April 03, 2023

Crypto as Gold Substitute Revisited

Author - Ben McGregor

Gold edges up and equity markets rebound on banking crisis pause

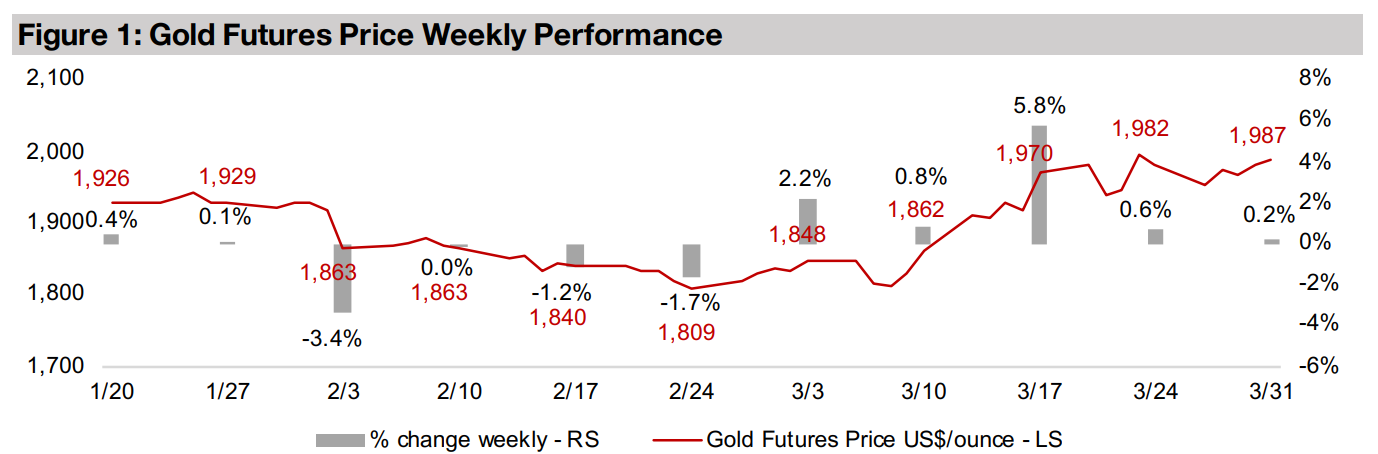

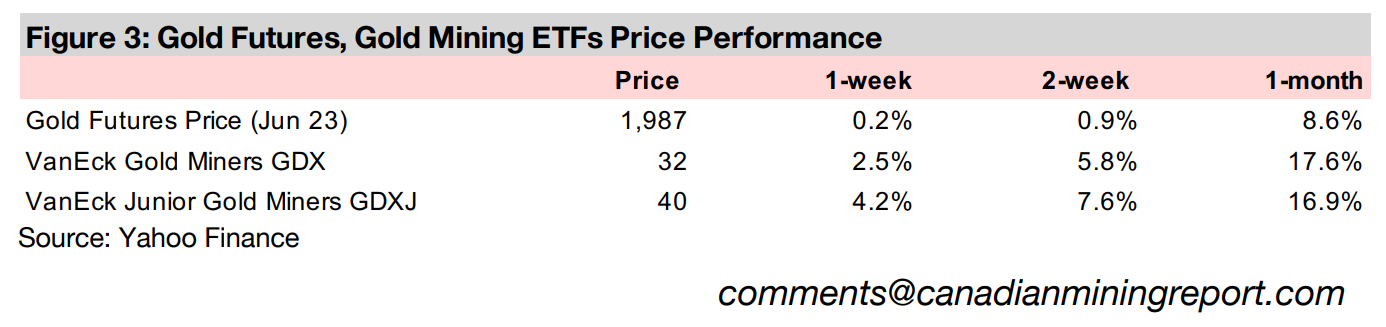

Gold edged up 0.2% this week to US$1,987/oz with the first relatively calm week for in around a month, with equity markets seeing a relief rally as the banking crisis seems to have paused while gold still held up as investors hedged their bets.

Gold versus crypto and Canada-focussed large TSXV gold explorers

This week we revisit the gold versus crypto debate given the resurgence of the digital currency index over the past month and look at the relative performance and drivers of the large TSXV gold explorers which have their main projects based in Canada.

