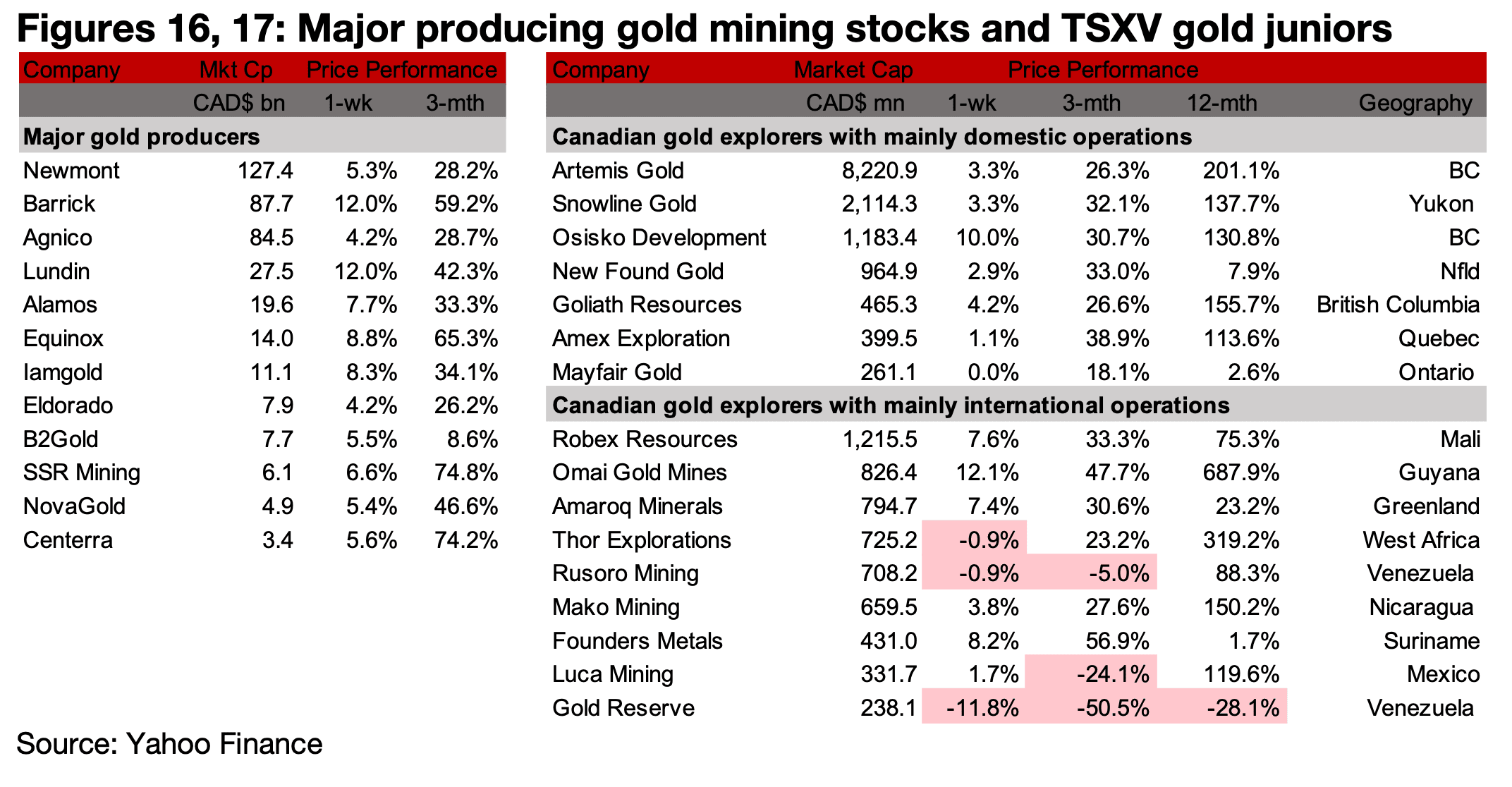

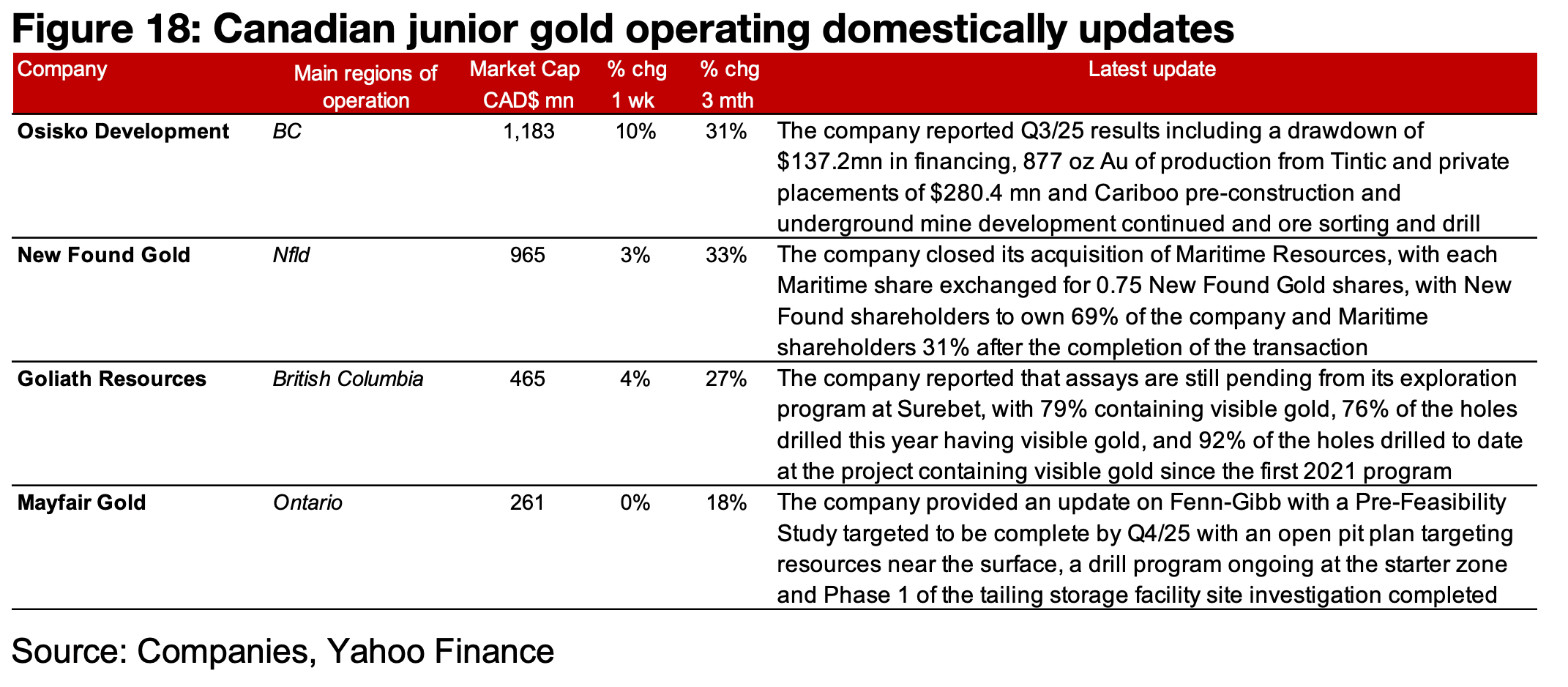

Major gold producers and most of TSXV gold rise

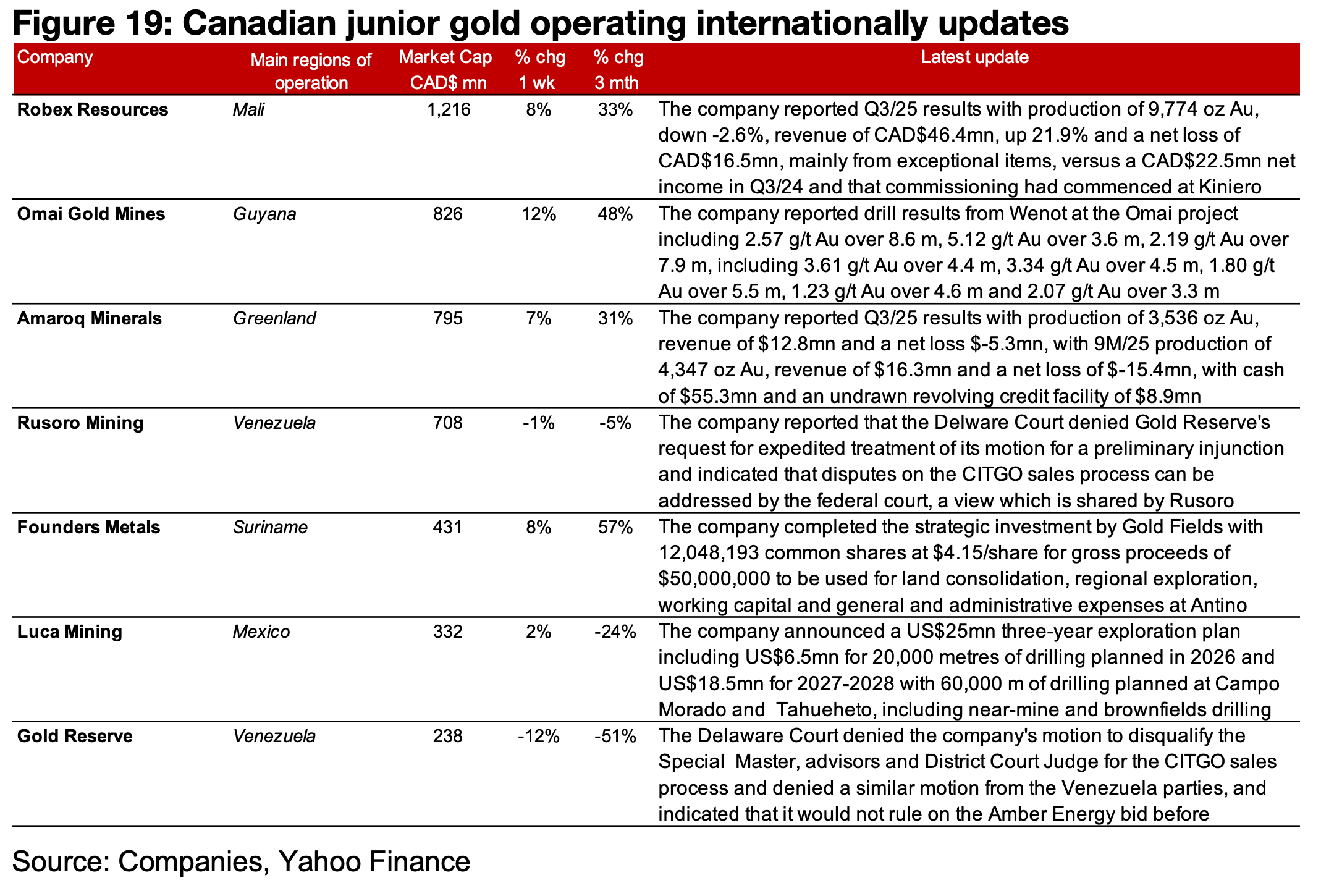

The major gold producers and the most of TSXV gold rose on the increase in the gold price (Figures 16, 17) For the TSXV gold companies operating mainly domestically, with Osisko Development reporting Q3/25 results, New Found Gold closed its acquisition of Maritime, Goliath announced pending assays from Surebet and Mayfair provided an update on Fenn-Gibb (Figure 18). For the TSXV gold companies operating mainly internationally, Robex and Amaroq reported Q3/25 results, Omai announced drill results from Wenot, Rusoro and Gold Reserve reacted to the US Delaware Court decision on the CITGO sales process, Founders completed the strategic investment by Gold Fields and Luca announced a US$25mn drill program over the next three years (Figure 19).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.