February 17, 2026

Big Gold’s Q4/25 Starts Huge

Author - Ben McGregor

Barrick, Agnico Eagle report extremely strong Q4/25 results

The reporting season for Big Gold started with Barrick and Agnico Eagle releasing Q4/25 extremely strong results as the gold price surged while cost inflation remained low, driving up margins and seeing the companies accumulate substantial cash.

Big Gold’s Q4/25 Starts Huge

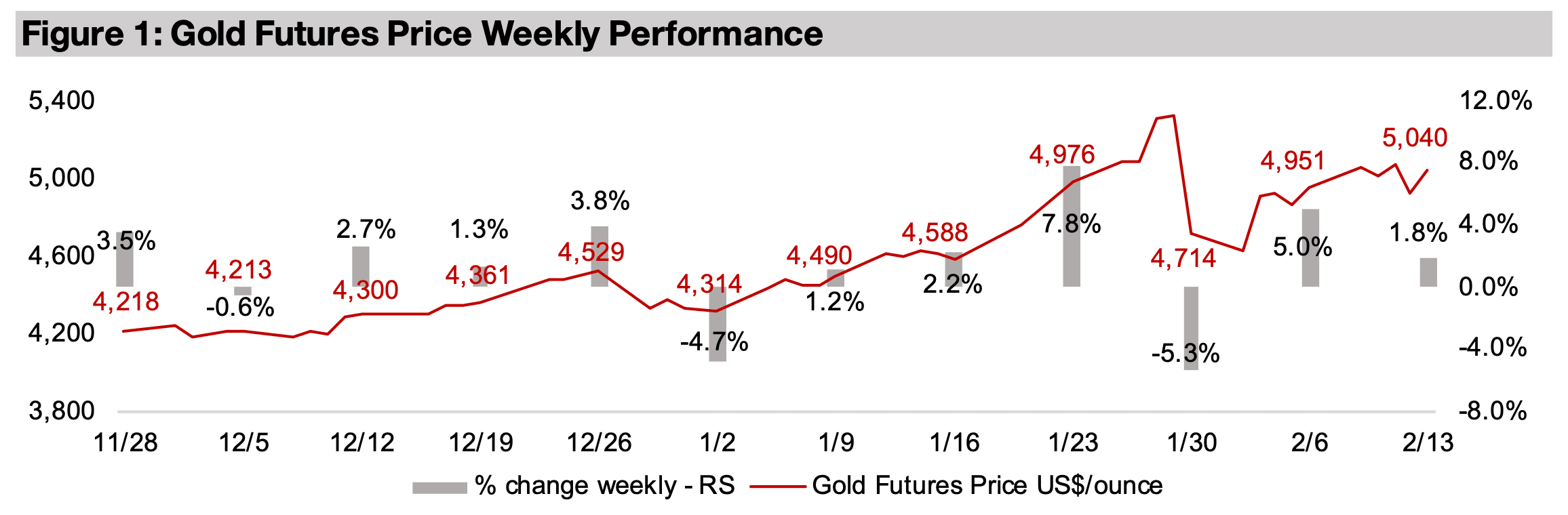

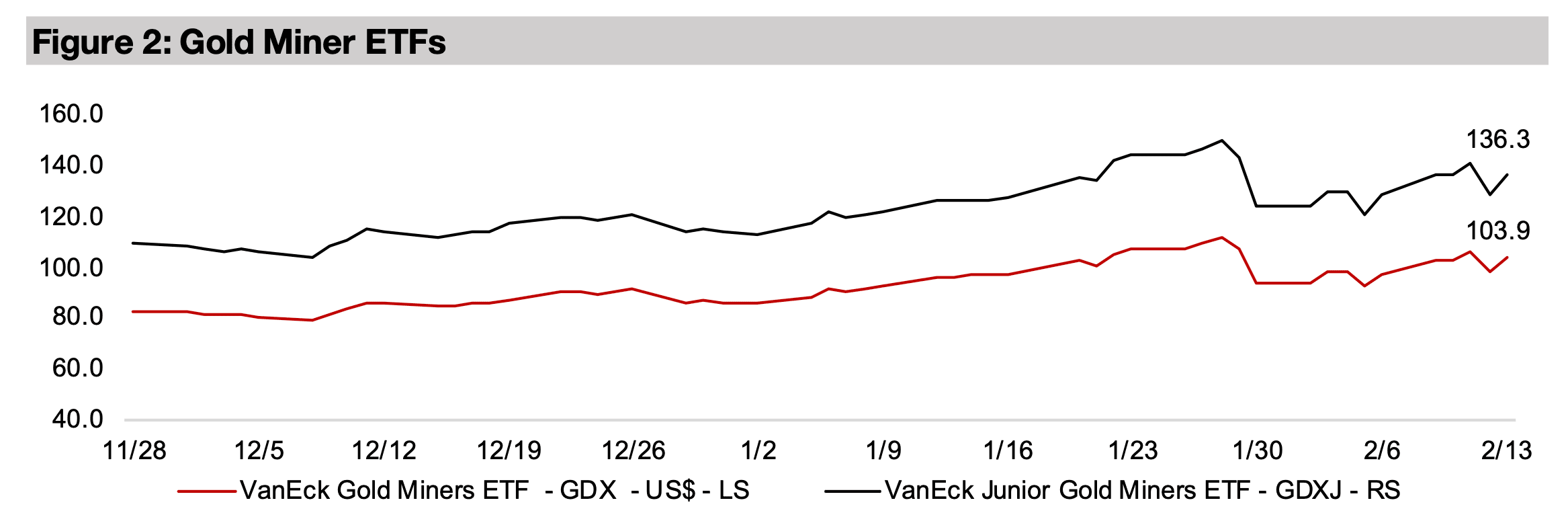

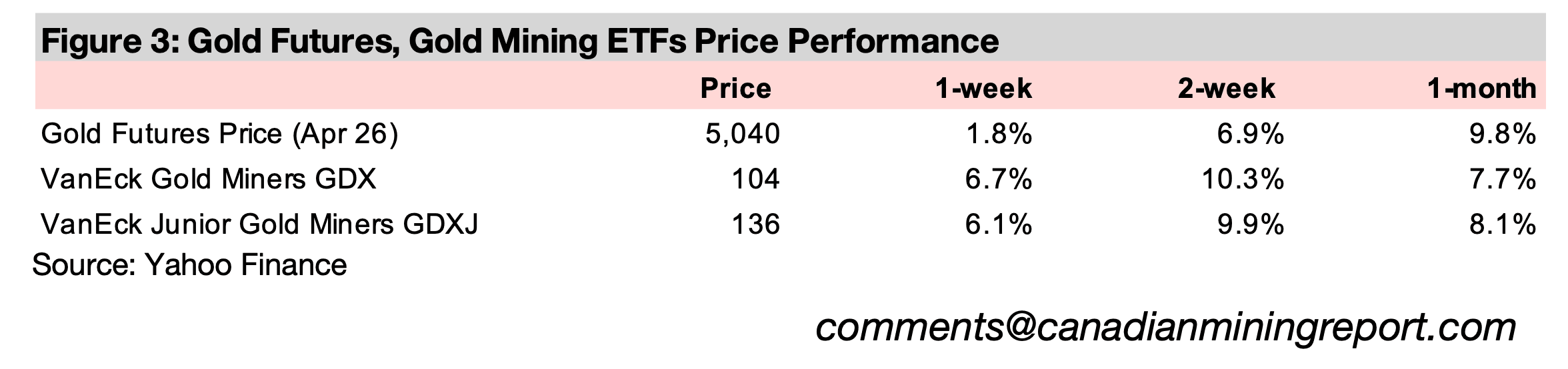

The gold price rose 1.8% to US$5,040/oz, after dropping below the key US$5,000/oz

for just a week. This was partly driven by January 2026 US CPI inflation that came in

below consensus estimates, which boosted expectations for further potential rate

cuts. While typically this would be expected to also boost equity markets, they

declined significantly, with the S&P 500 down -1.2%, the Nasdaq dropping -1.8%

and the Russell 2000 losing -0.8%. This was driven especially by a continued slump

in the software sector, with markets expecting that AI could take over a considerable

proportion of its function.

