September 09, 2025

Crises and Crypto Demand to Push Gold Higher

We have predicted this… Here at the Canadian Mining Report, we have been pounding the table on gold for years.

And as of writing, gold has almost broken through $3,600 per ounce.

It’s not going to stop here. $4,000 is in sight, and we see signs that $5,000 is not impossible.

Here’s why…

An Economic Slowdown

When the US president fired the head of the Bureau of Labor Statistics, experts laughed. You can’t fix poor economic numbers by changing the person in charge of gathering and releasing them.

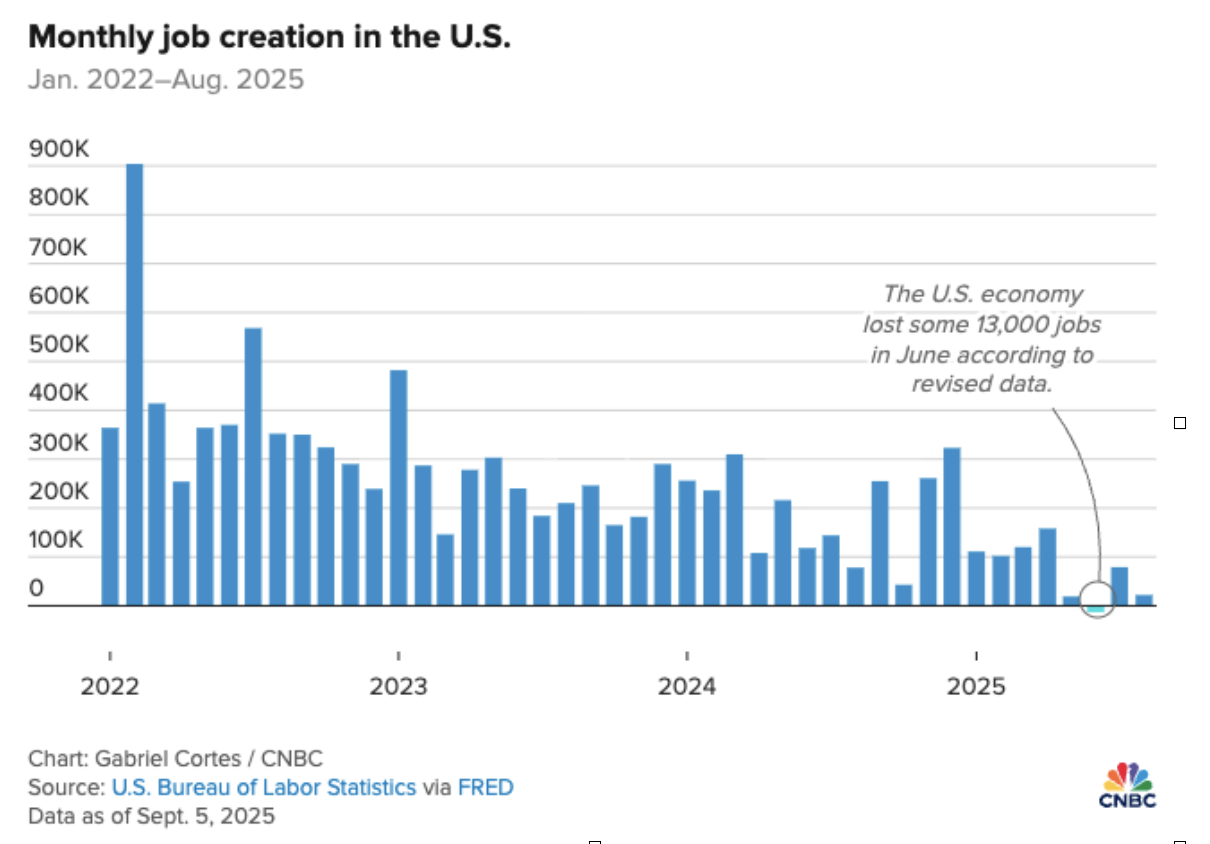

Now, what seemed like a one-off glitch in a perfect employment trend has turned into a trend of its own.

The latest data, covering August, isn’t good. The US economy has added just 22,000 jobs, as opposed to a forecast of 75,000.

Moreover, the numbers for June were revised down. For the first time in years, the world’s most resilient economy actually lost jobs.

This isn’t a one-off event anymore. The gloried US jobs market is slowing down. And with a massive immigration crisis, which includes the deportation of workers, this problem could become even bigger in the future.

Meanwhile, the price of gold keeps rising. Economic problems make investors cautious, and gold has always acted as a crisis hedge.

Investors anticipate that the US Fed will lower interest rates this month. If it happens, gold should rise even higher. We will not be surprised to see it cross $4,000 by the end of the year.

Plus, there is another source of demand for gold…

Crypto Companies Look to Invest in Gold

Cryptocurrencies were supposed to replace gold as safe haven assets. Some bitcoin advocates said that BTC is better than gold and would make the yellow metal obsolete.

Crypto fans are changing their tune these days.

Just recently, the Financial Times reported that the stablecoin group Tether was looking to invest in gold.

Tether is the world’s biggest stablecoin company. It has a market capitalization of about $170 billion.

The Financial Times reported that Tether’s CEO, Paolo Ardoino, has been having discussions with companies in the gold mining sector, from producers to royalty companies and traders.

Tether already holds about $8.7 billion in gold, according to its public documents. Now it wants to expand its presence in the gold market.

In June, Tether invested more than $100 million in a gold royalty company, Elemental Altus. Elemental is listed on the Toronto Venture Exchange.

These moves tell us that there is an attitude shift toward gold in the crypto world. Before, gold was seen as a barbaric relic. Now, crypto entrepreneurs call it “natural bitcoin.”

If an economic crisis happens, which we think is going to be the case, investors who rushed into bitcoin in the past may reconsider—and get exposure to gold as well.

They will not only be looking for the metal itself. Just like Tether did, they will most likely seek out gold mining companies.

How Canadian Mining Companies Will Profit from the Next Crisis

What we see right now in the news is alarming… Low job growth in the United States, the prospect of lower interest rates fueling investment bubbles, erratic trade policies undermining global international relations… It all can blow up quite quickly.

In our view, the global economy could be in trouble within months. Investors should start preparing right now, before it’s too late.

Gold should be high on anyone’s list of safe-haven investments.

Gold mining companies should be a close second. These are the ultimate “defensive” stocks. If the global economy nosedives, investors will forget about the latest trends and turn to trusted investments such as gold and mining companies.

There are plenty of them to choose from… and there are hundreds of them trading in Canada.

We urge you to pay special attention to royalty companies, established and profitable producers, and well-financed exploration-stage stocks. They could provide the most downside protection—and upside potential.

As far as crypto goes, we will leave it to your discretion. From our standpoint, gold and other real assets have the risk-reward characteristics that have helped investors navigate both the peaks and the troughs of the stock market for ages. We have confidence that gold and other real assets will continue delivering in the future.

And now, even the crypto world agrees that gold is pretty much impossible to replace.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.