Gold stocks continue up as equity markets gain

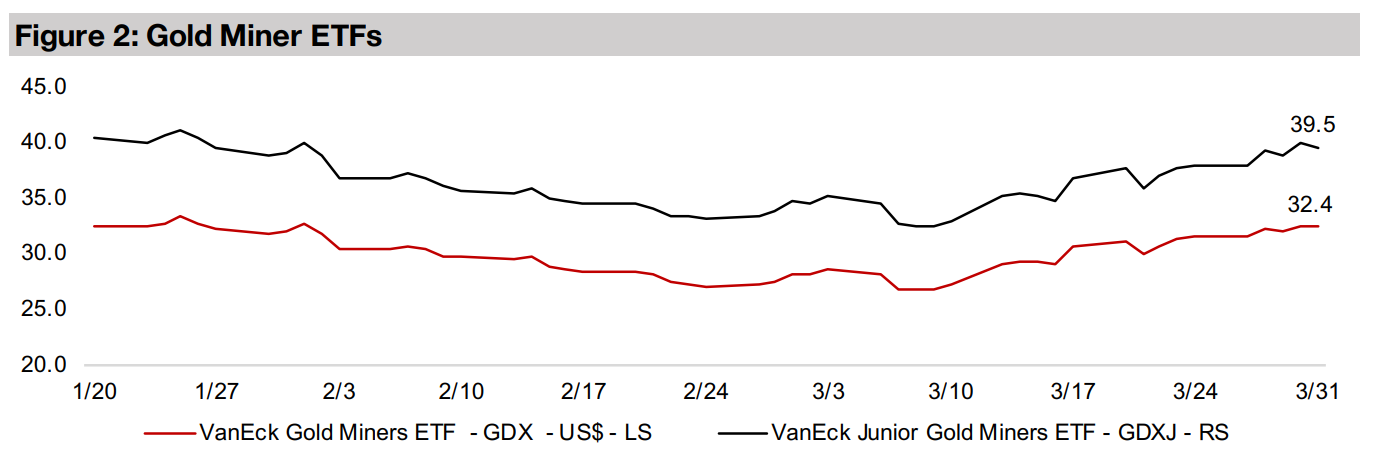

Gold stocks continued up, with the GDX rising 2.5% and the GDXJ gaining 4.2% as there was a shift back into risk assets with markets regaining their confidence with the banking crisis at least abating, if not entirely solved, along with the uptick in gold.

Crypto as Gold Substitute Revisited

Gold edged up 0.2% this week to US$1,987/oz, as there appeared to be general relief

in markets that there was not further negative news flow related to the banking crisis,

and that it had at least taken a pause, if not been largely solved. This return into risk

assets could explain the slowdown in gold gains, but investors were still not selling

off the metal, as they were likely hedging their bets with the probability still there that

the crisis could resume. There is some evidence that the bank bailouts of the past

month are acting as a 'defacto quantitative easing' which could even be offsetting

the effect Fed's interest rate hikes and helping pump up markets.

Adding to this are market expectations that just one more rate hike will be coming in

the US, likely of only 25 bps, before a pause, and that rate reductions could begin by

as early as H2/22. However, we expect that any rate cuts would come only much

later in the year, meaning a second full year of high interest rates, and the potential

for further economic fallout in sectors apart from banks. Overall, we suspect that we

are hardly out of the woods yet in this crisis, and that the rebound in equity markets

this week seems to be more one of relief that the immediate crisis didn't worsen rather

than a vote of confidence that everything has turned the corner.

Gold wins except in case of high growth, low inflation with low geopolitical risk

All of this remains good news for gold. If there is in fact a defacto monetary expansion from the bailouts, then gold could benefit as it tends to track the money supply over long periods. If the Fed lowers rates earlier than expected, inflation expectations, and inflation itself, could rise, which would boost gold. If this week turns out to only be a pause in the banking sector crisis, then gold could benefit from a flight to safety on more negative news flow. The main scenario where gold doesn't win is in a scenario of high sustained economic growth with very low inflation and extremely low political risk. Which seems quite unlikely for this year, and even for the next few years.

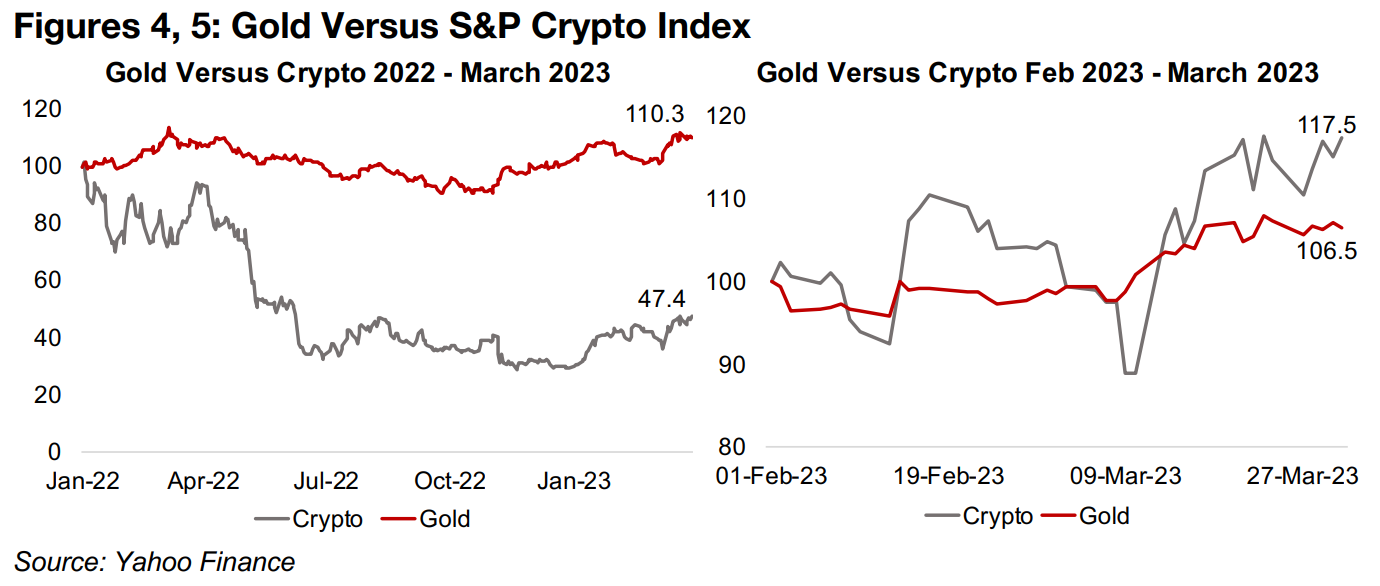

Is crypto's recent comeback really because it is a safe haven?