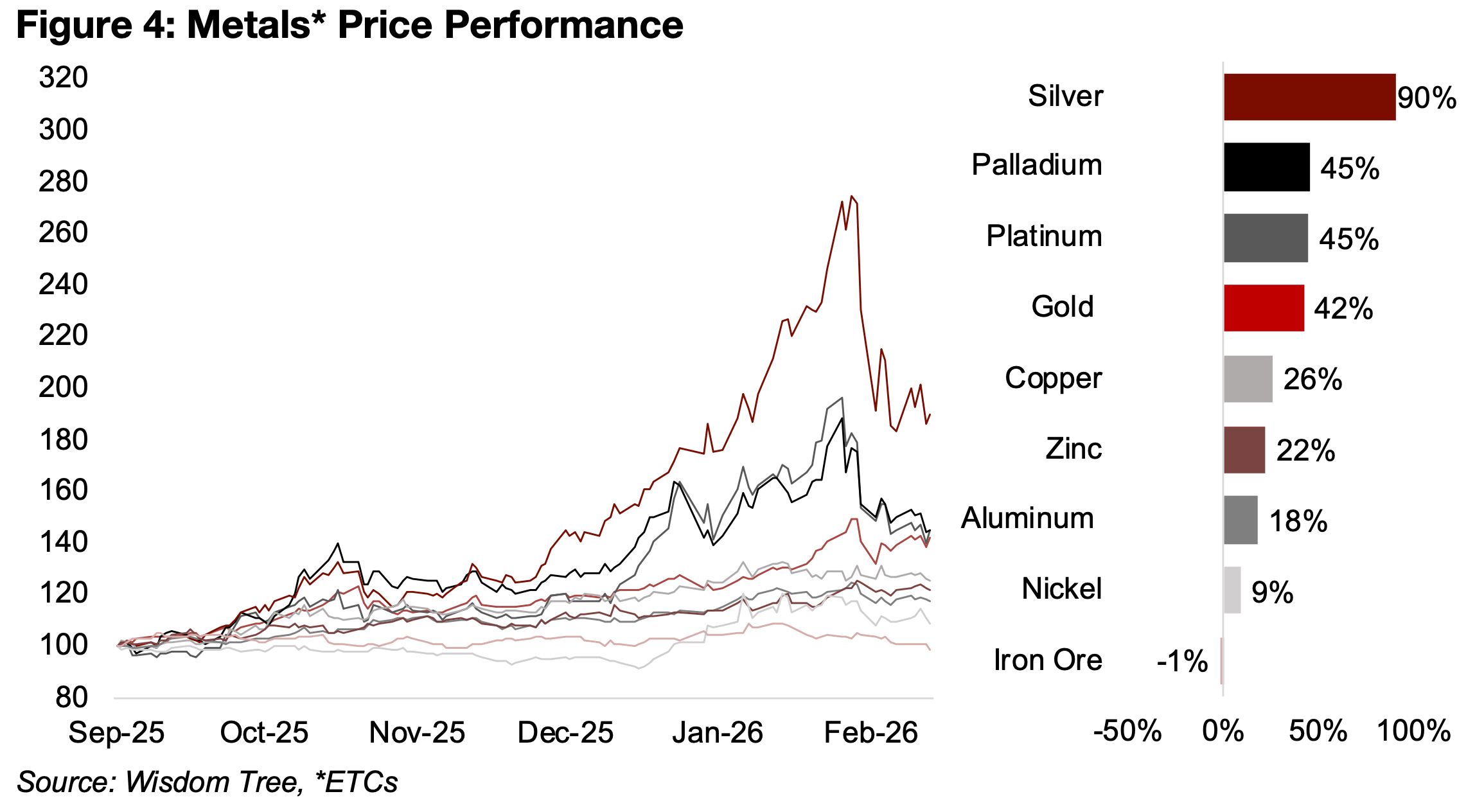

Silver continued to decline, with the spot price down -5.2%, although its ETC actually

gained 3.6%, as these instruments can differ from spot prices, especially in markets

with the type of severe distortion currently the case for the metal (Figure 4). This still

leaves silver’s performance since September 2025 up 90%, over twice gold’s gains

of 42%, although the gold to silver ratio remains far above the medium-term average,

and implies that silver could come down further. However, the gains in palladium and

platinum have converged down towards gold, after declines of -0.3% and -3.3% over

the past week, seeing both metals up 45% since September 2025.

US headline CPI inflation for January 2026 was 2.39%, the fourth consecutive month of decline from the most recent peak of 3.02% in September 2025. Core inflation also dropped to 2.51%, with it resuming an overall down trend off the most recent highs of 3.11% in 2025, which only paused briefly in December 2025 when the rate rose slightly mom to 2.65%. There had been some market concern over rising inflation over H1/25, but these pressures seem to be subsiding.

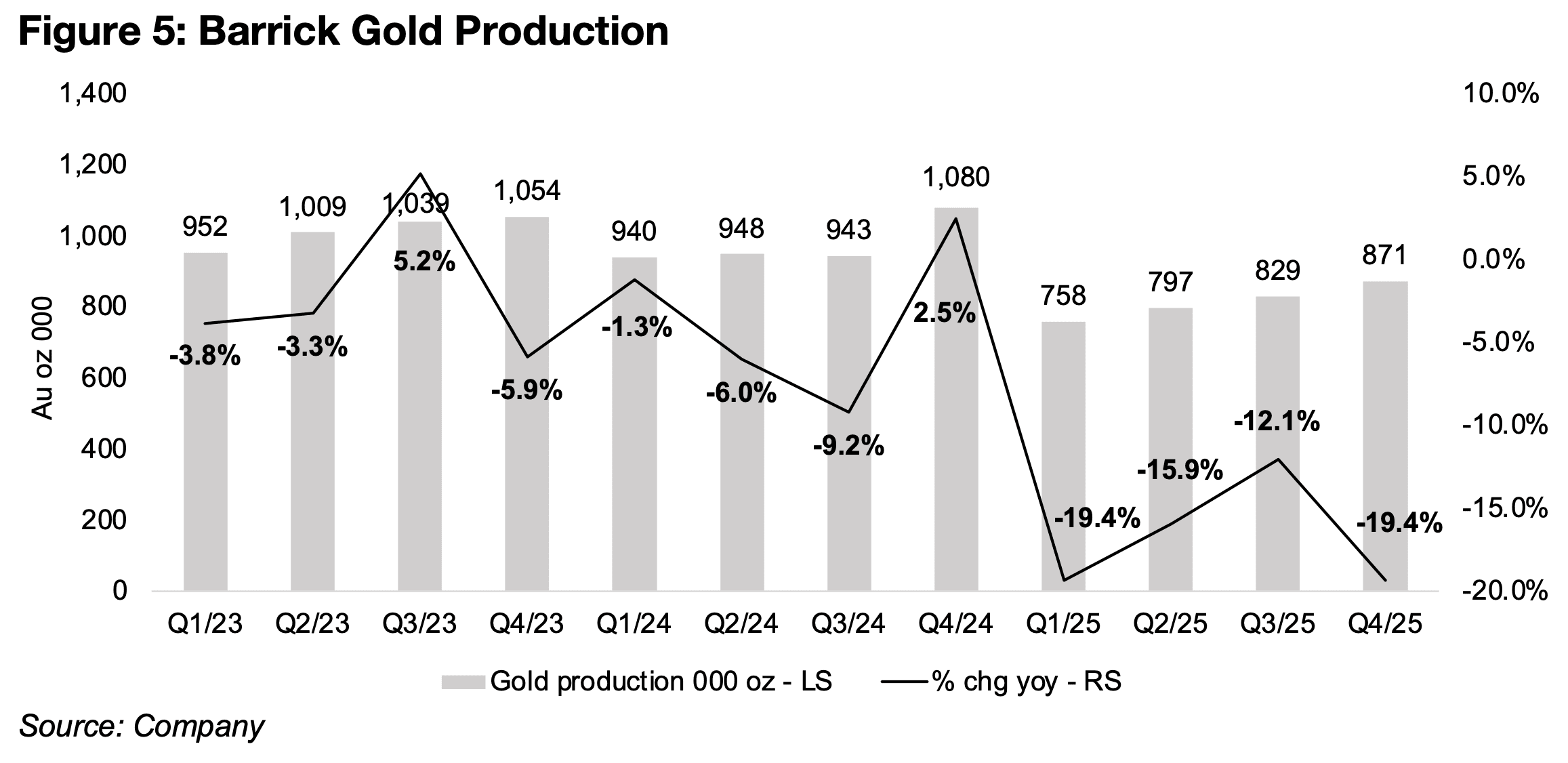

Barrick’s drop in production far offset by surging gold price

The results season for Big Gold’s Q4/25 has started, with two of the three giants,

Barrick and Agnico Eagle both reporting, and the third large player, Newmont,

expected to report this week along with most of the other majors. Barrick’s

production growth in Q4/25 was weak yoy at -19.1%, and has contracted

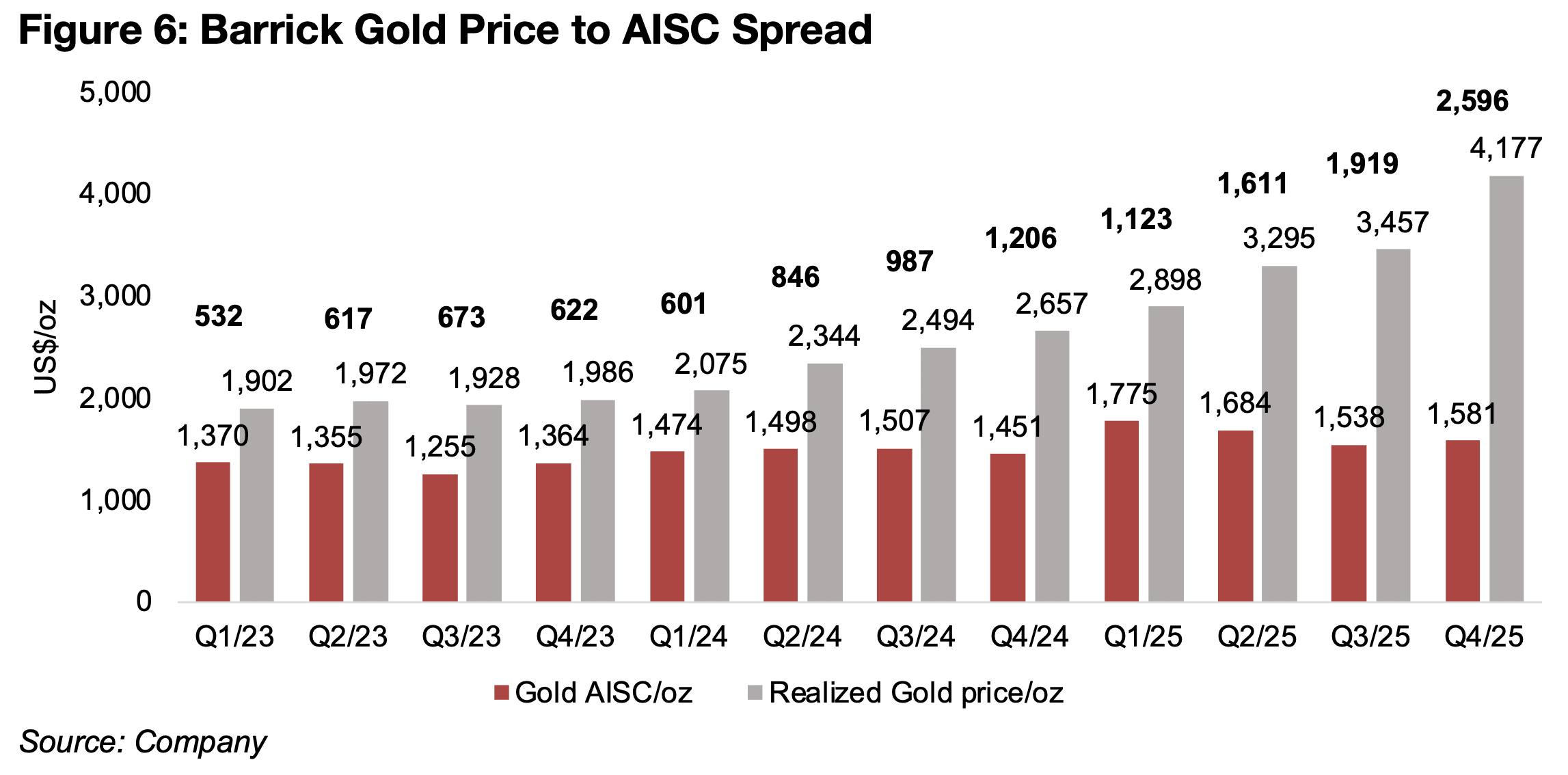

substantially for the past four quarters (Figure 5). However, this was far offset by a

jump in the realized gold price, which jumped to US$4,177/oz, up over US$1,500/oz

yoy and over US$700/oz versus even just the last quarter (Figure 6). The all in

sustaining cost (AISC) per ounce rose just US$130/oz yoy and US$43/oz, in contrast,

driving a huge widening of the realized gold price versus AISC spread to US$2,596/oz

versus US$1,206/oz in Q4/24 and US$1,919/oz in Q3/25.