Since the banking crisis erupted one asset class interestingly making a strong comeback has been crypto, which is up 32% off its recent lows on March 10, 2023. We had previously written about crypto being lauded as a digital substitute for gold at its heights in 2021 and into early 2022 and how it was brought into disrepute by a collapse over the rest of 2022. The S&P broader crypto index declined over 50% over the past twelve months, as equities dropped and economic and geopolitical concern surged, in contrast to gold, which gained 10%, delivering on its expectation as a safe haven (Figure 4). This suggested that the idea of gold's replacement by crypto was exaggerated, and brought heavily into question the digital asset's ability to hold its value, exposing it as more a risk asset then safe haven. However, the shift to crypto over the past month has again raised the question of it is a gold substitute (Figure 5).

Crypto continuing to act as a risk asset, tracking the Nasdaq

Like the bank sector this year, crypto had its own systemic reckoning last year, with

many small coins, and even some major coins, completely collapsing, and broader

structural issues with the crypto system erupted with the FTX scandal. Nonetheless,

as banks started collapsing over the past month, there was a shift into

cryptocurrencies, which seemed at first glance to indicate that investors were at least

viewing crypto as safer than deposits in many banks.

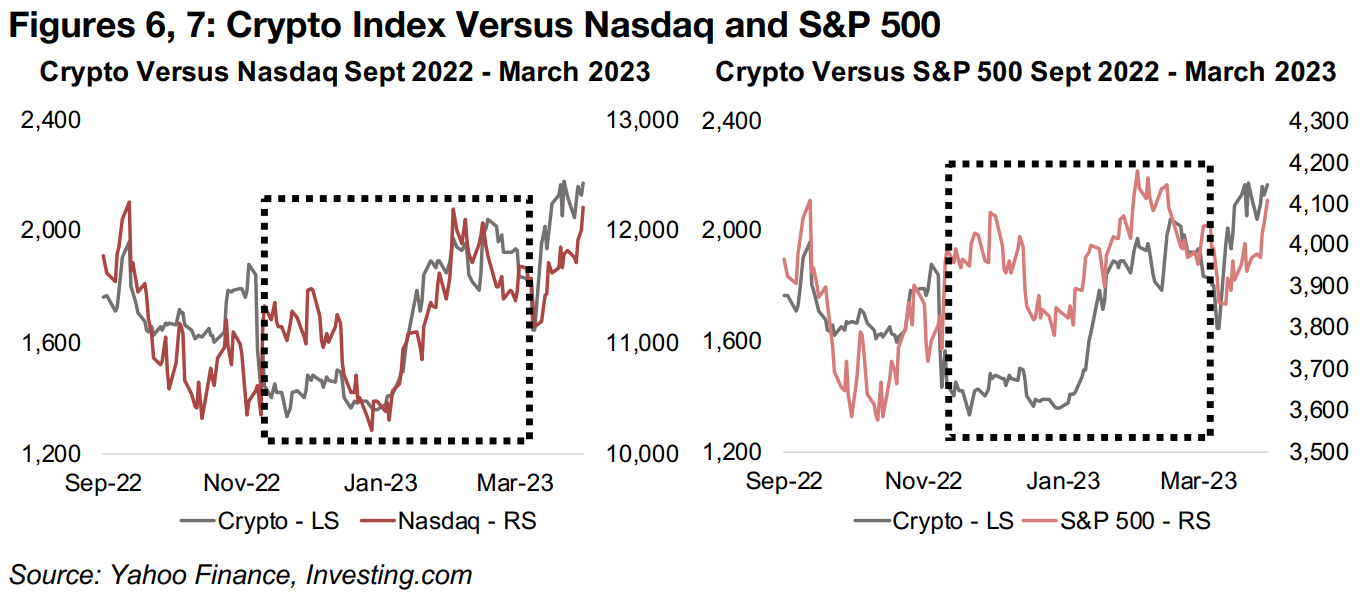

However, looking at the movements of the Nasdaq and crypto together paints a

different picture. It was not only crypto, but also Nasdaq that surged over the past

month, as investors rotated heavily away from financials, and into other sectors,

especially mega-cap tech stocks (Figure 6). This move into mega-cap tech was also

responsible for the large gains over the past month in the S&P 500. So risk assets

like equity, apart from the financials, obviously, actually saw a significant boost from

this crisis.

If we look back to the performance of crypto versus the Nasdaq from September

2022, we can see that these two assets track quite closely, as has been noted by

analysts. They appear to have a much closer a correlation certainly than crypto and

the S&P 500, at least from December 2022 through to the first half of February 2023

(Figure 7). This suggests that it might not be that markets are moving into crypto as

a safe haven, but that they are moving into a risk on stance, although this has been

concentrated in mega-cap tech. This continues to paint crypto as more of a risk asset

than a safe haven like gold.