The main driver of the major decline in gold production in 2025 was the temporary

suspension of the Loulo-Gountkoto mine in Mali, on January 14, 2025, with Barrick

holding 80% of the project and the Mali government 20%. This came after Mali

demanded Barrick pay increased taxes under a new mining code increasing the

government share of the revenue from gold mines, driving the company to seek

arbitration with ICSID in December 2024. However, in November 2025 Barrick

reached an agreement with Mali, paying US$430mn, allowing it to restart operations

at the projects, which should see overall gold production rise in 2026.

These developments had followed a new government being established in Mali by a

military a coup in 2021, which shifted policies towards greater control over the

country’s gold mines. There have been several countries in West Africa that have also

had military takeovers in the past five years including Guinea, Burkina Faso and Niger,

which have formed the Alliance of Sahel States and have a similar focus of resource

nationalization and a split from previous strong political ties with France.

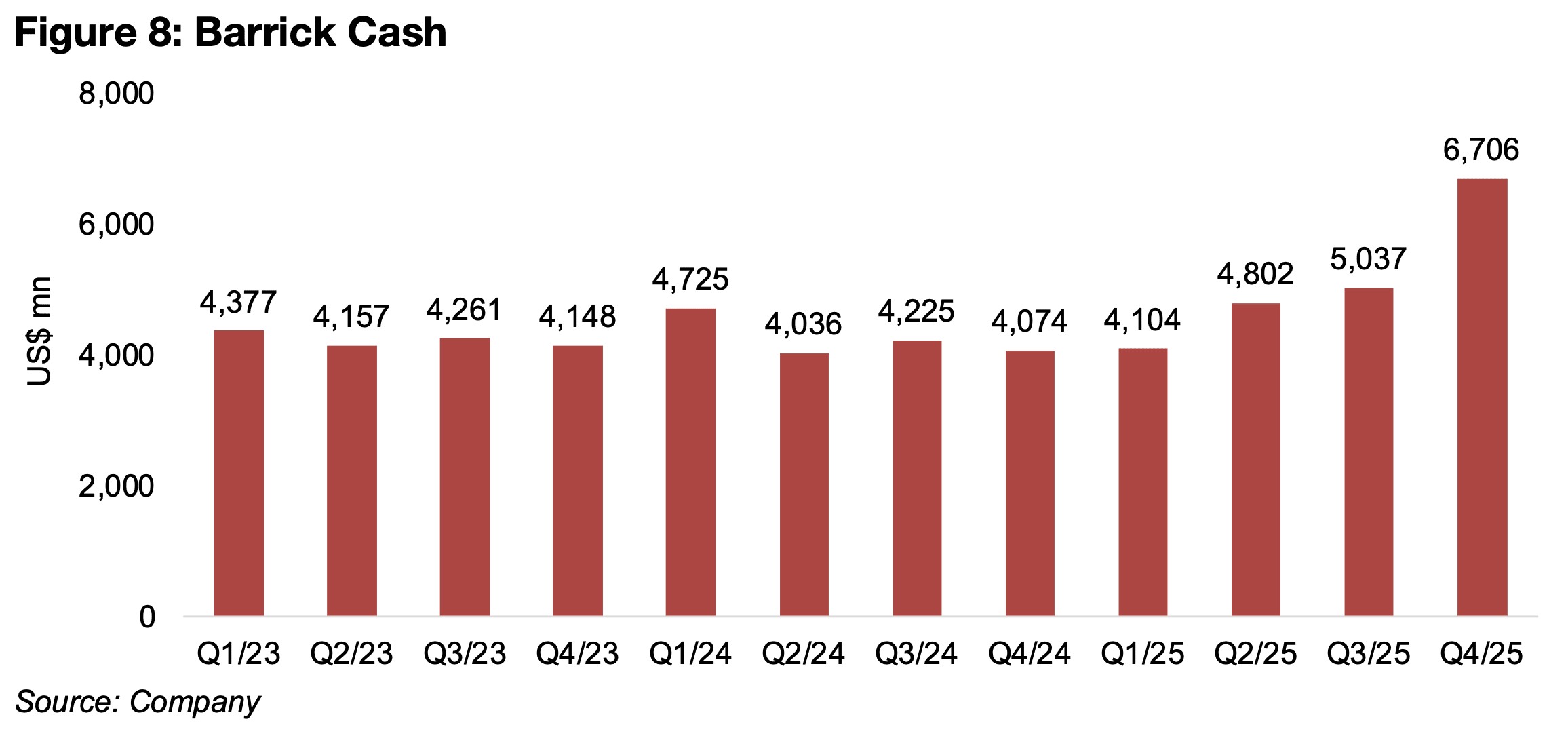

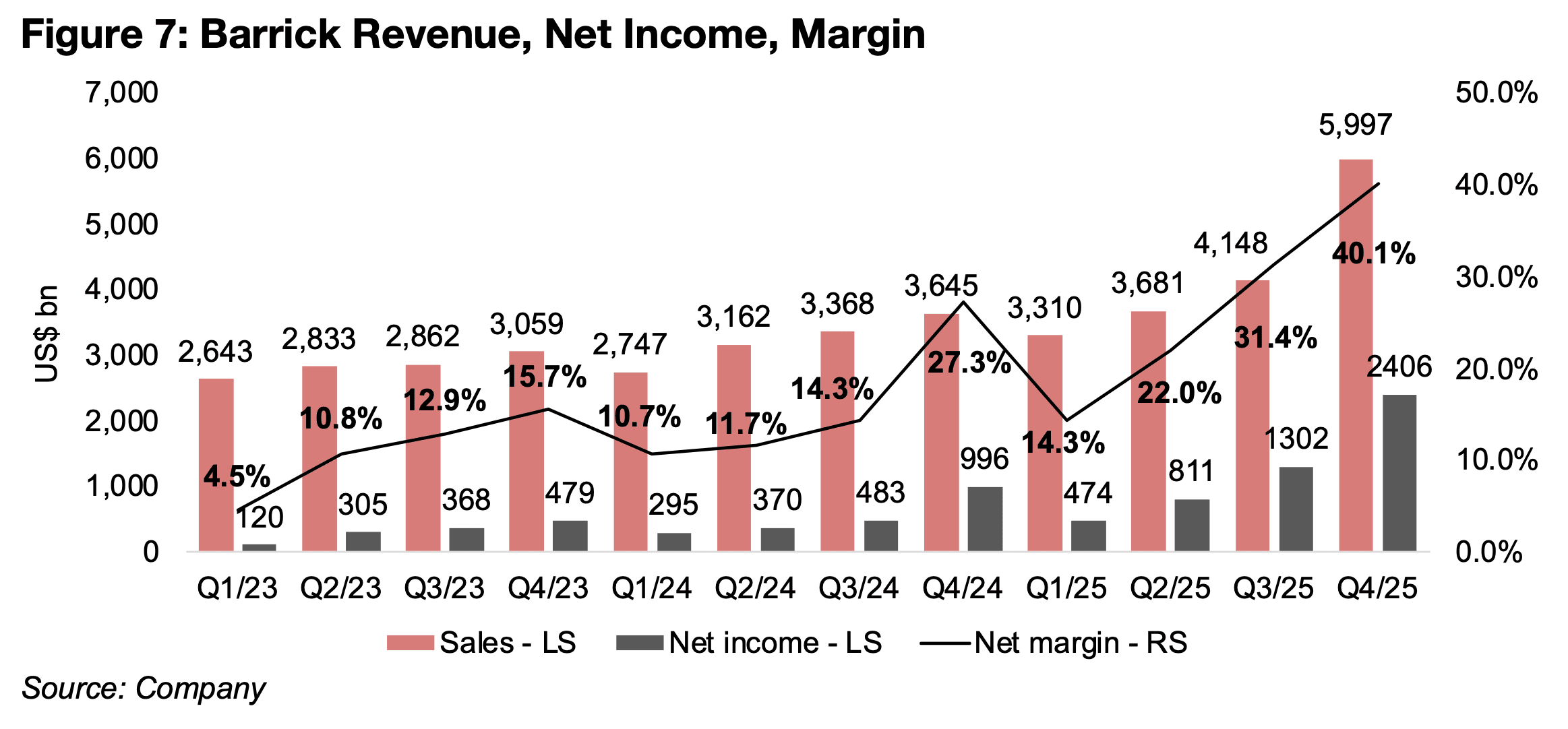

The gain in the realized gold price far offset the weak production growth, driving up revenue 65% yoy and net income 142%, with the net margin rocketing up to 40.1%, versus 27.3% in Q4/24 and 31.4% in Q3/25 (Figure 7). The company continued to pile up cash, which reached US$6.7bn in Q4/25 up from US$5.0bn in Q3/25 and far above the average US$4.3bn from Q1/23 to Q2/25 (Figure 8). The company’s stated policy is to acquired Tier One assets and focus on organic growth, which could see it avoid riskier jurisdictions, especially after the recent experience in Mali. This could see the many large Canadian gold companies as potential targets for acquisition by the company. Barrick could purchase sizeable stakes in Iamgold, Equinox, Hudbay, SSR Mining, Oceanagold, Dundee or B2Gold with just its current cash. Even prior to the Loulo-Gounkoto suspension, production growth was declining in 2024 yoy, and this could drive purchases of the projects of larger juniors with more advanced projects.