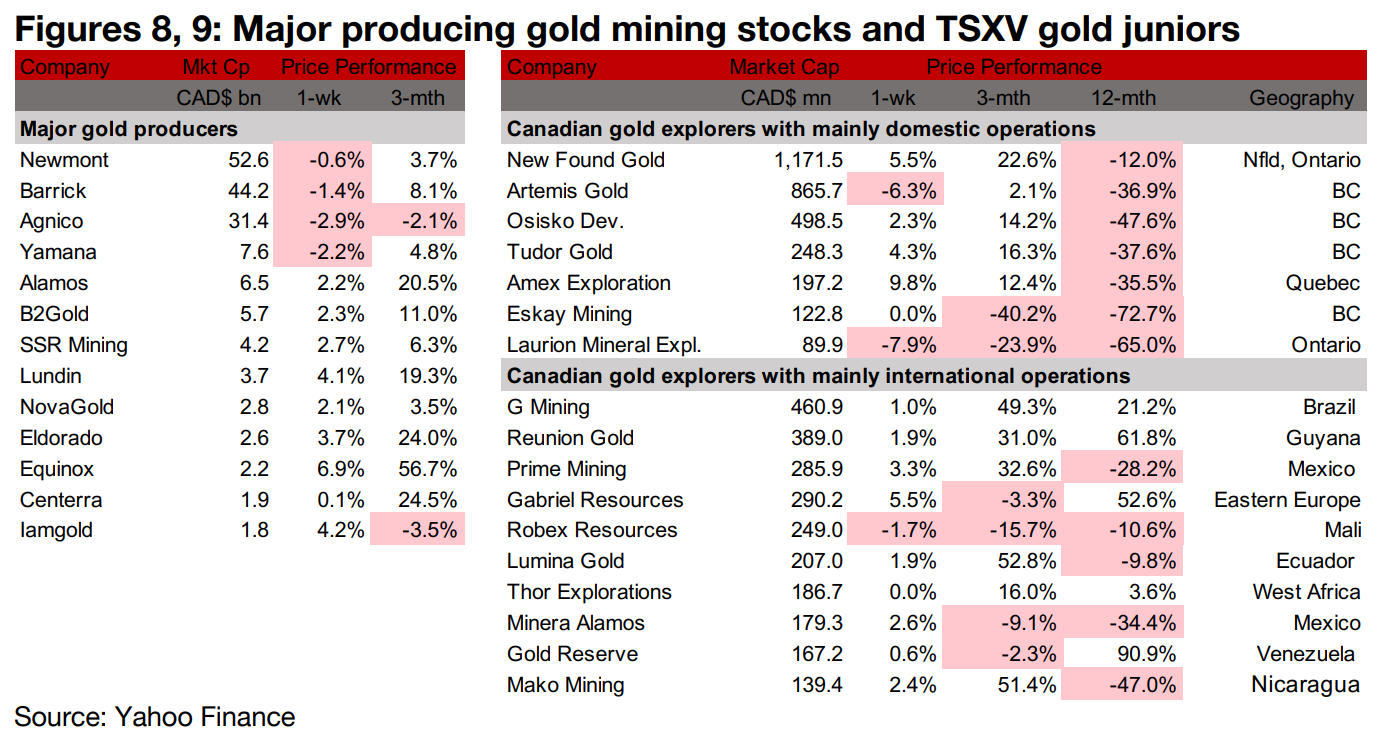

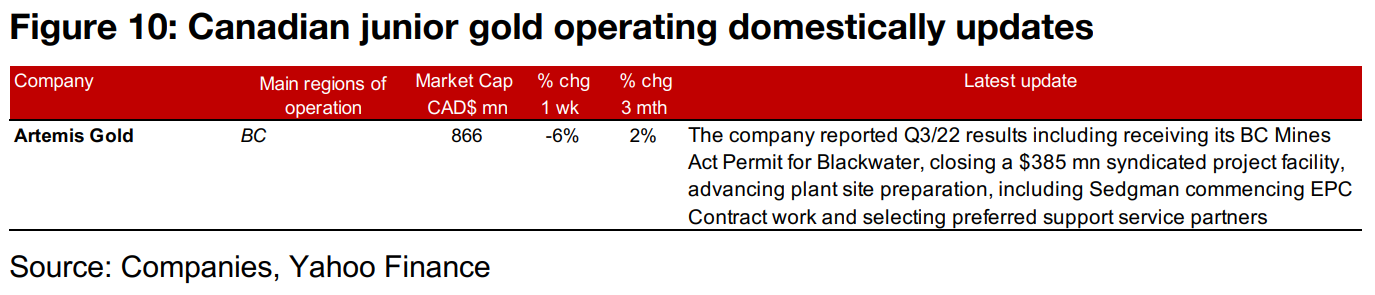

Gold producers mostly gain and TSXV gold mixed

The producing gold miners were mixed and TSXV large gold nearly all rose as gold edged up and equity markets gained (Figures 8, 9). For the TSXV larger gold juniors news flow was limited to a single company, Artemis Gold, which reported its Q3/22 results, focussed on the completion of permitting and the early stages of construction for its Blackwater project. (Figure 10).

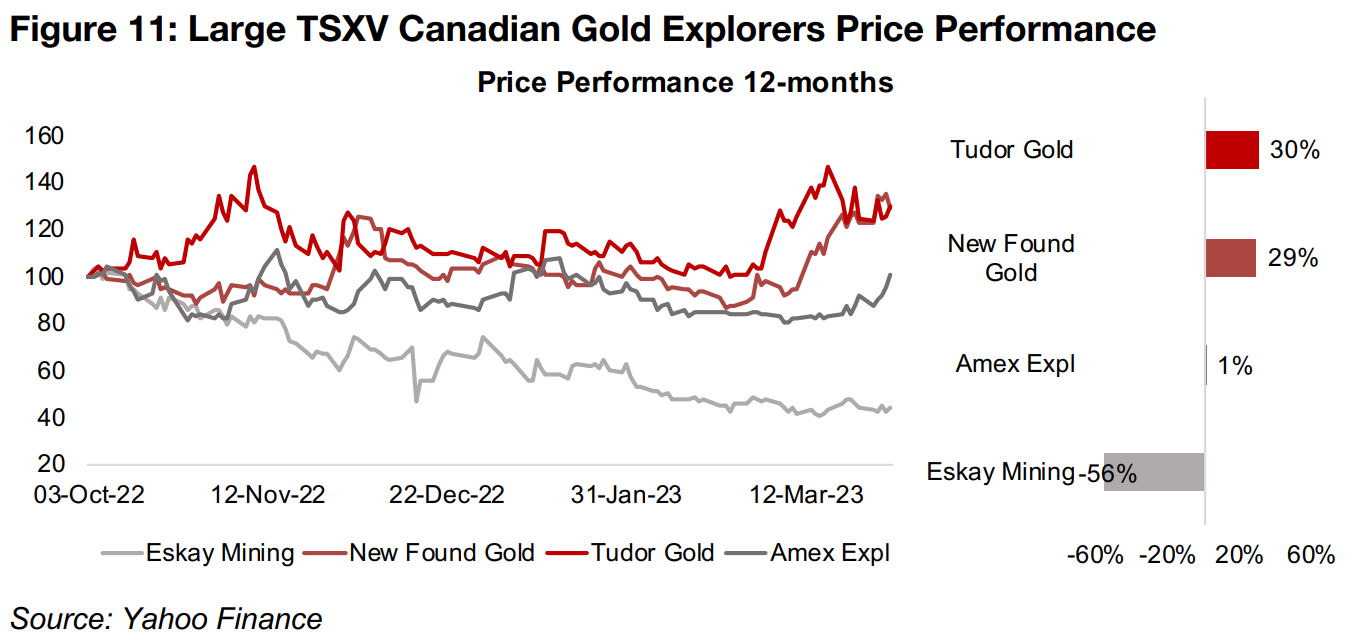

In Focus: Large TSXV Canadian Gold Explorers

Diverging performance for top four TSXV gold stocks with Canadian projects This week In Focus are the largest TSXV gold explorers with their main projects in Canada, comprising New Found Gold, Amex Exploration, Tudor Gold and Eskay Mining. The price performance of the group overall has diverged considerably over the past six months, although Tudor Gold and New Found have gained nearly exactly the same, at 30% each, with Amex Exploration near flat, up just 1.0% and Eskay Mining has declined -56%. However, all four of these stocks are down considerably over the past twelve months, pressured by rising risk aversion driving a slide in equity markets. Early-stage junior explorers which haven't reached the PEA stage can see particular pressure in these down markets as a lack of revenue or any studies outlining their potential output could potentially drive investors to overlook them.

Diverging performance for top four TSXV gold stocks with Canadian projects

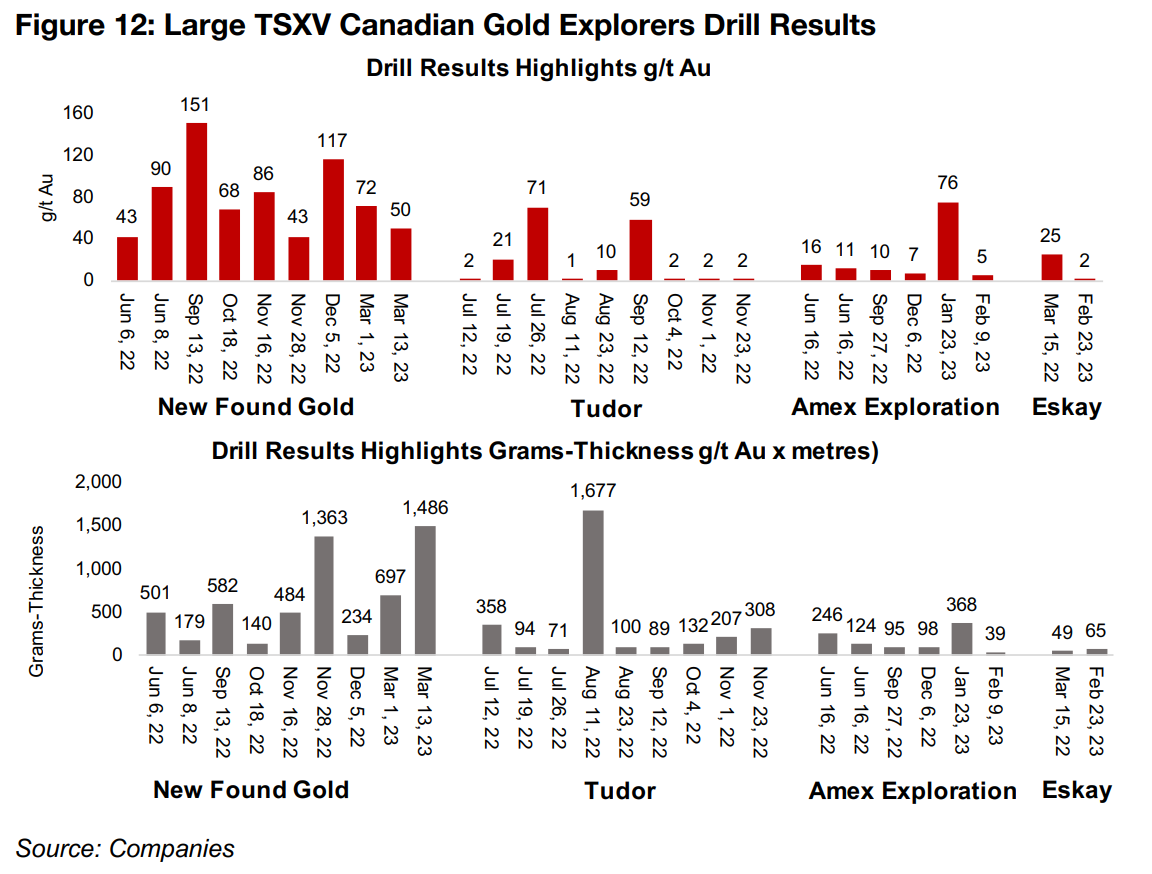

The drivers of the gain for New Found Gold, operating the Queensway project in New Found Land, are demonstrated quite clearly in Figure 12; they continue to have the highest grade in grams/tonne (g/t) and highest grams-thickness (taking the grade of a drill result in g/t Au and multiplying by its metres in length) of the four by far. It also has had the strongest drill results based on these measures of the larger TSXV explorers in 2020-2022. The company has regularly produced results starting at over 40 g/t Au and as high as 150 g/t, and over decent lengths, with a grams-thickness of over 1,000 reported as recently as this month. Overall, these results dwarf those of the other three explorers and are at much greater frequency, with a 500,000 m drilling program ongoing, upsized from 300,000 m still ongoing.