Agnico Eagle’s production dip and higher costs offset by jump in gold

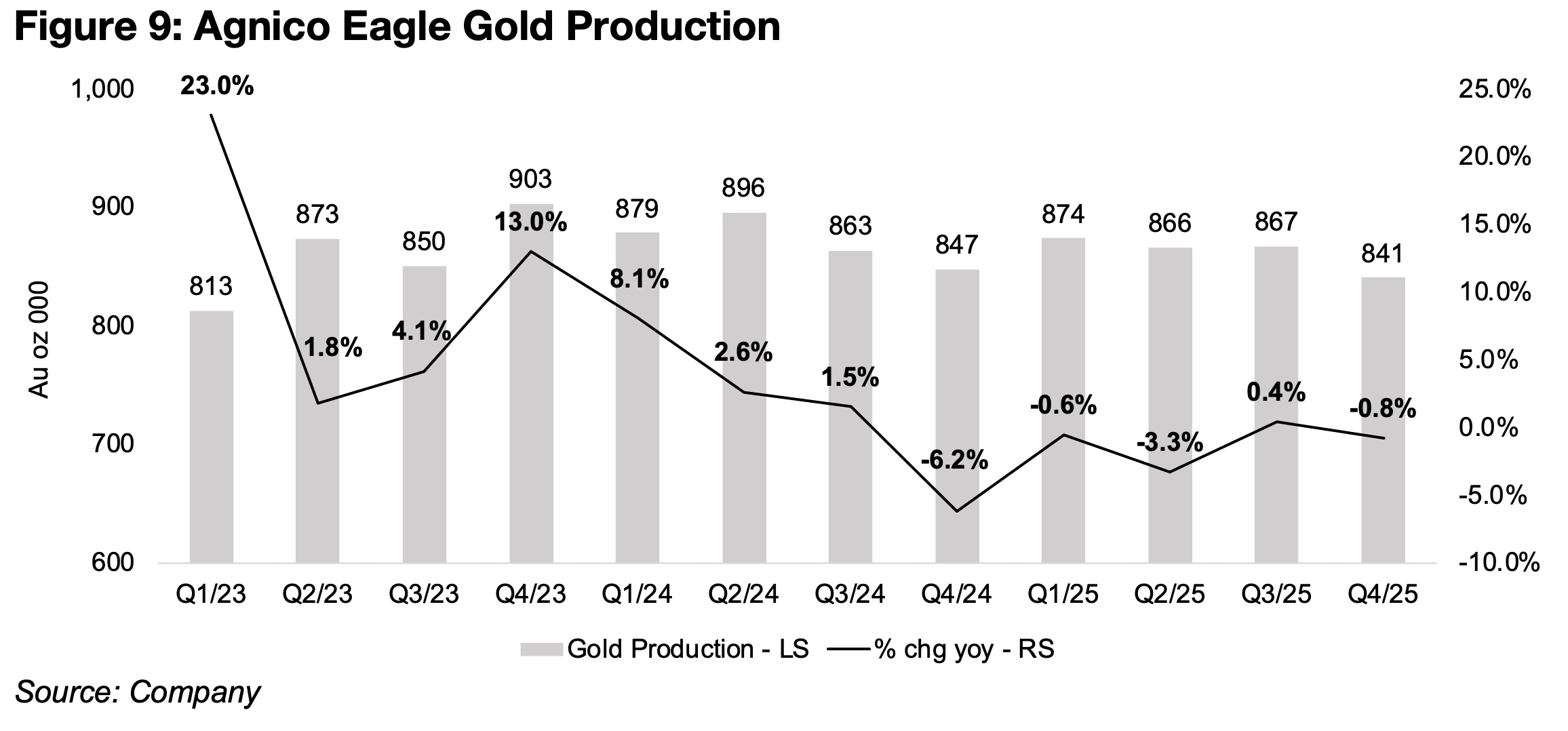

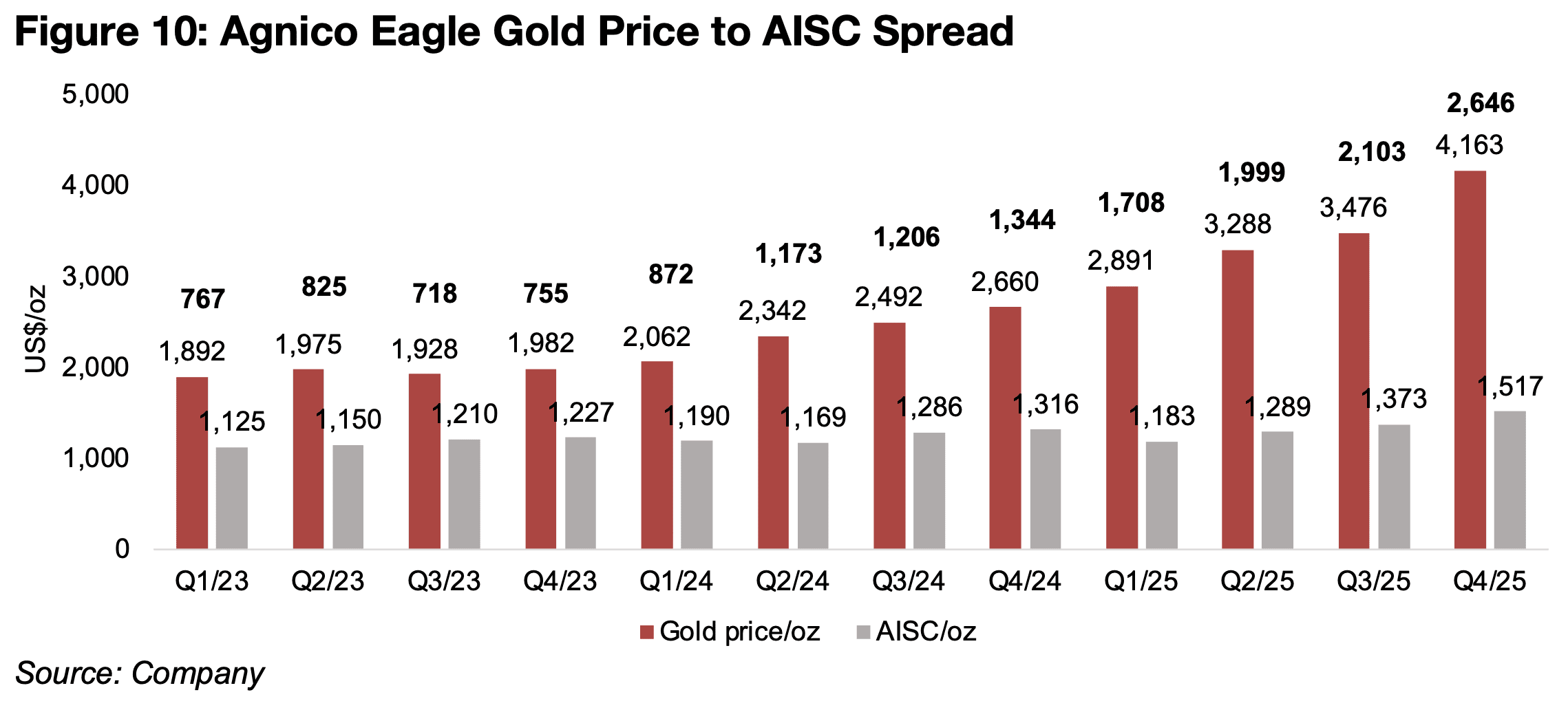

Agnico Eagle’s production growth rate edged down for most of 2025, with a slight rise of 0.4% only in Q3/25, although the drop has been far more moderate than the fall in Barrick’s production on the developments in Mali (Figure 9). This followed a downtrend in output growth through 2024, from 13.0% in Q1/24 to -6.2% in Q4/24. The decline in Q4/25 was driven by lower production from Macassa with the grade and throughput down and La Ronde, where throughput decreased, although production at Detour Lake rose on a higher grade and at Canadian Malartic on an increase in grade and throughput. The company’s realized gold price, at US$4,163/oz in 2025, has far outpaced the rise in costs, although the increase in the AISC, up US$201/oz yoy and US$144/oz qoq, has been higher than for Barrick (Figure 10).

The higher AISC was driven mainly by higher royalty costs yoy on the higher gold prices, but also higher sustaining capex for Meadowbank and LaRonde, although general and administrative expenses were down yoy. The realized gold price to AISC spread reached US$2,646/oz and has trended up consistently over the past eight quarters, more than tripling from US$755 in Q4/23.

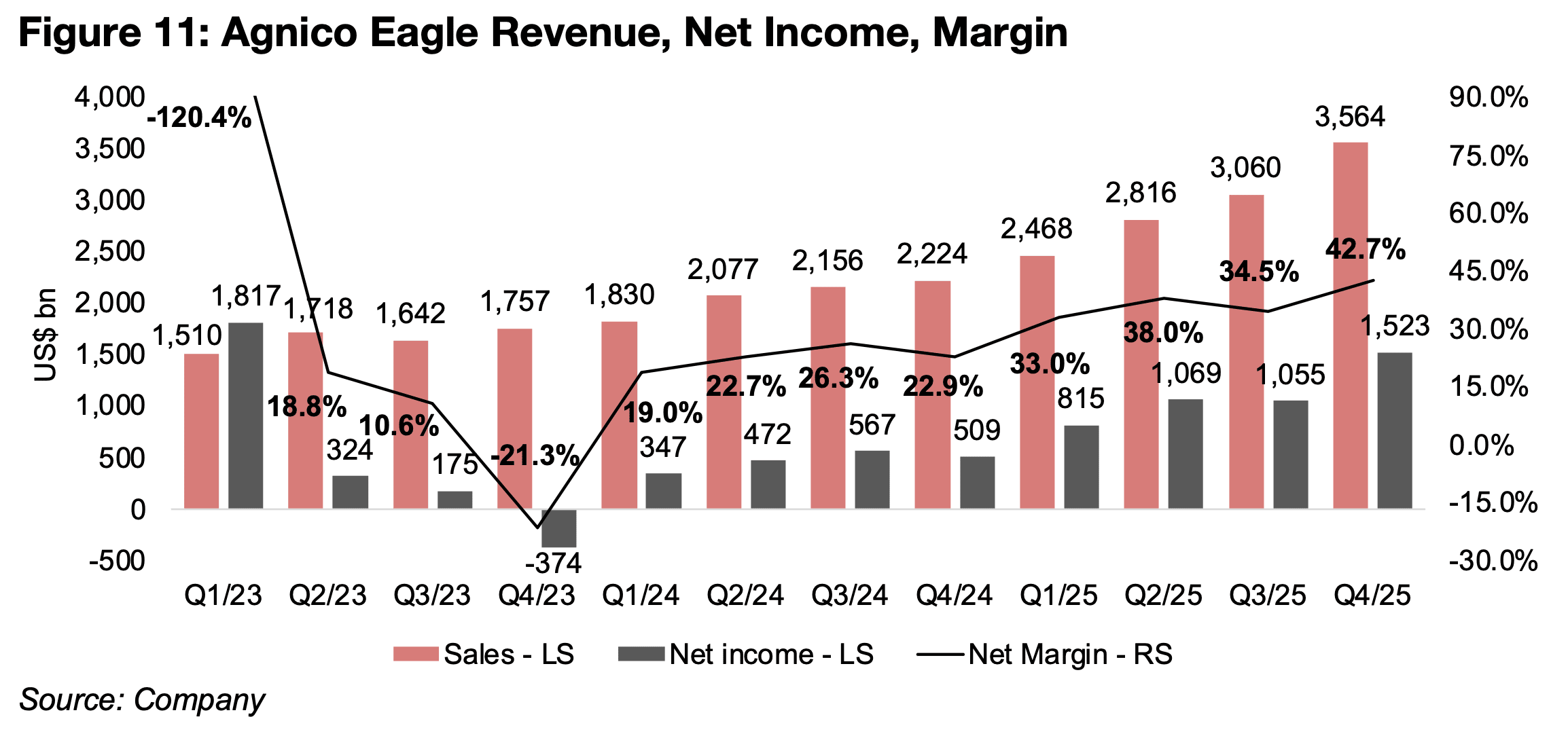

Agnico Eagle’s revenue for Q4/25 rose 60.3% yoy and 16.5% qoq to US$3.6bn, while

net income jumped 199% yoy and 44% qoq, with net margin rising to 42.7%, up 22.9%

in Q4/24 and 34.5% in Q3/25 (Figure 11). However, the gain in net income was not

only from the improvement in core operations, but also from the reversal of an

impairment charge. The company took an impairment loss of $594mn on the

Macassa mine in 2023 with US$421mn from goodwill and $173mn on non-current

assets. However, in 2025 there was $156mn partial reversal of this impairment loss.