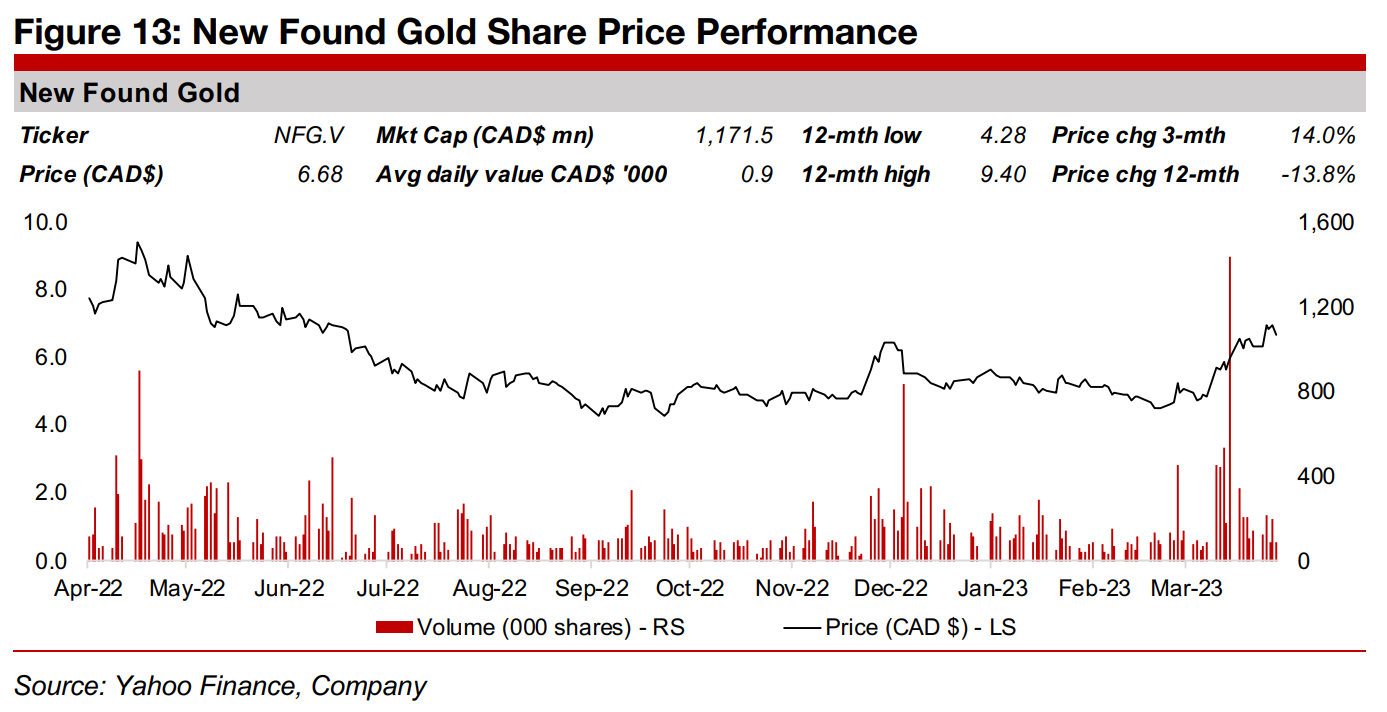

New Found Gold continuing to expand into new zones

As New Found Gold is still expanding to new zones, including most recently the Iceberg zone, and still seeing significant expansion of more established zones like Keats, it continues to hold off on an Initial Resource Estimate. There appears to be some parallels here with Great Bear Resources, which was acquired last year, and had a similar situation with a large high grade project showing increasing continuity and room for expansion, which was purchased before it reached in initial mineral resource estimate. The company's extremely high grade has helped it hold up over the past year when many TSXV gold stocks were hit hard, with it dropping -13.8% over 12-months, and rebounding 14.0% over the past 3-months (Figure 13).

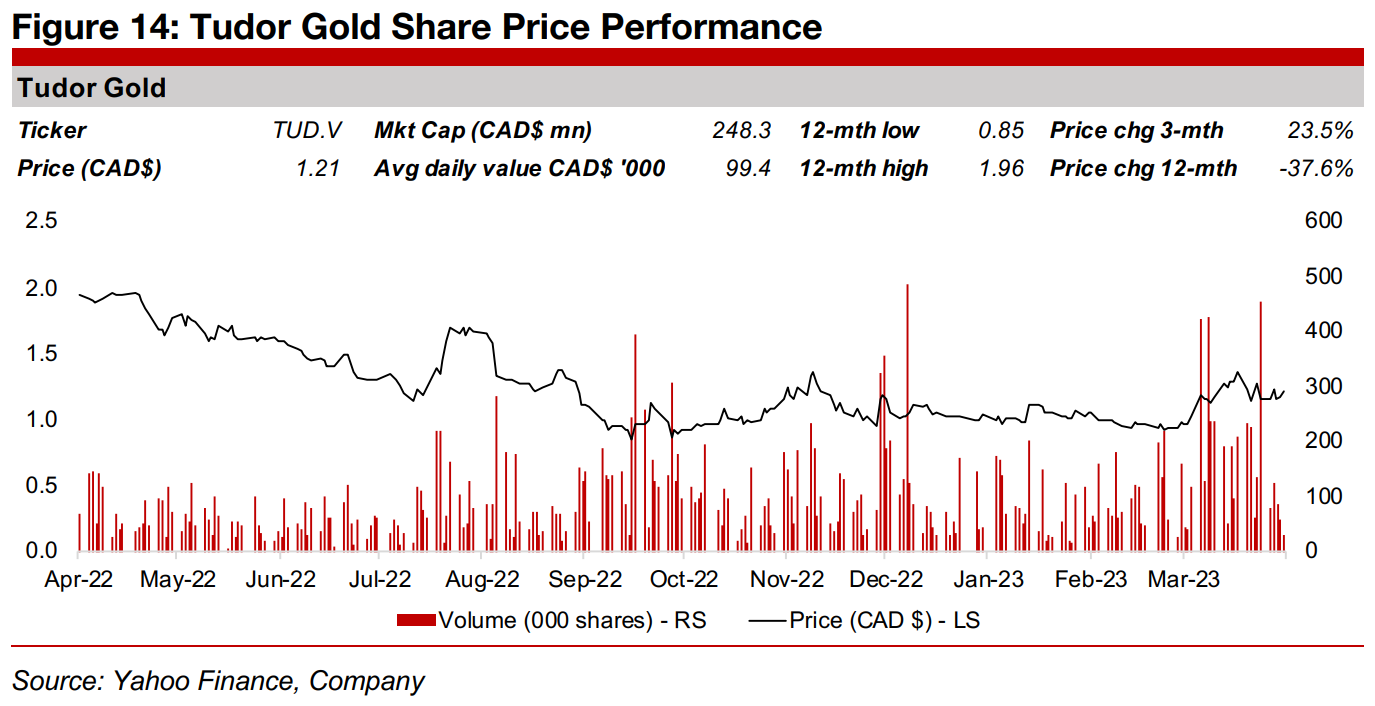

Tudor sees support from major upgrade of mineral resource estimate

In contrast to New Found Gold, Tudor Gold has already released a mineral estimate

for its Treaty Creek gold, silver and copper project in British Columbia, and a

substantial upgrade of the resource was announced in March 2023. The project's

total resources increased 20% to 30.7mn oz AuEq, comprising 23.4 mn oz AuEq

Indicated at 1.13 g/t Au and 7.4mn oz Inferred at 0.98 g/t Au, with the overall grade

for the Resource rising 53%.

The company's drill results over the past year have on average been at a much lower

grade than New Found Gold, although with some high widths seeing its strongest

grams-width result surpass even New Found Gold's best result. However, its most

recent three drill result highlights have been at 2.0 g/t Au or lower. The stock has

struggled over the past 12-months, down -37.6%, although the upgraded Resource

Estimate and the gold stock rebound has seen it increase 23.5% over 3-months, the

strongest quarterly performance of the group.