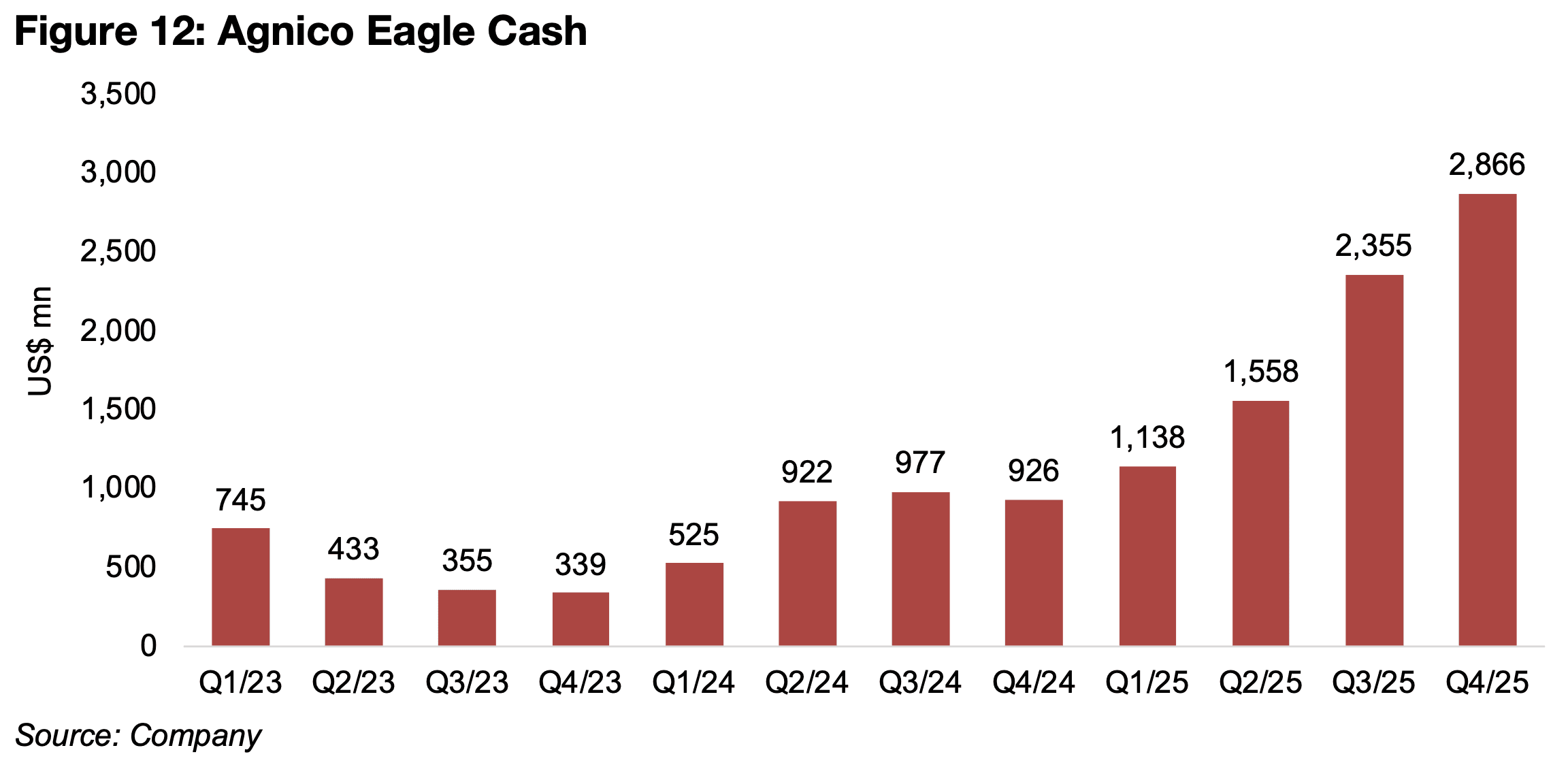

The cash balance rose significantly last year, nearly tripling to US$2.87bn from

US$0.9bn in Q4/24, after being relatively low in 2023, especially compared to

Newmont and Barrick (Figure 12). However, over the past two quarters, the company

has also accumulated significant enough cash to also pursue substantial acquisitions

in sector. This leaves the three major gold producers with over US$15.0bn in cash,

and this could rise further when Newmont reports this week and could see some of

the stronger juniors see bids over the next few years.