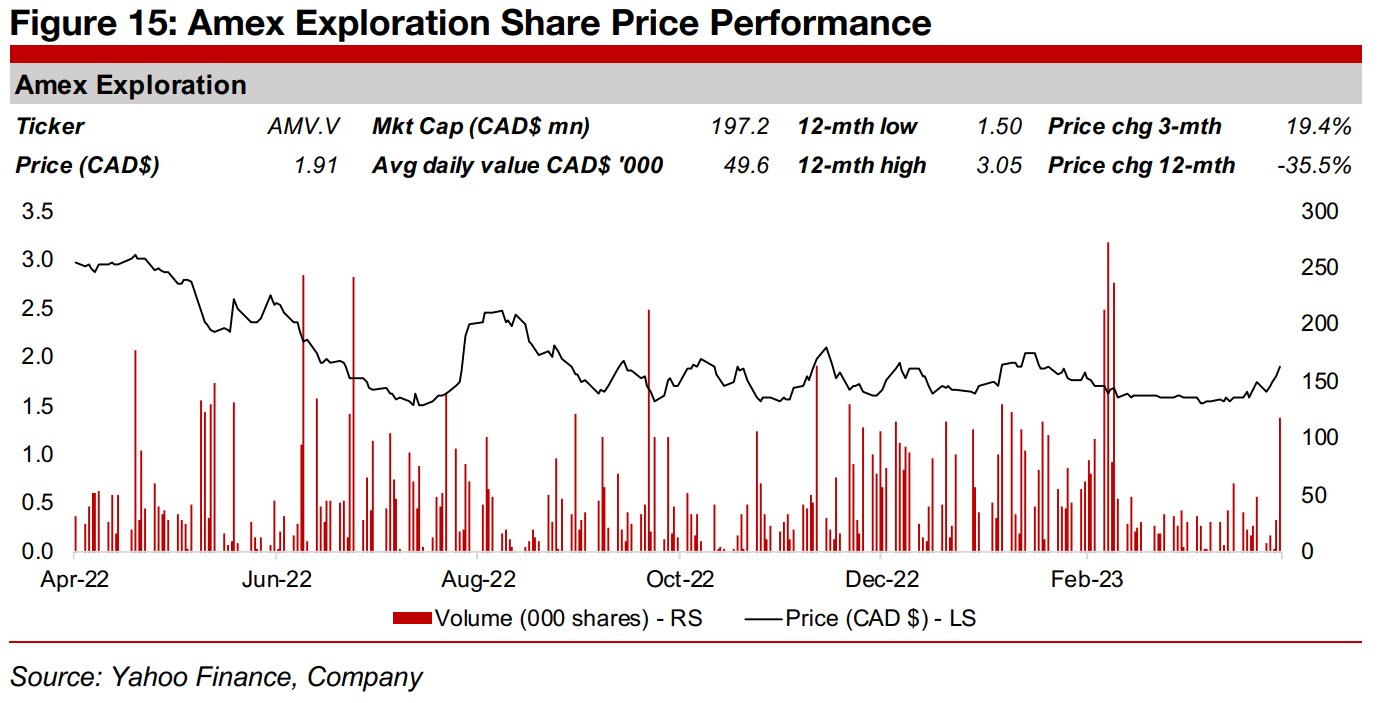

Continuing to report drill results regularly for Perron

Amex Exploration is also pre-resource at its Perron project in Quebec and has continued to release a series of decent drill results over the past year, with grades ranging from 5 g/t Au to 16 g/t Au, apart from an outstanding 76 g/t Au reported in January 2023. The average grade from the headline drill results from Perron since mid-2022 at 20.7 g/t Au are reasonably similar to Tudor's average 18.8 g/t Au. However, Amex's average grams-thickness for these results is just 161.6, about half of Tudor's 337.4 average grams-thickness, with the average meters for the results of the latter significantly higher. Tudor's share price is down by -35.5% over the past year but has rebounded 19.4% over 3-months which puts its performance broadly inline with Tudor Gold.

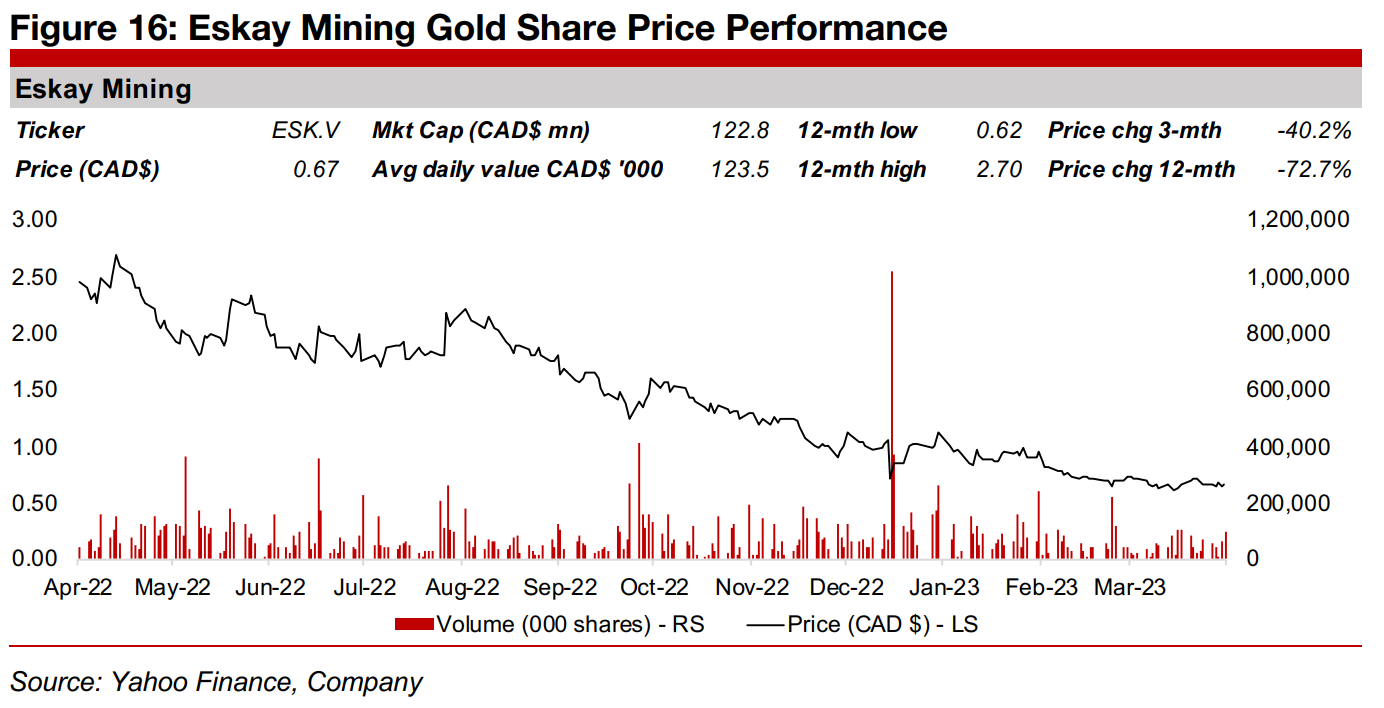

Eskay continues to discover new zones, but major drill results limited

Eskay Mining has seen the weakest performance of the group, down -72.7% over 12-months and -40.2% over 3-months as it continues early-stage exploration for its Eskay VMS project. News releases directly highlighting strong drill result numbers have been limited to just two, in March 2022 and then about a year later in February 2023, although there have been several general updates on its exploration activities over the year. This lack of strong drill results has likely led to the share price decline especially in a time when markets are becoming more risk averse and less willing to back junior miners at earlier stages.

Disclaimer: This report is for informational use only and should not be used an alternative to the financial and legal advice of a qualified professional in business planning and investment. We do not represent that forecasts in this report will lead to a specific outcome or result, and are not liable in the event of any business action taken in whole or in part as a result of the contents of this report.