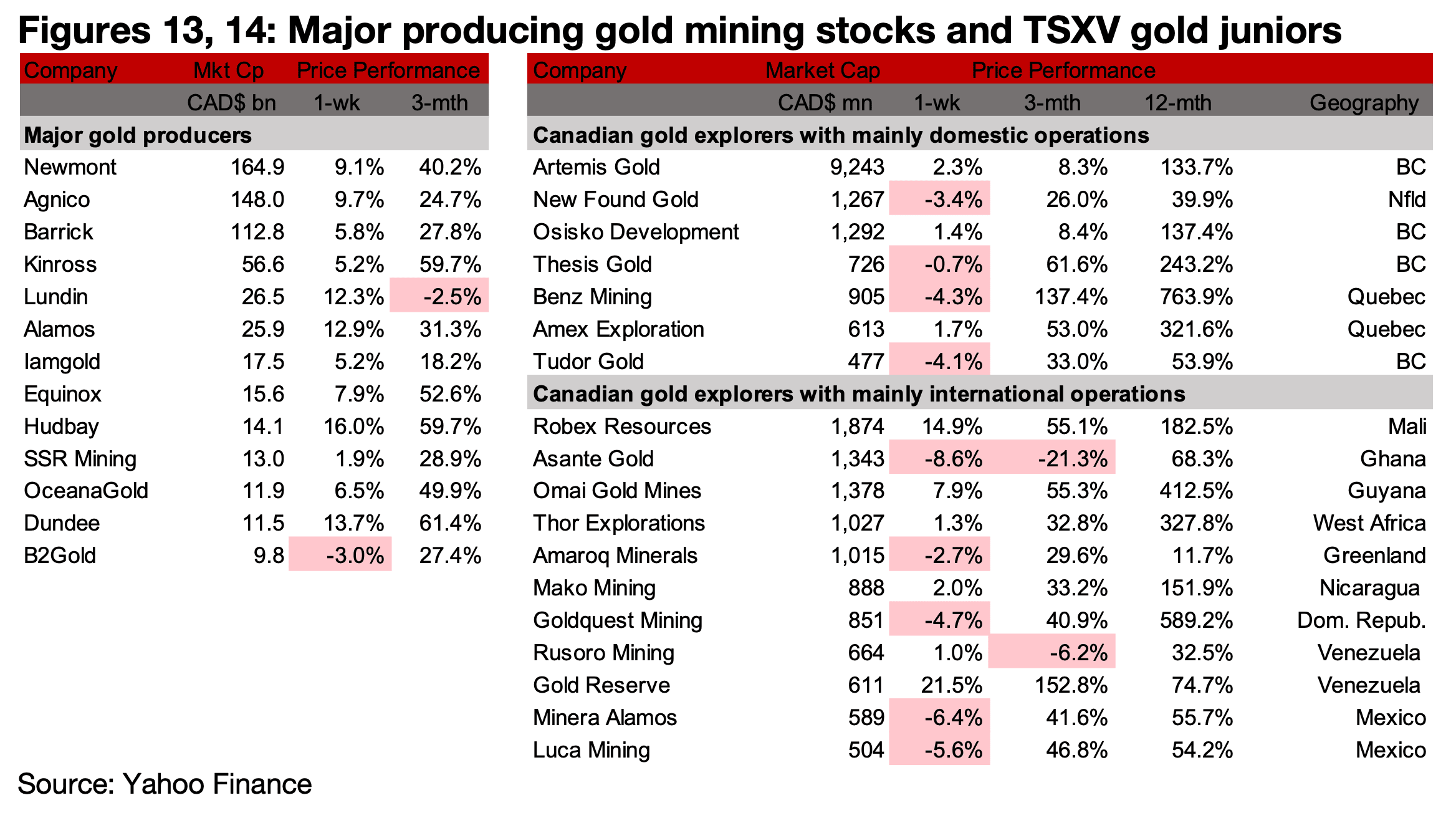

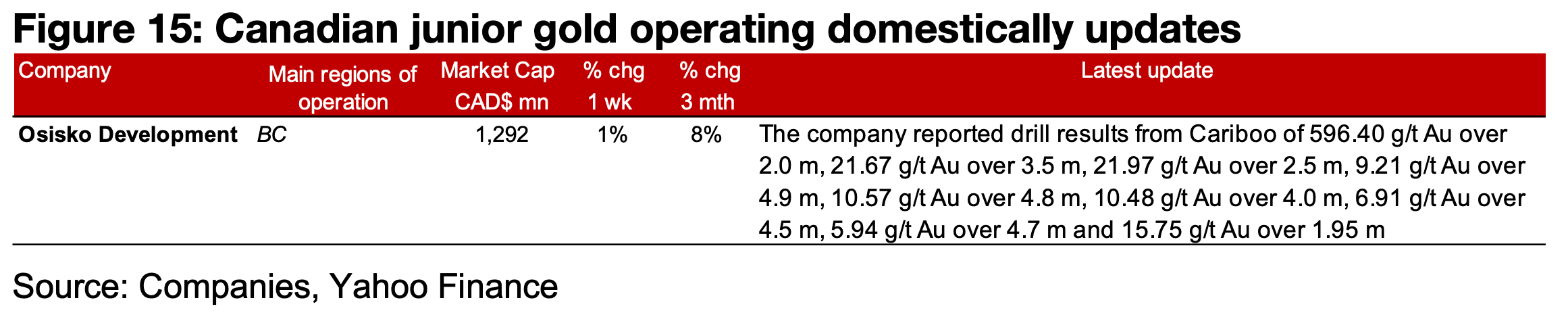

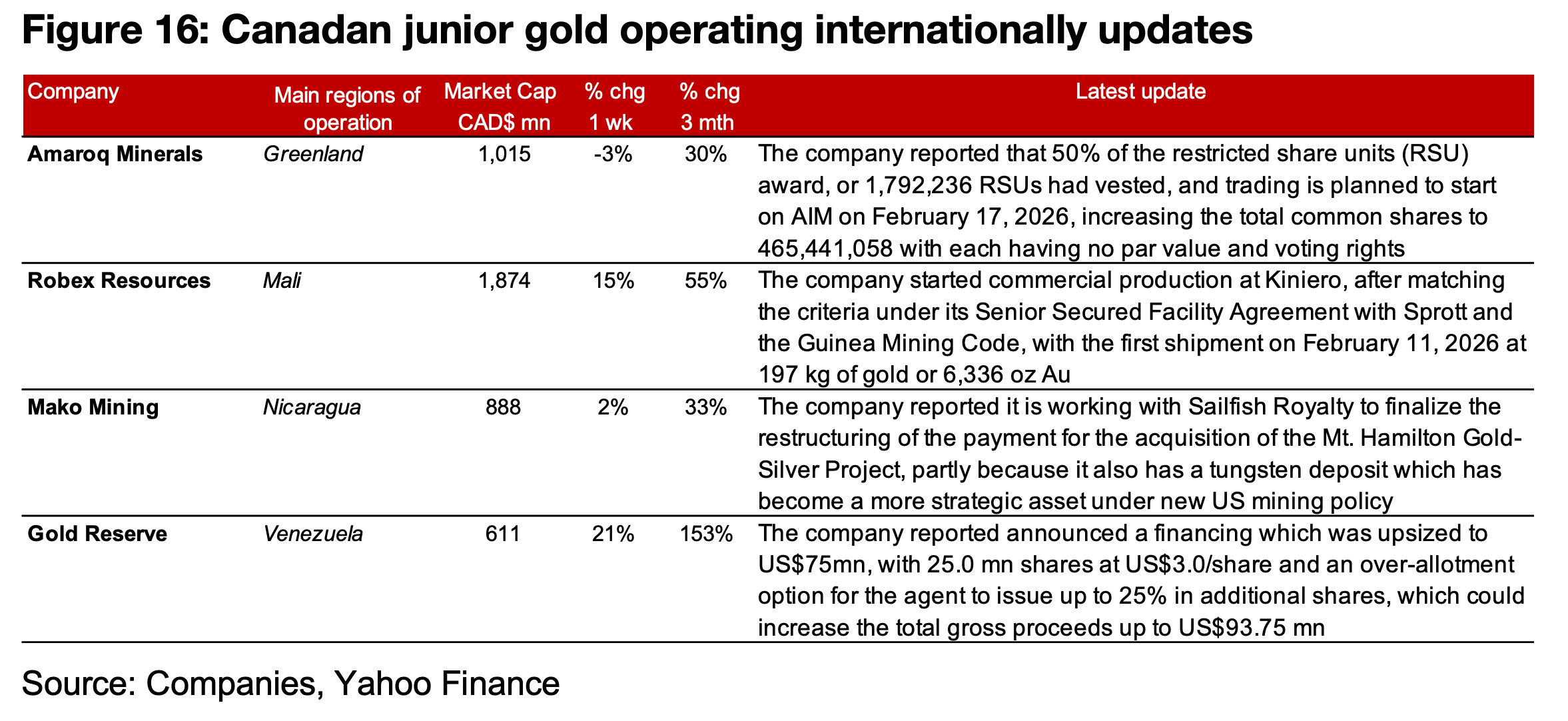

Major producers nearly all up and TSXV gold mixed

The major producers almost were all up except for B2Gold while TSXV gold was mixed (Figures 13, 14). For the TSXV gold companies operating mainly domestically, Osisko Development reported infill drilling results from the Cariboo project (Figure 15). For the TSXV gold companies operating mainly internationally, Amaroq Minerals reported the vesting of half of the restricted share units award which will start trading on AIM and Robex started commercial production after meeting the criteria under its secured facility with Sprott and the Guinea Mining Code. Mako is working with Sailfish Royalty to finalize the restructuring of the payment for the Mt. Hamilton Gold-Silver project based on its additional tungsten deposit which has become a more strategic asset since the implementation of new US mining policy and Gold Reserve reported a financing upsized to US$75mn which could reach US$93.75mn including the full over-allotment option of the agent (Figure 16).

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.